Marion County Mortgage Instrument and Promissory Note Form (Kansas)

All Marion County specific forms and documents listed below are included in your immediate download package:

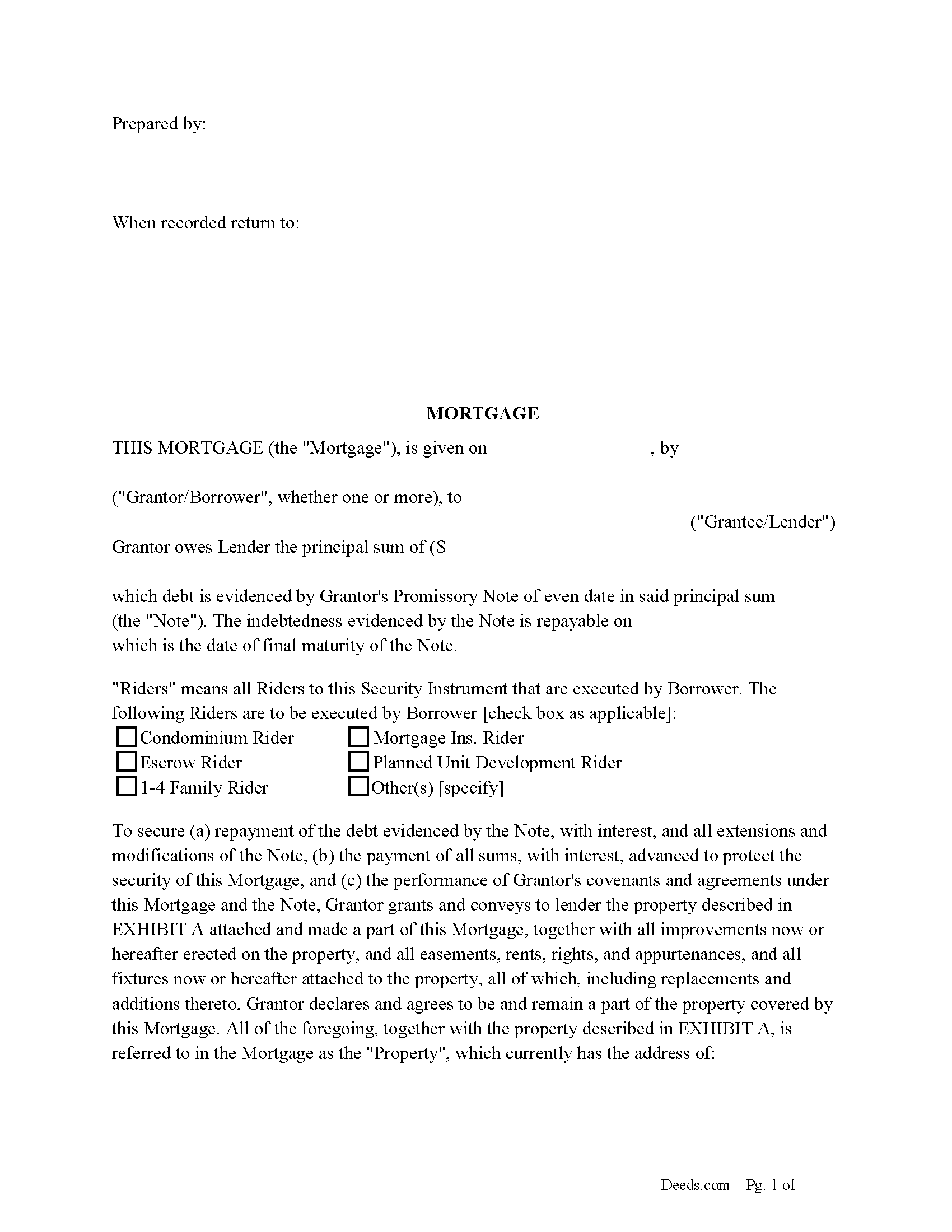

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Marion County compliant document last validated/updated 12/17/2024

