Tipton County Transfer on Death Deed Form (Indiana)

All Tipton County specific forms and documents listed below are included in your immediate download package:

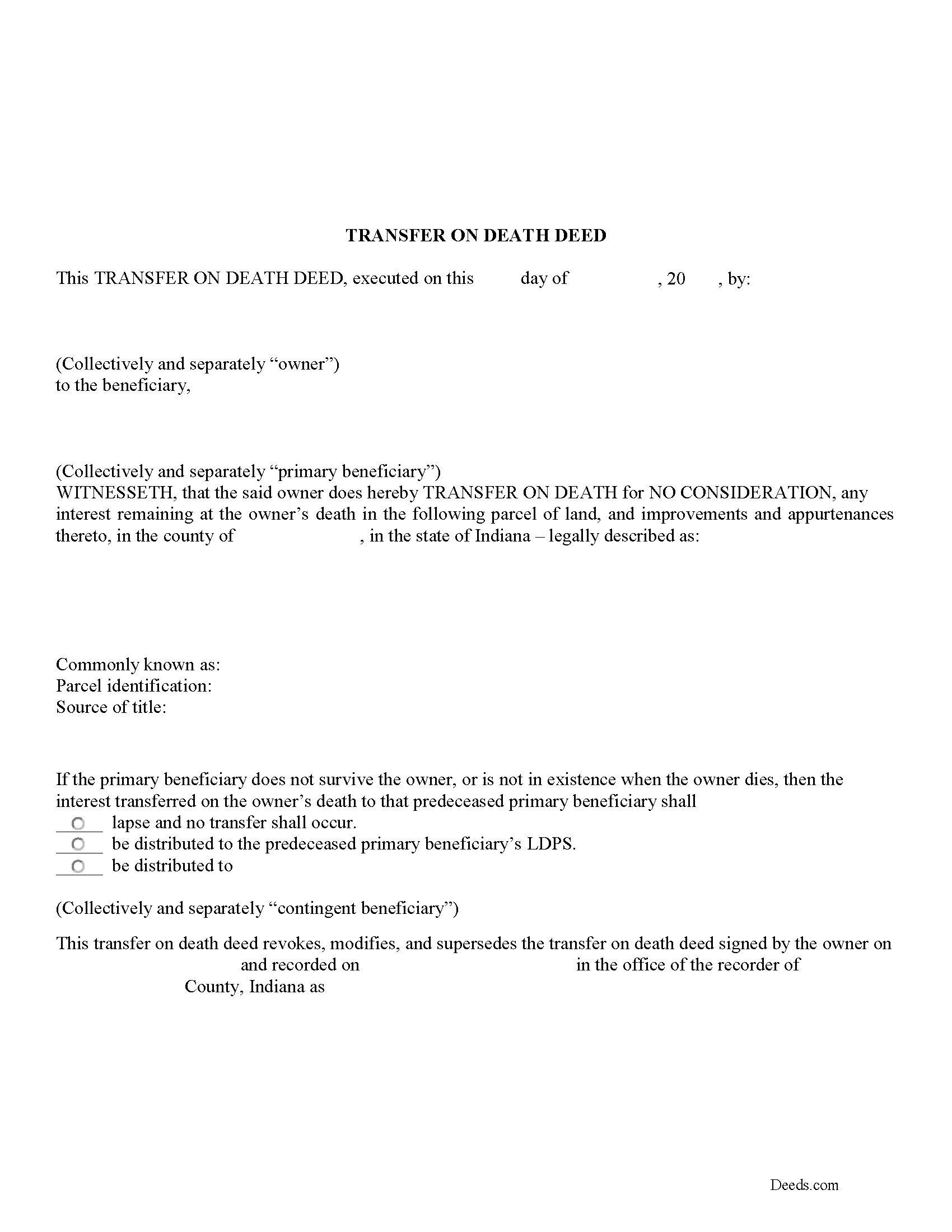

Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all Indiana recording and content requirements.

