Marion County Quitclaim Deed Form (Kansas)

All Marion County specific forms and documents listed below are included in your immediate download package:

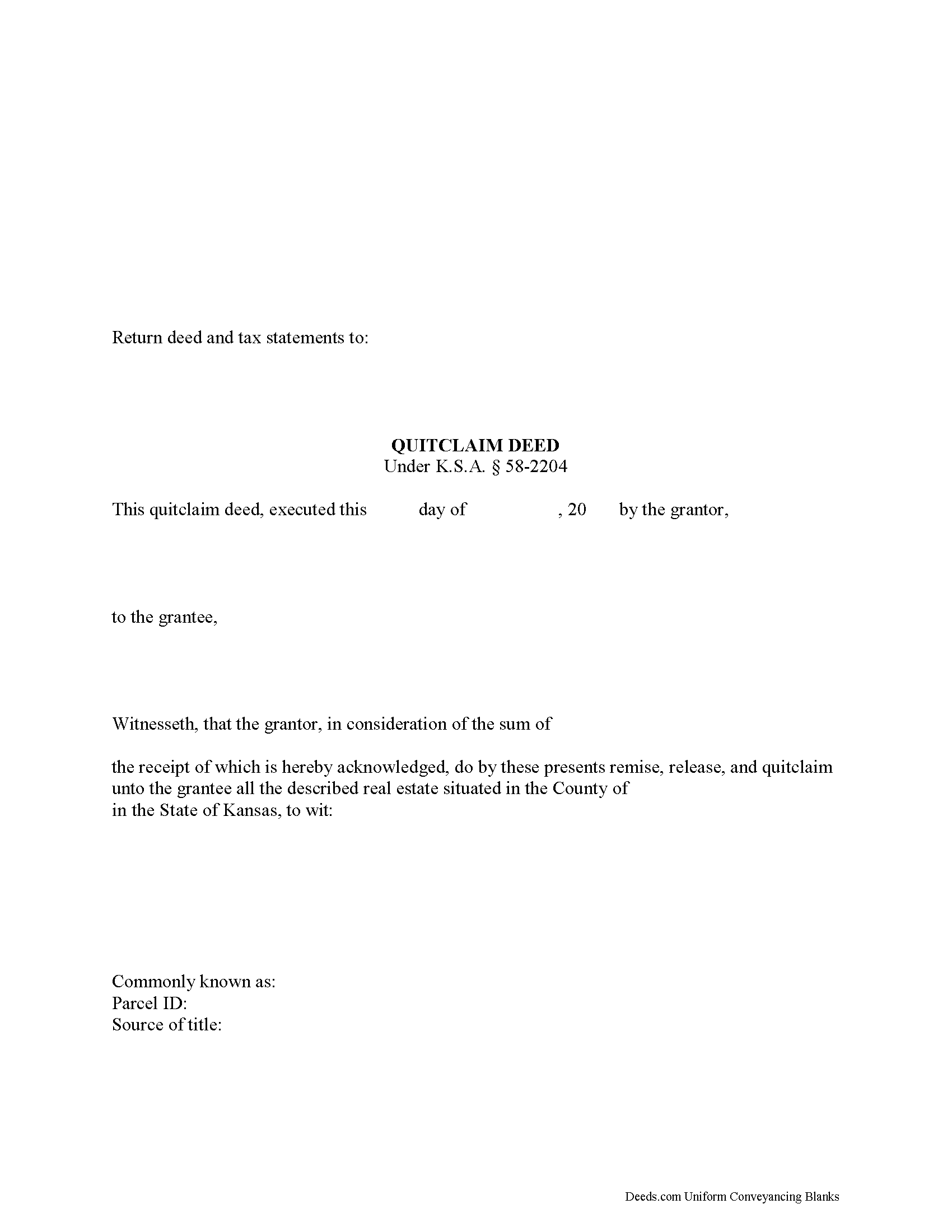

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Kansas recording and content requirements.

