Tippecanoe County Notice of Intention to Hold Lien Form (Indiana)

All Tippecanoe County specific forms and documents listed below are included in your immediate download package:

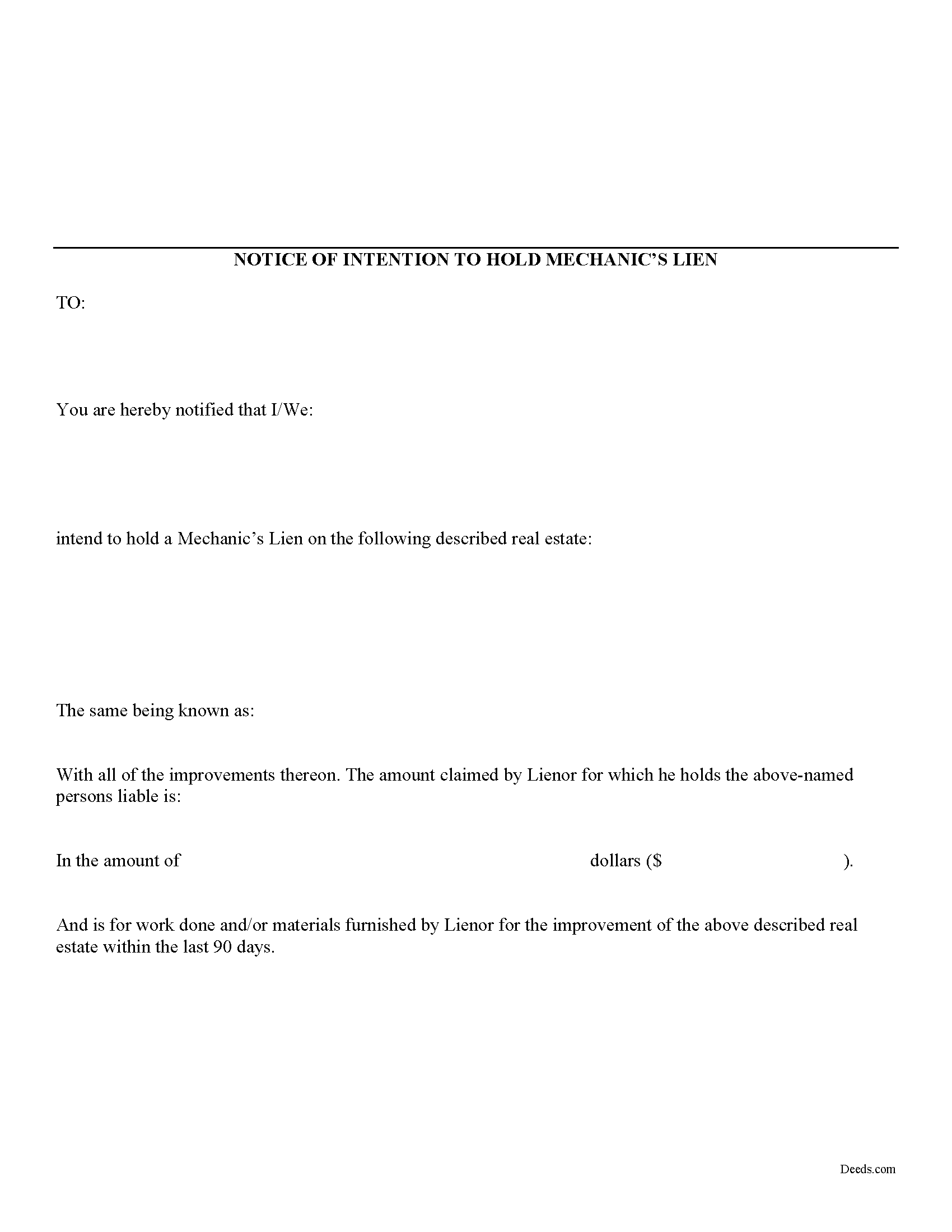

Notice of Intention to Hold Lien Form

Fill in the blank Notice of Intention to Hold Lien form formatted to comply with all Indiana recording and content requirements.

