St Joseph County Transfer on Death Deed Beneficiary Affidavit Form (Indiana)

All St Joseph County specific forms and documents listed below are included in your immediate download package:

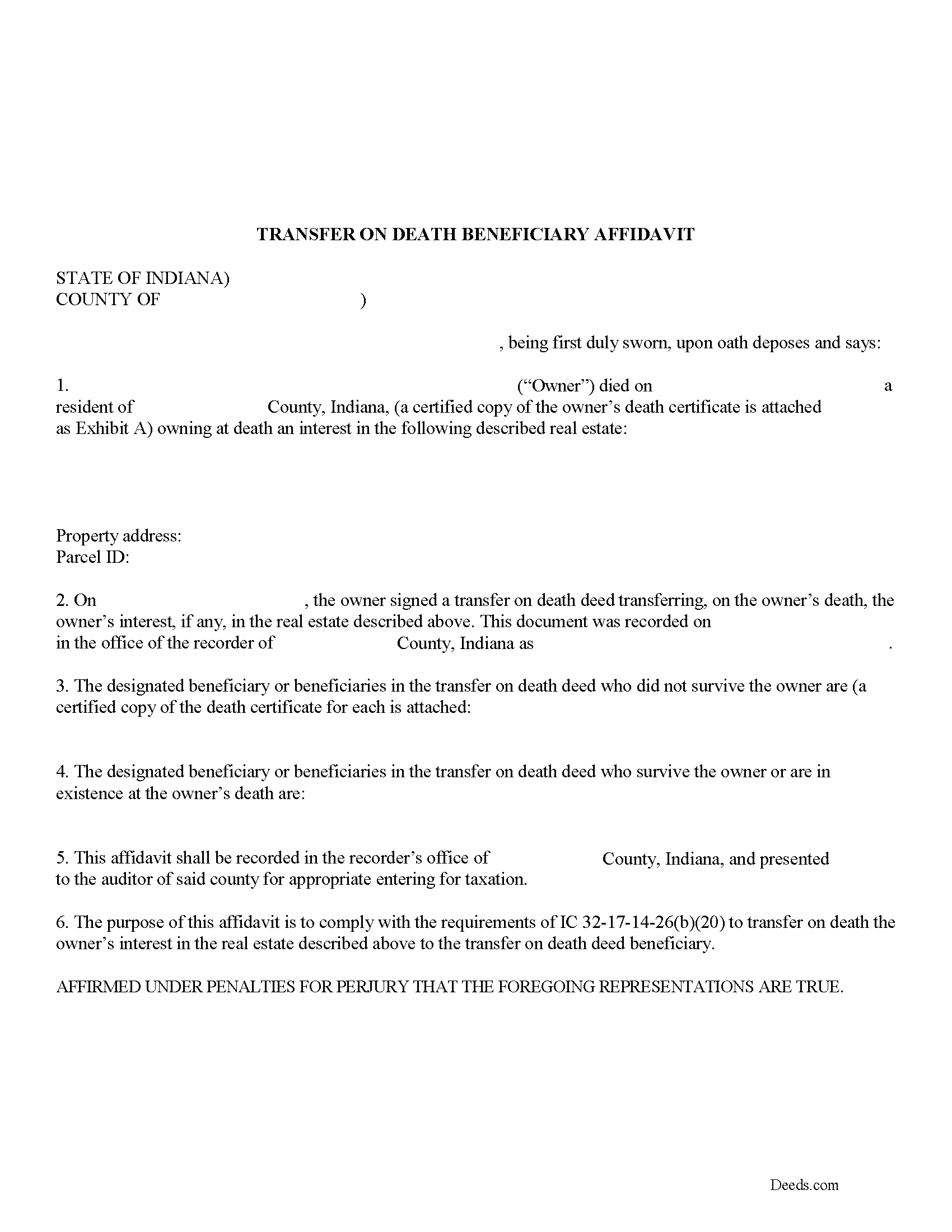

Transfer on Death Deed Beneficiary Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included St Joseph County compliant document last validated/updated 8/16/2024

