Carroll County Affidavit of Surviving Spouse Form (Indiana)

All Carroll County specific forms and documents listed below are included in your immediate download package:

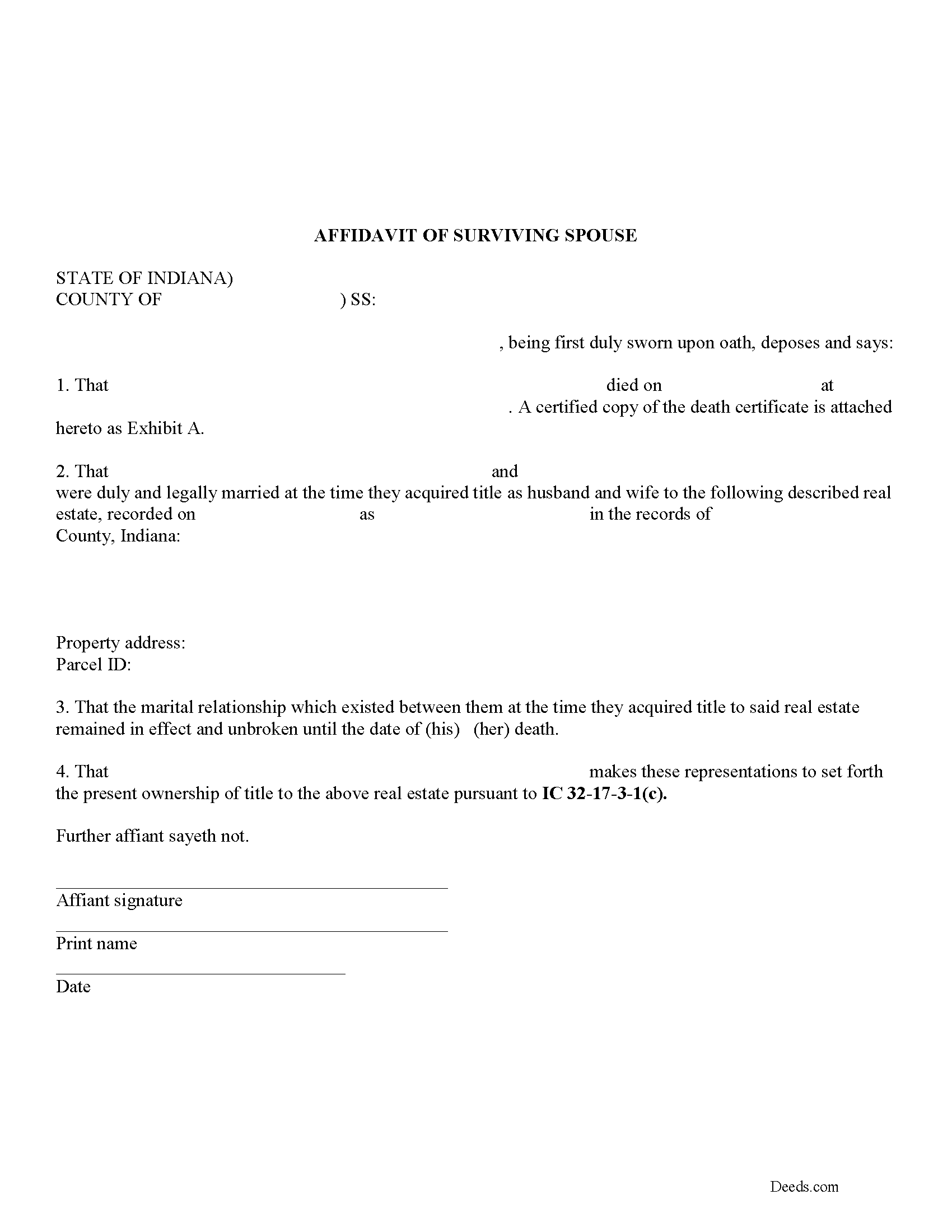

Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Carroll County compliant document last validated/updated 12/4/2024

