Henry County Mortgage Secured by Promissory Note Form (Indiana)

All Henry County specific forms and documents listed below are included in your immediate download package:

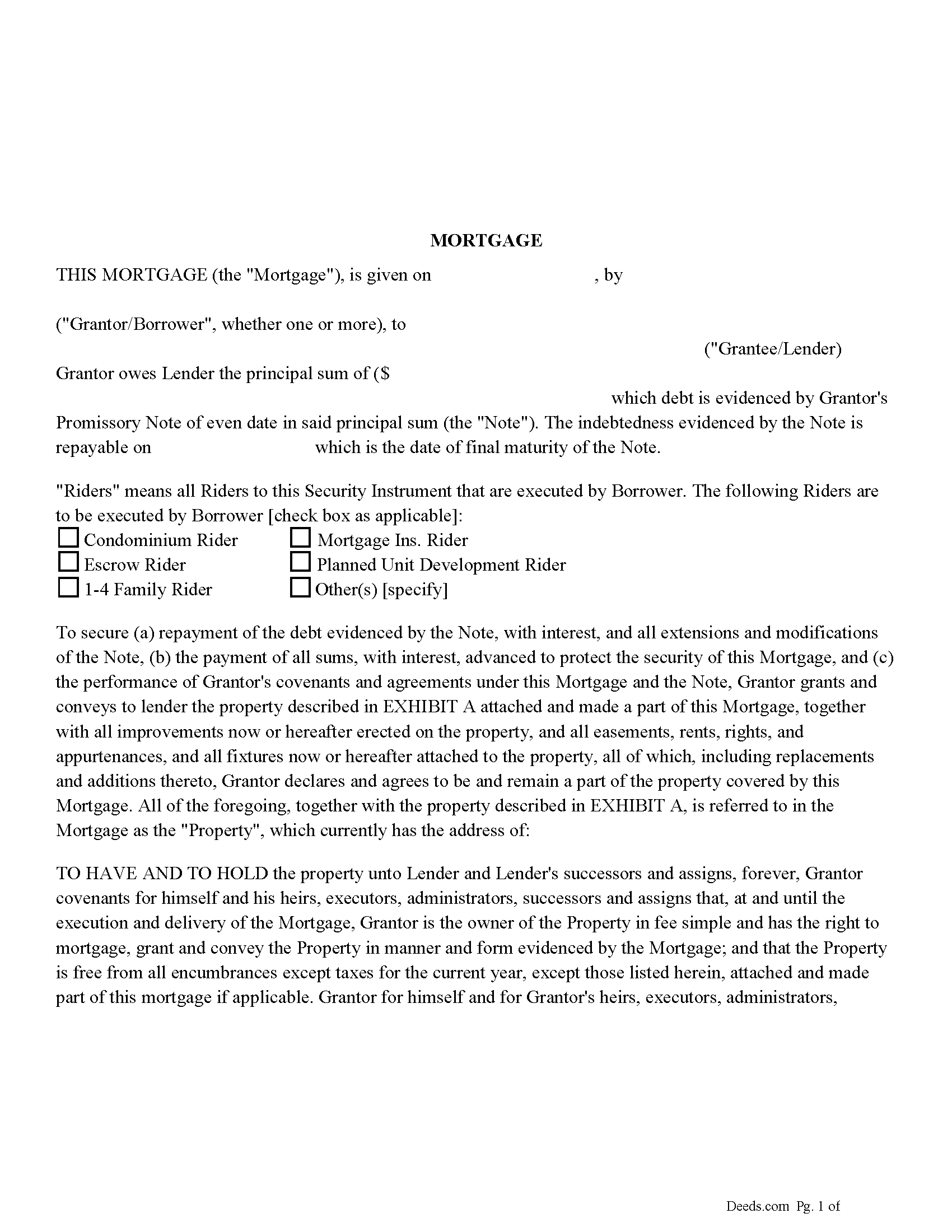

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Henry County compliant document last validated/updated 11/18/2024

