Campbell County Correction Deed Form (Kentucky)

All Campbell County specific forms and documents listed below are included in your immediate download package:

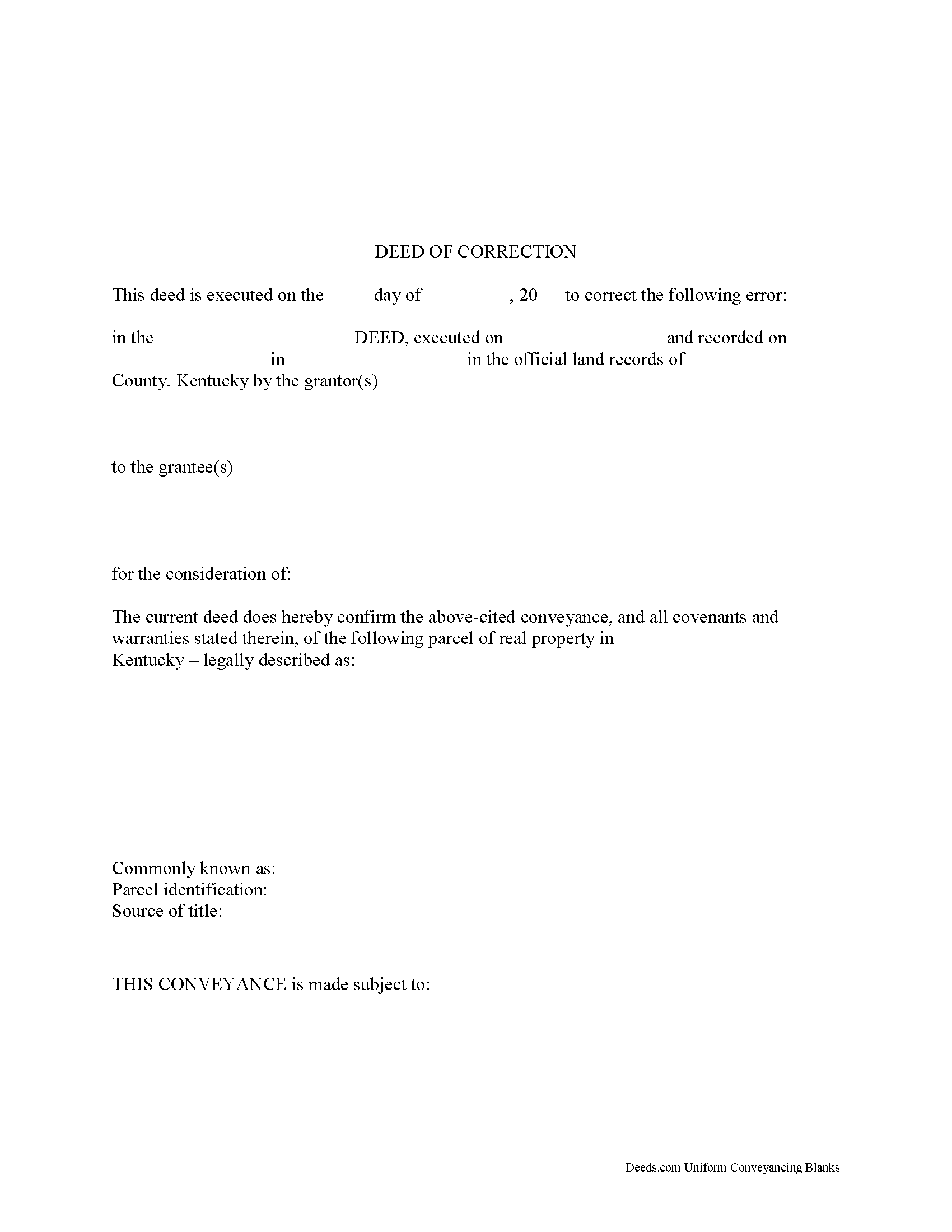

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Campbell County compliant document last validated/updated 11/20/2024