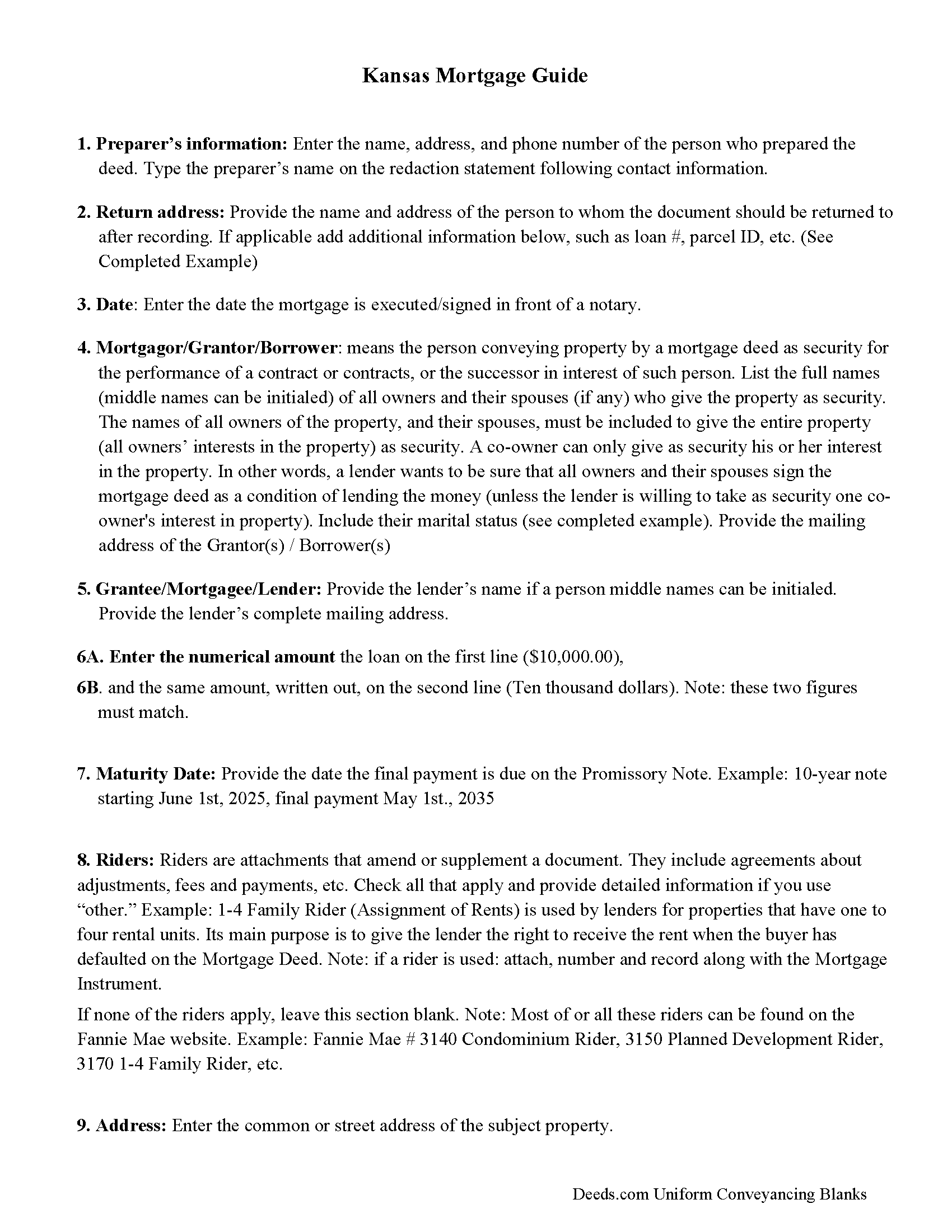

Mortgage Form Guidelines

Line by line guide explaining every blank on the form

Included Marion County compliant document last