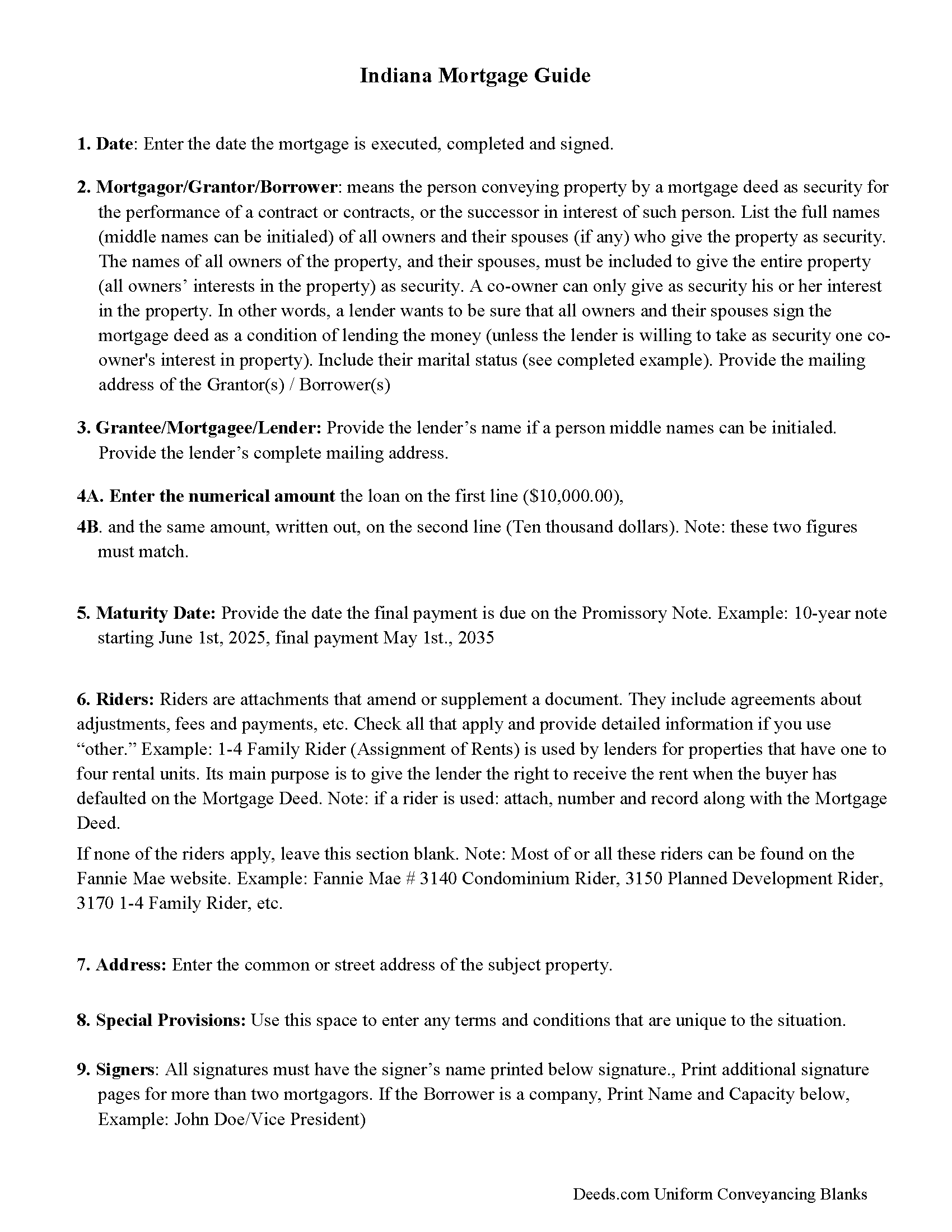

Mortgage Form Guidelines

Line by line guide explaining every blank on the form

Included Henry County compliant document last