Included Tipton County compliant document last validated/updated 8/26/2024

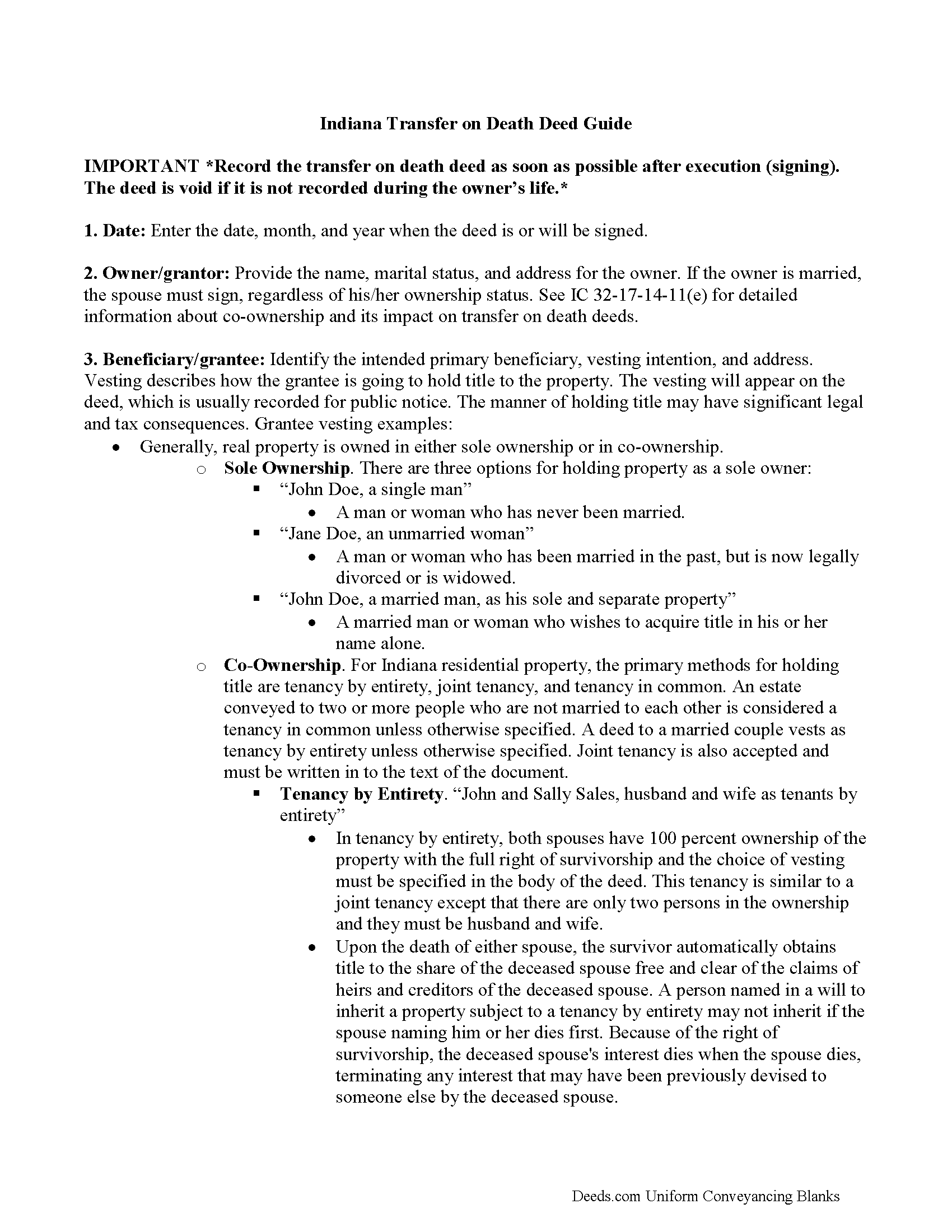

Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

Included Tipton County compliant document last validated/updated 8/28/2024

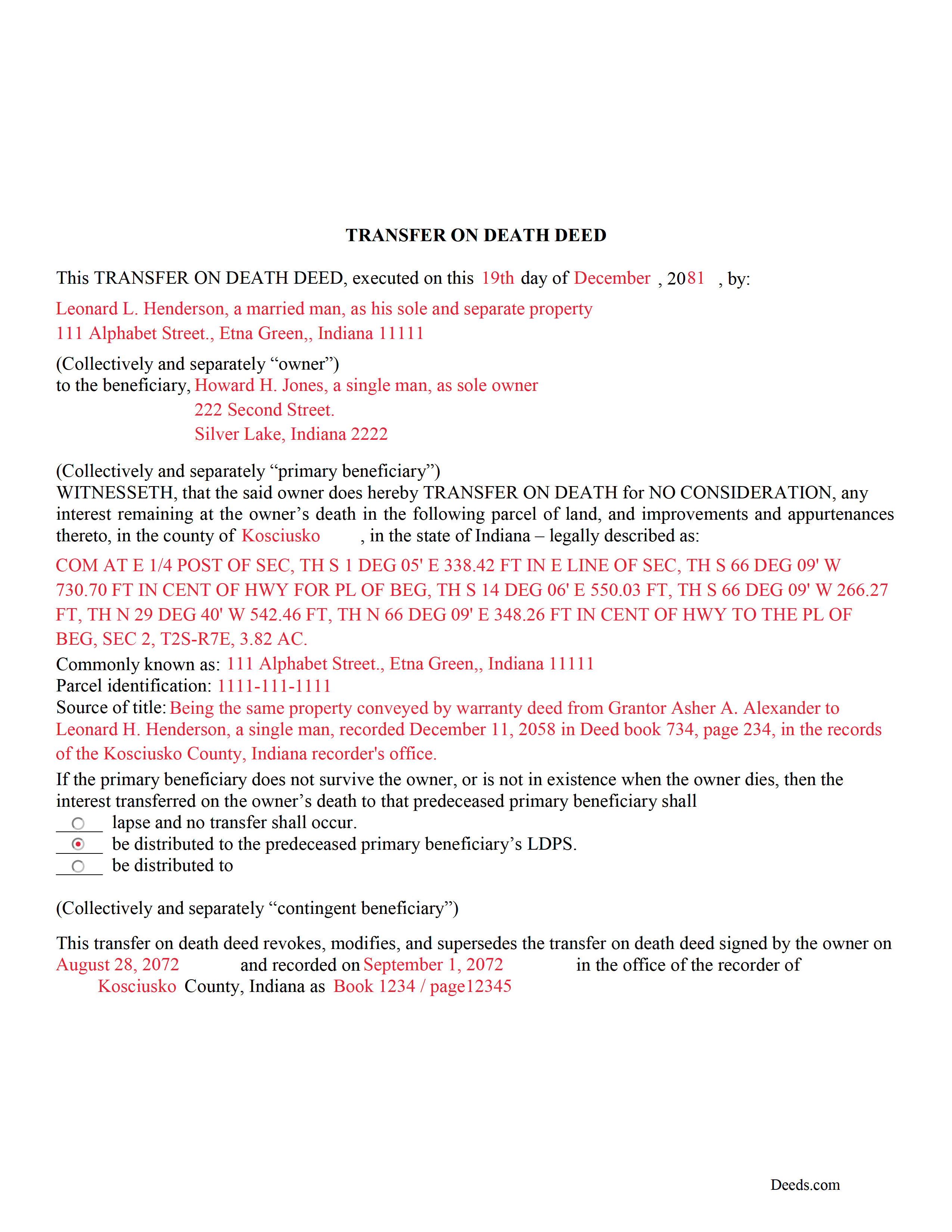

Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

Included Tipton County compliant document last validated/updated 12/17/2024

The following Indiana and Tipton County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Tipton County. The executed documents should then be recorded in the following office:

Tipton County Recorder

101 East Jefferson, 2nd floor, Tipton, Indiana 46072

Hours: 8:00 to 4:00 M, W-F; Tue until 5:00

Phone: (765) 675-4614

Local jurisdictions located in Tipton County include:

- Goldsmith

- Hobbs

- Kempton

- Sharpsville

- Tipton

- Windfall

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Tipton County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Tipton County using our eRecording service.

Are these forms guaranteed to be recordable in Tipton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tipton County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Tipton County that you need to transfer you would only need to order our forms once for all of your properties in Tipton County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Tipton County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Tipton County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Indiana outlines the rules for its transfer on death deed in I.C. 32-17-14 -- the "Transfer on Death Property Act."

Indiana transfer on death deeds transfer ownership rights of real property to a predetermined beneficiary after the owner's death. This enables Indiana residents to pass their real estate to their heirs outside of probate. The owners keep full control over the property during their lives -- the conveyance only occurs after the owners die -- so they may sell, rent or use the land as they wish. They may change the designated beneficiary or cancel the entire transfer by simply executing a revocation that redefines their wishes.

Note that this is only valid when it is executed (signed) and recorded WHILE THE OWNER IS STILL ALIVE. If not, the deed is void and the property passes through probate with the rest of the owner's estate.

