Pratt County Limited Power of Attorney for Sale Form (Kansas)

All Pratt County specific forms and documents listed below are included in your immediate download package:

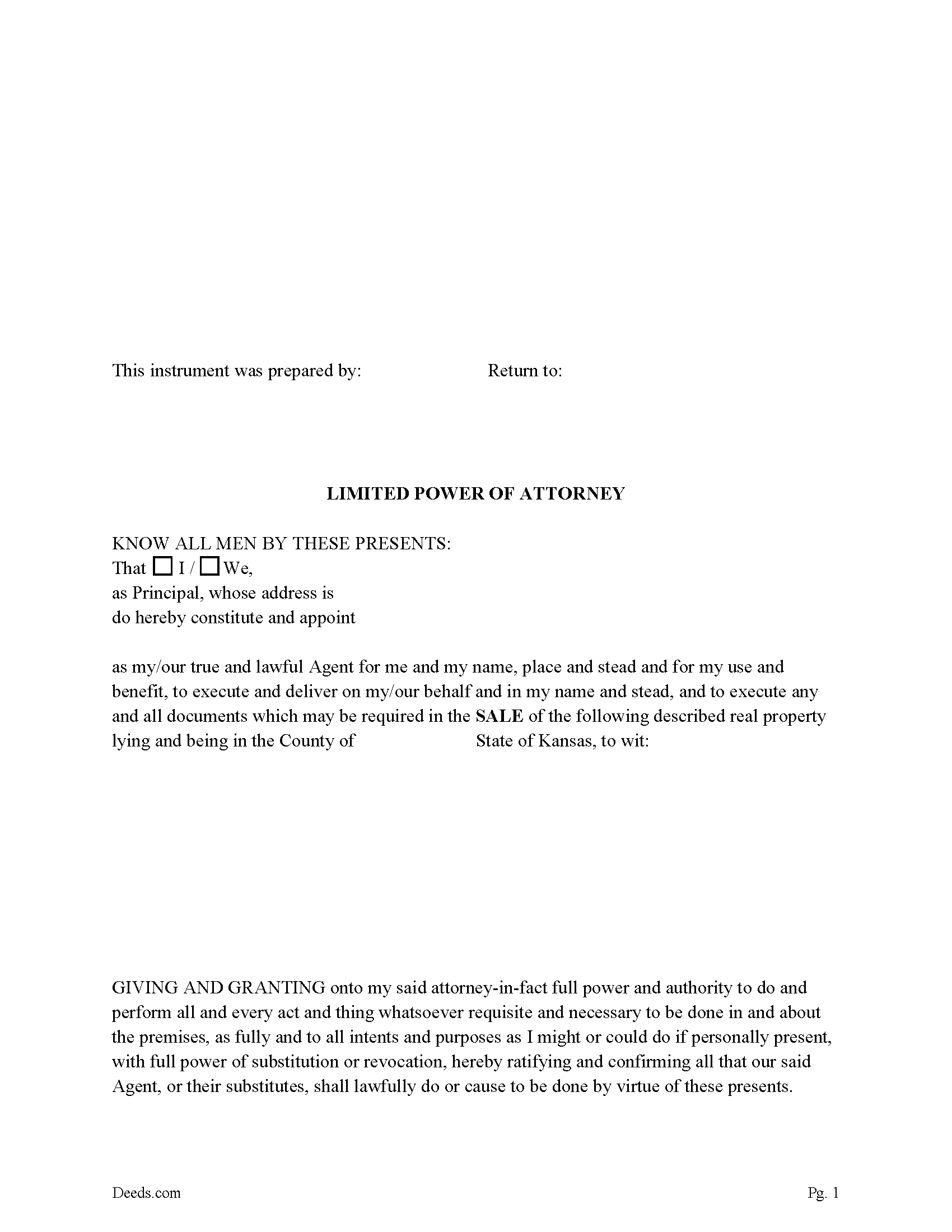

Limited Power of Attorney for Sale Form

Fill in the blank Limited Power of Attorney for Sale form formatted to comply with all Kansas recording and content requirements.

