Harrison County Personal Representative Deed for Distribution Form (Indiana)

All Harrison County specific forms and documents listed below are included in your immediate download package:

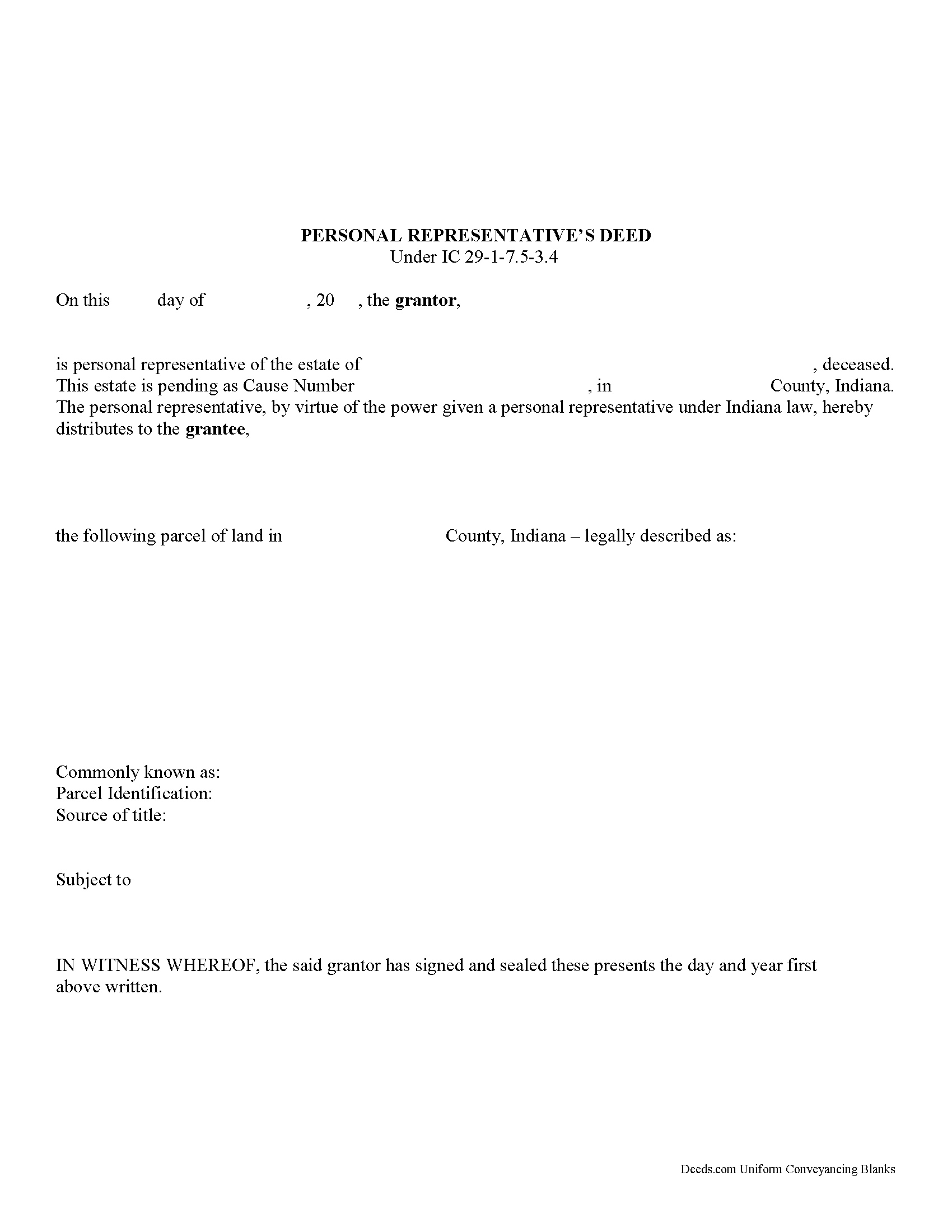

Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Harrison County compliant document last validated/updated 10/28/2024

