St Joseph County Installment Contract for Sale of Real Estate Form (Indiana)

All St Joseph County specific forms and documents listed below are included in your immediate download package:

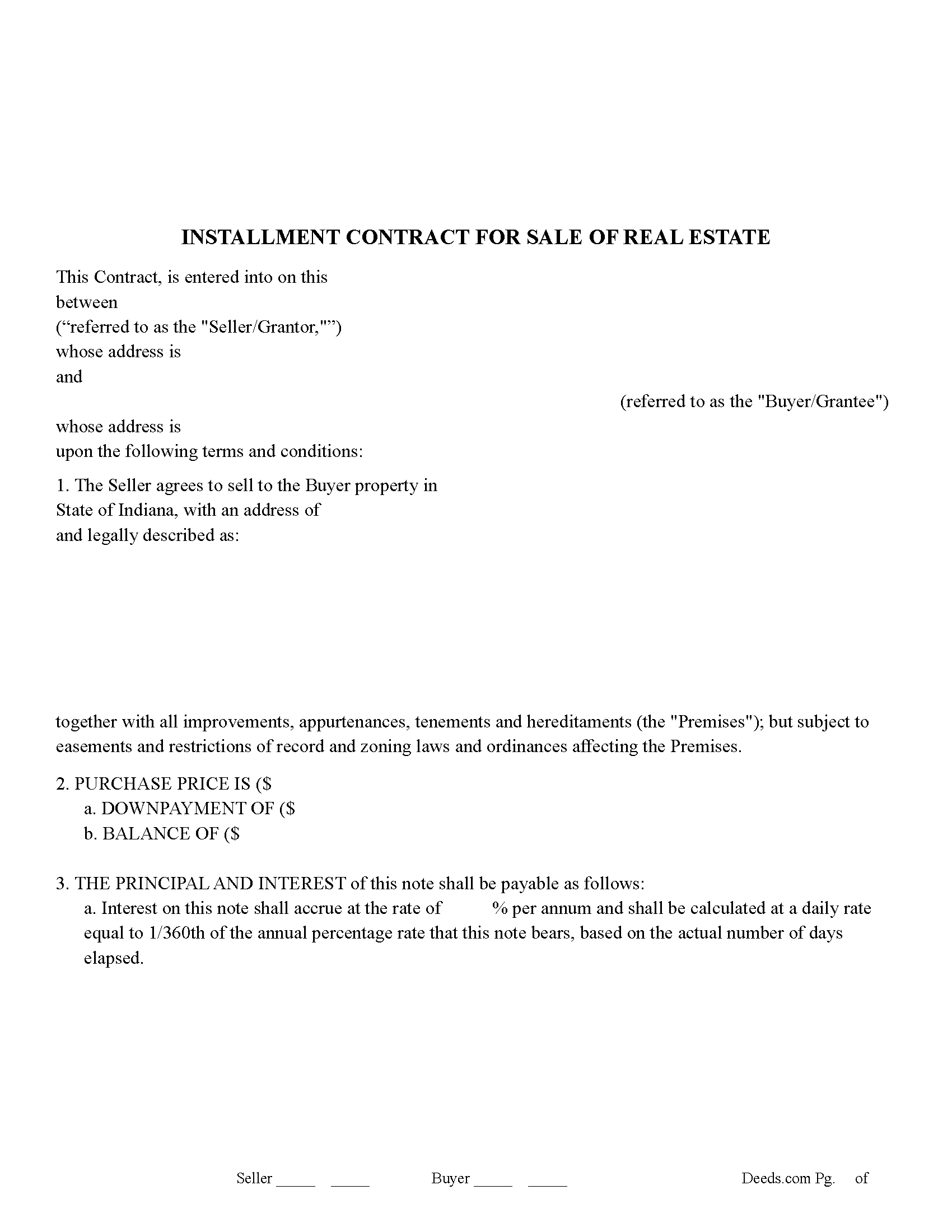

Installment Contract for Sale of Real Estate Form

Fill in the blank Installment Contract for Sale of Real Estate form formatted to comply with all Indiana recording and content requirements.

