Perry County General Durable Power of Attorney Form (Indiana)

All Perry County specific forms and documents listed below are included in your immediate download package:

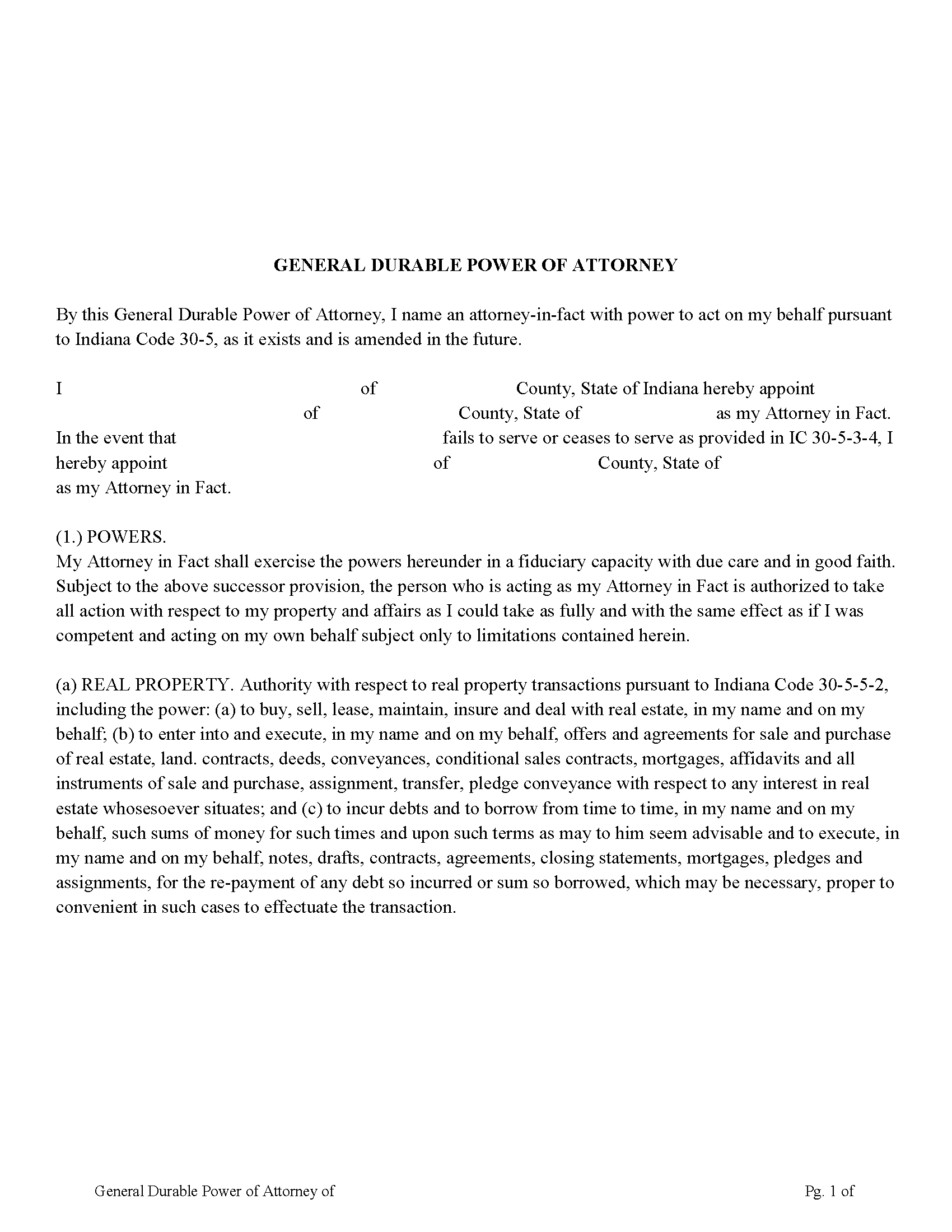

General Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Perry County compliant document last validated/updated 10/23/2024