validated/updated 10/2/2024

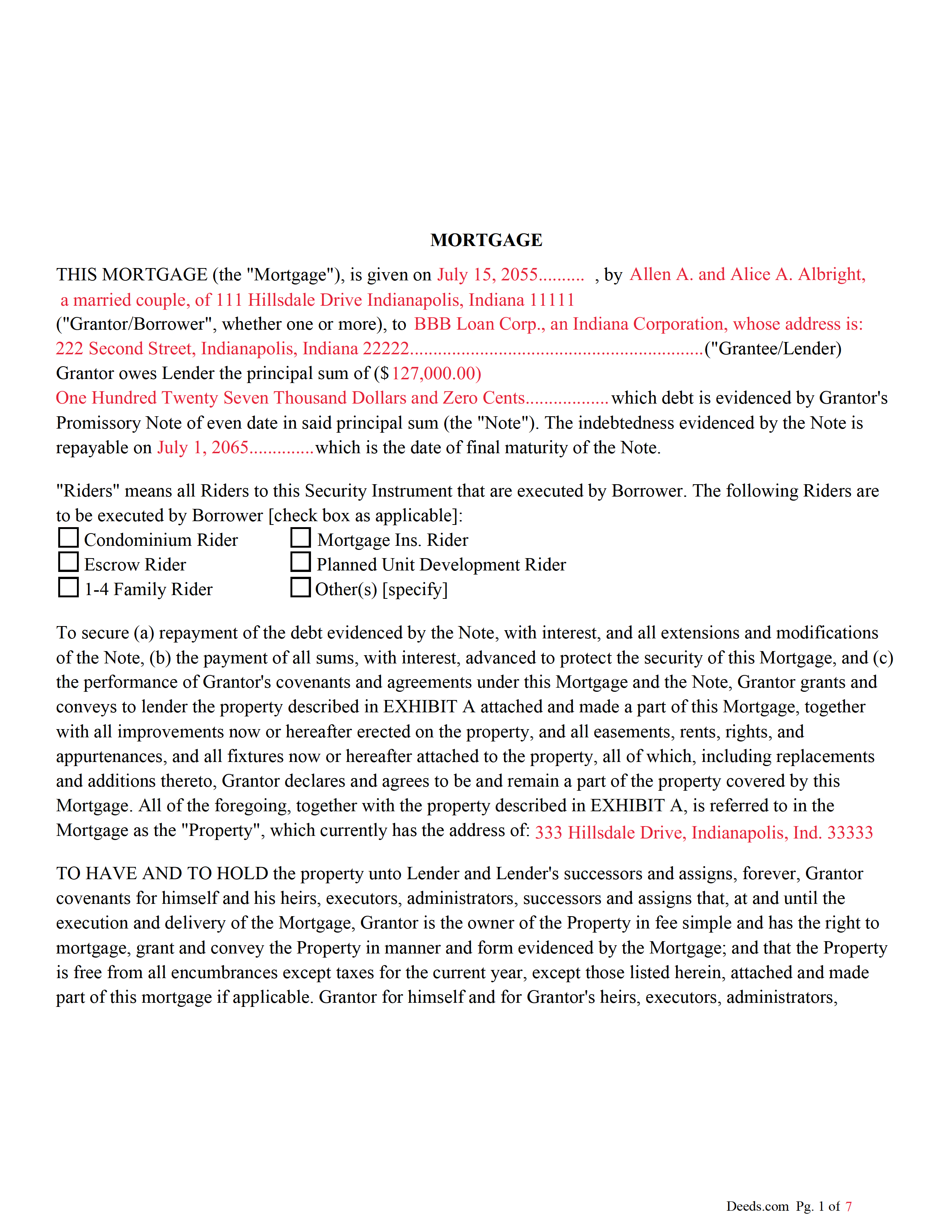

Completed Example of the Mortgage Document

Example of a properly completed form for reference.