Included Tippecanoe County compliant document last validated/updated 12/20/2024

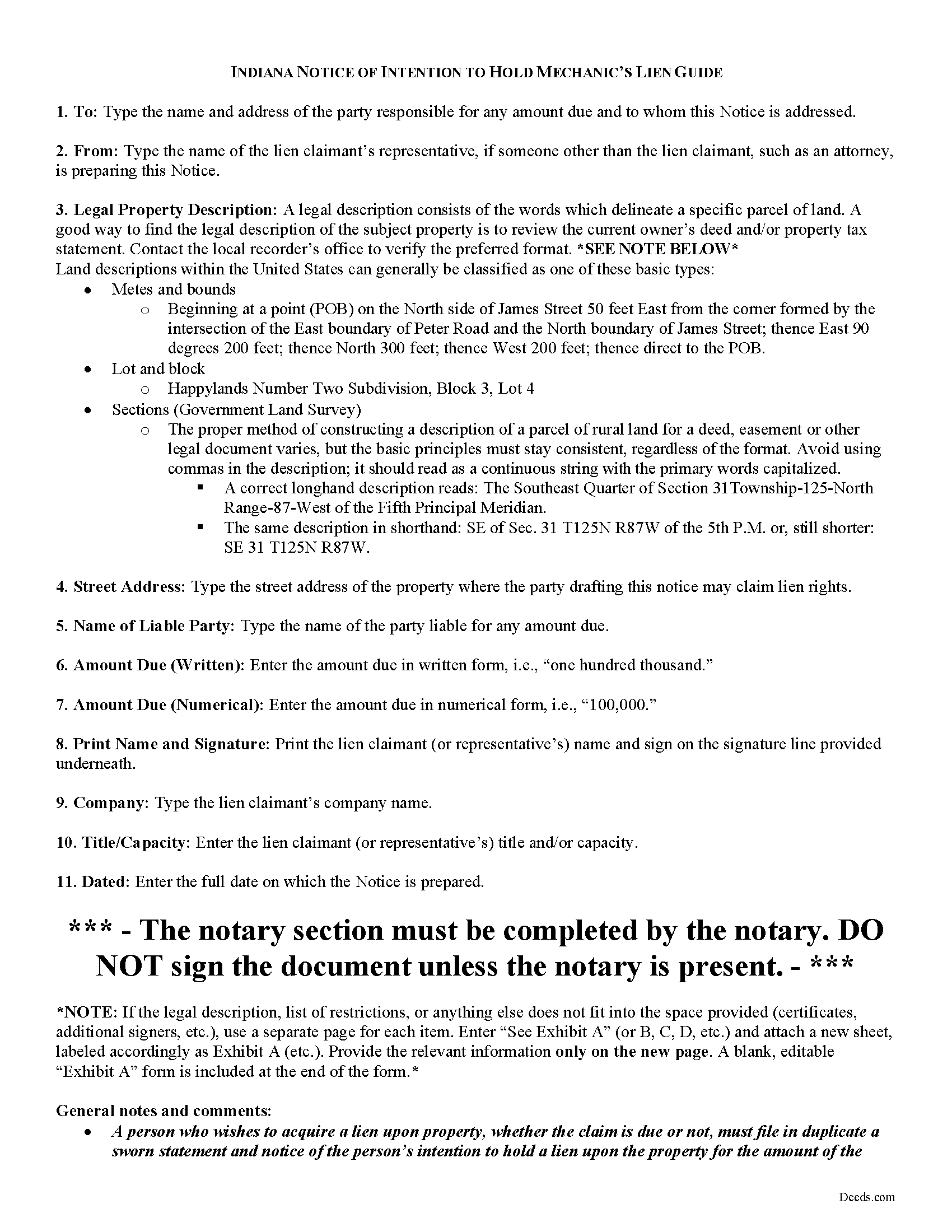

Notice of Intention to Hold Lien Guide

Line by line guide explaining every blank on the form.

