Macon County Quitclaim Deed Form (Illinois)

All Macon County specific forms and documents listed below are included in your immediate download package:

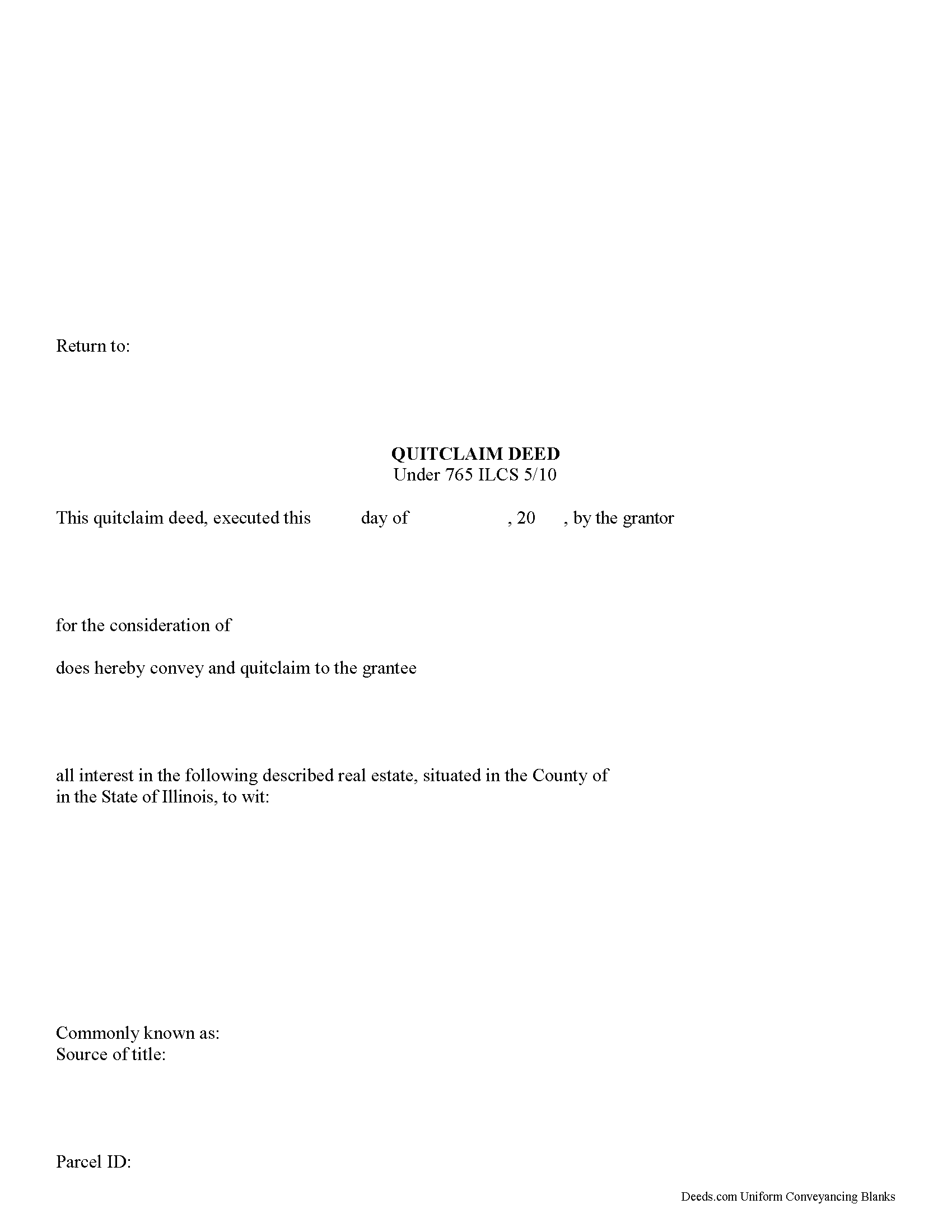

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Illinois recording and content requirements.