Included Henry County compliant document last validated/updated 11/6/2024

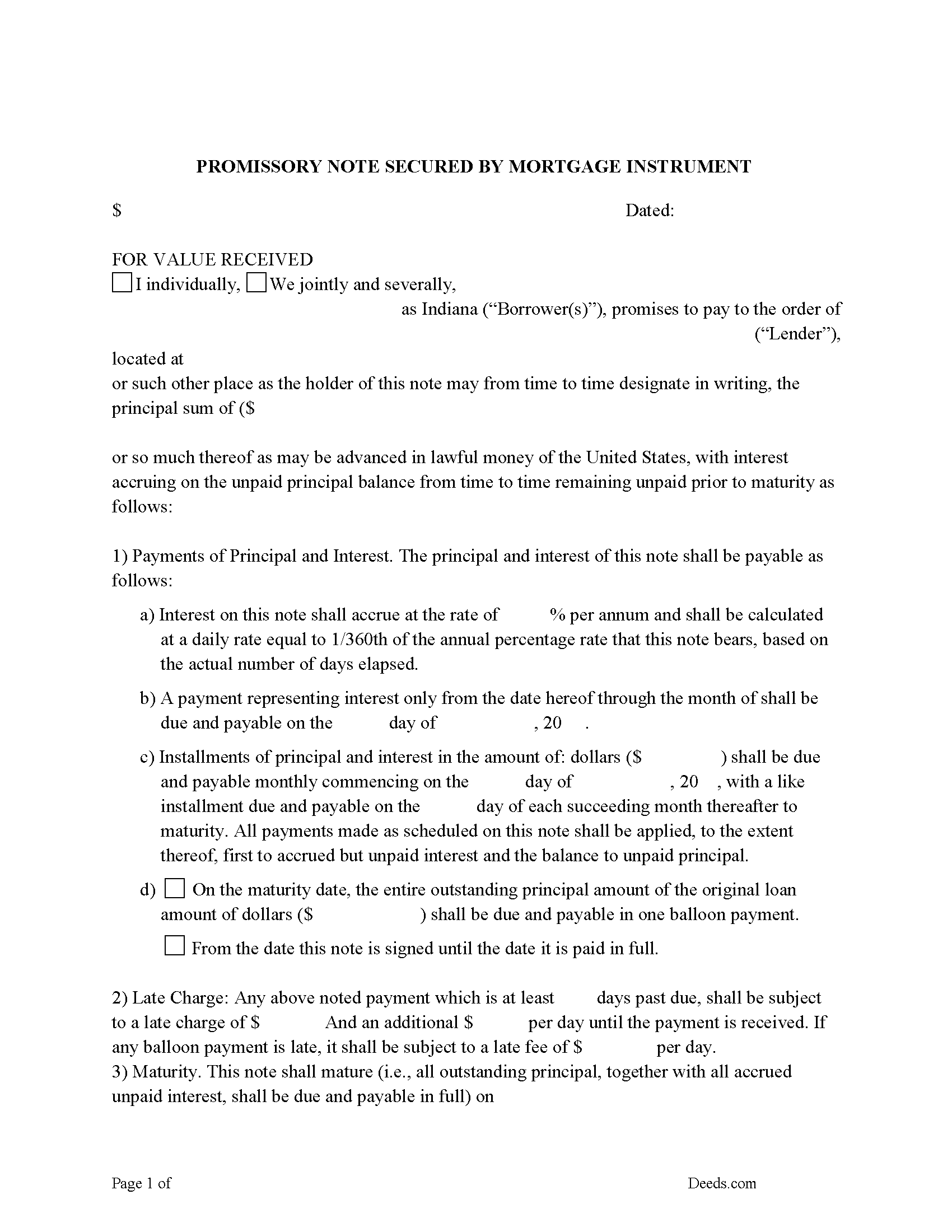

Promissory Note Form

Fill in the blank form.