Included St Joseph County compliant document last validated/updated 8/29/2024

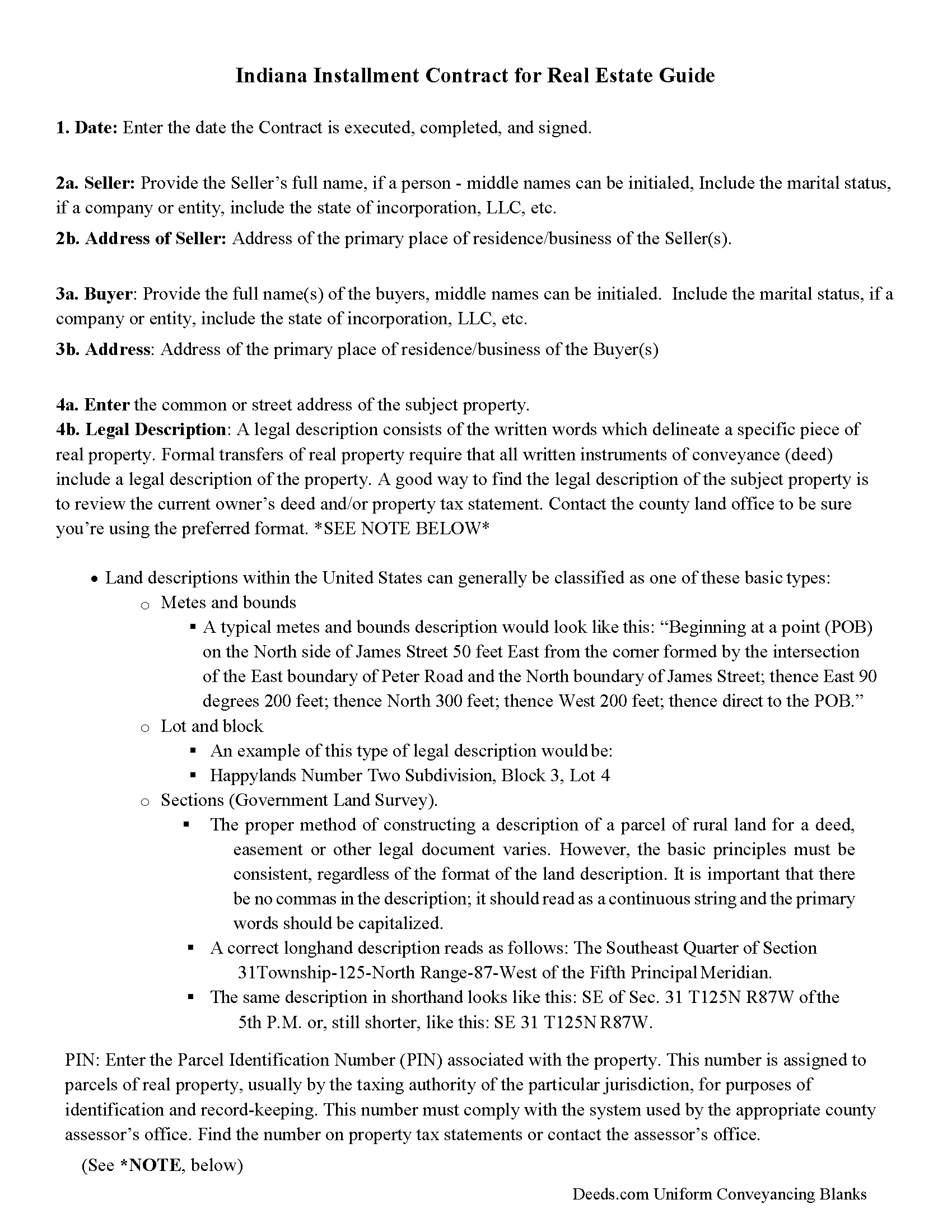

Installment Contract for Sale of Real Estate Guide

Line by line guide explaining every blank on the Installment Contract for Sale of Real Estate form.

