Ripley County Limited Power of Attorney for Real Property Form (Indiana)

All Ripley County specific forms and documents listed below are included in your immediate download package:

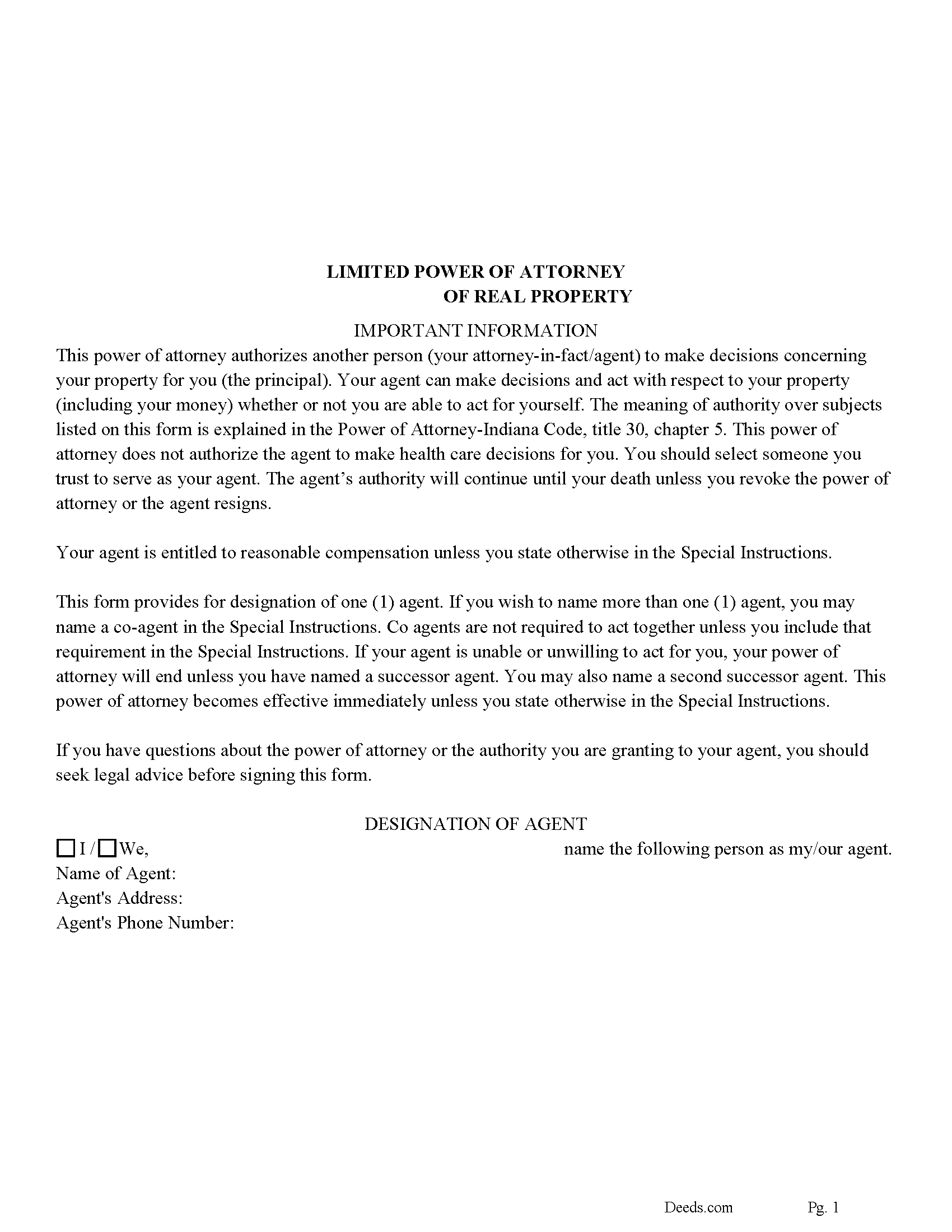

Limited Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Ripley County compliant document last validated/updated 11/5/2024

