Marion County Full Release of Mortgage Form (Indiana)

All Marion County specific forms and documents listed below are included in your immediate download package:

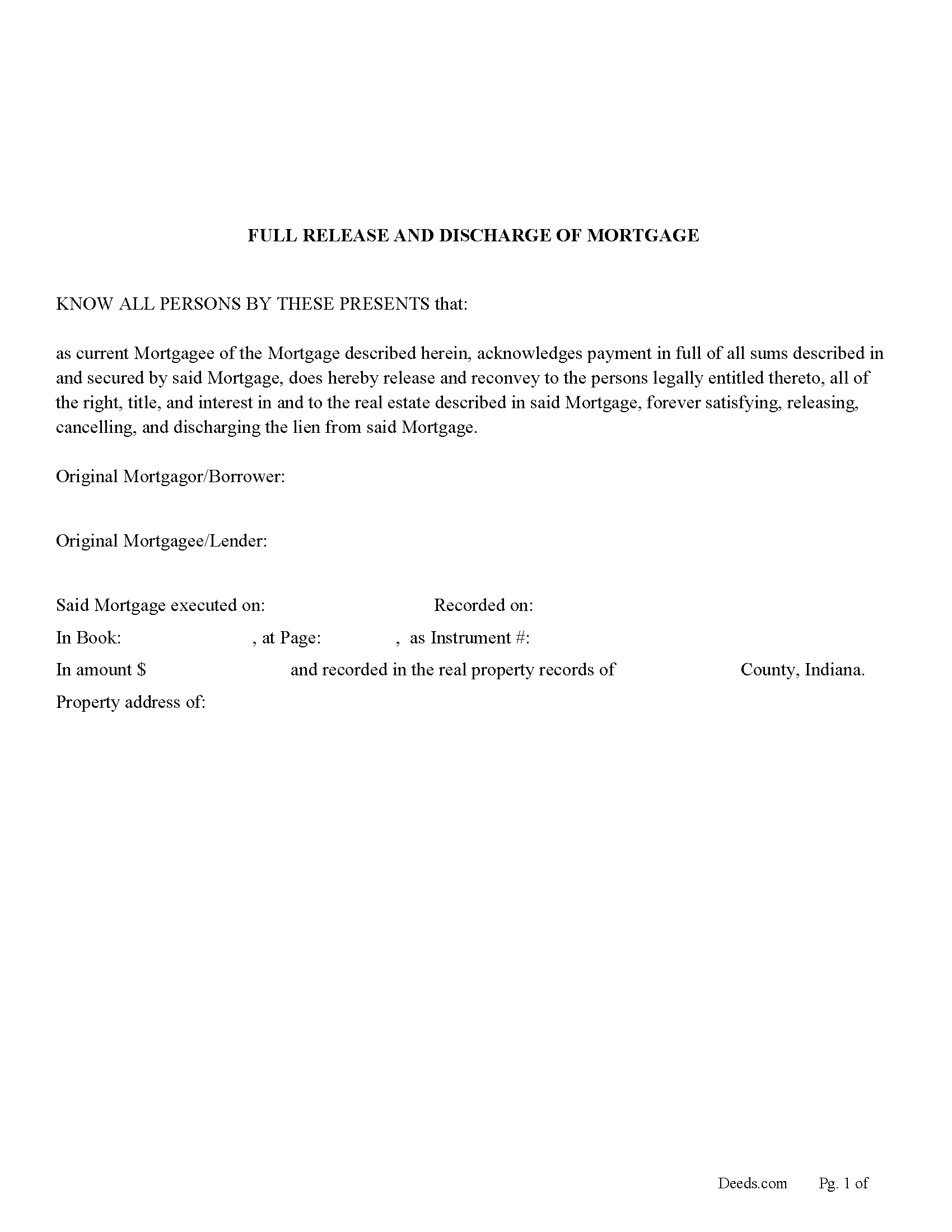

Full Release of Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Marion County compliant document last validated/updated 7/11/2024