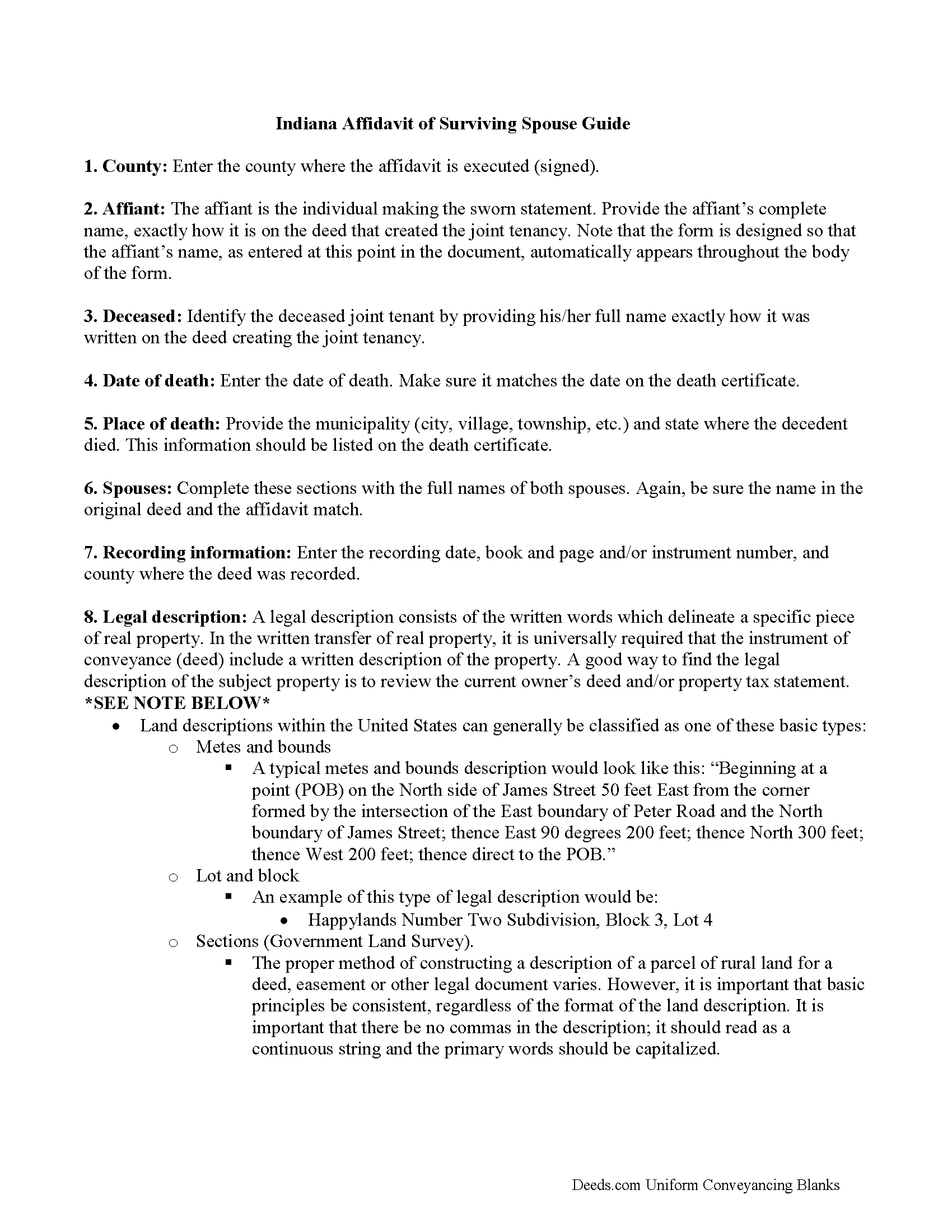

Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

Included Carroll County compliant document last validated/updated 10/8/2024

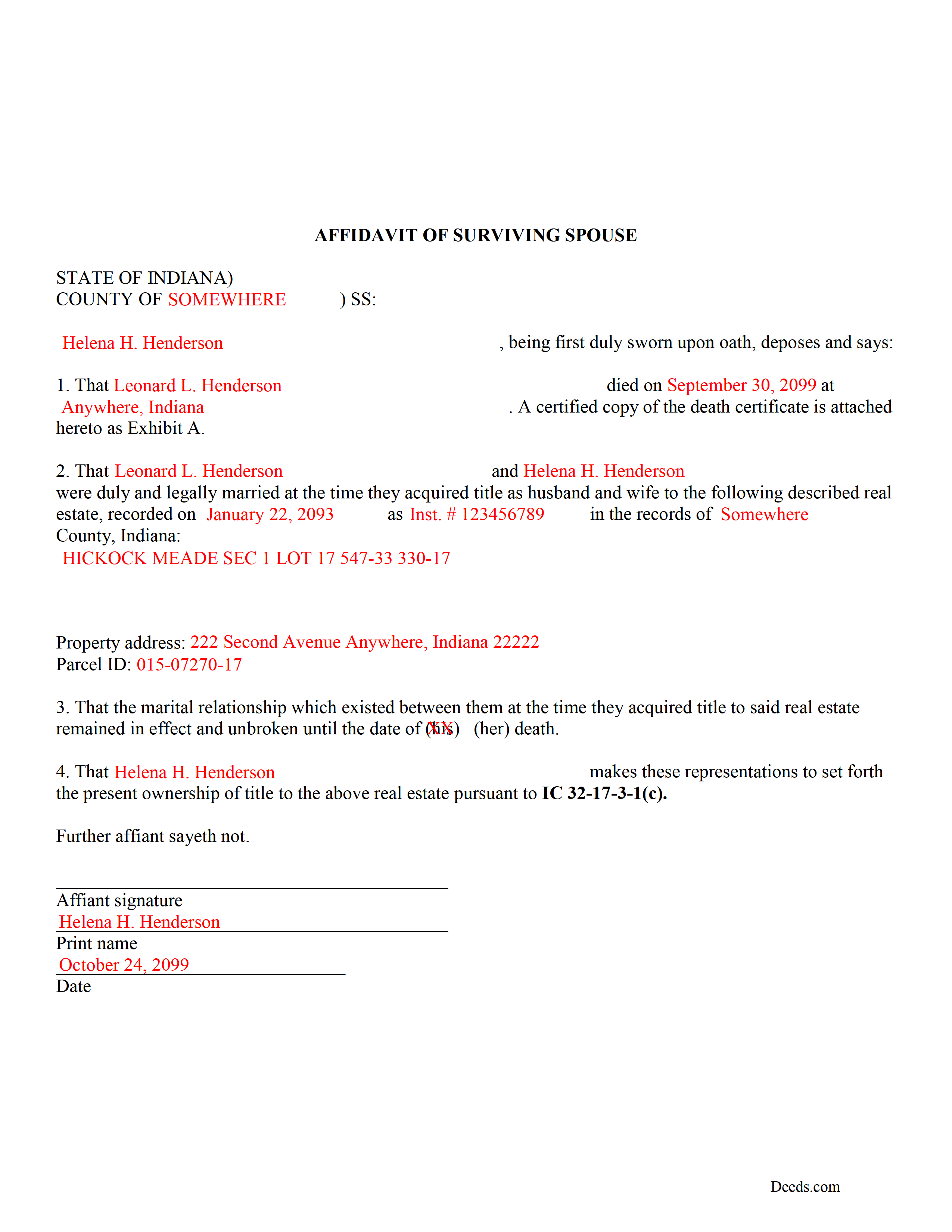

Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

Included Carroll County compliant document last validated/updated 10/10/2024

The following Indiana and Carroll County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Surviving Spouse forms, the subject real estate must be physically located in Carroll County. The executed documents should then be recorded in the following office:

Carroll County Recorder

Courthouse - 101 West Main St, 2nd floor, Delphi, Indiana 46923

Hours: Mon-Tue & Thu-Fri 8:00 to 5:00; Wed 8:00 to 12:00

Phone: (765) 564-2124

Local jurisdictions located in Carroll County include:

- Bringhurst

- Burlington

- Burrows

- Camden

- Cutler

- Delphi

- Flora

- Rockfield

- Yeoman

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Carroll County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Carroll County using our eRecording service.

Are these forms guaranteed to be recordable in Carroll County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carroll County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Surviving Spouse forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Carroll County that you need to transfer you would only need to order our forms once for all of your properties in Carroll County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Carroll County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Carroll County Affidavit of Surviving Spouse forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Married couples in Indiana may hold title to real estate as tenants by the entireties. This means that when one spouse dies, the other gains full ownership of the property by function of law, and without the need for probate. Use this instrument to formalize the acceptance of ownership rights conveyed when a spouse dies. Complete and sign the affidavit and submit it, along with a certified copy of the decedent's death certificate, to the recorder for the county where the real estate is located.

In order to gain full ownership, the husband or wife submits a completed affidavit of surviving spouse, along with an official copy of the death certificate of the deceased spouse, to the recorder for the county where the land is located.