Included Pratt County compliant document last validated/updated 11/20/2024

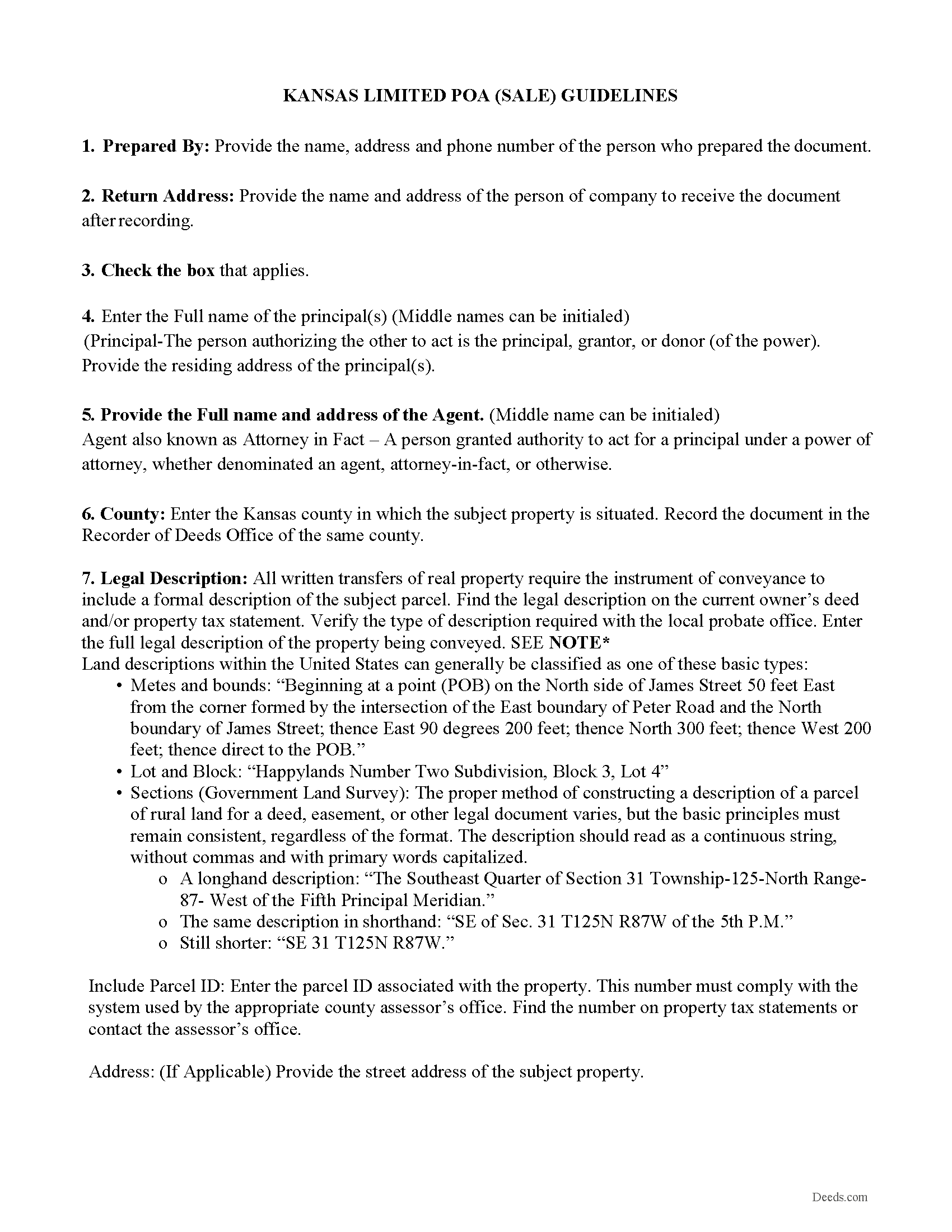

Limited Power of Attorney for Sale Guide

Line by line guide explaining every blank on the Limited Power of Attorney for Sale form.