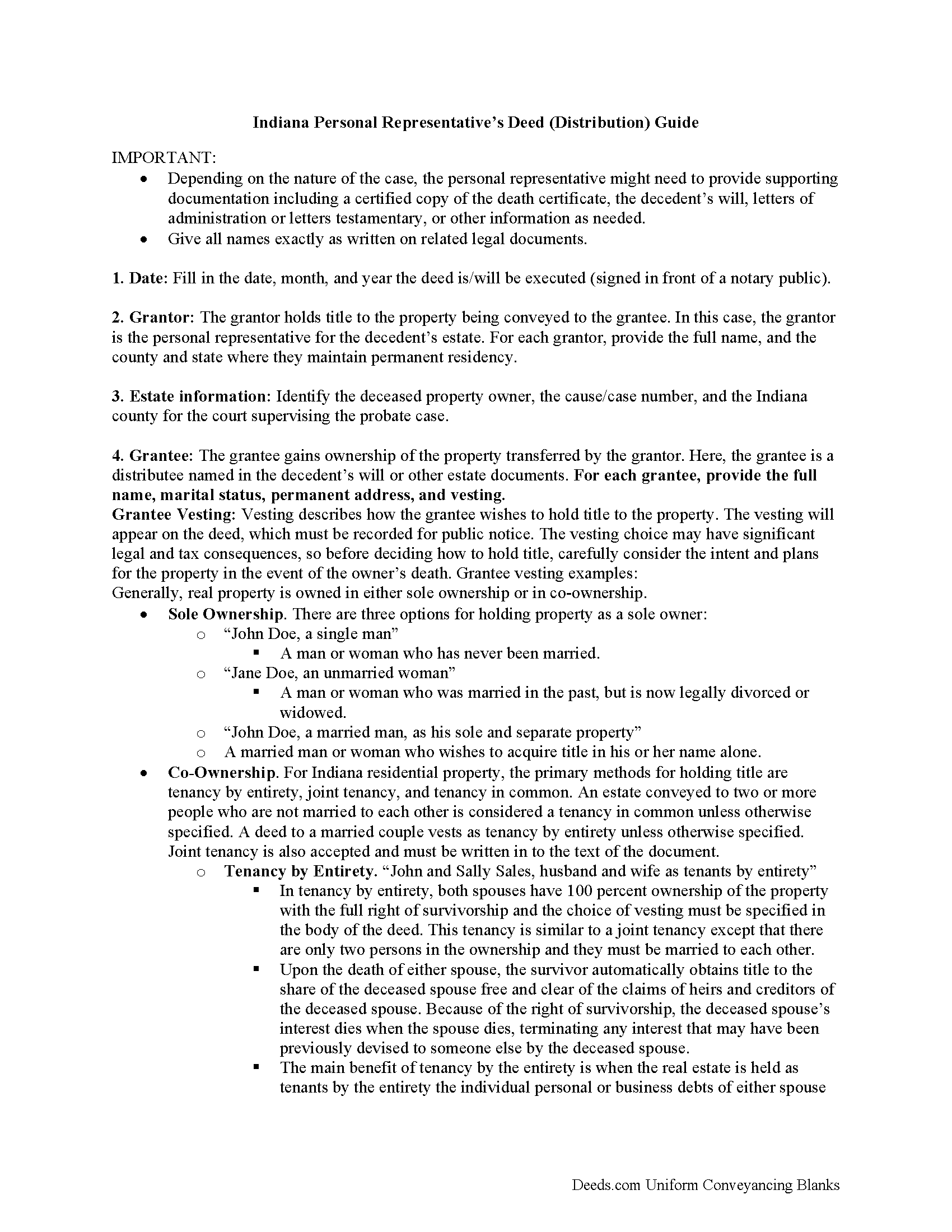

Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

Included Harrison County compliant document last validated/updated 10/10/2024

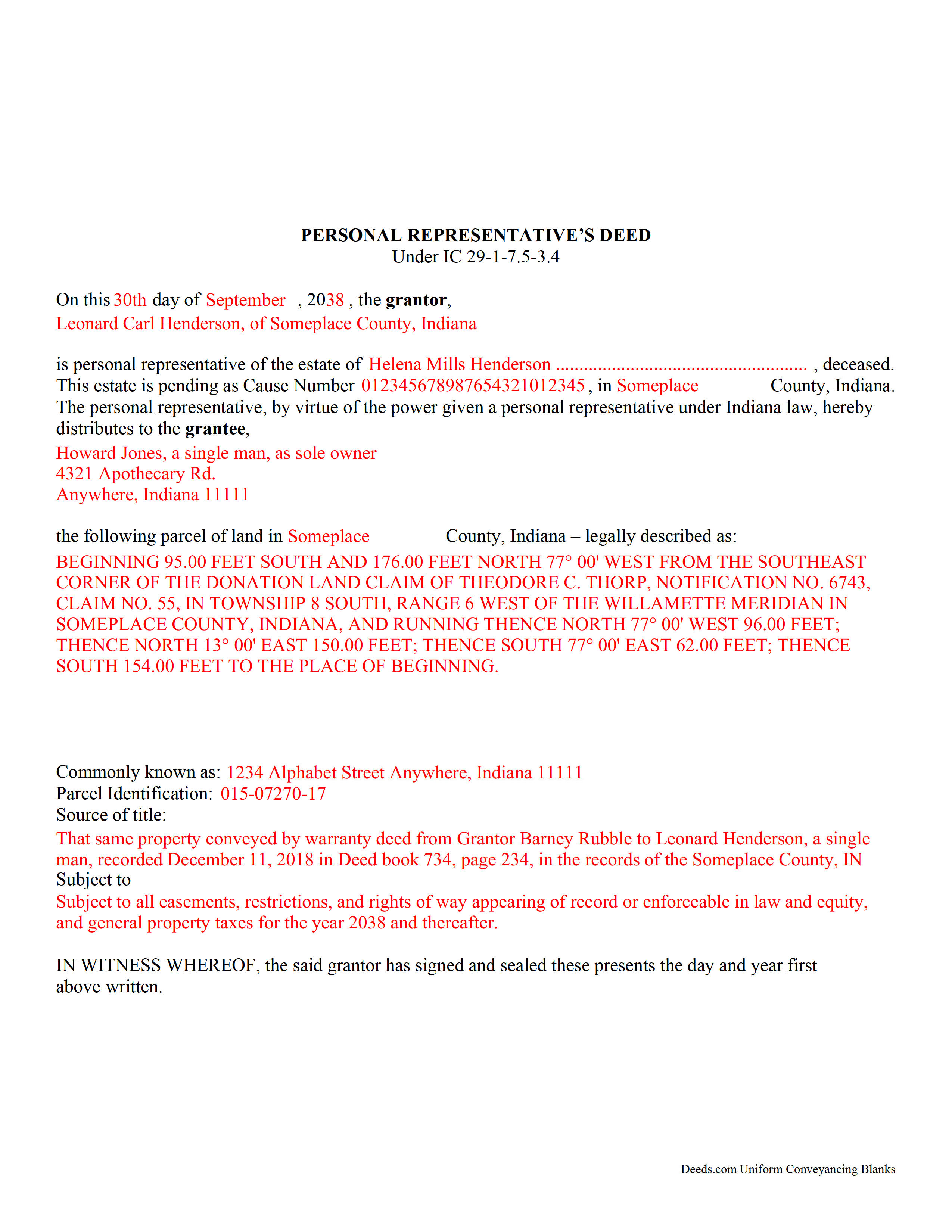

Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

Included Harrison County compliant document last validated/updated 11/11/2024

The following Indiana and Harrison County supplemental forms are included as a courtesy with your order:

When using these Personal Representative Deed for Distribution forms, the subject real estate must be physically located in Harrison County. The executed documents should then be recorded in the following office:

Harrison County Recorder

245 Atwood St NE, Suite 201, Corydon, Indiana 47112

Hours: 8:00am - 4:30pm Monday - Friday

Phone: (812) 738-3788

Local jurisdictions located in Harrison County include:

- Bradford

- Central

- Corydon

- Crandall

- Depauw

- Elizabeth

- Laconia

- Lanesville

- Mauckport

- New Middletown

- New Salisbury

- Palmyra

- Ramsey

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Harrison County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Harrison County using our eRecording service.

Are these forms guaranteed to be recordable in Harrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harrison County including margin requirements, content requirements, font and font size requirements.

Can the Personal Representative Deed for Distribution forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Harrison County that you need to transfer you would only need to order our forms once for all of your properties in Harrison County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Harrison County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Harrison County Personal Representative Deed for Distribution forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use this form for authorized personal representatives to transfer a decedent's real estate to a devisee or heir as directed by the deceased property owner's will, or according to Indiana's laws of descent and distribution.

