Brown County Mechanics Lien Form (Indiana)

All Brown County specific forms and documents listed below are included in your immediate download package:

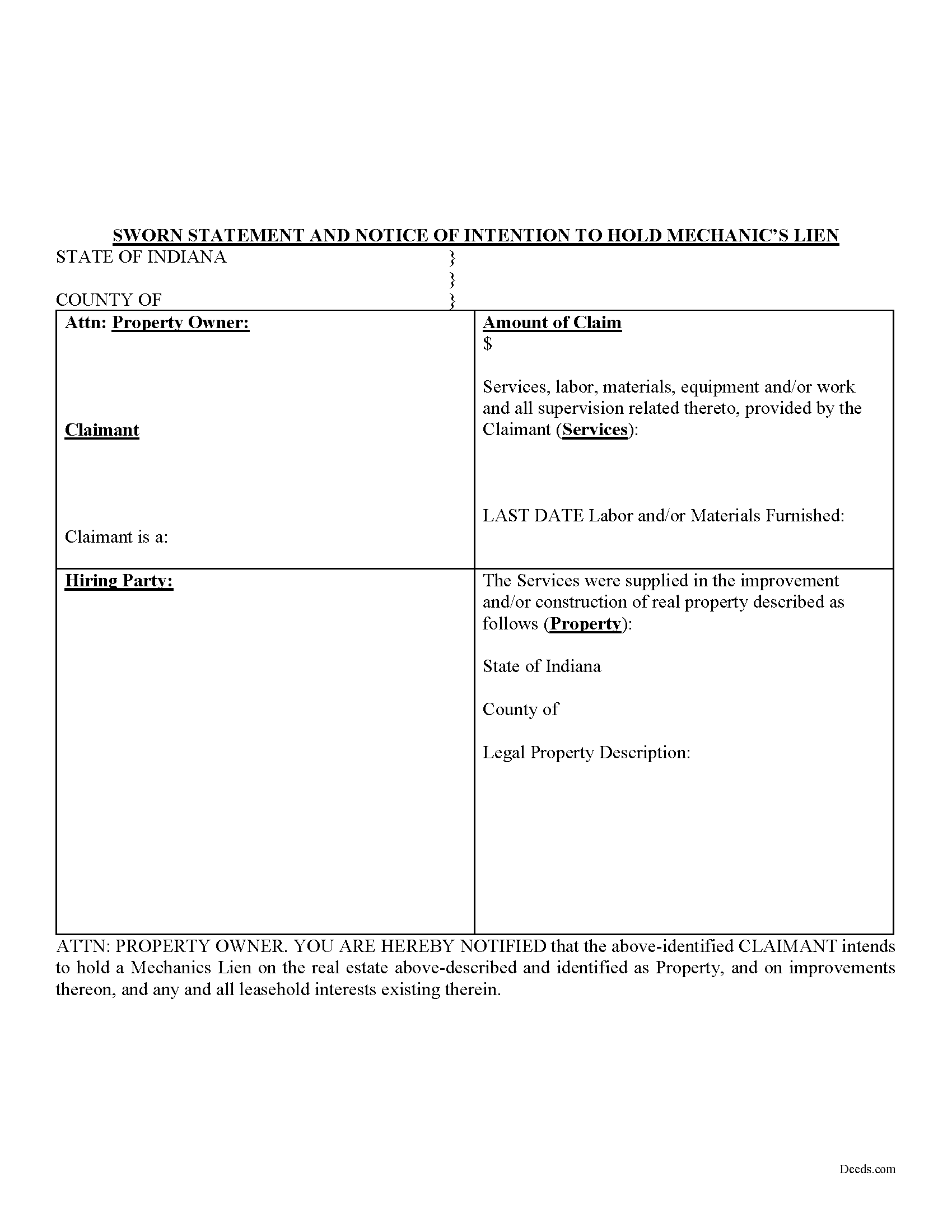

Mechanics Lien Form

Fill in the blank Mechanics Lien form formatted to comply with all Indiana recording and content requirements.