Included Henry County compliant document last validated/updated 11/22/2024

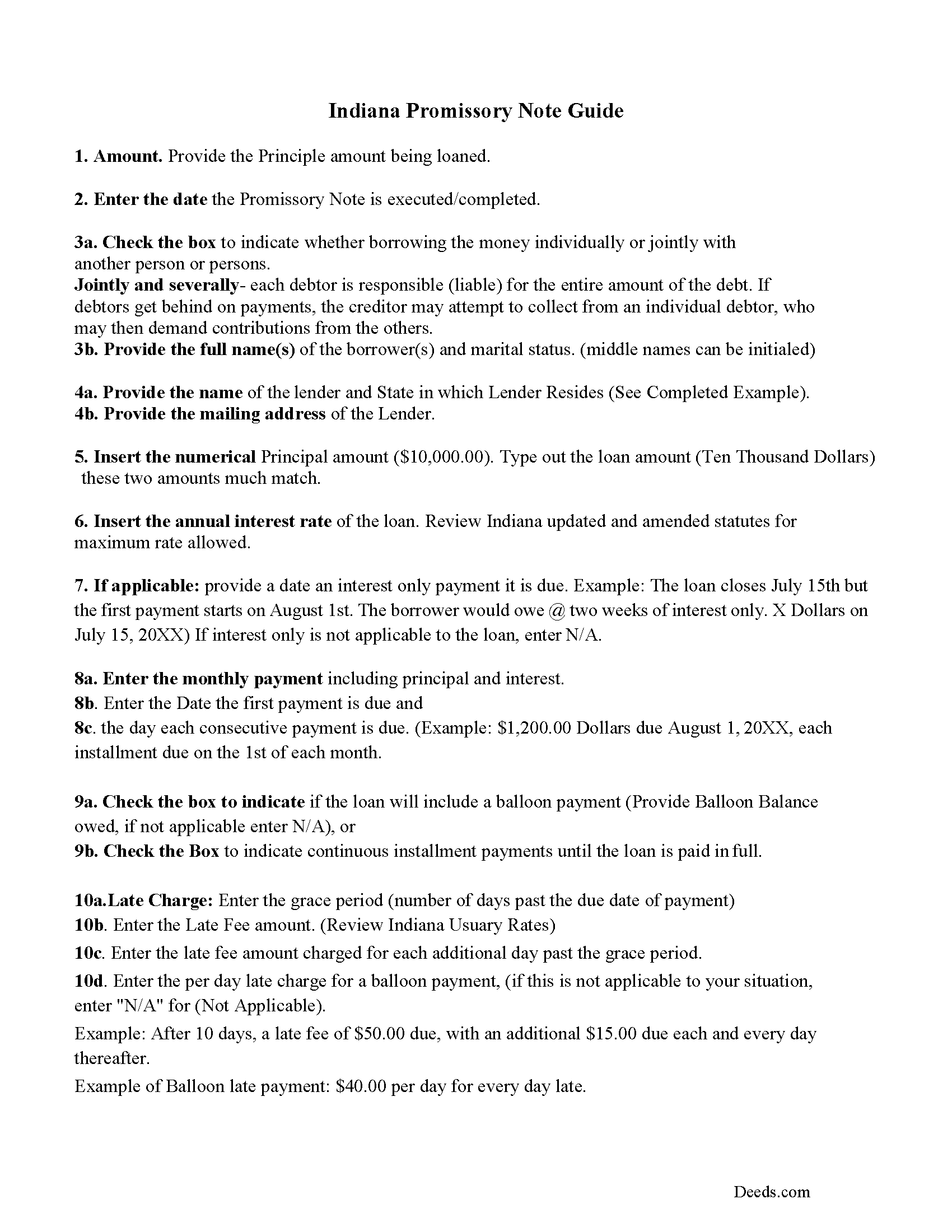

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Henry County compliant document last validated/updated 12/5/2024