These conveyances might also have an impact on taxes and eligibility for healthcare programs. Carefully review all aspects of estate planning when considering a transfer on death deed.

(Indiana Transfer on Death Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Tipton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tipton County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hinz H.

May 28th, 2020

Prompt accurate service

Thank you!

Erica W.

July 21st, 2020

Very easy and convenient. I will use this service again!

Thank you!

Leonard D.

May 2nd, 2019

I'm still working on it. I'm surprised that it appears so much information has to be included about beneficiaries.

Thank you!

Lynn H.

January 12th, 2023

A very informative WEB site. It was simple to access the forms I needed for my specific situation. I would highly recommend Deeds.com.

I will be back with future needs when they arise! I was left with a very positive impression.

Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle D.

March 4th, 2019

Very professional service, they were timely and proficient with answers and sending in the documents that I requested. Will work with them again in the future

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Billie G.

October 14th, 2021

Loved this service! It was quick, easy and effective! I'll definitely be using them again!

Thank you!

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Sharon M.

February 23rd, 2021

I will be going through title, so didn't order deed, but I think your website is wonderful. It's great to offer online services, such a great time saving for me with my work. Thank you, Sharon M.

Thank you for taking the time to leave your feedback Sharon, we really appreciate it. Have a fantastic day!

Susan Z.

February 1st, 2019

Helpful website. Couldn't use the forms for my situation and area

Thank you for your feedback Susan. We don't want you to have to pay for something you didn't use, we've gone ahead and canceled your order and payment. Have a great day!

GINA G.

April 15th, 2020

Excelente service!

Thank you!

Irene G.

January 26th, 2021

Excellent service for anyone doing their own deed filing without the use of a title company or an attorney. I will definitely recommend deeds.com to my notary clients and will be personally using this service again! ;)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rysta W.

June 29th, 2021

Very easy to use and great price.

Thank you for your feedback. We really appreciate it. Have a great day!