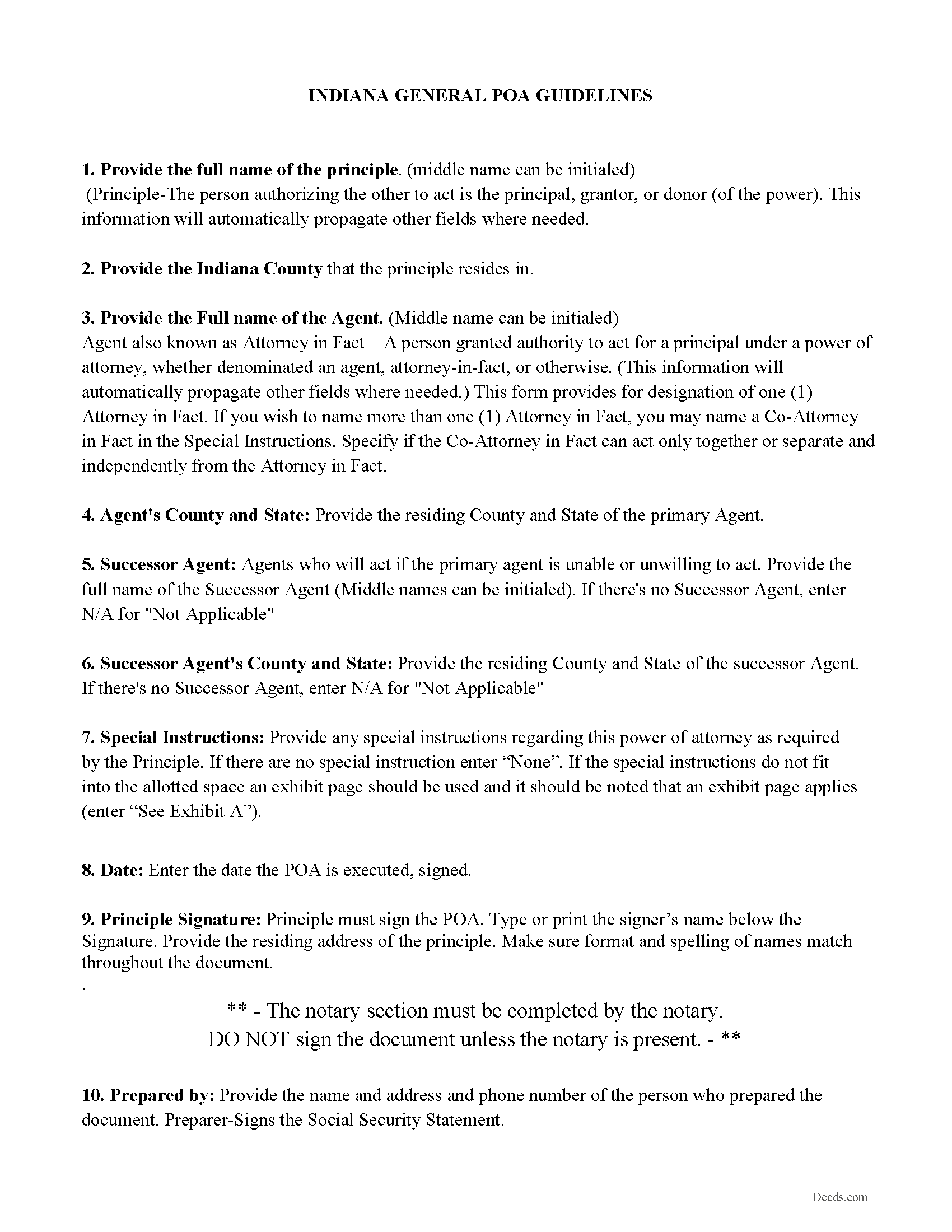

Power of Attorney Guidelines

Line by line guide explaining every blank on the form, includes Indiana POA Statutes