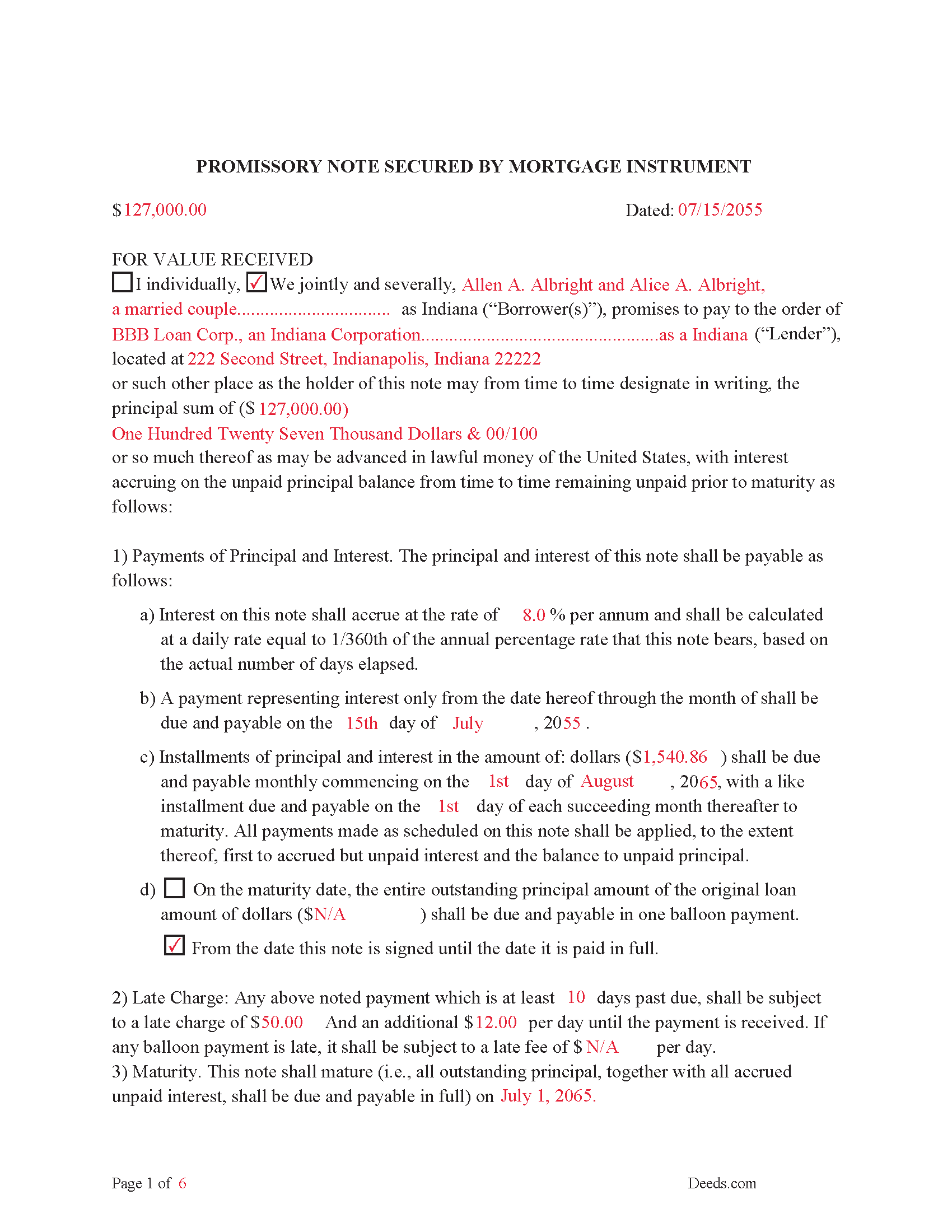

Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included Henry County compliant document last validated/updated 9/4/2024