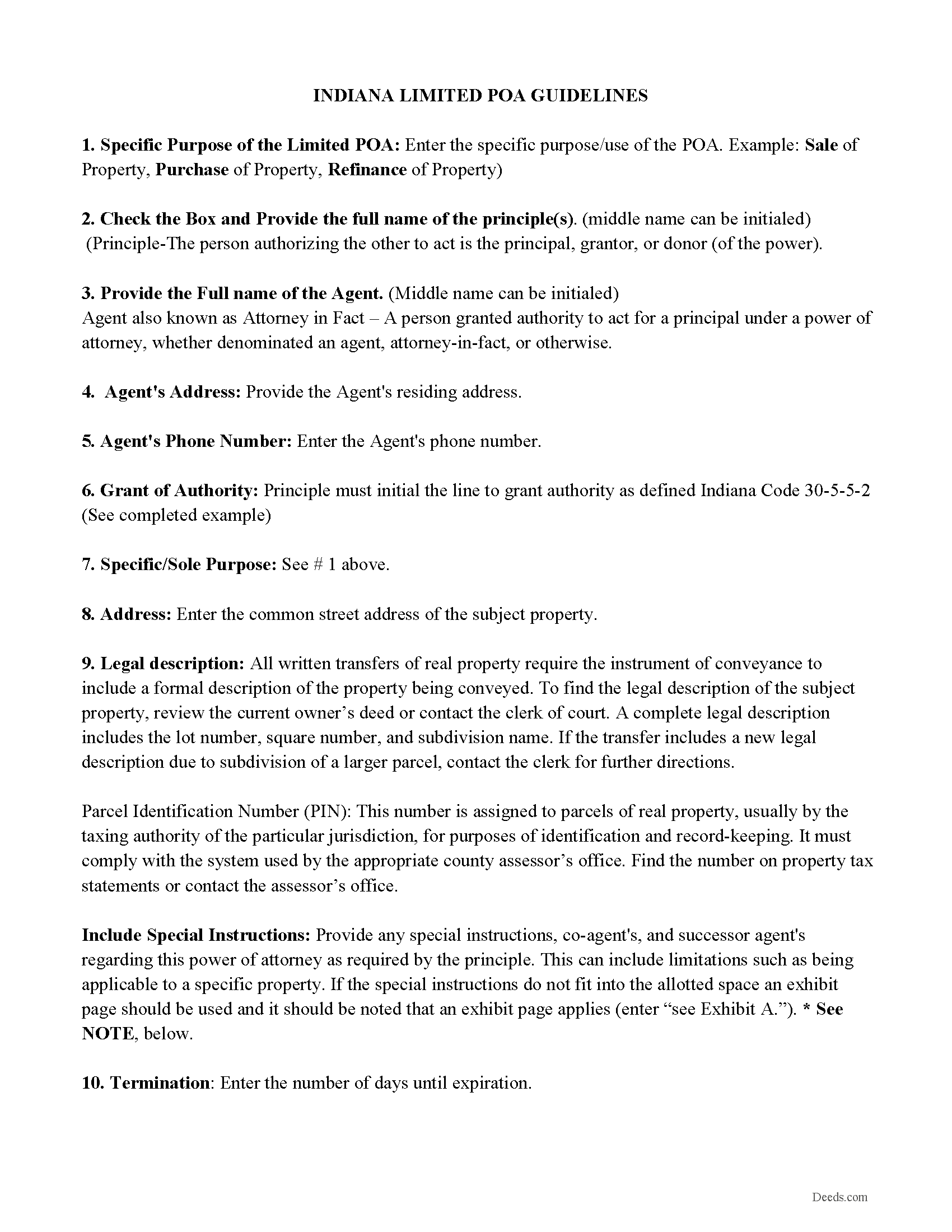

Limited POA Guidelines

Line by line guide explaining every blank on the form.