Included Brown County compliant document last validated/updated 11/5/2024

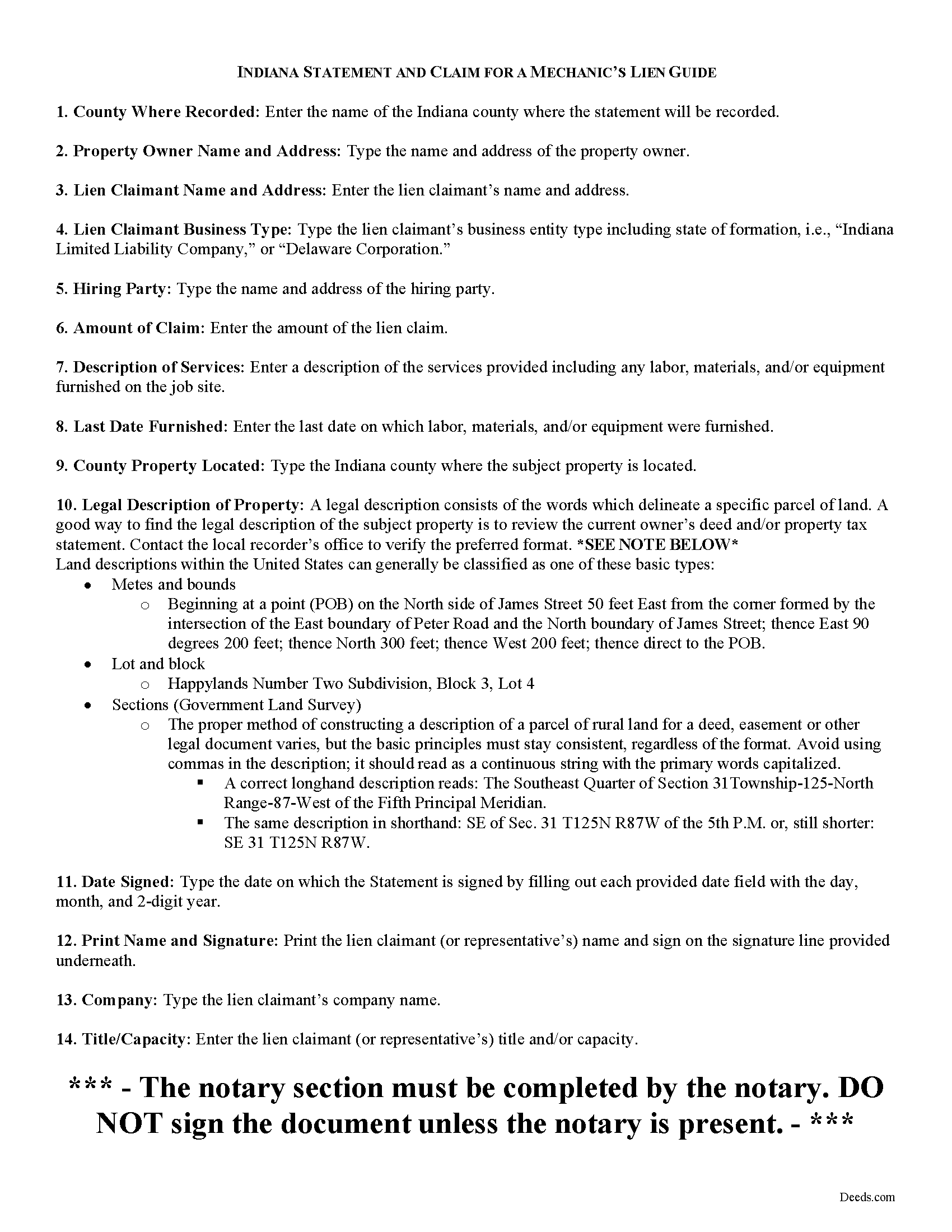

Mechanics Lien Guide

Line by line guide explaining every blank on the form.