This does not, however, remove the deceased's name from the deed. To accomplish that, the survivor must execute and record a new deed from the married couple to the remaining spouse only. After completing this final step, the public record and current deed will contain the most up-to-date information.

(Indiana Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Carroll County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carroll County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Kay I.

December 11th, 2019

Very easy to use. However, the "sample" filled in red ink did not print for me to refer to. Is that the correct desire, not to print?

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah K.

February 2nd, 2023

great job but, I wanted to upload a document. I got it wrong, but the info was good.

Thank you!

Doug C.

November 20th, 2020

Great Job guys! I would not even have thought to look for this service. The county recorder's office and kiosks are all closed because of covid. I was directed to you because of a referral on the county site. I wish I had known you had forms available as well. I searched for a day to find the appropriate form.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Frances B.

June 13th, 2019

Excellent product!!!! Accepted at my courthouse without a hitch.

I recommend this company whole heartedly!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martin T.

January 8th, 2021

The deed I needed was available to me easily. I was able to fill it out with the help of the example deed provided. I am very satisfied with the value received for the price paid.

Thank you!

JOE M.

August 31st, 2024

The form I needed were easy to find. And very affordable. Great service.

Thank you for your feedback. We really appreciate it. Have a great day!

Valerie I.

November 19th, 2020

Quick and easy! Had my document submitted to the county and back in one day. Good rates as well!

Thank you!

Cynthia S.

September 22nd, 2022

I am an attorney assisting my son with some simple legal docs & this service saved me a lot of time and is user friendly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

September 21st, 2021

The affidavit guidance was a great help and helped reduce the stress that usually comes with dealing with legalese. The Preliminary Change of Ownership that CA requires is quite complex since it covers a hoard of situations. I was left with a bit of uncertainty, but I definitely wouldn't want to try it without guidance.

Thank you for your feedback. We really appreciate it. Have a great day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.