Included Tippecanoe County compliant document last validated/updated 10/25/2024

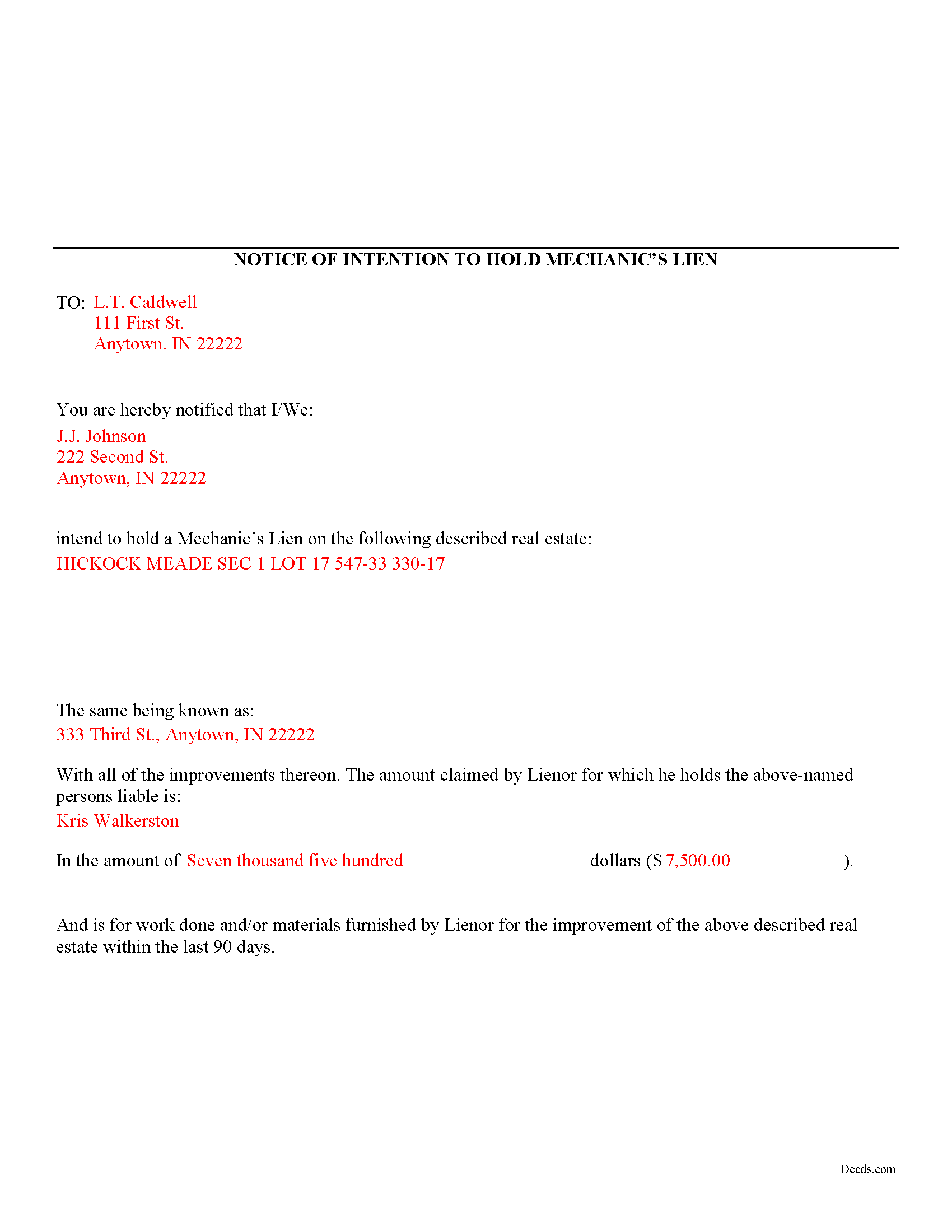

Completed Example of Notice of Intention to Hole Lien Document

Example of a properly completed form for reference.