Included St Joseph County compliant document last validated/updated 9/3/2024

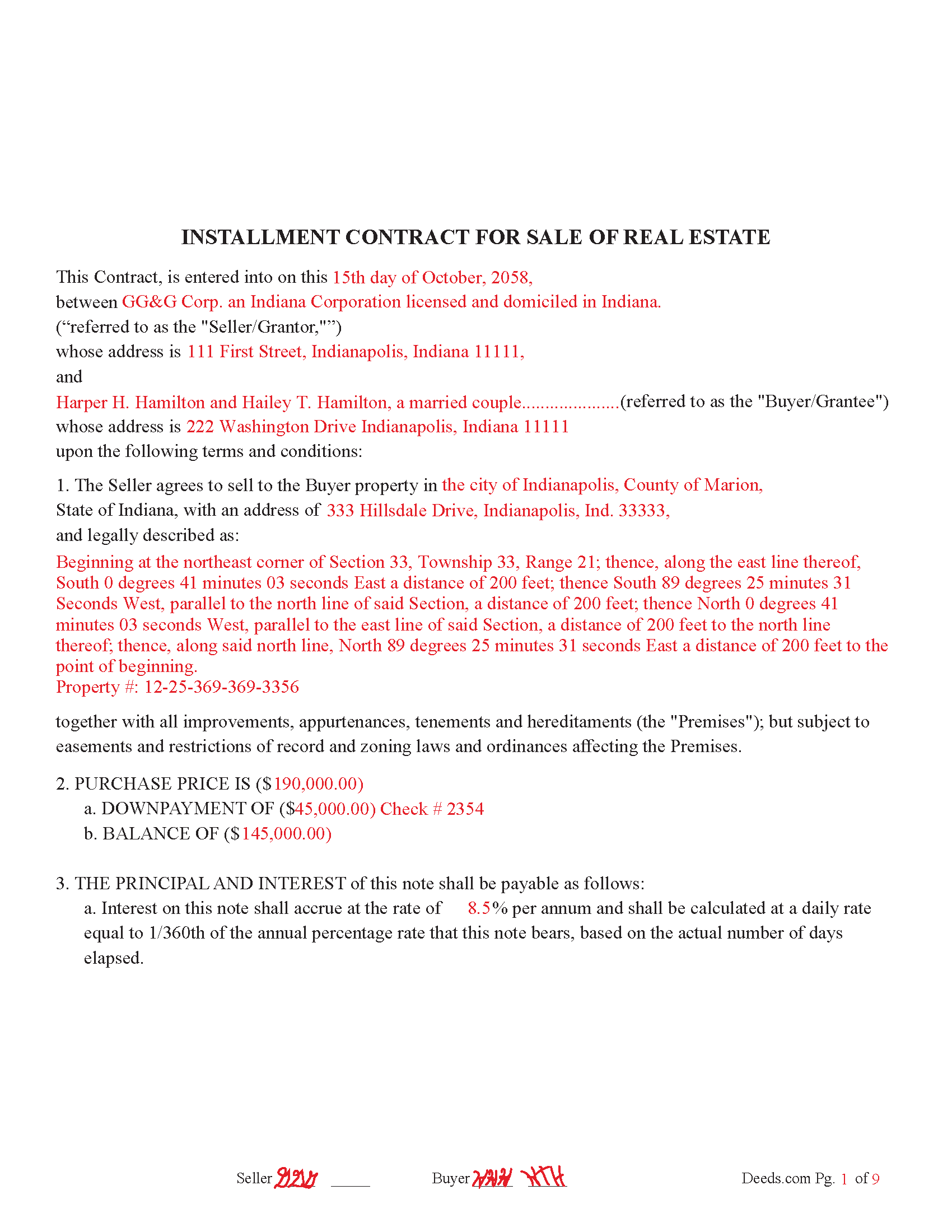

Completed Example of the Installment Contract for Sale of Real Estate Document

Example of a properly completed Indiana Installment Contract for Sale of Real Estate document for reference.