Included Macon County compliant document last validated/updated 6/27/2024

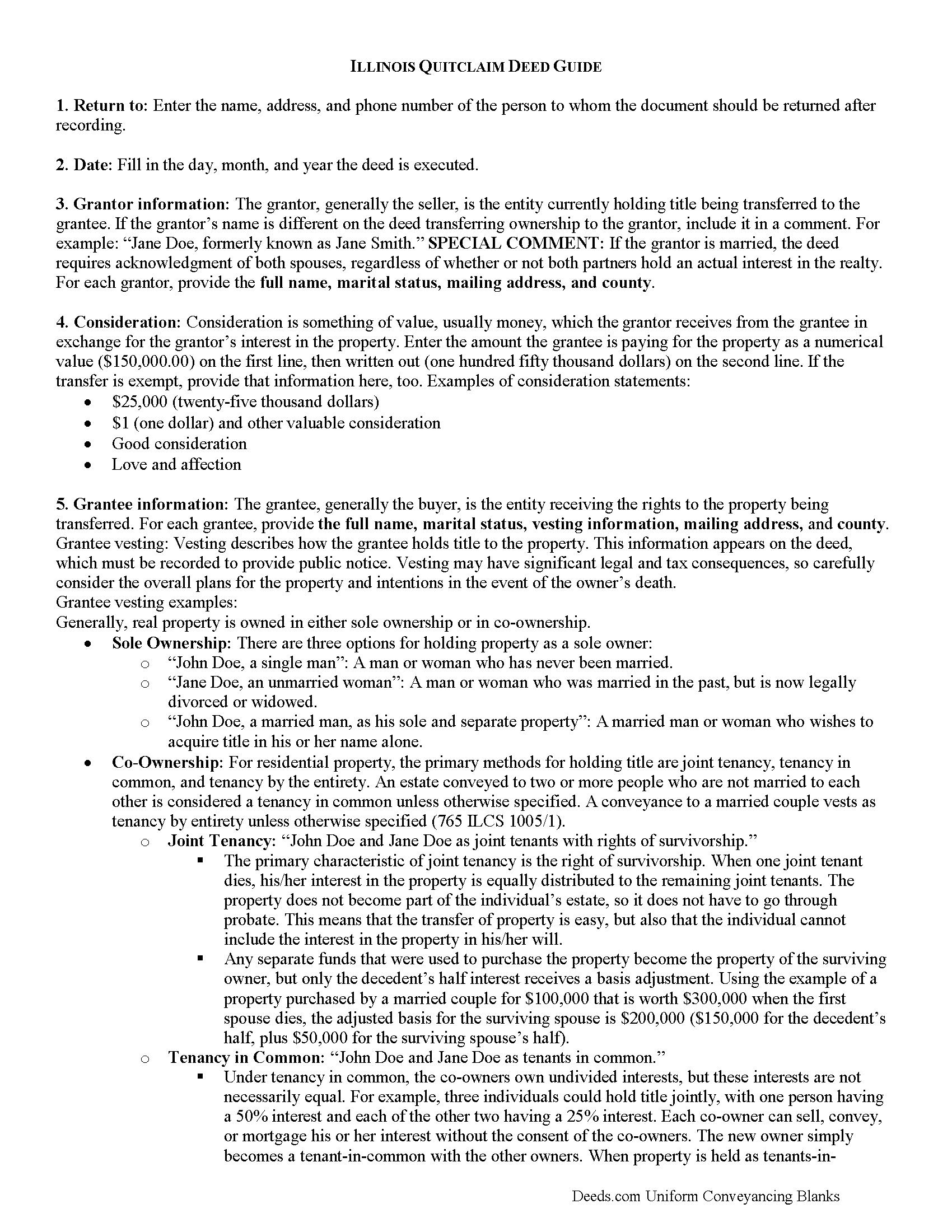

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Macon County compliant document last validated/updated 9/19/2024