validated/updated 12/18/2024

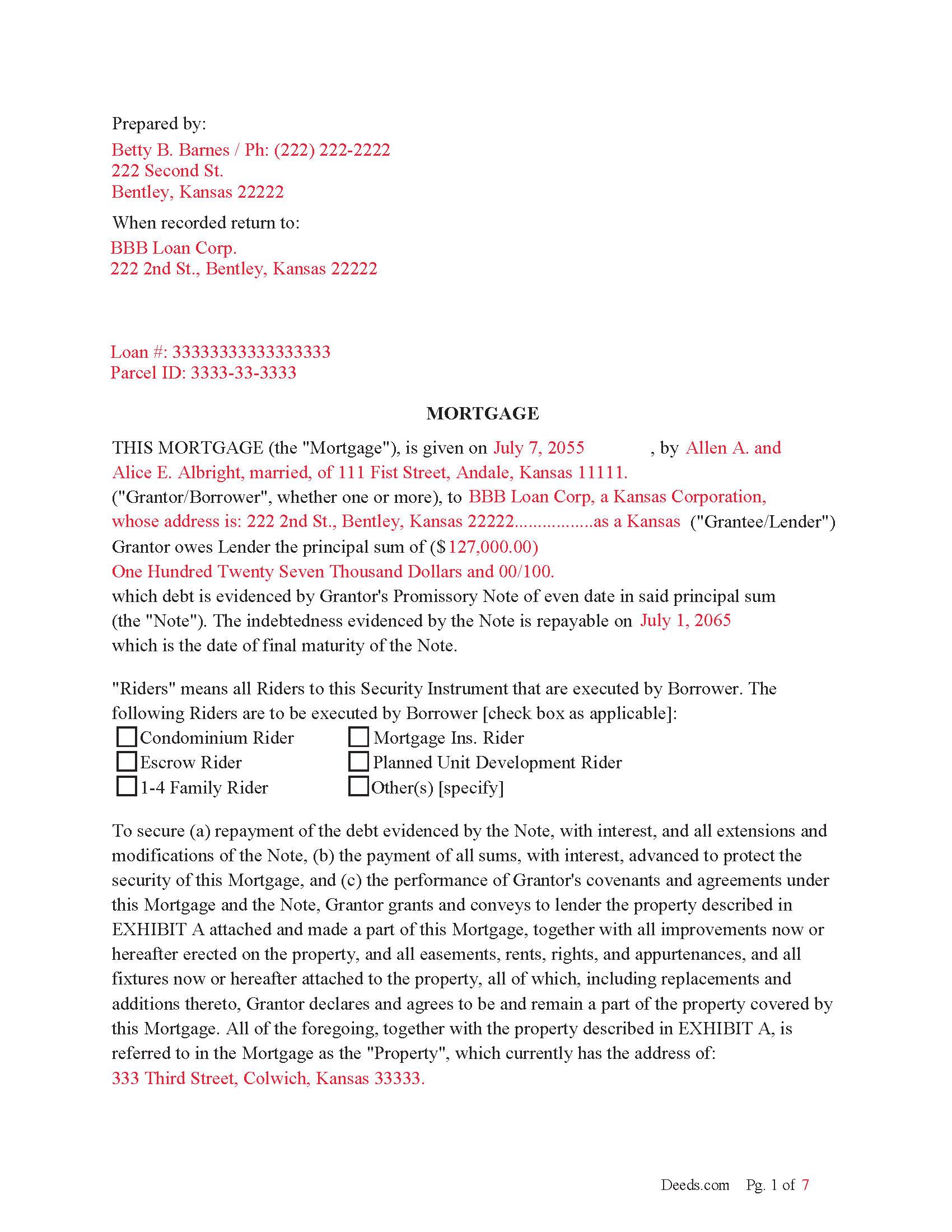

Completed Example of the Mortgage Document

Example of a properly completed form for reference.