Included Brown County compliant document last validated/updated 10/29/2024

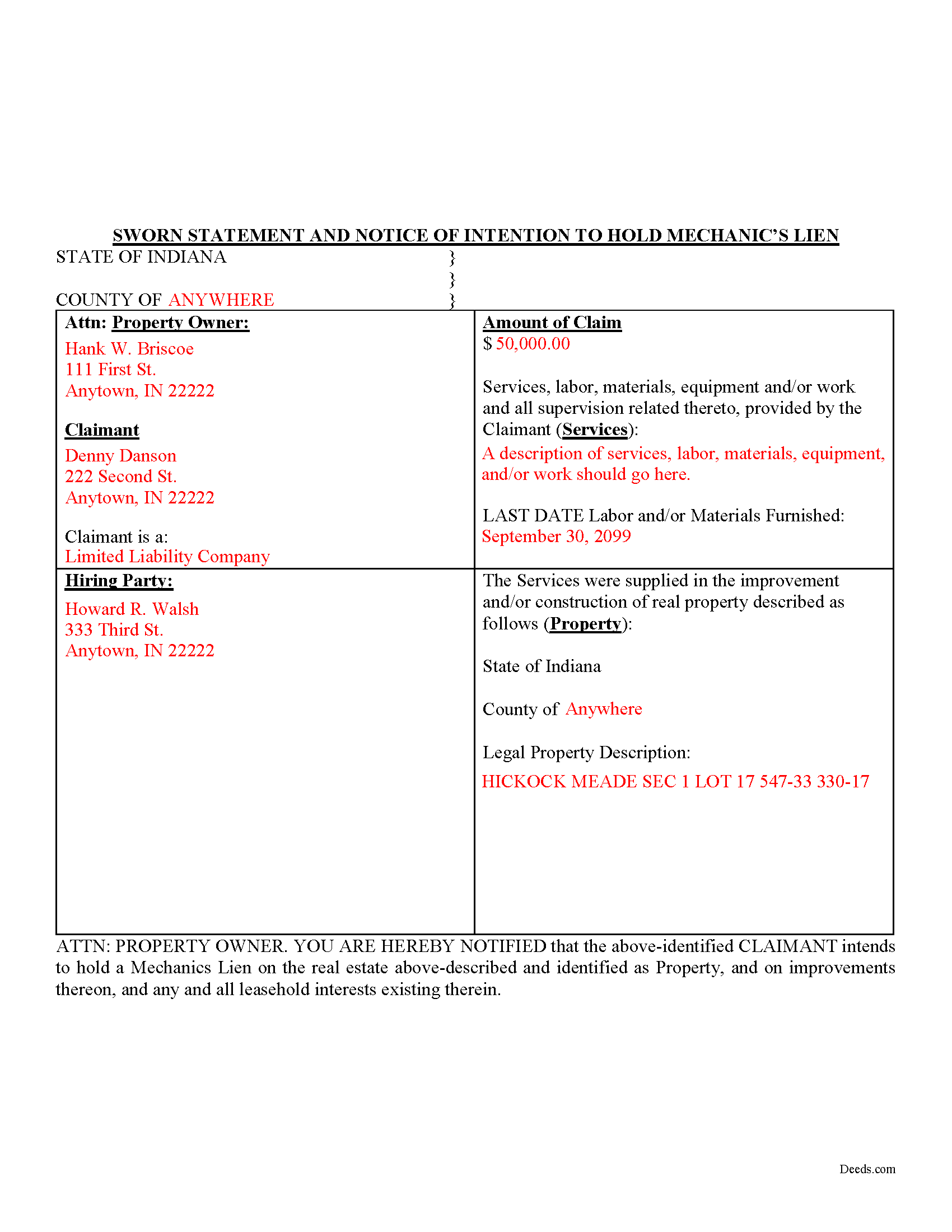

Completed Example of the Mechanics Lien Document

Example of a properly completed form for reference.

Included Brown County compliant document last validated/updated 4/18/2024

The following Indiana and Brown County supplemental forms are included as a courtesy with your order:

When using these Mechanics Lien forms, the subject real estate must be physically located in Brown County. The executed documents should then be recorded in the following office:

Brown County Recorder

201 Locust Lane / PO Box 86, Nashville, Indiana 47448

Hours: 8:00 a.m. - 4:00 p.m. Monday-Friday

Phone: (812) 988-5462

Local jurisdictions located in Brown County include:

- Helmsburg

- Nashville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Brown County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Brown County using our eRecording service.

Are these forms guaranteed to be recordable in Brown County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brown County including margin requirements, content requirements, font and font size requirements.

Can the Mechanics Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Brown County that you need to transfer you would only need to order our forms once for all of your properties in Brown County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Brown County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Brown County Mechanics Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Mechanic's liens are used to compel an owner or other party to pay an outstanding bill for a work of improvement on real property. For instance, a contractor that completes work on a property might get stiffed on a bill due to disagreement about the scope of work or a baseless complaint about the finished job. Because liens prevent an owner from selling or refinancing a property (or make it difficult to do so), liens are an effective remedy for contractors and other parties to earn their payment.

In Indiana, mechanic's liens are available to a contractor, subcontractor, mechanic, or a lessor leasing construction and other equipment and tools. IC 32-28-3-1(a). Such liens can be granted to parties involved in the erection, alteration, repair, or removal of a house, mill, manufactory, or other building. Id. They are also available for operations involving waterworks, earthmoving, or other drainage and sewerage works. Id.