Included Pratt County compliant document last validated/updated 9/11/2024

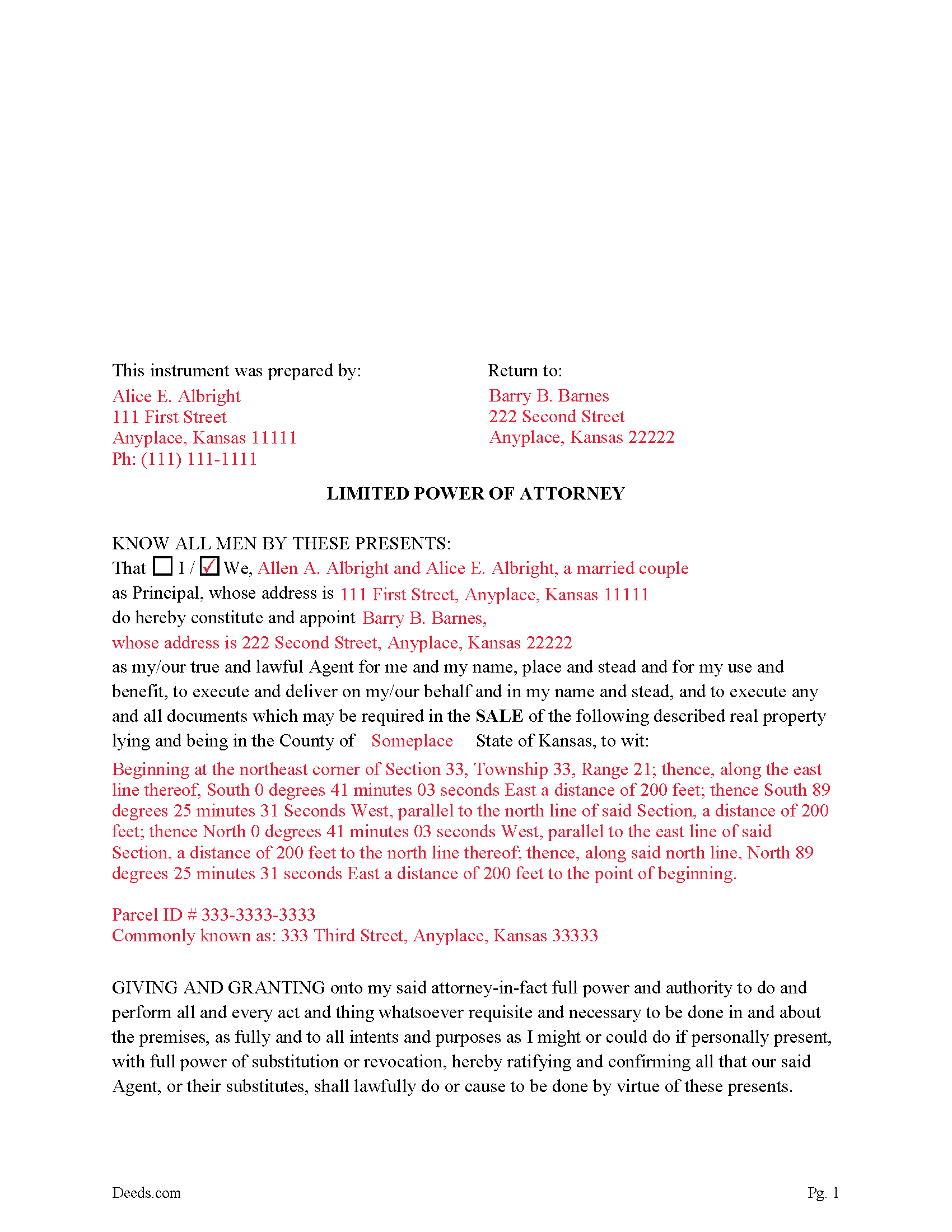

Completed Example of the Limited Power of Attorney for Sale Document

Example of a properly completed Kansas Limited Power of Attorney for Sale document for reference.

Included Pratt County compliant document last validated/updated 12/20/2024

The following Kansas and Pratt County supplemental forms are included as a courtesy with your order:

When using these Limited Power of Attorney for Sale forms, the subject real estate must be physically located in Pratt County. The executed documents should then be recorded in the following office:

Pratt County Register of Deeds

300 South Ninnescah St, 2nd floor / PO Box 874, Pratt, Kansas 67124

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (620) 672-4140

Local jurisdictions located in Pratt County include:

- Byers

- Coats

- Iuka

- Pratt

- Sawyer

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Pratt County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Pratt County using our eRecording service.