Included Marion County compliant document last validated/updated 10/10/2024

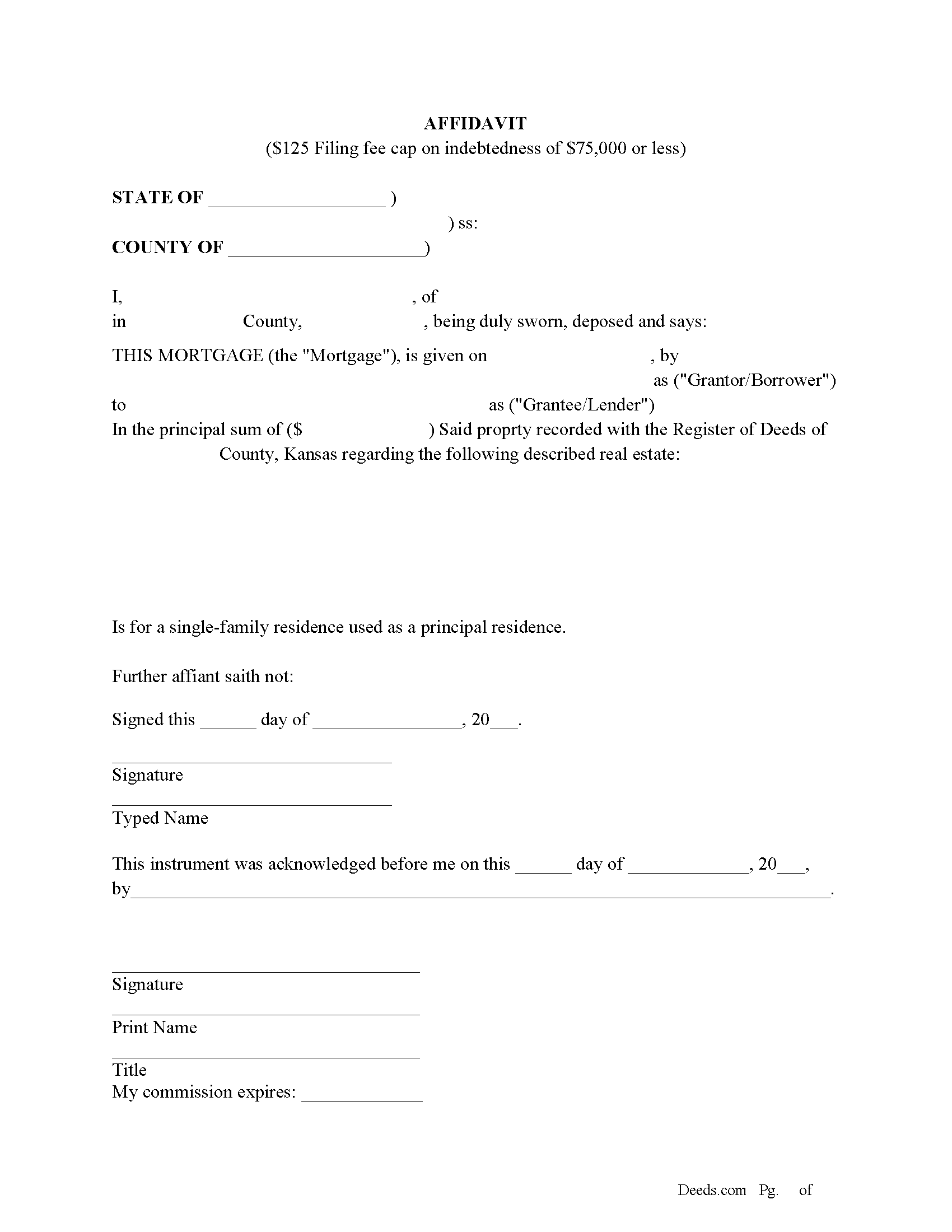

Filing Cap Fee Affidavit

Mortgages filed after January 1, 2015 have a filing fee cap of $125 if the indebtedness is $75,000 or less and it is for a single family home used as the principal residence of the owner.