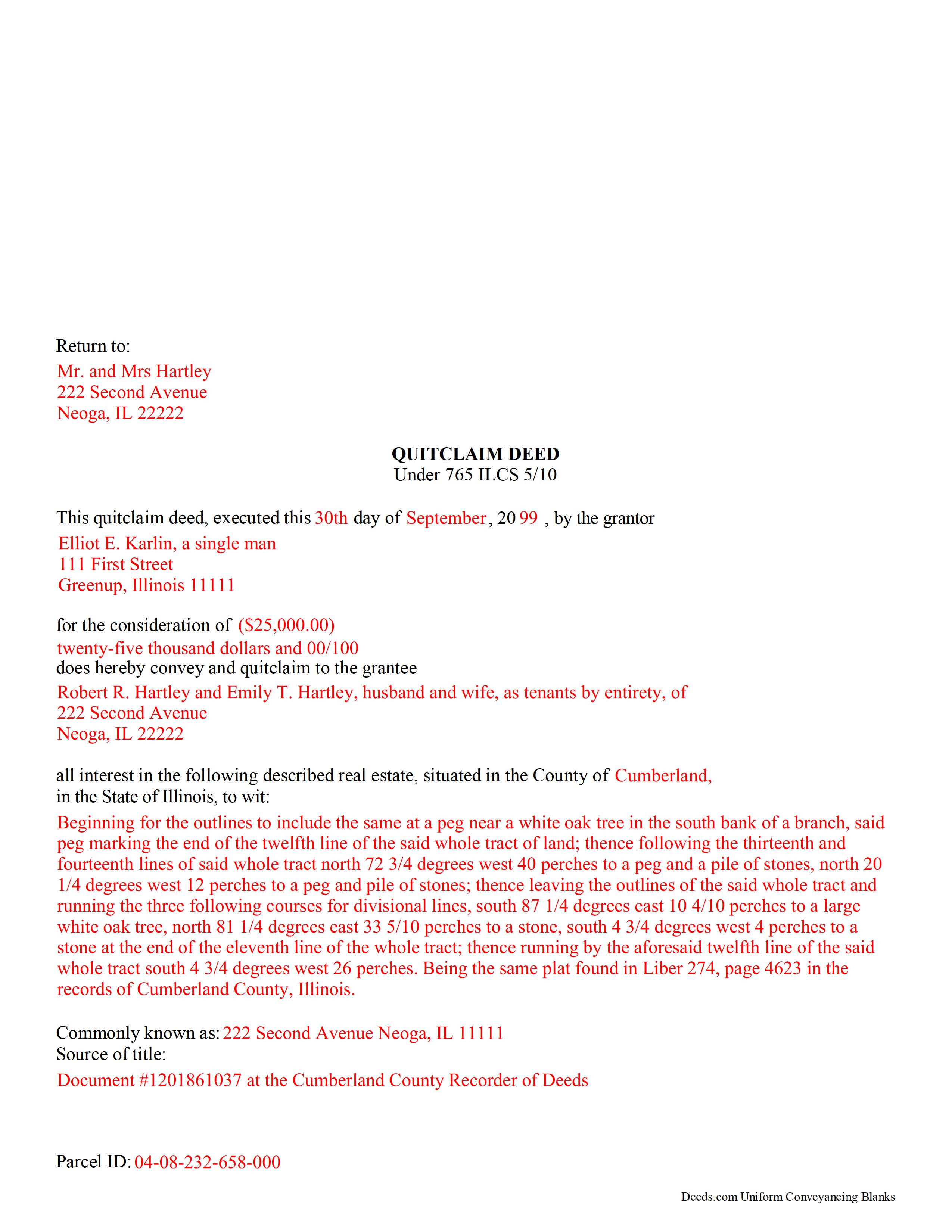

Completed Example of the Quitclaim Deed Document

Example of a properly completed Illinois Quitclaim Deed document for reference.

Included Macon County compliant document last validated/updated 11/7/2024

The following Illinois and Macon County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Macon County. The executed documents should then be recorded in the following office:

Macon County Recorder

141 S Main St, Rm 201, Decatur, Illinois 62523

Hours: 8:30 to 4:30 M-F

Phone: (217) 424-1359

Local jurisdictions located in Macon County include:

- Argenta

- Blue Mound

- Boody

- Decatur

- Elwin

- Forsyth

- Harristown

- Macon

- Maroa

- Mt Zion

- Niantic

- Oreana

- Warrensburg

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Macon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Macon County using our eRecording service.

Are these forms guaranteed to be recordable in Macon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Macon County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Macon County that you need to transfer you would only need to order our forms once for all of your properties in Macon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Macon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Macon County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Requirements for a Valid Quitclaim Deed in Illinois

To ensure your Illinois quitclaim deed is valid, it must include the following information:

Grantor's Information: Name and address of the person transferring the property (765 ILCS 5/10).