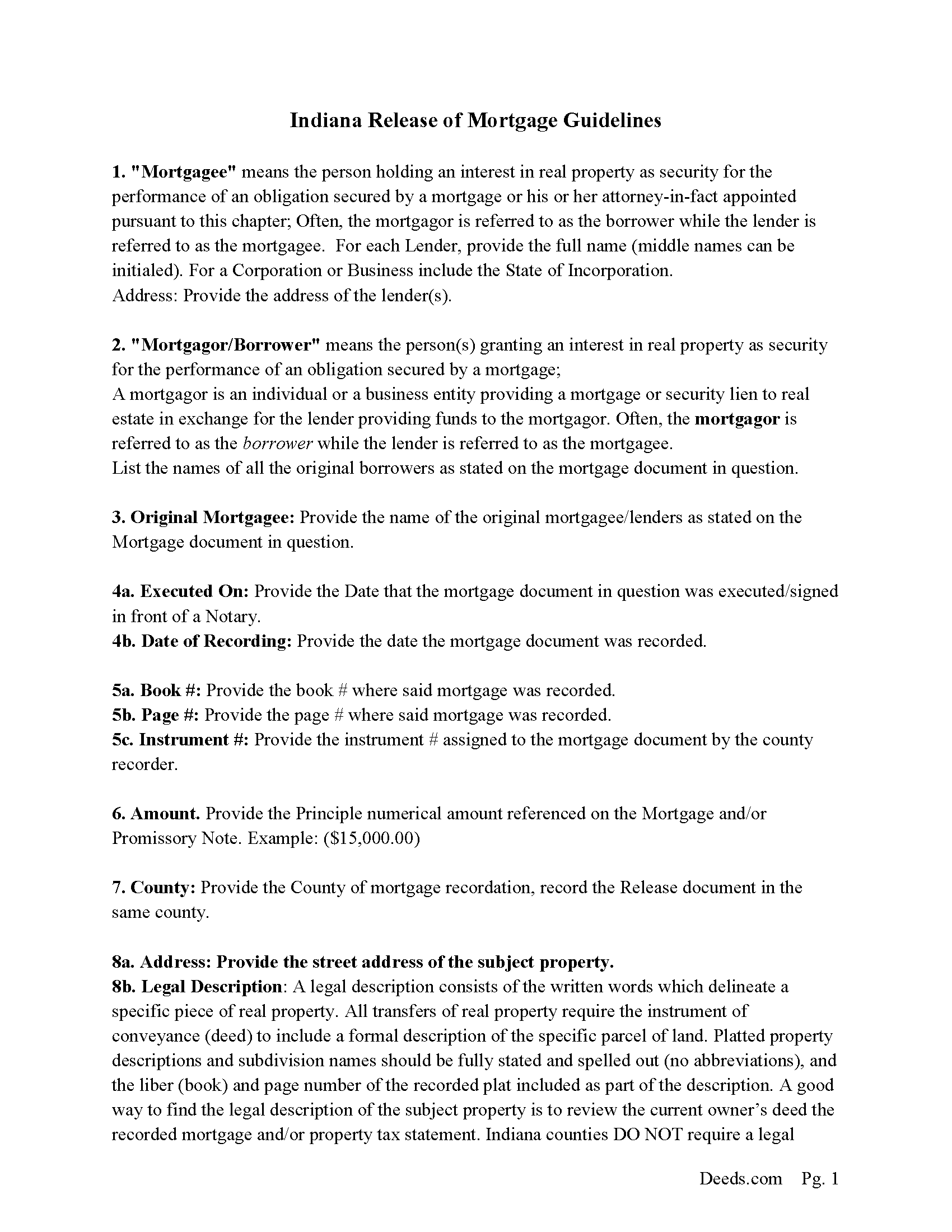

Release of Mortgage Guidelines

Line by line guide explaining every blank on the form

Included Marion County compliant document last validated/updated 10/22/2024

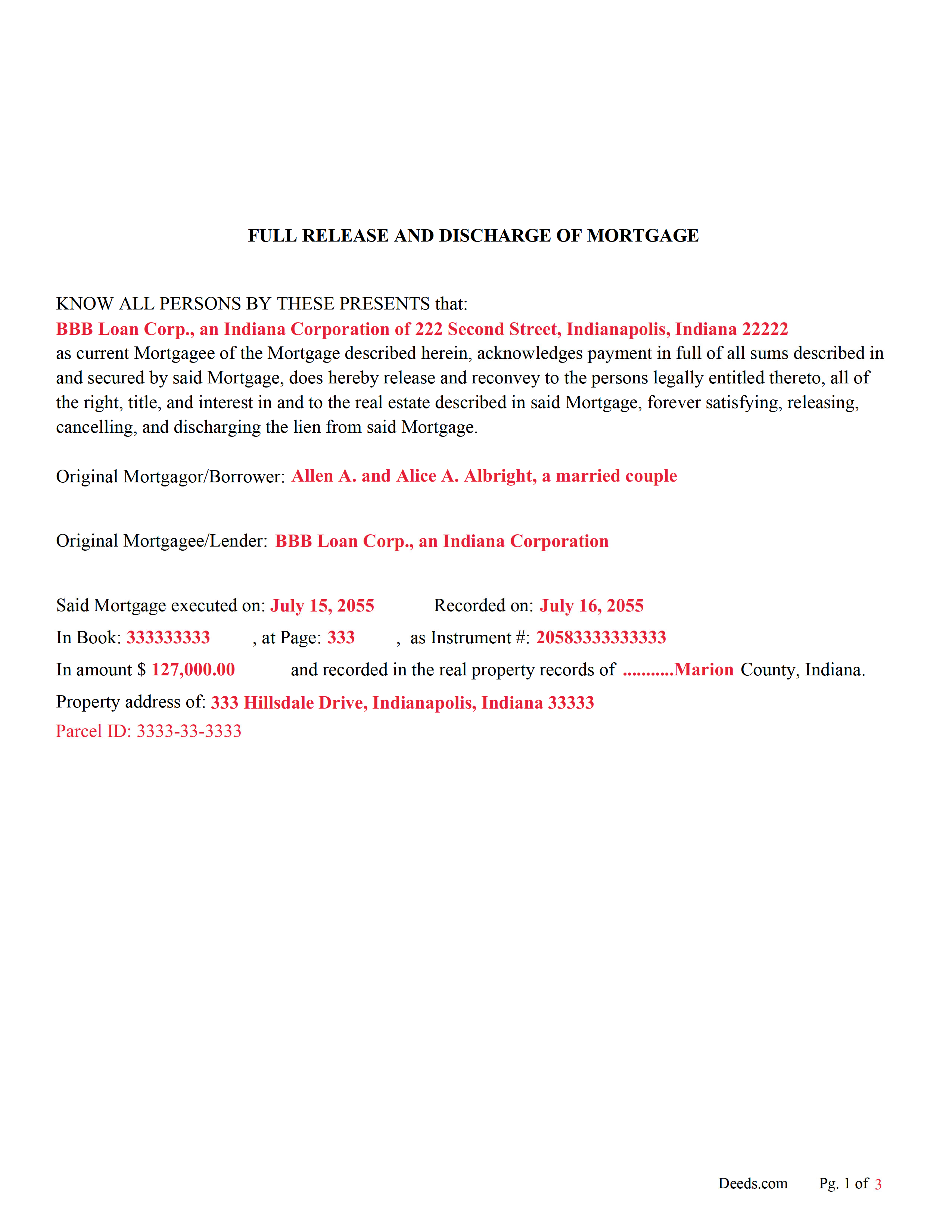

Completed Example of the Release of Mortgage Document

Example of a properly completed form for reference.

Included Marion County compliant document last validated/updated 10/30/2024

The following Indiana and Marion County supplemental forms are included as a courtesy with your order:

When using these Full Release of Mortgage forms, the subject real estate must be physically located in Marion County. The executed documents should then be recorded in the following office:

Marion County Recorder

City/County Bldg - 200 E Washington, Suite 741, Indianapolis, Indiana 46204

Hours: 8:00 to 4:30 Monday through Friday / Recording Cut-Off 4:15

Phone: (317) 327-4020

Local jurisdictions located in Marion County include:

- Beech Grove

- Indianapolis

- Speedway

- West Newton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Marion County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Marion County using our eRecording service.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can the Full Release of Mortgage forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marion County that you need to transfer you would only need to order our forms once for all of your properties in Marion County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Marion County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Marion County Full Release of Mortgage forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In general a lender has 15 days once notified to release a mortgage to avoid penalty.