Included Ripley County compliant document last validated/updated 12/5/2024

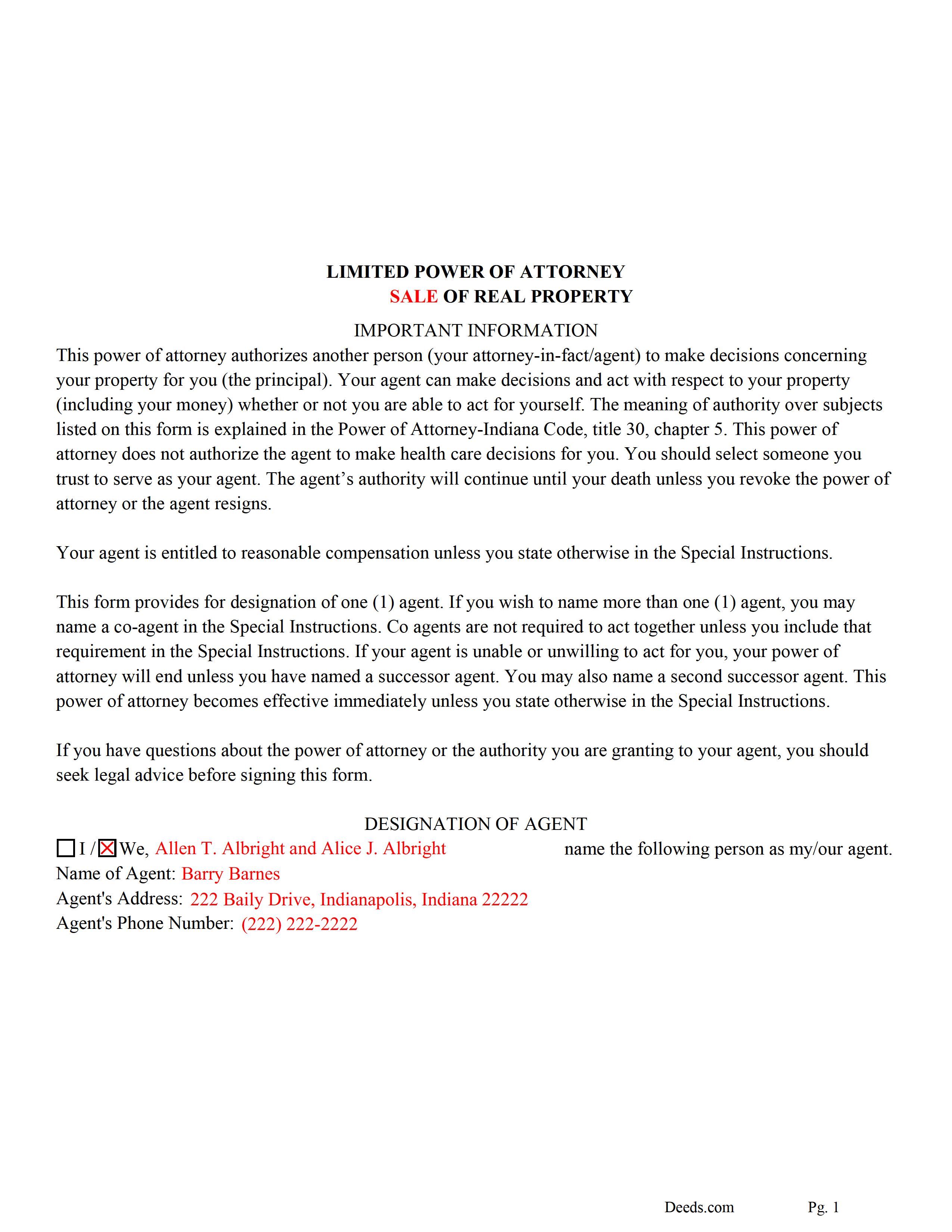

Completed Example of the Limited POA

Example of a properly completed form for reference.