Included Marion County compliant document last validated/updated 10/31/2024

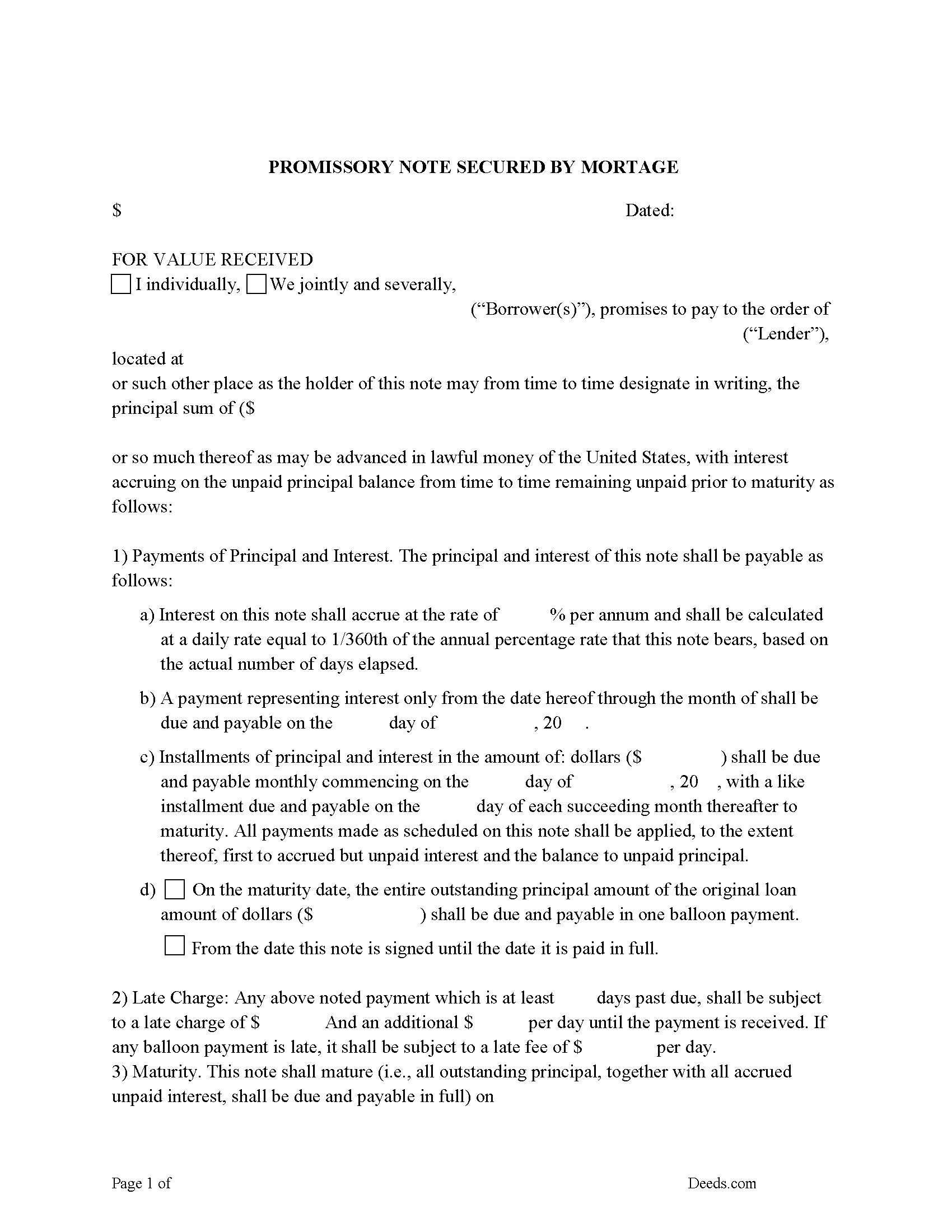

Promissory Note Form

Promissory Note secured by Mortgage.