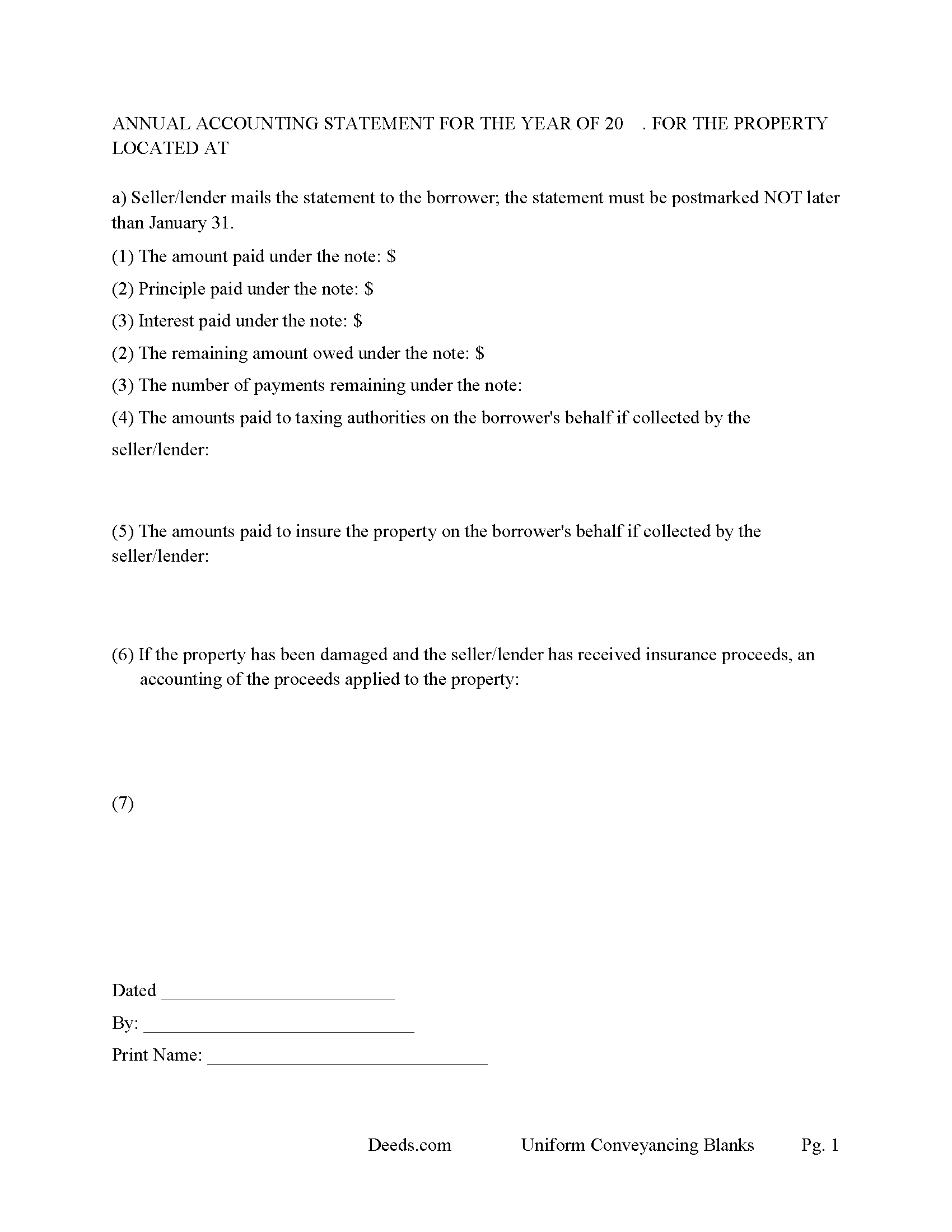

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Henry County compliant document last validated/updated 12/17/2024

The following Indiana and Henry County supplemental forms are included as a courtesy with your order:

When using these Mortgage Secured by Promissory Note forms, the subject real estate must be physically located in Henry County. The executed documents should then be recorded in the following office:

Henry County Recorder

101 S Main St, Rm 106, Newcastle, Indiana 47362

Hours: Tues through Thurs 7:00 to 5:00; Fri 7:00 to 4:00

Phone: (765) 529-4304

Local jurisdictions located in Henry County include:

- Dunreith

- Greensboro

- Kennard

- Knightstown

- Lewisville

- Middletown

- Mooreland

- Mount Summit

- New Castle

- New Lisbon

- Shirley

- Spiceland

- Springport

- Straughn

- Sulphur Springs

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Henry County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Henry County using our eRecording service.

