Haskell County Certificate of Trust Form (Kansas)

All Haskell County specific forms and documents listed below are included in your immediate download package:

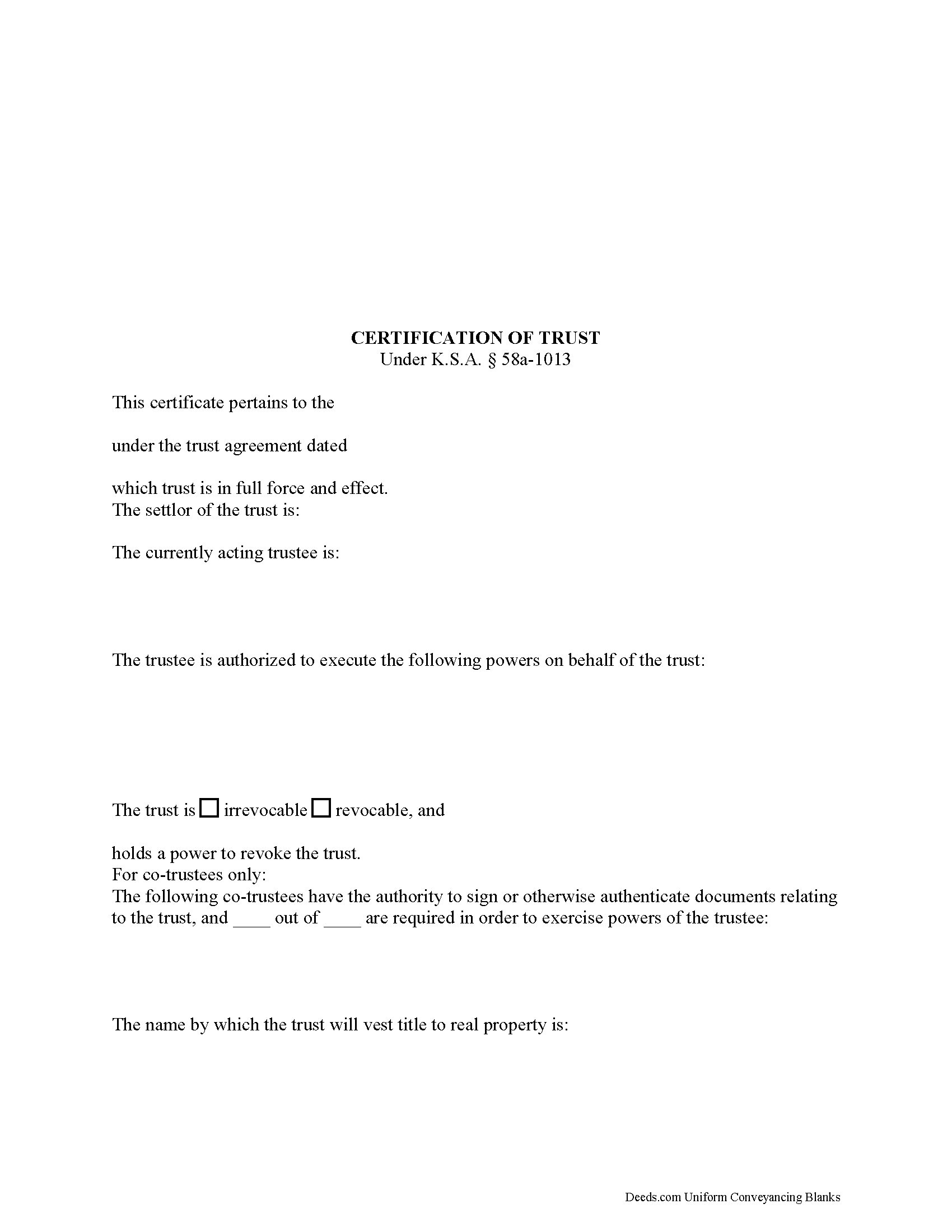

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Haskell County compliant document last validated/updated 11/18/2024