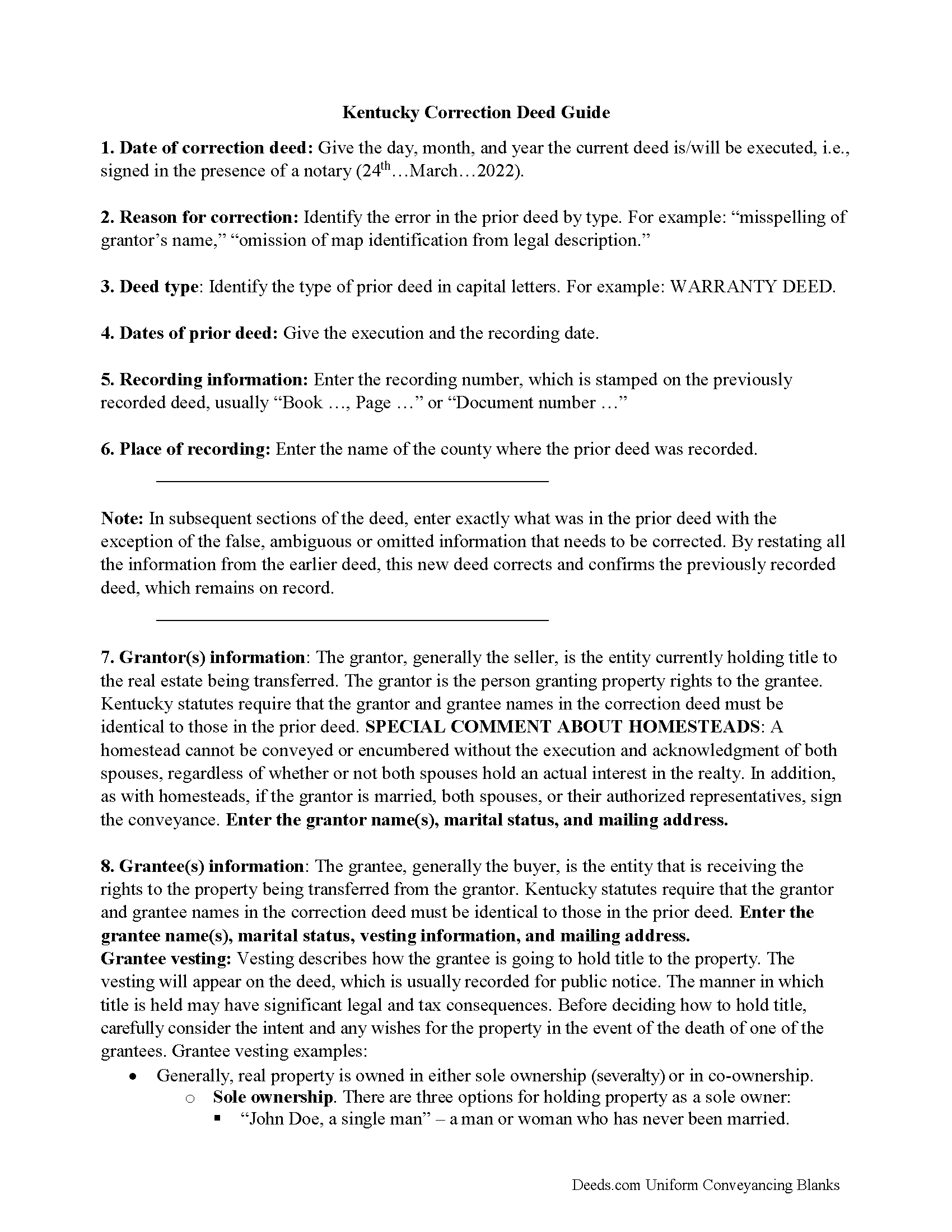

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Campbell County compliant document last validated/updated 12/20/2024