Included Perry County compliant document last validated/updated 10/18/2024

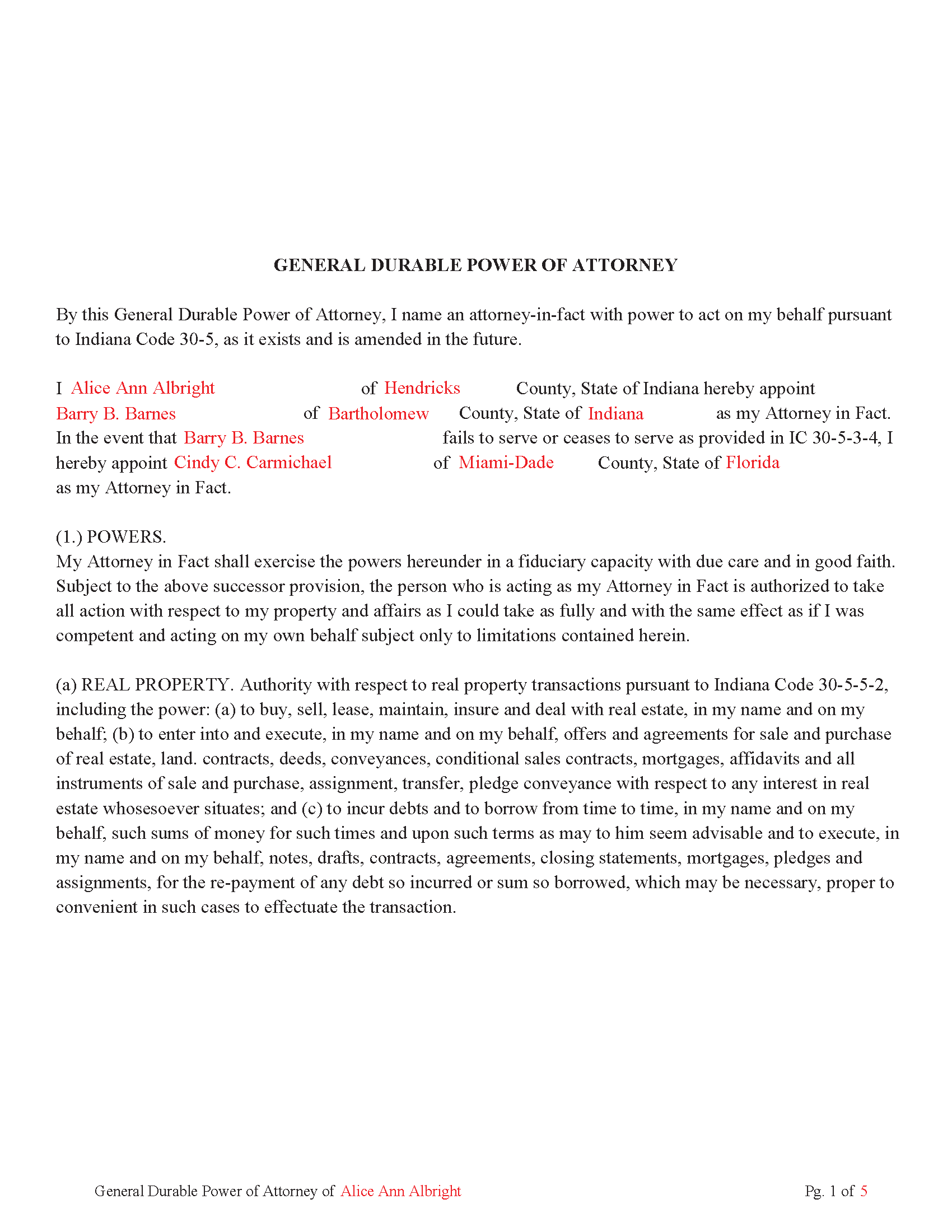

Completed Example of the Power of Attorney Document

Example of a properly completed form for reference.

Included Perry County compliant document last validated/updated 7/29/2024

The following Indiana and Perry County supplemental forms are included as a courtesy with your order:

When using these General Durable Power of Attorney forms, the subject real estate must be physically located in Perry County. The executed documents should then be recorded in the following office:

Perry County Recorder

2219 Payne St, Tell City, Indiana 47586

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 547-4261

Local jurisdictions located in Perry County include:

- Branchville

- Bristow

- Cannelton

- Derby

- Leopold

- Rome

- Saint Croix

- Tell City

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Perry County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Perry County using our eRecording service.

Are these forms guaranteed to be recordable in Perry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Perry County including margin requirements, content requirements, font and font size requirements.

Can the General Durable Power of Attorney forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Perry County that you need to transfer you would only need to order our forms once for all of your properties in Perry County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Perry County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Perry County General Durable Power of Attorney forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

(5) Five Page General Durable Power of Attorney, following Indiana Code and subjects listed below.

By this General Durable Power of Attorney, you name an attorney-in-fact with power to act on your behalf pursuant to Indiana Code 30-5, as it exists and is amended in the future.