Included Marion County compliant document last validated/updated 11/20/2024

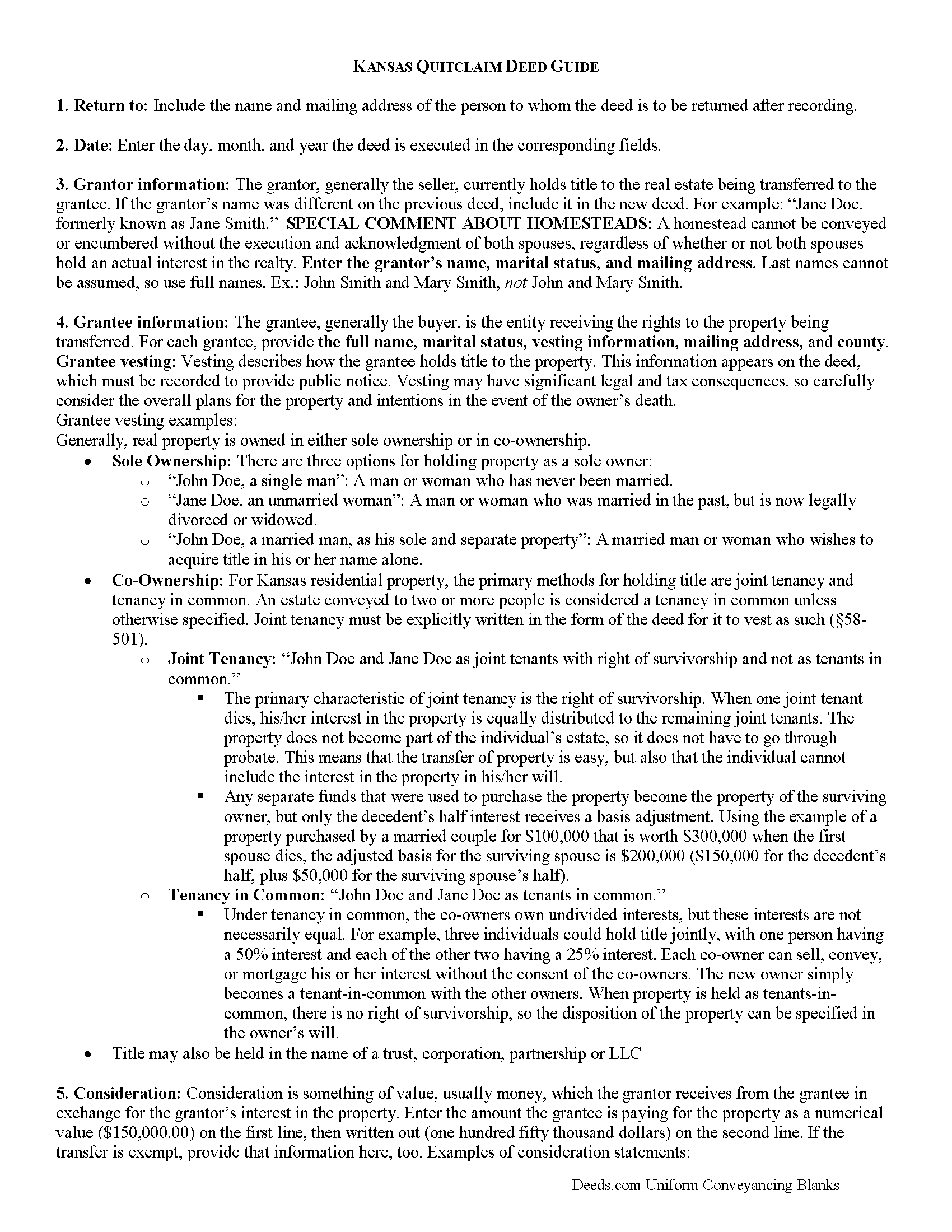

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Marion County compliant document last validated/updated 5/6/2024