Included Marion County compliant document last validated/updated 12/26/2024

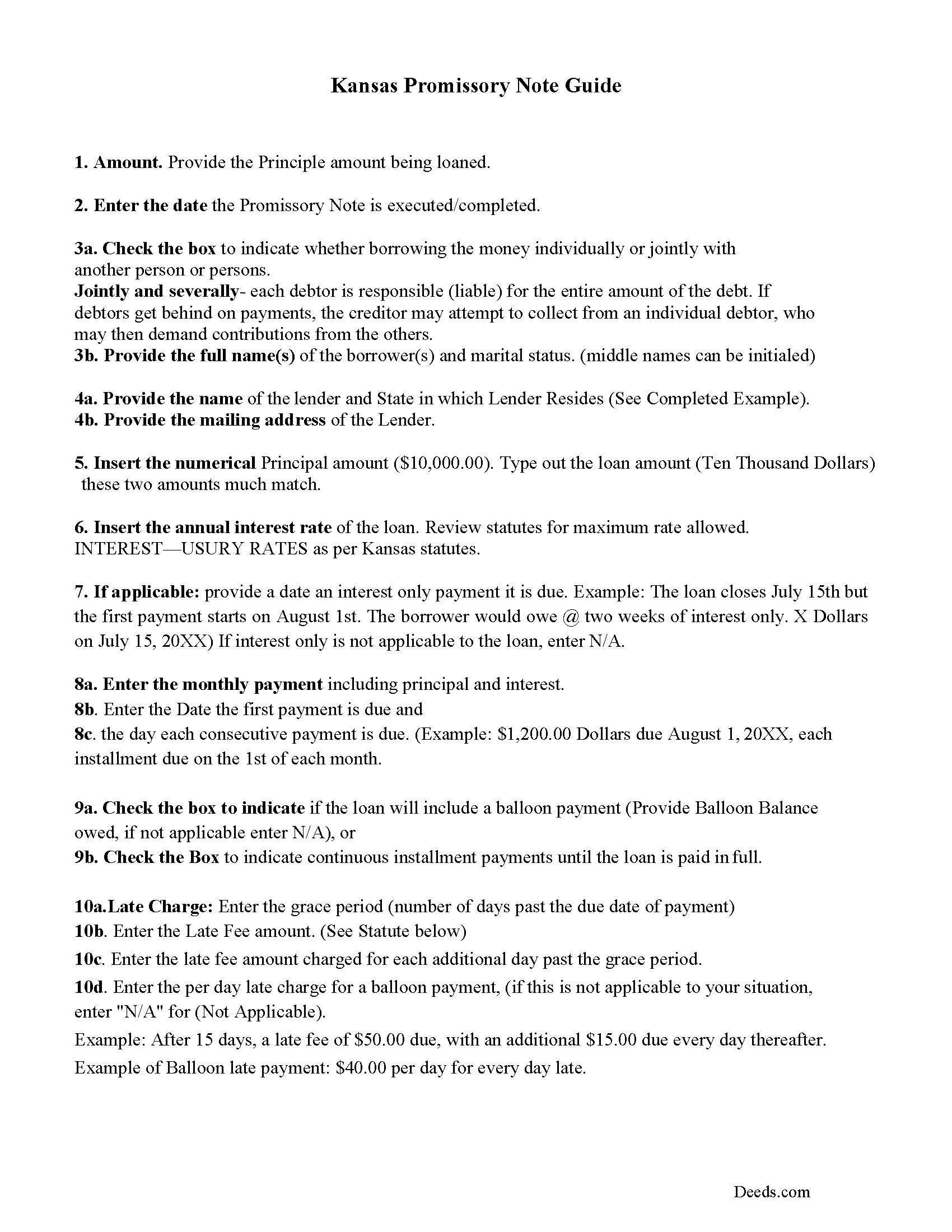

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Marion County compliant document last validated/updated 12/25/2024