Included St Joseph County compliant document last validated/updated 10/22/2024

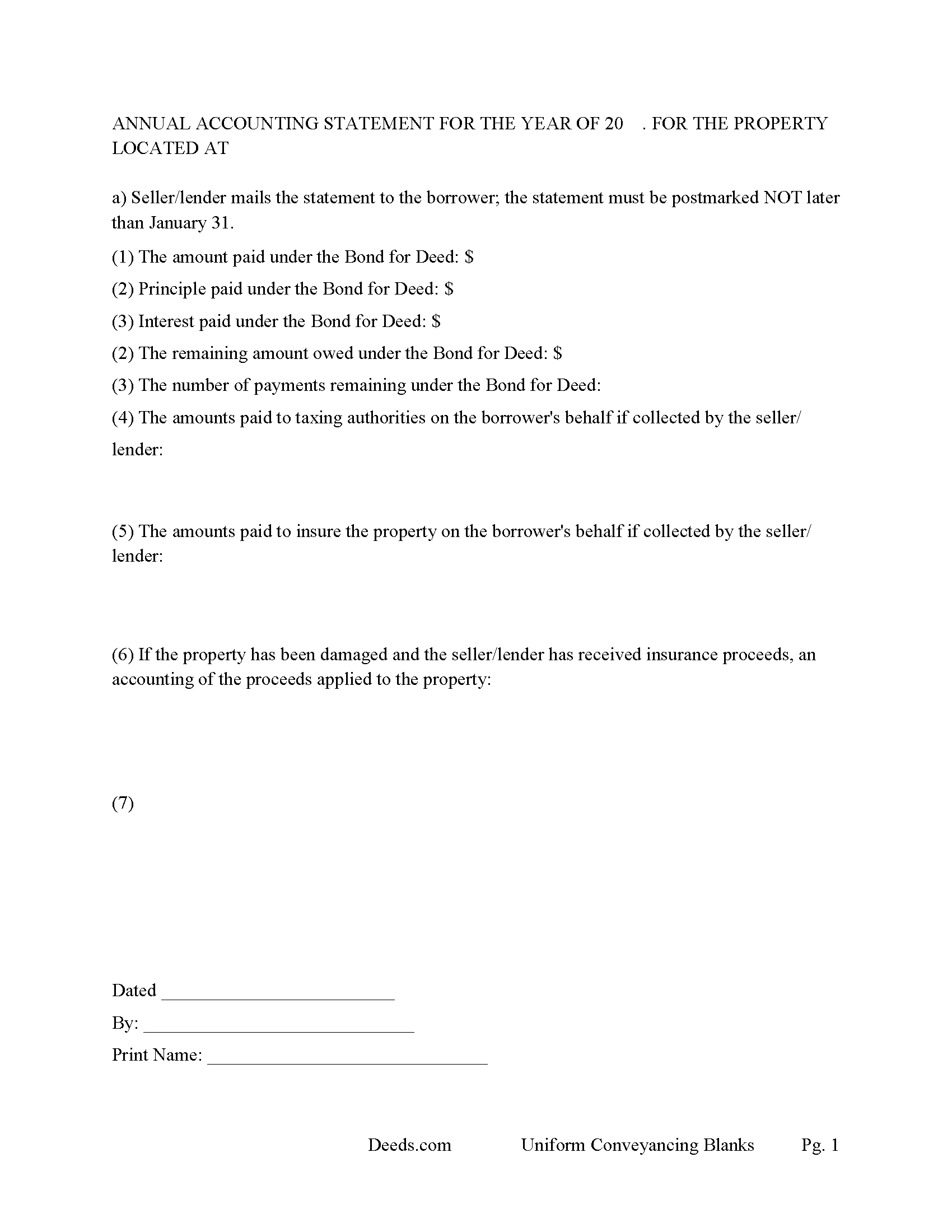

Annual Accounting Statement Form

Issue to Buyer(s) for fiscal year accounting reporting.