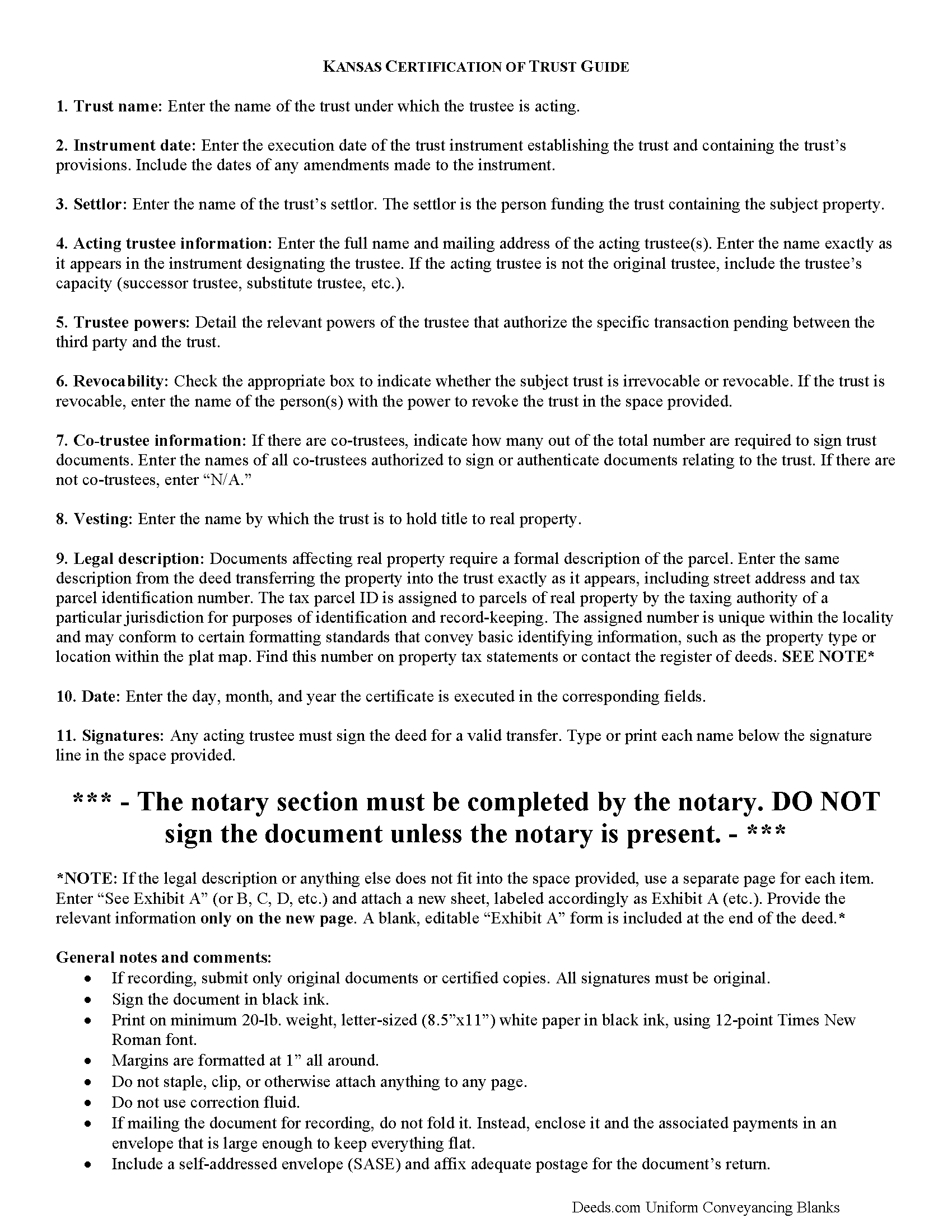

Certificate of Trust Form

Line by line guide explaining every blank on the form.