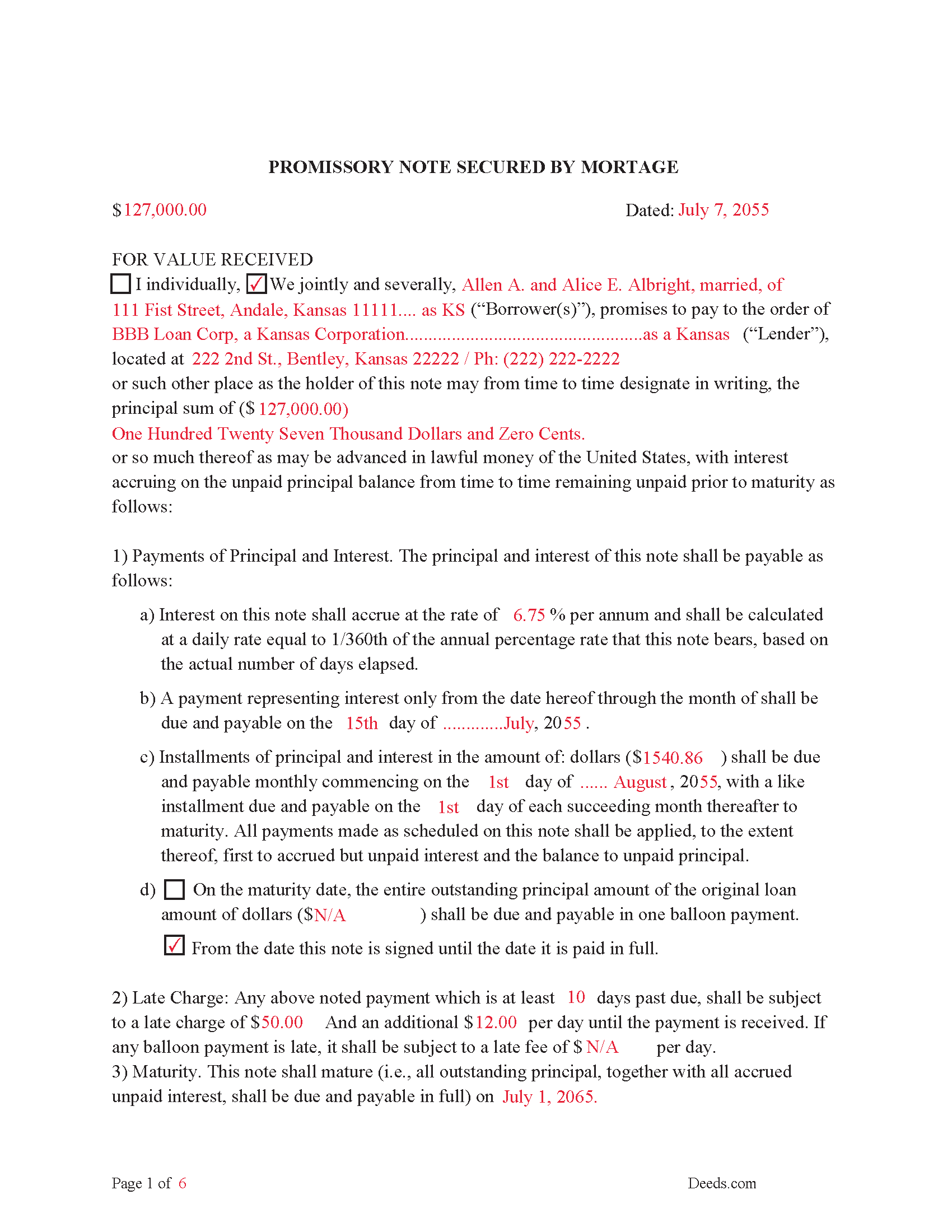

Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included Marion County compliant document last validated/updated 12/13/2024