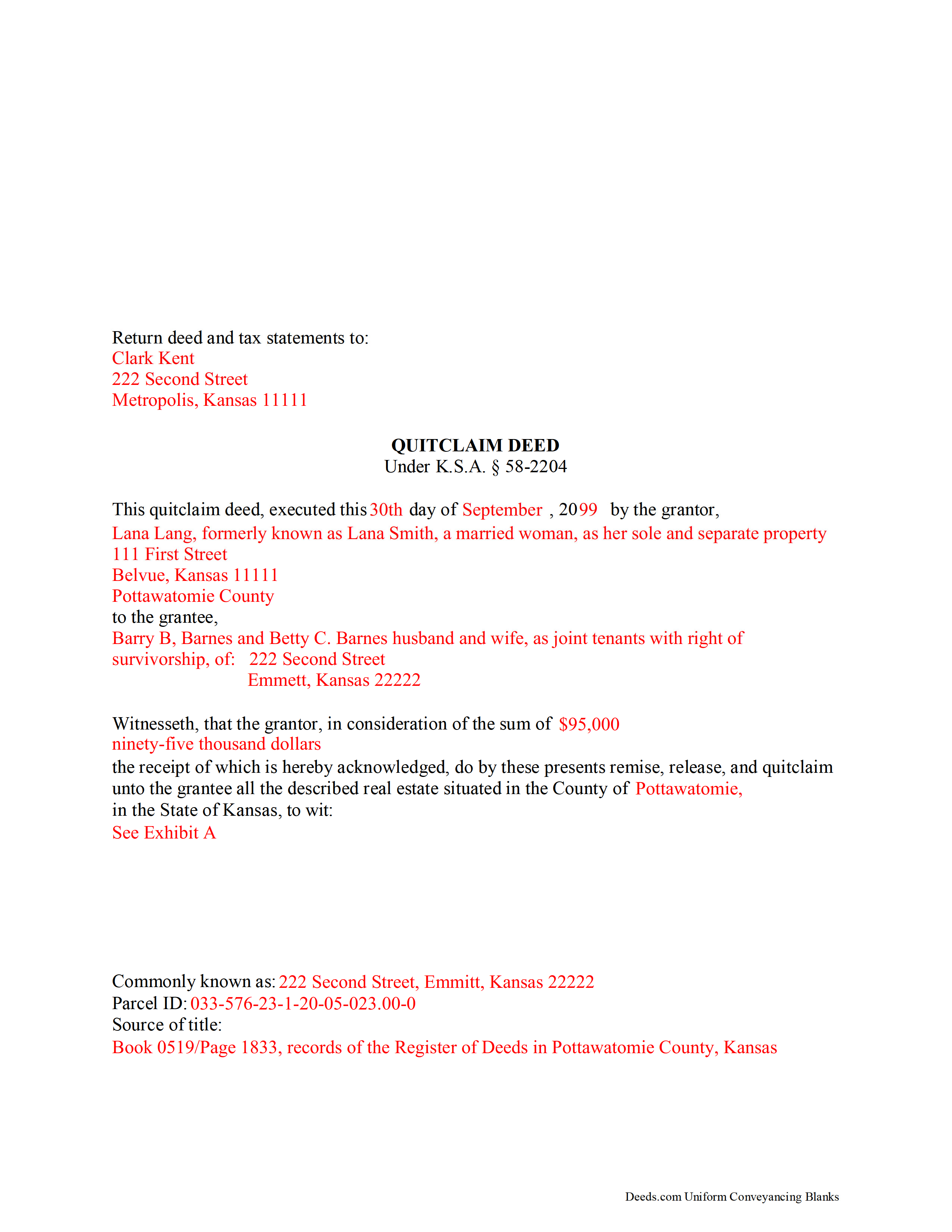

Completed Example of the Quitclaim Deed Document

Example of a properly completed Kansas Quitclaim Deed document for reference.