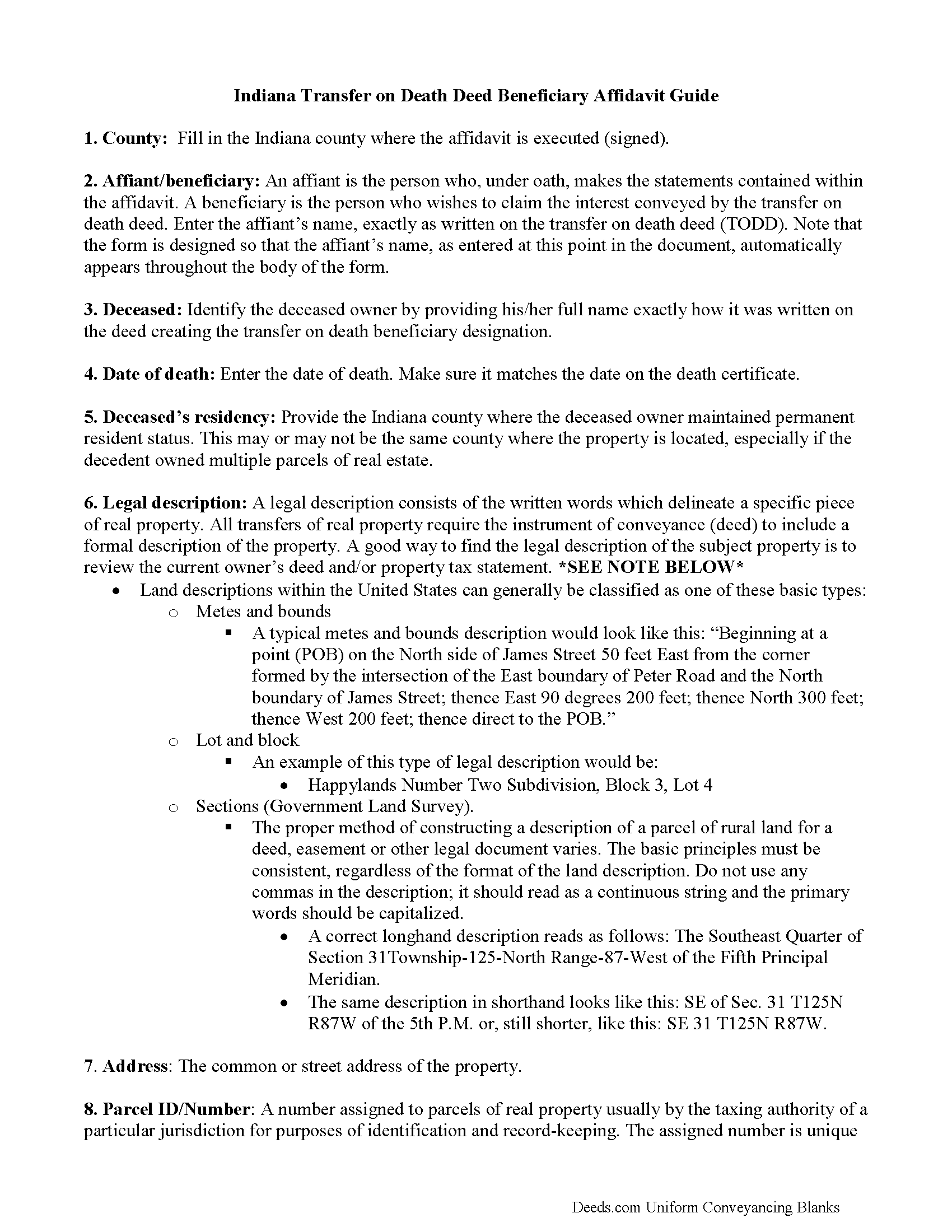

Transfer on Death Deed Beneficiary Affidavit Guide

Line by line guide explaining every blank on the form.