When we die, another person becomes responsible for managing the assets we leave behind. If we die testate (with a will), this person is called an executor. If we die intestate (without a will), or other specific situations occur, the court supervising the probate estate appoints an administrator. Once the executor or administrator is in place, Indiana laws identify this individual as a "personal representative." See IC 29-1-1-3(23) for the list of titles included under this role.

The judge supervising the case confirms the personal representative (PR) by issuing letters testamentary or letters of administration, as appropriate. Note that the PR must apply for the letters within five months of the decedent's death (IC 29-1-7-15.1(b)). Once the letters are in place, the PR gains access to the probate estate, defined as "property transferred at the death of a decedent under the decedent's will or under IC 29-1-2, in the case of a decedent dying intestate" IC 29-1-1-3(24).

One common task handled by the PR is transferring ownership of the decedent's real property. Indiana's statutes contain a form related to property distributed to a devisee or heir (IC 29-1-7.5-3.4). In addition to the statutory requirement to provide relevant facts of the probate case, personal representative's deeds must meet all state and local standards for format and content.

Note that personal representative's deeds to not include warranties of title, so it makes sense for distributees or potential purchasers to consider a title search for the property. This can reveal defects in the chain of title (ownership history), and may prevent potential issues in future transactions.

Depending on the circumstances, the PR might need to provide additional supporting documentation including a certified copy of the authorizing letter, death certificate, will, etc. Also, the transfer might require approval from the court or others with an interest in the estate or the property.

Navigating the complexities of a probate case can be overwhelming, but taking the time to ensure a valid transfer during active probate is much easier than untangling problems later on. Please contact an attorney or probate court officer with specific questions or for complex situations.

(Indiana Personal Representative Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Harrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harrison County Personal Representative Deed for Distribution form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin C.

August 10th, 2022

Nice site but $30 to download a blank form is a bit much.

Thank you for your feedback. We really appreciate it. Have a great day!

Munir S.

August 2nd, 2024

Good service. Easy to use, responsive, fast, and fairly priced. First time user, will continue to use it for future needs. Recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.

Patricia W.

December 16th, 2019

Easy to use with the itemized instruction.

Thank you for your feedback. We really appreciate it. Have a great day!

SueAnn V.

July 22nd, 2021

Thanks so much for the TOD Beneficiary Deed with the explanation, supplementary forms and great example!

I just filed it today for the state of Colorado, in my county and it was accepted by the Clerk/Recorder.

I really appreciate the thorough work that Deeds.com does.

I definitely will use this site again and also recommend it to family and friends.

Thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda E.

October 14th, 2019

I thought this form was great and easy to complete but the instructions were unclear as to whether the grantee- beneficiaries needed to sign and notarize their signatures as well. It did not appear to be the case but it would be helpful if the instructions spelled this out better.

Thank you for your feedback. We really appreciate it. Have a great day!

Terrance S.

April 6th, 2020

I'd say 5 stars. Thank you.

Thank you!

Charles D.

July 22nd, 2023

Good product!! I highly recommend.

Thank you!

John B.

November 15th, 2023

Fantastic service, easy to use, and supported the entire way through every process. Excellent service!

We are motivated by your feedback to continue delivering excellence. Thank you!

JOYCE R.

June 25th, 2019

I am a tax attorney and had worked as a Valuation Engineer with Internal Revenue Service. I can access (almost immediately) complete title reports and transactions history of real estate transfers. It is a joy to have access to your valuable service.

JOYCE REBHUN,JD,MBA,PhD,EA

Thank you for your feedback. We really appreciate it. Have a great day!

Tracey B.

January 7th, 2019

Has no problems at all, everything was perfect. TB

Thanks Tracey, we appreciate your feedback.

QINGXIONG L.

January 1st, 2021

The major problem is too expensive, particularly sometime, only few words need to file correction deed which cost 20 dollars!!

Thank you for your feedback. We really appreciate it. Have a great day!

RICHARD M.

March 12th, 2022

EASY TO USE AND GREAT I COULD DOWNLOAD MULTIPLE DOCUMENTS

Thank you!