Included Ripley County compliant document last validated/updated 11/25/2024

The following Indiana and Ripley County supplemental forms are included as a courtesy with your order:

When using these Limited Power of Attorney for Real Property forms, the subject real estate must be physically located in Ripley County. The executed documents should then be recorded in the following office:

Ripley County Recorder

102 W First North St / PO Box 404, Versailles, Indiana 47042

Hours: M-F 8-4

Phone: 812-689-5808

Local jurisdictions located in Ripley County include:

- Batesville

- Cross Plains

- Friendship

- Holton

- Milan

- Morris

- Napoleon

- Osgood

- Pierceville

- Sunman

- Versailles

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Ripley County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Ripley County using our eRecording service.

Are these forms guaranteed to be recordable in Ripley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ripley County including margin requirements, content requirements, font and font size requirements.

Can the Limited Power of Attorney for Real Property forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Ripley County that you need to transfer you would only need to order our forms once for all of your properties in Ripley County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Ripley County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Ripley County Limited Power of Attorney for Real Property forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use this power of attorney to appoint an agent to act on your behalf. The agent's powers follow IC 30-5-5-2 (Real property transactions) and are further limited by specifying a sole purpose to purchase, sell or refinance a specific property. The agent's powers can be further limited or defined in a "Special Instructions" section of the form. This POA terminates upon the satisfactory closing or upon a certain number of days (which you provide) after its execution, whichever happens first.

IC 30-5-5-2Real property transactions

Sec. 2. (a) Language conferring general authority with respect to real property transactions means the principal authorizes the attorney in fact to do the following:

(1) Accept as a gift or as security for a loan, to reject, demand, buy, lease, receive, or otherwise acquire either ownership or possession of an estate or interest in real property.

(2) Sell, exchange, convey with or without covenants, quitclaim, release, surrender, mortgage, encumber, partition or consent to partitioning, plat or consent to platting, lease, sublet, or otherwise dispose of an estate or interest in real property.

(3) Release in whole or in part, assign in whole or in part, satisfy in whole or in part, and enforce by action or proceeding, a mortgage, an encumbrance, a lien, or other claim to real property that exists or is claimed to exist in favor of the principal.

(4) Perform acts of management or conservation with respect to an estate or interest in real property owned or claimed to be owned by the principal, including the power to do the following:

(A) Insure against casualty, liability, or loss.

(B) Obtain, regain, or protect possession of the estate or interest by action or proceeding.

(C) Pay, compromise, or contest taxes and assessments.

(D) Apply for and receive refunds for taxes and assessments.

(E) Purchase supplies and hire assistance or labor.

(F) Make repairs or alterations in the structures or lands.

(5) Use, develop, modify, alter, replace, remove, erect, or install structures or other improvements upon real property in which the principal has or claims to have an interest.

(6) Demand, receive, or obtain by action or proceeding money or other things of value to which the principal is, may become, or may claim to be entitled to as the proceeds of an interest in real property or of one (1) or more transactions under this section, conserve, invest, disburse, or use any proceeds received for purposes authorized under this section, and reimburse the attorney in fact for expenditures properly made by the attorney in fact.

(7) Participate in a reorganization with respect to real property, receive and hold shares of stocks or instruments of similar character received under a plan of reorganization, and act with respect to the shares, including the power to do the following:

(A) Sell or otherwise dispose of the shares.

(B) Exercise or sell options.

(C) Convert the shares.

(D) Vote on the shares in person or by the granting of a proxy.

(8) Agree and contract in any manner and on any terms with a person for the accomplishment of any purpose under this section and perform, rescind, reform, release, or modify an agreement or a contract made by or on behalf of the principal.

(9) Execute, acknowledge, seal, and deliver a deed, revocation, mortgage, lease, notice, check, or other instrument that the attorney in fact considers useful for the accomplishment of a purpose under this section.