Included St Joseph County compliant document last validated/updated 9/23/2024

The following Indiana and St Joseph County supplemental forms are included as a courtesy with your order:

When using these Installment Contract for Sale of Real Estate forms, the subject real estate must be physically located in St Joseph County. The executed documents should then be recorded in the following office:

St. Joseph Recorder

227 W Jefferson Blvd, Rm 321, South Bend, Indiana 46601

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (574) 235-9525

Local jurisdictions located in St Joseph County include:

- Granger

- Lakeville

- Mishawaka

- New Carlisle

- North Liberty

- Notre Dame

- Osceola

- South Bend

- Walkerton

- Wyatt

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the St Joseph County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in St Joseph County using our eRecording service.

Are these forms guaranteed to be recordable in St Joseph County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by St Joseph County including margin requirements, content requirements, font and font size requirements.

Can the Installment Contract for Sale of Real Estate forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in St Joseph County that you need to transfer you would only need to order our forms once for all of your properties in St Joseph County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or St Joseph County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our St Joseph County Installment Contract for Sale of Real Estate forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An "Installment Contract for Sale of Real Estate", also known as a Contract for Deed, Land Contract, or Contract for Sale) is a legal agreement/contract where the buyer makes payments directly to the seller in exchange for the right to use the property. The buyer receives the deed and full ownership of the property only after all payments have been made.

A land contract form can be used in Indiana when both the buyer and seller agree to an installment sale of real property, where the buyer makes payments directly to the seller over time, rather than obtaining a traditional mortgage from a bank. The seller retains the legal title to the property until the full purchase price is paid, at which point the title is transferred to the buyer. Here are some common scenarios where an INSTALLMENT CONTRACT FOR SALE OF REAL ESTATE might be used:

1. Buyer Lacks Access to Traditional Financing

Credit Challenges: The buyer may have difficulty qualifying for a traditional mortgage due to poor credit, insufficient credit history, or other financial issues.

Income Verification: The buyer may be self-employed or have income that is difficult to verify, making it harder to secure a conventional loan.

2. Seller Financing Preferences - Investment Strategy: The seller may prefer to finance the sale as an investment, earning interest over time instead of receiving the full purchase price upfront. Speed of Sale, a land contract can be an attractive option in a slow market, enabling the seller to reach a deal with a buyer who might not qualify for a traditional mortgage.

3. Flexible Terms - Custom Payment Arrangements: The buyer and seller can negotiate terms that suit their needs, such as the payment schedule, interest rate, down payment, and the duration of the contract. Possession Before Full Payment: The buyer can take possession of the property and start using it while making payments, even if they cannot pay the full purchase price upfront.

4. Buyer's Intent to Improve Property -Rehabilitation Projects: The buyer may intend to rehabilitate or improve the property before obtaining full financing. A land contract allows them to take possession and make improvements before completing the purchase.

5. Simplified Process - Reduced Costs: A land contract may reduce the costs associated with closing, as it often bypasses the need for a traditional lender and related fees.

Faster Execution: The process of negotiating and executing a land contract can be faster than obtaining a traditional mortgage.

6. Unique Property - Non-Conforming Properties: For properties that may not meet the standards required by traditional mortgage lenders (such as rural, unique, or non-conforming properties), a land contract can be a viable option.

7. Inter-Family Transactions - Family Agreements: A land contract can be useful in family transactions where a parent is selling a home to a child or another relative, offering a flexible payment arrangement that suits both parties.