Included Haskell County compliant document last validated/updated 12/10/2024

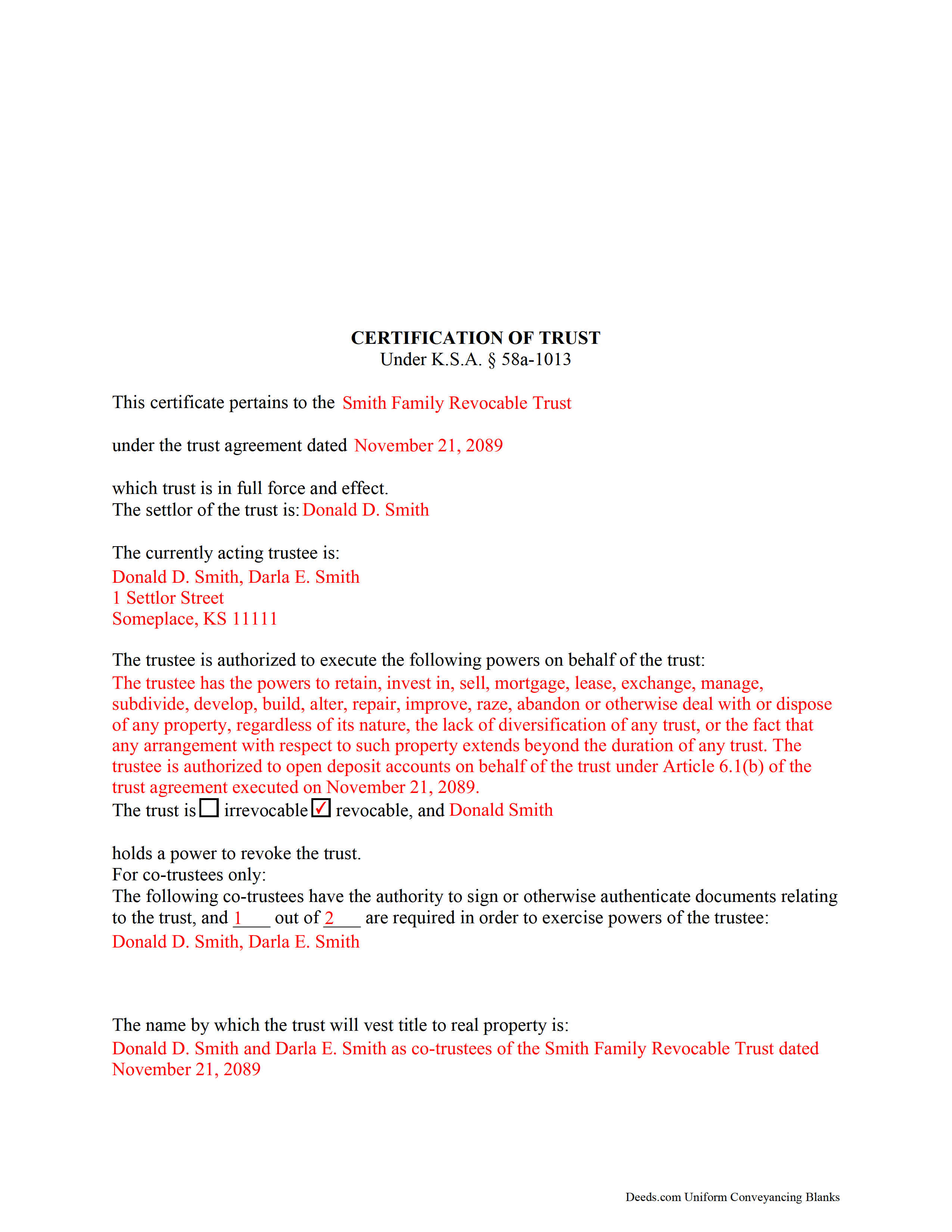

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Haskell County compliant document last validated/updated 12/9/2024

The following Kansas and Haskell County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Haskell County. The executed documents should then be recorded in the following office:

Haskell County Register of Deeds

Courthouse - 300 South Inman St / PO Box 656, Sublette, Kansas 67877

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (620) 675-8343

Local jurisdictions located in Haskell County include:

- Satanta

- Sublette

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Haskell County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Haskell County using our eRecording service.