((1) a sum not to exceed five hundred dollars ($500) for the failure, neglect, or refusal of the owner, holder, or custodian to:

(A) release;

(B) discharge; and

(C) satisfy of record the mortgage or lien; and

(2) costs and reasonable attorney's fees incurred in enforcing the release, discharge, or satisfaction of record of the mortgage or lien.

(c) If the court finds in favor of a plaintiff who files an action to recover damages under subsection (b), the court shall award the plaintiff the costs of the action and reasonable attorney's fees as a part of the judgment.

(d) The court may appoint a commissioner and direct the commissioner to release and satisfy the mortgage, mechanic's lien, judgment, or other lien. The costs incurred in connection with releasing and satisfying the mortgage, mechanic's lien, judgment, or other lien shall be taxed as a part of the costs of the action. (e) The owner, holder, or custodian, by virtue of having recorded the mortgage, mechanic's lien, judgment, or other lien in Indiana, submits to the jurisdiction of the courts of Indiana as to any action arising under this section.) (IC 32-28-1-2 (b)(1))

IC 32-29-1-6 Payment in full; release and discharge of mortgage

Sec. 6. After a mortgagee of property whose mortgage has been recorded has received full payment from the mortgagor of the sum specified in the mortgage, the mortgagee shall, at the request of the mortgagor, enter in the record of the mortgage that the mortgage has been satisfied. An entry in the record showing that a mortgage has been satisfied operates as a complete release and discharge of the mortgage.

((a) It is lawful for:

(1) the president, vice president, cashier, secretary, treasurer, attorney in fact, or other authorized representative of a national bank, state bank, trust company, or savings bank; or

(2) the president, vice president, general manager, secretary, treasurer, attorney in fact, or other authorized representative of any other corporation doing business in Indiana;

to release upon the record mortgages, judgments, and other record liens upon the payment of the debts secured by the liens.) (IC 32-29-5-1)

(Indiana Mortgage Release Package includes form, guidelines, and completed example) For use in Indiana only.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Full Release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald C.

May 25th, 2019

Pros, quick purchase and document availability including instructions and examples.

Cons, For the cert. of trust, the form would not accept the length of our trust name with no way to get around. The pdf file printing did not meet the requirements for 2.5" top margin and .5" other margins as well as the 10pt font size as the form information was shrunk down even when normal printing.

Thank you for your feedback. We really appreciate it. Have a great day!

Renee M.

September 15th, 2021

My sister in law is in a hospital ICU with Covid, so we were trying to get her affairs in order. Deeds.com made this difficult situation so much better by making this process very easy to understand and do.

Glad we could help Renee, hoping the very best for you and your family.

Sterling H.

September 17th, 2024

I liked being able to drill down to state and county. Just simply the search for all property records

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Melinda P.

January 4th, 2020

I received my documents immediately! Thats was a huge relief!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lindsay B.

February 16th, 2019

The form was easy to fill out. The only problem I had was on the Notary page I live in a different state than the property and I couldn't change the name of the state or county where the notary had to sign.

Thanks Lindsay, we appreciate your feedback.

Joseh R.

May 6th, 2020

Very pleased! Forms easy to understand and use. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon M.

February 23rd, 2021

I will be going through title, so didn't order deed, but I think your website is wonderful. It's great to offer online services, such a great time saving for me with my work. Thank you, Sharon M.

Thank you for taking the time to leave your feedback Sharon, we really appreciate it. Have a fantastic day!

Pamela J.

October 10th, 2021

Thank you the service was prompt and efficient.

Thank you!

Anthony C.

January 9th, 2021

Good information for solving my issue...

Thank you!

BRIAN M.

May 1st, 2020

Excellent Service, Fast and efficient. Thank You!

Thank you!

candy h.

June 18th, 2020

service was great!

Thank you!

Martin P.

April 6th, 2019

The DEEDs website is very easy to navigate and find the required documents. I have not yet had an opportunity to review the documents I purchased and downloaded. That is the reason I have assigned a rating of four stars. I fully hope that can raise my rating to five stars after I've used those documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!