Any eligible claimant can get a lien, either separately or jointly, on the structure or property that the person erected, altered, repaired, moved, or removed. IC 32-28-3-1(b). The same terms apply to parties who furnished materials or machinery. Id. A claimant can also levy a lien on the interest of the owner of the lot or parcel of land on which the structure or improvement stands or with which the structure or improvement is connected. Id. The lien is limited, however, to the extent of the value of any labor done or the material furnished, or both, including any use of the leased equipment and tools. Id. For parties providing labor only, any claims for wages of employed mechanics and laborers will be in the form of a lien on the machinery, tools, stock, material, or finished or unfinished work. IC 32-28-3-1(c).

To claim a lien, the claimant selling or furnishing labor, material, or machinery for an owner occupied single or double family dwelling to anyone other than the occupying owner or the owner's legal representative, must furnish the occupying owner a written notice of the delivery or work and of the existence of lien rights not later than thirty (30) days after the date of first delivery or labor performed. IC 32-28-3-1(h). The Notice of Furnishing is a required step to acquire a lien upon the lot or parcel of land or the improvement on the lot or parcel of land. Id. If the project is a single or double family dwelling intended for the occupying owner, then the written notice must be furnished to the owner of the real estate along with a written notice of delivery or labor and the existence of lien rights not later than sixty (60) days after the date of the first delivery or labor performed. IC 32-28-3-1(i). Additionally, a copy of the written notice must be filed in the recorder's office of the county where the property is situated, not later than sixty (60) days after the date of the first delivery or labor performed. Id

Filing the actual mechanic's lien is accomplished by recording a document called a "Notice of Intention to Hold Mechanic's Lien." The required notices described above must have been sent or else the lien will be limited to any time after such notice is sent. Any person who wishes to acquire a lien upon public property or property held by three or more tenants, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than ninety (90) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(a).

Any person who wishes to acquire a lien upon property held as a dwelling unit, whether the claim is due or not, must file in duplicate a sworn statement and notice of the person's intention to hold a lien upon the property for the amount of the claim: (1) in the recorder's office of the county; and (2) not later than sixty (60) days after performing labor or furnishing materials or machinery. IC 32-28-3-3(b).

The statement and notice of intention to hold a lien may be verified and filed on behalf of a client by an attorney registered with the clerk of the supreme court as an attorney in good standing under the requirements of the supreme court. Id.

A statement and notice of intention to hold a lien filed under this section must specifically set forth: (1) the amount claimed; (2) the name and address of the claimant; (3) the owner's: (A) name; and (B) latest address as shown on the property tax records of the county; and (4) the: (A) legal description; and (B) street and number, if any; of the lot or land on which the house, mill, manufactory or other buildings, bridge, reservoir, system of waterworks, or other structure may stand or be connected with or to which it may be removed. IC 32-28-3-3(c).

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please consult with an Indiana attorney for any questions regarding filing mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Brown County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brown County Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Felincia L.

September 28th, 2024

The process was fast and efficient. I did get a bit confused after entering info for my package but soon realized I had completed this part of the process and only needed to leave the page and wait for review of the document and then the invoice. It was pretty simple. After payment of the invoice I was notified that the document had been submitted. A few hours later I received notice that the document was recorded by the city. It was fast!

We are motivated by your feedback to continue delivering excellence. Thank you!

Danny A.

January 10th, 2021

This app is a fast and convenient way to download documents you need.

Thank you!

Beverly D.

January 12th, 2021

Thank You, Job well done. So nice not to have to leave house and drive all over to record these documents. Very satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

Terrill M.

January 10th, 2020

Great forms and information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Remon W.

January 26th, 2021

Excellent and fast service. I will be using this site as needed in the future.

Thank you Remon, we appreciate you.

Johnny A.

December 15th, 2018

My complete name is

Johnny Alicea Rodriguez

And the DEED is on my half brother and mine name.

Jimmy Dominguez and myself

Thanks

Kimberly G.

April 5th, 2021

It would be helpful if there were a specific example of putting a deed into a trust. Also, the limitation of characters on the description of the property was not enough.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela W.

March 12th, 2022

Very helpful and very quick to respond. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jason R.

April 28th, 2020

Very easy to use. Great examples.

Thank you for your feedback. We really appreciate it. Have a great day!

John Q.

June 26th, 2020

I downloaded the forms, which was very easy, and filled them out with the help of the very helpful instructions! I was able to go down to my court house and file the forms within 24 hours of downloading! I am at peace knowing my son's will avoid a lot of headaches when I pass because my property deed will transfer to them without probate court TOD !!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie G.

November 30th, 2020

Great online tool to get your deeds recorded without having to go downtown! Will be using deeds.com for all our future recordings!

Thank you!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.