Are these forms guaranteed to be recordable in Haskell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Haskell County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Haskell County that you need to transfer you would only need to order our forms once for all of your properties in Haskell County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Haskell County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Haskell County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Part of the Kansas Uniform Trust Code, the certification of trust is codified at K.S.A. 58a-1013.

In lieu of the trust instrument, a trustee doing business with a third party who is not a trust beneficiary can provide an acknowledged certification of trust. The certification is an abstract of the trust instrument and contains only information essential to the transaction.

A trust instrument, executed by the trust's settlor, contains the trust provisions. It designates a trustee, or a fiduciary that represents the trust. The trust instrument also identifies the trust beneficiaries, or the person(s) having a present or future interest in the trust (K.S.A. 58a-103(2)(A)).

A certification of trust does not disclose the trust's beneficiaries, or other information a settlor may wish to keep private. In Kansas, only trust instruments pertaining to "the state, or any county, municipality, political or governmental subdivision, or governmental agency of the state as the beneficiary" are required to be recorded (K.S.A. 58-2431, 2).

The document certifies, first and foremost, the existence of the trust and the trustee's authority to represent the trust. The certification also states the name, date, and type (revocable or irrevocable) of trust and provides the identity of the trust's settlor, or the person who established the trust and is funding the trust with assets, as well as the name of any person able to revoke the trust, if applicable.

In addition, the certification details the powers that the trustee has been granted relevant to the transaction at hand. For trusts with more than one trustee, the document identifies all trustees who may authorize documents relating to the trust and whether all or less than all is required to authenticate trust documents. Finally, the certification should include the manner of taking title to trust property.

All Kansas documents affecting real property require a legal description. If using the document in conjunction with a trustee's deed, the certification should contain the legal description of the subject real property.

A recipient of a certification of trust can request copies of excerpts from the original trust instrument and later amendments which designate the trustee and confer the power to act in the pending transaction, but may assume without inquiry the existence of the facts contained in the certification (K.S.A. 58a-1013(e),(f). Requesting the entire trust instrument in addition to the certification or excerpts opens the recipient to certain liabilities in court.

Consult a lawyer for guidance and with any questions relating to trusts or certifications of trust, as each situation is unique.

(Kansas Certificate of Trust Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Haskell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Haskell County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Gary G.

November 4th, 2020

I'm glad I found this service . Very useful. Time saving

Thank you for your feedback. We really appreciate it. Have a great day!

Theresa B.

September 10th, 2019

Will review after I attempt to complete. I like your site. Im very nervous to try this Hope not outdated information. Will let you know if filing goes okay.

Thank you!

Ryan B.

January 13th, 2021

This was a very quick and convenient way to complete one of the tasks for my divorce that I imagined would be extremely difficult. Thank you deeds.com for making a difficult situation bearable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie B.

May 26th, 2023

I had no clue how to write an easement termination, and I did not want to pay an attorney for it, so I ordered the instructions and form. It was very helpful to have a completed sample. I am satisfied and confident in the document I produced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Louise M.

August 31st, 2023

Amazing fast service. From the U.K. I was unable to get a check in U.S. dollars. This solved my problem as I was able to make payment with a card. So much faster than sending the documents from the U.K. via the postal service. rnEasy to use site, very quickly processed. rnHighly recommend

Thank you for your feedback. We really appreciate it. Have a great day!

Susan L.

January 4th, 2022

Instructions easy to follow, example form was a big help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cathleen H.

January 25th, 2019

The pdf form is good; however, the input boxes merge into the line above so the text is hard to read when complete. I added a return before entering my data and this solved the problem.

Thank you for your feedback Cathleen. We will have staff take a look at the document for issues with the text fields. Have a great day!

Carol D.

January 17th, 2019

No review provided.

Thank you!

Ryan K.

August 23rd, 2023

Excellent service! Quick and much easier than having to do everything through the mail. The agent was quick to answer questions and everything was processed and submitted from Deeds.com within a couple of hours. Will definitely use again if the need arises.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melanie N.

October 12th, 2019

I'm happy with the forms, thank you.

Thank you!

Veronica G.

November 11th, 2020

Excellent service A+

Thank you!

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone.

Sincerely,

Lori G.

Thank you!