(10) Prosecute, defend, submit to arbitration, settle, and propose or accept a compromise with respect to a claim existing in favor of or against the principal based on or involving a real property transaction, and intervene in an action or proceeding relating to a claim.

(11) Hire, discharge, and compensate an attorney, accountant, expert witness, or other assistant when the attorney in fact considers the action to be desirable for the proper execution of a power under this section or for the keeping of necessary records.

(12) Perform acts relating to land use and zoning concerning property in which the principal has an ownership interest.

(13) Perform any other act with respect to an estate or interest in property.

(b) The powers described in this section are exercisable equally with respect to an interest in an estate or real property owned by the principal at the time of the giving of the power of attorney or acquired after that time, whether located in Indiana or in another jurisdiction.

As added by P.L.149-1991, SEC.2.

Recording requirements

Any document being recorded must include:

* Documents must be notarized. IC 32-21-2-3

* Documents executed or acknowledged in Indiana must include a statement that includes:

o "I affirm under penalties of perjury, that I have taken reasonable care to redact each social security number in this document unless required by law. This instrument is prepared by (printed name of individual)". IC 36-2-11-15

* The names of all those signing or serving as a witness on the document must be identical throughout the document and must be printed or typewritten under each signature. IC 36-2-11-16

* Legible content that can be easily reproduced and/or copied. IC 36-2-11-16

* A 2-inch top and bottom margin on the first and last pages for the recording stamp. If there is no room for stamps, an extra page will be added. IC 36-2-11-16.5

These requirements are dictated by Indiana Code and are not intended to be an exclusive list.

(Indiana Limited POA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Ripley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ripley County Limited Power of Attorney for Real Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

CARMEN R J.

August 7th, 2019

Thank you intensly

Thank you!

Nancy R.

June 5th, 2022

I AM NOT TOO SMART WHEN IT COMES TO COMPUTER STUFF, BUT THIS WEBSITE MADE IT SO VERY EASY & SIMPLE TO ACCOMPLISH THE TASK THAT WAS NEEDED. I FOUND MY STATE, FOUND THE TYPE OF DEED I NEEDED, FILLED IN THE BLANKS, PRINTED IT OUT & THEN GOT THE REQUIRED SIGNATURES WITNESSED & NOTARIZED -- EASY-PEASY! I WILL BE USING DEEDS.COM IN THE FUTURE & WILL CERTAINLY RECOMMEND IT TO FRIENDS & FAMILY.

I REALLY APPRECIATED ALL THE OTHER FORMS OF EXPLANATION THEY GIVE YOU AS WELL AS AN EXAMPLE OF HOW YOUR COMPLETED DOCUMENT SHOULD LOOK ONCE YOU'RE FINISHED.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana T.

July 15th, 2022

Very helpful Got information and form I wanted.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith C.

February 3rd, 2021

very happy so far. Haven't gone to record deeds yet so am in good hopes everything will be in good order. Time saver!!!

Thank you!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn S.

August 20th, 2022

I was pleased with the service and product.

Thank you!

Byron G.

June 23rd, 2022

So easy to use. Would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Ron S.

April 5th, 2019

Fair price and beneficiary deed was recorded without issue. Completion instructions provided were insufficient in some cases.

Thank you!

Brooksye G.

January 15th, 2019

Very helpful. I live in Arkansas and needed information and documents for a Missouri transaction. I got everything I needed without any hassle.

Thank you Brooksye, we really appreciate your feedback.

David L.

December 29th, 2020

It was a very easy to use application. I can only give it four stars because I have yet to receive confirmation from the county that my application was acceptable, ie., format, font, etc. I believe it will be fine.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!

Novella M T.

January 5th, 2022

Amazing forms, nice to have something specific and not generic like some other sites. Getting the other required forms included is a nice bonus.

Great to hear Novella. We appreciate you taking the time to leave your feedback.