Included St Joseph County compliant document last validated/updated 10/23/2024

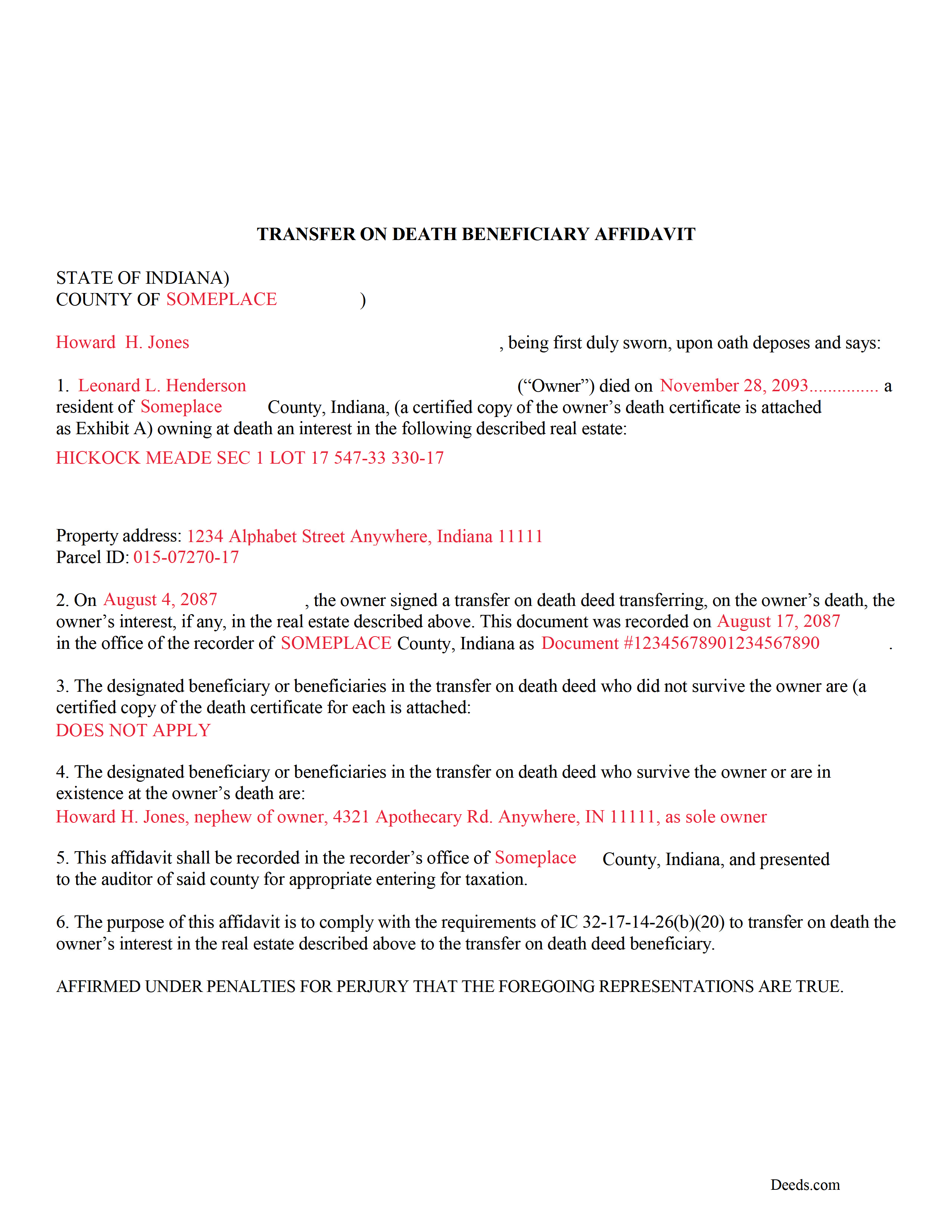

Completed Example of the Transfer on Death Deed Beneficiary Affidavit Document

Example of a properly completed form for reference.