Included Marion County compliant document last validated/updated 10/21/2024

The following Kansas and Marion County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Marion County. The executed documents should then be recorded in the following office:

Marion County Register of Deeds

230 South Third St, Suite 105, Marion, Kansas 66861

Hours: 8:00 to 5:00 M-F

Phone: (620) 382-2151

Local jurisdictions located in Marion County include:

- Burns

- Durham

- Florence

- Goessel

- Hillsboro

- Lehigh

- Lincolnville

- Lost Springs

- Marion

- Peabody

- Ramona

- Tampa

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Marion County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Marion County using our eRecording service.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marion County that you need to transfer you would only need to order our forms once for all of your properties in Marion County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Marion County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Marion County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Kansas Quitclaim Deed Content:

K.S.A. 58-2202 explains that "every conveyance of real estate shall pass all the estate of the grantor therein." K.S.A. 58-2202 states that transfers in ownership of land are valid when a deed is executed by someone with an ownership interest in the property. K.S.A. 58-2204 provides the statutory form for quitclaim deeds, including the minimum requirements and correct language. The necessary information includes the names and addresses of all grantors and grantees, a complete legal description of the property, the consideration (usually money), and the notarized signature of the grantor or an authorized representative. K.S.A. 58-2209 reinforces the requirement of the grantor's notarized signature. K.S.A. 58-2211 expands the discussion about who may acknowledge the instrument to include those authorized by uniform law to perform notarial acts. K.S.A. 28-115 states that all signatures must have the signor's name typed or printed immediately below them. Finally, K.S.A. 58-2221 adds the obligation to include details about the transaction in which the grantor gained ownership of the property. In addition, be certain that the document contains an appropriately descriptive heading (in this case, "Quit Claim Deed).

Recording:

K.S.A. 58-2221 explains that every written instrument conveying ownership interests in real estate should be presented for recording to the office of the register of deeds of the county where the land is located. K.S.A. 28-115 contains formatting requirements:

* Legal-sized paper (8" x 14") is the maximum size for recording without a non-standard document fee.

* The document must be printed in minimum 8-point type.

Kansas follows a "race-notice" recording statute, as described in K.S.A. 58-2222, 2223. Every written instrument, such as a quit claim deed, submitted for recording as directed, imparts constructive notice to all subsequent bona fide purchasers (buyers for value). Unrecorded deeds only provide actual notice to the parties involved with the conveyance, but because they are not entered into the public record, future buyers might not be aware of the change in ownership. For example, let's say that the grantor quit claims his/her rights to the real estate to grantee A, who fails to record the otherwise properly executed deed. Then the grantor quit claims the same property to grantee B, who records the instrument according to the statute. By presenting the deed for recordation, grantee B enters the transaction into the public record and, as a result, will generally prevail in a dispute about the real owner of the parcel of land. In short, recording the quit claim deed as soon as possible after it is executed is one of the simplest ways to preserve the rights and interests of both the buyer and the seller.

(Kansas Quitclaim Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

RICHARD A.

March 4th, 2023

Smooth, simple, and complete. A great forms service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ardys A.

January 13th, 2019

Very pleased with all the info I received and not just a blank form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody L.

November 8th, 2020

Beware, you cannot save the information you typed and change it later. It will be a PDF upon saving. So if you need corrections...you have to start all over!

Thank you for your feedback. We really appreciate it. Have a great day!

Lori W.

March 14th, 2021

I got what I wanted immediately. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vera P.

May 14th, 2020

An excellent service!

Thank you!

Kenneth-Wayne L.

August 20th, 2020

1) I was very pleased when the staff mentioned your service since the three referenced on the Recorder's website all wanted HUGE Account set-up and maintenance fees AND BIG fees per recording, and yours has no set-up fee AND nominal per-recording fee; 2) My (few) recordings will be NON-LAND Related, summary or entire record(s) of Administrative (Procedures Act) records, Other than the Border width and Cover Sheet, do you anticipate any other special requirements for such recording(s)? NOTE: I just sent one by Snail Mail, and they just informed me that due to the GERMIPHOBIA 'Pandemic' the ONLY open and record Snail Mail ONCE A MONTH On the first of each chmonth!

Thank you!

Richard L.

December 17th, 2020

Service was very convenient; I received prompt assistance with my document - staff was very helpful.

Thank you!

John T.

October 12th, 2023

I have not completed the submission of documents yet but the initial sign up and documents were easily done and trouble free. Will update with results soon

Thank you!

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

Rick L.

May 26th, 2022

I love it! Very convenience.

Thank you!