Are these forms guaranteed to be recordable in Pratt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pratt County including margin requirements, content requirements, font and font size requirements.

Can the Limited Power of Attorney for Sale forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Pratt County that you need to transfer you would only need to order our forms once for all of your properties in Pratt County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Pratt County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Pratt County Limited Power of Attorney for Sale forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Kansas, a Limited Power of Attorney (LPOA) for the sale of real estate is a legal document that grants a designated person (the agent or attorney-in-fact) the authority to handle specific matters related to the sale of real property on behalf of the principal (the person granting the power). This power can include signing documents, handling transactions, and making decisions related to the sale. However, the statutes and legal requirements can be complex and are subject to change, so it's important to consult a legal professional for the most current and applicable advice.

General guidelines regarding a Limited Power of Attorney for real estate in Kansas:

Written Document: The power of attorney must be in writing. It should clearly state the principal's name, the agent's name, and the specific powers granted.

Durability: This document shall continue in effect during any subsequent disability, incompetency, or incapacity of the principal in accordance with the provisions of K.S.A. 58-650, et al.,

Acknowledgment: The document typically needs to be signed by the principal and should be notarized. This is particularly important for real estate transactions, as a notarized document is usually required for recording the deed or other documents in county records.

Specificity: Since it is a limited power of attorney, the document should specify exactly what real estate is involved and what powers the agent has regarding the sale of that property. This can include the power to negotiate and accept offers, execute documents, and handle closing procedures.

Recording: In many cases, the power of attorney document must be recorded with the county recorder’s office in the county where the property is located, especially if it will be used for executing deeds or other documents that will be recorded.

Effective and Termination: It is intended that this power of attorney is to become effective immediately upon execution and terminates upon the completion of the sale of the property.

Legal Capacity: The principal must be of sound mind and have the legal capacity to execute the power of attorney at the time it is signed.

Compliance with Other Laws: Ensure that the document complies with other relevant Kansas laws and any specific requirements of the county where the property is located.

(Kansas Limited POA for Sale Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Pratt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pratt County Limited Power of Attorney for Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Debra W.

December 24th, 2018

I found this site a must. It provided all the forms I needed to file a Quit Claim Deed. I filed what use to be called a Quick Claim Deed 30 years ago. You only had to file the one form. Today it is called a Quit Claim Deed. The pack provided forms that I had no idea had to be filed with the Quit Claim Deed. I would not have known this otherwise if the option hadn't presented itself. Thank you!

Thanks for taking the time to leave your feedback Debra, we really appreciate it.

Carl T.

February 23rd, 2021

Great site with good information and pricing. Let me know when you are able to record documents in California.

Thank you for your feedback. We really appreciate it. Have a great day!

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

NormaJean Q.

July 4th, 2021

Thank you, thie was very helpful. I did find the forms I needed.Very easy to use.,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kay I.

December 11th, 2019

Very easy to use. However, the "sample" filled in red ink did not print for me to refer to. Is that the correct desire, not to print?

Thank you for your feedback. We really appreciate it. Have a great day!

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Sidney L.

July 22nd, 2022

Not a fan. Filling in the WI RE transfer return was simple enough. However, it downloaded as a DOR file and I can't find a program to open it. So, I have no way to print the form to complete the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra S.

April 10th, 2019

Very helpful, with blank and sample completed documents. The only thing I was confused about was the "legal description" of my property. The documents weren't too helpful on what that meant. Otherwise they were great. It saved me $200 to prepare these myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia H.

February 20th, 2023

The entire process was simple and easy, from purchasing, downloading and saving the documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George W.

April 2nd, 2020

The process was easy and the forms were a very complete package. FAST AND EASY DOWNLOAD

Thank you George.

Betty S.

May 2nd, 2022

Thank you for the excellent and complete layout of all forms needed to complete the Affidavit of Death and Heirship, including the notarial officer and an example of how these forms should be completed. This method definitely saves time and money and an answer to my family's Prayers.

Thank you for your feedback. We really appreciate it. Have a great day!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!