Included Tippecanoe County compliant document last validated/updated 10/18/2024

The following Indiana and Tippecanoe County supplemental forms are included as a courtesy with your order:

When using these Notice of Intention to Hold Lien forms, the subject real estate must be physically located in Tippecanoe County. The executed documents should then be recorded in the following office:

Tippecanoe County Recorder

20 N Third St, 2nd floor, Lafayette, Indiana 47901

Hours: 8:00 to 4:30 Monday through Friday

Phone: (812) 423-9352

Local jurisdictions located in Tippecanoe County include:

- Battle Ground

- Buck Creek

- Clarks Hill

- Dayton

- Lafayette

- Montmorenci

- Romney

- Stockwell

- West Lafayette

- Westpoint

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Tippecanoe County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Tippecanoe County using our eRecording service.

Are these forms guaranteed to be recordable in Tippecanoe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tippecanoe County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Intention to Hold Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Tippecanoe County that you need to transfer you would only need to order our forms once for all of your properties in Tippecanoe County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Tippecanoe County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Tippecanoe County Notice of Intention to Hold Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A Notice of Intention to Hold a Mechanic's Lien is a required pre-lien notice used to make property owners aware that there may be lien rights exercised on their property.

Any person who wishes to acquire a lien upon public property or property held by three or more tenants, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than ninety (90) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(a).

Any person who wishes to acquire a lien upon property held as a dwelling unit, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than sixty (60) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(b).

The statement and notice of intention to hold a lien may be verified and filed on behalf of a client by an attorney registered with the clerk of the supreme court as an attorney in good standing under the requirements of the supreme court. Id.

A statement and notice of intention to hold a lien filed under this section must specifically set forth: (1) the amount claimed; (2) the name and address of the claimant; (3) the owner's: (A) name; and (B) latest address as shown on the property tax records of the county; and (4) the: (A) legal description; and (B) street and number, if any; of the lot or land on which the house, mill, manufactory or other buildings, bridge, reservoir, system of waterworks, or other structure may stand or be connected with or to which it may be removed. IC 32-28-3-3(c).

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please consult with an Indiana attorney for any questions regarding mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Tippecanoe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tippecanoe County Notice of Intention to Hold Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra C.

December 30th, 2020

Quick and easy. Would recommend this site to everyone. Deed was sent to the site and recorded at my local county within 24 hours. Website could be set up better. Not labeled well for us that is not computer savvy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Harold F.

April 24th, 2020

You're a creditable company that performs well and provides what I requested.

Thank you!

Daniel W.

April 18th, 2020

They are amazing. So fast and friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kay M.

August 27th, 2020

Worked great. Not being real tech savey was no problem.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl C.

February 23rd, 2023

my only problem is the cost of the form I downloaded.

A bit cheaper would be nice

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

Rick R.

February 5th, 2021

So far excellent service - I made a boo boo on the deed - no problem they made the change before they sent it off to be recorded. I will never drive to the Recorder's office again.

Thank you!

Roger G.

October 25th, 2019

Straight to the point and easy to use site.

Thank you!

Samuel J M.

December 14th, 2018

I needed to prepare a Correction Warranty Deed and have not done so in years. I ordered your form and modified it to fit my situation. Saved me a lot of time.

Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria S.

November 25th, 2019

Hard to find, obscure, forms were available. I did not think I was going to be able to find them, let alone find such high quality docs, great job!

Thank you for your feedback. We really appreciate it. Have a great day!

Nicholas B.

October 24th, 2020

A lot of information to read over but downloading process was great and ill definitely use the service again. Showed me my country and city that my forms would be valid in and the information is step by step with examples and that is great

Thank you for your feedback. We really appreciate it. Have a great day!

Linda D C.

August 26th, 2021

This was so easy to use. I appreciated the finished sample to guide me and the proper attachments necessary to process my Quit Claim Deed. I am gifting it to my nephew as I am too old to run farm and I live in a different state now. I tried other websites but their info was not up to date or accurate. Thank you so much. 71 Y/O Nana.

Thank you for your feedback. We really appreciate it. Have a great day!