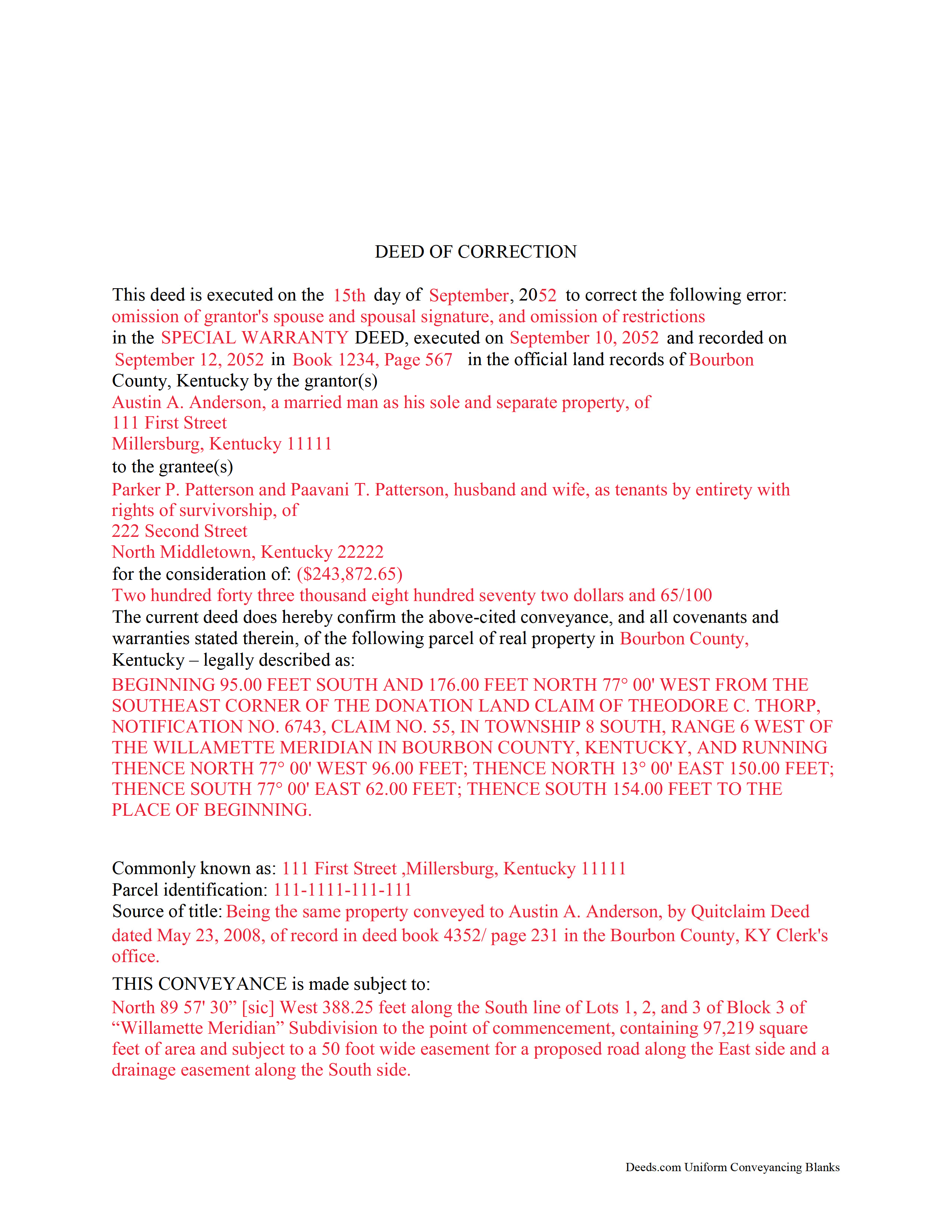

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Campbell County compliant document last validated/updated 11/29/2024

The following Kentucky and Campbell County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Campbell County. The executed documents should then be recorded in the following office:

Campbell County Clerk

1098 Monmouth St, Newport, Kentucky 41071

Hours: 8:30 to 4:00 M-F; Sat 9:00 to 12:00

Phone: (859) 292-3845

Local jurisdictions located in Campbell County include:

- Alexandria

- Bellevue

- California

- Dayton

- Fort Thomas

- Melbourne

- Newport

- Silver Grove

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Campbell County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Campbell County using our eRecording service.

Are these forms guaranteed to be recordable in Campbell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Campbell County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Campbell County that you need to transfer you would only need to order our forms once for all of your properties in Campbell County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kentucky or Campbell County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Campbell County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Kentucky, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is in effect an explanation and correction of an error in a prior instrument. As such, it passes no title, but only reiterates and confirms the prior conveyance. It must be executed from the original grantor(s) to the original grantee(s), and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance it is correcting by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its de facto reiteration. The prior deed, however, which constitutes the actual conveyance of title, remains on record.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. When making more substantial changes, for example to the vesting information or legal description of the property, it is best to seek legal advice regarding the long-term consequences.

Kentucky statutes give the following examples of corrections that can be made with a deed of correction: the number of acres or the source of the title for example (KRS 382.337). This implies that some material changes, such as the amount of property and errors to the chain of title, can be addressed through a correction deed. However, adding a name to the title or removing a name from it cannot be achieved via a correction deed in Kentucky and instead require a new deed of conveyance.

Another correction vehicle available in Kentucky is the affidavit of correction. It can be filed by one of the parties or the attorney who prepared the deed, but the statute limits its use to errors in the marital status and the acknowledgment or notary section of the deed (KRS 382.337), so they are only useful for a small number of corrections overall.

Correction deeds cost less to record in Kentucky than standard deeds, and they are exempt from transfer tax, and a consideration certificate is generally not required (KRS 382.135) unless the consideration amount is different from that in the prior deed (KRS 142.050). In that case, a new consideration certificate, notarized and signed by grantor and grantee, is required, and the clerk might collect additional transfer tax if the consideration amount is higher than in the prior deed.

(Kentucky Correction Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Campbell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Campbell County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Terreva B.

August 9th, 2019

Yes it helped with some things but I need more info

Thank you!

Carlos T.

September 15th, 2021

Site was easy to use and forms were exactly what I needed. Will use this in the future for other needed forms. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lan S.

November 23rd, 2020

extremely satisfied with the service. I could not get file size correctly at the beginning. I received quick responses pointing out specific problem, which was very helpful for me to correct the mistake. It took 5 or 6 times due to different errors to finally achieve the qualified version. The customer care team was very patient walking me through the process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sierra S.

November 30th, 2020

Thank you so much for making this process seemless. We are very pleased with the service.

Thank you!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

November 22nd, 2019

Quick and easy download. Got everything I needed. I would recommend deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

December 15th, 2021

Thanks for such great service!

Thank you for your feedback. We really appreciate it. Have a great day!

Dan L.

May 31st, 2024

The only suggestion I have is to include sample of putting quitclaim into a revocable trust.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

willie B.

May 21st, 2019

I love how you can get information you need online great program ,outstanding just love it....

Thank you!

Pamela G.

January 29th, 2019

This is an easily navigated site and the forms came with detailed directions. I have already recommended Deeds.com to a family member.

Thank you so much Pamela, we really appreciate it!

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. rn Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!