Procedures for Using a Contract for Deed

1. Drafting the Contract:

The contract must include all essential terms: purchase price, payment schedule, interest rate, penalties for default, responsibilities for taxes and insurance, and the date when the deed will be transferred.

2. Indiana Code § 32-21-7 - Land Contracts

This statute outlines the requirements and procedures for recording land contracts. It requires that the contract be recorded in the recorder's office in the county where the property is located within 45 days after the contract is executed. The purpose of recording is to provide notice to third parties, thereby protecting the buyer's interest in the property.

Failure to record the contract can affect the enforceability of the buyer’s interest against third parties.

3. Payment and Maintenance:

The buyer makes monthly installment payments to the seller, who retains legal title until the contract is fully paid. (This contract allows for a Balloon payment). The buyer takes on responsibilities such as property taxes, insurance, and maintenance.

Terms and uses

1. TITLE AND TITLE INSURANCE. Seller shall provide Buyer with a standard form owner’s policy of title insurance in the amount of the purchase price. The title policy to be issued shall contain no exceptions other than those provided in said standard form plus encumbrances or defects approved by Buyer as provided below. As soon as reasonably possible after escrow is opened Buyer shall be furnished with a preliminary commitment. Said preliminary commitment shall include legible copies of all documents forming the basis for any special exception set forth. If Buyer chooses an extended owner’s policy, Buyer shall pay the difference in cost between the standard owner policy, and the extended owner’s policy.

2. DEED Of CONVEYANCE. Upon receipt of Buyer's payment in full of the balance of the purchase price, Seller shall furnish a General Warranty Deed, conveying to Buyer title to the property.

3. LATE CHARGE: Any above noted payment which is at least days past due, shall be subject to a late charge of $ And an additional $ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $ per day.

4. Uses include residential property, rental property up to 4 units, condominiums, and planned unit developments. Traditional installment payment with or without a balloon payment.

A contract for sale with stringent default terms can be beneficial to the seller.

Our Promise

The documents you receive here will meet, or exceed, the St Joseph County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your St Joseph County Installment Contract for Sale of Real Estate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Roger M.

December 28th, 2020

A better or more simplified explanation of what some of the more common titles would be used for would help. You list 6-8 types of Trusts alone. An example of doing a Grant Deed to move a property into, out of, or from a Trust to a Trust would have been helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Kim M.

January 5th, 2019

Purchased the Warranty Deed package for $19.95 which included all the forms I needed including instructions and a sample form. Seamless transaction filing with our local county clerk's office - she even commented it was one of the best prepared packages she has seen. Thanks for saving me a ton of money!

Thank you Kim, we appreciate your feedback.

Joey S.

March 5th, 2022

This is the easiest process ever!

Thank you!

Michele B.

June 9th, 2022

It was a wonderful experience. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Harman F.

April 7th, 2024

I was able to find the document I very much needed to get my process started. I really appreciate that there was a website to assist me in finding what I needed . I'm very Thankful that this website was available!

We are delighted to have been of service. Thank you for the positive review!

Roger W H.

March 31st, 2022

So far GOOD, just can't locate legal description. Will sign in later when have correct info. Thanx!! Rog

Thank you!

Diana A.

February 5th, 2019

My service today was outstanding.your rep asked me several questions and was able to get me all the information I needed.

Thank you!

Jin L.

December 27th, 2019

Your service is pretty awesome! I needed to get my docs recorded before year end, and you guys were on it. Thank you very much for the quick turnaround!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

John K.

July 11th, 2020

I was unable to finish what I started due to computer crash. I'll get back soon. I paid off my mortgage last year in November. I need to see what to do to get the deed to my property.

Thank you!

Lisa J.

April 16th, 2021

I ordered a Lis Pendens form and it was exactly what I needed. Saved me a lot of time since I am self representing. Already filed it at courthouse! No problem!

Thank you for your feedback. We really appreciate it. Have a great day!