(a) REAL PROPERTY. Authority with respect to real property transactions pursuant to Indiana Code 30-5-5-2

(b) TANGIBLE PERSONAL PROPERTY. Authority with respect to tangible personal property transactions pursuant to Indiana Code 30-5-5-3

(c) BOND, SHARE AND COMMODITY. Authority with respect to bond, share. and commodity transactions pursuant to Indiana Code 30-5-5-4,

(d) BANKING. Authority with respect to banking transactions pursuant to Indiana Code 30-5-5-5, including but not limited to the authority:

(e) BUSINESS. Authority with respect to business operating transactions pursuant to Indiana Code 30-5-5-6, including the power:

(f) INSURANCE. Authority with respect to insurance transactions pursuant to

Indiana Code 30-5-5-7.

(g) BENEFICIARY. Authority with respect to beneficiary transactions pursuant to

Indiana Code 30-5-5-8.

(h) GIFTS. In the event I become permanently mentally incapacitated, to make gifts of my property and to have general authority with respect to gift transactions as provided in IC 30-5-5- 9

(i) FIDUCIARY. Authority with respect to fiduciary transactions pursuant to Indiana Code 30-5-5-10

(j) CLAIMS AND LITIGATION. Authority with respect to claims and litigation pursuant to

Indiana Code 30-5-5-11.

(k) FAMILY MAINTENANCE. Authority with respect to family maintenance pursuant to

Indiana Code 30-5-5-12.

(l) MILITARY SERVICE. Authority with respect to benefits from military service pursuant to

Indiana Code 30-5-5-13.

(m) RECORDS, REPORTS AND STATEMENTS. Authority with respect to records, reports and statements pursuant to Indiana Code 30-5-5-14, including, but not limited to, the power to execute on my behalf any

(n) ESTATE TRANSACTIONS. Authority with respect to estate transaction pursuant to

Indiana Code 30-5-5-15.

(o) DELEGATING AUTHORITY. Authority with respect in delegating authority in writing to one (1) or more persons as to any or all powers given to the attorney-in-fact by this General Durable Power of Attorney document, pursuant to Indiana Code 30-5-5-18.

(p) TAX MATTERS. Authority: (a) to prepare, execute and file on your behalf.

(q) SOCIAL SECURITY ADMINISTRATION. Authority to act as your representative and attorney-in-fact for all matters involving the Social Security Administration and benefits from the administration.

(r) ALL OTHER MATTERS. Authority with respect to all other possible matters and affairs affecting property owned by you pursuant to Indiana Code 30-5-5-19.

(Indiana General Durable POA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Perry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Perry County General Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

Rita T.

November 30th, 2022

This is the first time I use this site, and it was very easy and user friendly. I was able to fill out what i needed with the help of their example. quick download. like it. The price was reasonable. Definitely will use again. Highly recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David C.

January 17th, 2020

Very fast service

Thank you!

Sylvia H.

July 21st, 2022

Thank you so much for making it easy and professionally trustworthy.

You are the best!!!

Thank you!

Darlene D.

June 21st, 2019

A little confusing to try to save your docouments and how to process them but once figured out easy to do.

Thank you!

annie m.

February 13th, 2023

recently joined Deeds.com. still exploring the site. has been very helpful in providing local information for recording, such as fees and requirements. i am working to correct mistakes made within a deed. it is amazing how these municipalities operate outside the scope of Article 1, Section 8, Clause 17; to claim land is "in" the "State of ____. when the land is actually not ceded to the United States of America as for use for needful buildings. beware of the fraud perpetrated by Attorneys in the recording of your Deeds. Registration as "RESIDENTIAL" puts your private-use land on the TAX rolls with the use of that one word. i recommend this site as it appears there is information for each state and each county office. will update my review once i place an order.

Thank you!

MARILYN I.

March 20th, 2023

Very pleased with your user friendly site.

Thank you!

Candy A.

June 27th, 2020

Super simple to download all necessary forms. BIG thank you for this service.

Thank you!

Kenneth R.

May 26th, 2023

Easy to use and saves money.

Thank you!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

May 29th, 2019

My sale is a land contract and it is complicated. We were thinking we'd have to get an attorney. Your site is very thorough and helpful. We will still have an attorney look over our final papers --and we are still waiting on my deed from the bank to finalize our input. Had several questions, but they seemed to be answered as I went along. The actual process of downloading and saving and having a link went very smoothly. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!