Grantee's Information: Name and address of the person receiving the property (55 ILCS 5/3-5020, 5026).

Consideration: Usually money, this is the amount paid for the property.

Legal Description: Complete description of the property, including the county where it's located (765 ILCS 5/10).

Execution Date: The date the deed is signed by the grantor.

Notarized Signature: The grantor's signature must be notarized (765 ILCS 5/10).

Return Address: Address for sending the deed after it's recorded (55 ILCS 5/3-5020.5).

Previous Deeds Information: Document and book/page numbers from prior deeds (55 ILCS 5/3-5020.5).

Prepared By Statement: Name and address of the person who prepared the deed (55 ILCS 5/3-5022).

Property Identifiers: Include the assessor's section or lot and block identifiers, and real estate index ID if available (55 ILCS 5/3-5027).

If the property is a homestead, both the grantor and their spouse must sign the deed, even if the spouse does not hold title to the property. If the property is not a homestead, include a statement indicating this (765 ILCS 5/27).

Recording the Quitclaim Deed

To record your quitclaim deed, follow these guidelines:

Signature Formatting: Type or print the signor's name below each signature (55 ILCS 5/3-5018).

Margins: Leave a 3" x 5" blank space in the top right corner of the first page for the recorder's use. All other margins should be 1/2" all around (765 ILCS 5/10).

Paper and Ink: Use permanent black ink on white paper (minimum 20 lb. weight) (765 ILCS 5/28).

Paper Size: Print the deed on individual 8" x 11" sheets of paper. Do not staple, clip, tape, or attach anything to the pages (765 ILCS 5/10).

Submission: Submit the deed to the recorder in the county where the property is located (765 ILCS 5/10).

Importance of Recording

Illinois follows a "notice" recording statute (765 ILCS 5/30-31). This means a deed is effective from the time it is filed for recording. If a grantor transfers the same property to two different grantees, the first grantee to record the deed will have legal ownership. To protect your ownership rights, record the deed as soon as possible after it is signed.

Conclusion

Following these requirements ensures your Illinois quitclaim deed is properly executed and recorded, protecting the interests of all parties involved in the transaction.

Our Promise

The documents you receive here will meet, or exceed, the Macon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Macon County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

March 21st, 2019

Excellent service! Questions were answered promptly, and the entire process was easy and fast. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Roy M.

November 4th, 2021

Excellent service. Easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darryl S.

April 16th, 2020

These guys saved the day! Very good at what they do and deliver AS ADVERTISED!! My county's recorder's office was closed to the public due to the COVID-19 pandemic, and the recorder's office did not offer the service I needed online. Attempting to close on a home the following day, I was in immediate need of a deed for property that I previously owned to provide to the underwriters for my pending loan. I thought I was dead in the water and would miss my next day closing date. Strolling the internet for options, I came upon DEEDS.COM. After reading the posted reviews, I thought I would give them a try. Within 10 minutes of placing my order, I received ALL the information I requested about the property I previously owned. Thank you DEEDS.COM for the prompt, courteous, and professional service. You guys are ROCK STARS!!! I closed on my new home.

Thank you so much for your kinds words Darryl, glad we were able to help.

Cathy S.

October 15th, 2022

Great forms! Repeat customer here, wouldn't go anywhere else.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ELOISA F.

May 27th, 2021

Once I had everything right;the recording was fast and easy. I was updated at every juncture and apprised of my mistakes in order to fix and record my deed. To improve service: I think that several different examples and scenarios would have helped. If you have different names from your children; birth certificates and marriage certificates are a requirement in Clark County, NV. If you want to add anyone to the deed in a Quit Claim Deed; you have to add yourself as a grantee even if you are the grantor along with the other grantees.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel V.

April 11th, 2023

Awesome service Recorded a deed within 24hrs and saved my self a 14hr+ journey

Thank you for your feedback. We really appreciate it. Have a great day!

Robert C.

November 20th, 2020

Great service! Easy to navigate and the instructions were perfectly understandable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jane E.

November 4th, 2020

The form was incompatible with my son's new computer. I do not have a printer. We did use your form to type a copy into "word" so he could print it.

Thank you!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

Rosemary S.

July 25th, 2020

It was quick and so very easy. Very detailed information. Love the app.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!