Included St Joseph County compliant document last validated/updated 11/14/2023

The following Indiana and St Joseph County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed Beneficiary Affidavit forms, the subject real estate must be physically located in St Joseph County. The executed documents should then be recorded in the following office:

St. Joseph Recorder

227 W Jefferson Blvd, Rm 321, South Bend, Indiana 46601

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (574) 235-9525

Local jurisdictions located in St Joseph County include:

- Granger

- Lakeville

- Mishawaka

- New Carlisle

- North Liberty

- Notre Dame

- Osceola

- South Bend

- Walkerton

- Wyatt

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the St Joseph County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in St Joseph County using our eRecording service.

Are these forms guaranteed to be recordable in St Joseph County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by St Joseph County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed Beneficiary Affidavit forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in St Joseph County that you need to transfer you would only need to order our forms once for all of your properties in St Joseph County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or St Joseph County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our St Joseph County Transfer on Death Deed Beneficiary Affidavit forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Indiana's transfer on death deeds are a useful way to convey ownership rights to property without the need for probate. The rules for claiming the property are defined in IC 32-17-14-26(b)(20). Primarily, the statute explains that the beneficiary must complete a transfer on death beneficiary affidavit containing specific details of the deed, present that affidavit to the local auditor to verify any transfer taxes, and then submit it to the county recorder who will enter it, and therefore the finalized conveyance, into the public record.

Beneficiaries listed on Indiana transfer on death deeds may use this form, which meets the statutory requirements, to claim ownership of the real property described in the deed.

(Indiana TOD Deed Beneficiary Affidavit Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the St Joseph County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your St Joseph County Transfer on Death Deed Beneficiary Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kirsten Z.

March 31st, 2021

Thank you! Including the Guide and completed example was especially helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas K.

December 26th, 2020

Very easy to navigate, download,and print forms!

Thank you!

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me.

Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

Ronald S.

May 20th, 2019

got what i wanted

Thank you for your feedback. We really appreciate it. Have a great day!

David K.

August 9th, 2021

My 1st trip to your site. I give it a full 5-star rating!

Thank you. I'll be back.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN F.

May 24th, 2023

Quick and easy! I had previously prepared a Lady Bird deed, submitted it through Deeds.com and it was accepted/recorded by my county in just a few hours. The Deed.com $21 fee was well worth it as I saved fuel, tolls and parking costs not to mention at least 2-3 hours of my time that it would've taken to get downtown and back home!

Thanks for the feedback John. We appreciate you taking the time to share your experience. Have an amazing day!

Pauline G.

May 2nd, 2019

Found just what I needed!!! Instructions were easy to follow and I accomplished the task like a professional. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

samira m.

December 9th, 2022

I love whoever is behind this website. I bought the wrong form and I told them and they refunded me asap! I figured out which form I need days later and bought it just now. They didn't have to refund me for my own mistake. That was very kind. I'll be returning for any other forms I may need and will tell others too. Thank you so much!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Vickey W.

February 5th, 2021

Your company was great, you all walked me through every step of the process. With the pandemic and the inability to go into the DC Recorder of Deeds office. I look forward to working with you in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Matthew L.

September 15th, 2022

I would make just two suggestions.

(1) Create and example showing multiple grantor(s) and

(2) In the same example, show where and estate is conveyed to two or more people.

It would help in knowing the correct format.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda E.

October 14th, 2019

I thought this form was great and easy to complete but the instructions were unclear as to whether the grantee- beneficiaries needed to sign and notarize their signatures as well. It did not appear to be the case but it would be helpful if the instructions spelled this out better.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan K.

July 13th, 2021

They were unable to complete the task and my money was immediately refunded.

Thank you for your feedback Susan, sorry we were unable to assist.