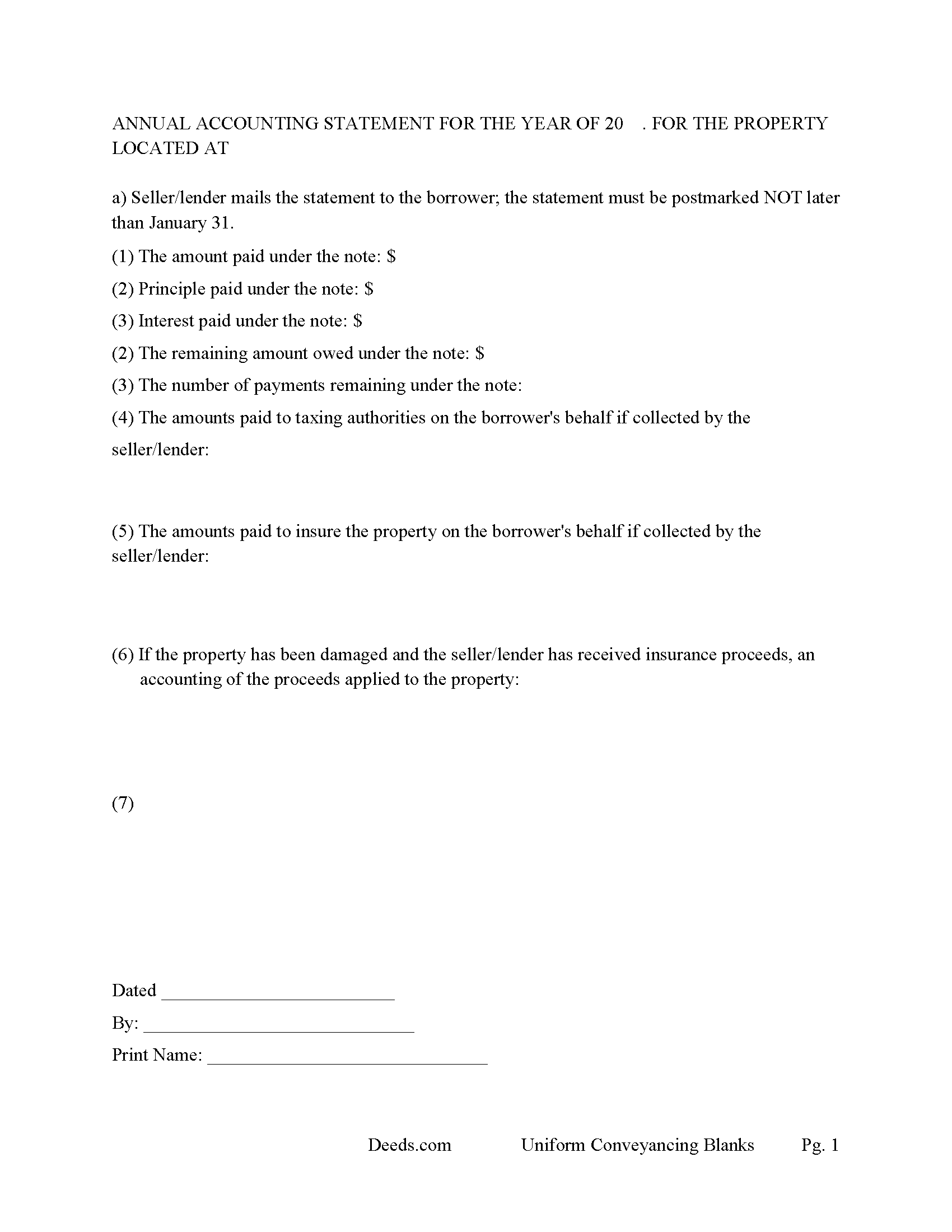

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Marion County compliant document last validated/updated 11/20/2024

The following Kansas and Marion County supplemental forms are included as a courtesy with your order:

When using these Mortgage Instrument and Promissory Note forms, the subject real estate must be physically located in Marion County. The executed documents should then be recorded in the following office:

Marion County Register of Deeds

230 South Third St, Suite 105, Marion, Kansas 66861

Hours: 8:00 to 5:00 M-F

Phone: (620) 382-2151

Local jurisdictions located in Marion County include:

- Burns

- Durham

- Florence

- Goessel

- Hillsboro

- Lehigh

- Lincolnville

- Lost Springs

- Marion

- Peabody

- Ramona

- Tampa

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Marion County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Marion County using our eRecording service.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Instrument and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marion County that you need to transfer you would only need to order our forms once for all of your properties in Marion County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Marion County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Marion County Mortgage Instrument and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In this mortgage the grantor/borrower "Warrants" title to grantee/lender (the said mortgage being dated, and duly signed and acknowledged by the grantor, shall be deemed and held to be a good and sufficient mortgage to the grantee, his or her heirs, assigns, executors and administrators, with warranty from the grantor and his or her legal representatives of a perfect title in the grantor, and against all previous encumbrances; and if in the above form the words "and warrants" be omitted, the mortgage shall be good without warranty. (KS Statute 58-2303)

Use this form to finance residential property, vacant land, rental property, condominiums, small commercial property and planned unit developments. For use in Kansas only.

(Kansas Mortgage Package includes forms, guidelines, and completed examples)

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Mortgage Instrument and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Steve D.

January 25th, 2020

I requested a property detail report on two houses that I own. The requests were easy to make. After submitting the requests, each report was available for my review within 15 minutes. The reports contained all the information I needed. I am very satisfied with this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from

your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary N.

January 13th, 2021

Very easy to use.

Thank you Mary.

Cindy A.

January 14th, 2019

Easy to understand and use. However, need to add line for phone number for preparer - Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

January 31st, 2021

Excellent service, quick and very efficient!

Thanks for your great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roberta M.

February 21st, 2022

I found a lot of useful information regarding the Lady Bird Deed and feel it will serve my needs as opposed to a Revocable

Living

Trust. The information was easy to understand and very helpful. The forms seem easy to complete and I plan to get them notarized and filed at the courthouse very soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Chris D.

December 10th, 2020

Easy and affordable. I would recommend deeds.com

Thank you!

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

Devra R.

May 30th, 2022

A refreshingly easy service to use. They offer auxiliary forms as a courtesy. Theres no "gotcha" capitalism. You pay the reasonable fee and the needed forms are accessible instantly to download. I've used it twice so far and it worked perfectly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

mary c.

May 24th, 2022

Really good product, included guide to filling out forms.

Totally pleased with that part.

Customer service however was terrible. Did not hear back after I sent two emails. The site signed me up but after I was accepted they would not allow me to download a form, with the notation my account was closed. Had to use another email. Had problems with that. Finally got off of site and went to a login site that allowed me to download the forms. If you can get past setting up your account, it is fantastic site. Nice price compared to alternatives. Also I recieved two validation codes. Have no idea why they were sent.

Thank you!

Tai H.

September 21st, 2019

Great service. Save me a time and effort in filling out LA County Quitclaim Deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.