Are these forms guaranteed to be recordable in Henry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Henry County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Secured by Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Henry County that you need to transfer you would only need to order our forms once for all of your properties in Henry County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Henry County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Henry County Mortgage Secured by Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Indiana Mortgage -- IC 32-29; IC 36-2-7-10

Requires:

1. From parties (Grantor).

2. To parties (Grantees).

3. Legal description.

4. Amount.

5. Signatures with names typed or printed below or next to each name.

6. Signatures acknowledged or notarized.

7. Prepared by statement.

8. Social Security redaction statement.

IC 32-29-1-2 Construction of mortgage

Sec. 2. A mortgage may not be construed to imply a covenant for the payment of the sum intended to be secured by the mortgage so as to enable the mortgagee or the mortgagee's assignees or representatives to maintain an action for the recovery of this sum. If an express covenant is not contained in the mortgage for the payment and a bond or other separate instrument to secure the payment has not been given, the remedy of the mortgagee is confined to the real property described in the mortgage.

IC 32-29-1-5 Form; mortgage

Sec. 5. A mortgage of land that is:

(1) worded in substance as "A.B. mortgages and warrants to C.D." (here describe the premises) "to secure the repayment of" (here recite the sum for which the mortgage is granted, or the notes or other evidences of debt, or a description of the debt sought to be secured, and the date of the repayment); and

(2) dated and signed, sealed, and acknowledged by the grantor;

is a good and sufficient mortgage to the grantee and the grantee's heirs, assigns, executors, and administrators, with warranty from the grantor (as defined in IC 32-17-1-1) and the grantor's legal representatives of perfect title in the grantor and against all previous encumbrances. However, if in the mortgage form the words "and warrant" are omitted, the mortgage is good but without warranty.

This Mortgage States: Grantor for himself and for Grantor's heirs, executors, administrators,

successors and assigns forever, warrants and agrees to defend the title to the Property to and for Lender and Lender's successors and assigns forever, against all claims and demands, except those listed herein, attached and made part of this mortgage if applicable.

Uses include residential property, condominiums, rental property, small commercial, vacant land and planned unit developments.

(Indiana Mortgage Package includes form, guidelines, and completed example)

For use in Indiana only.

Our Promise

The documents you receive here will meet, or exceed, the Henry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Henry County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine M.

October 6th, 2022

Easy smooth process to get a legal Maine template - thanks for providing

Thank you for your feedback. We really appreciate it. Have a great day!

Thelma S.

October 5th, 2019

So easy to navigate.

Thank you!

Randal R.

December 20th, 2019

While disappointed that my request could not be filled, I understand the issue, and appreciate the attempt and the responsiveness. I certainly will be back if the occasion arises!

Thank you!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca H.

August 6th, 2019

quick and easy. Perfect

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kermit W.

November 5th, 2020

Straightforward instructions and very quick turnaround.

Thank you for your feedback. We really appreciate it. Have a great day!

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Denise B.

September 3rd, 2020

Quick and easy!

Thank you Denise. We appreciate you.

B A A.

March 9th, 2023

So far I like the ease of availability of the site and the help guides.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah P.

September 13th, 2022

Very helpful! Easy and clear guidance. Good examples on sample forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suhila C.

August 23rd, 2020

This site is awesome. It has everything I need to purchase and sell (transfer deed ownership) land and property. I cannot wait to get our new land and building for business. Thanks, Suhila

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Irene G.

January 26th, 2021

Excellent service for anyone doing their own deed filing without the use of a title company or an attorney. I will definitely recommend deeds.com to my notary clients and will be personally using this service again! ;)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!