Kankakee County Mortgage Secured by Promissory Note Form (Illinois)

All Kankakee County specific forms and documents listed below are included in your immediate download package:

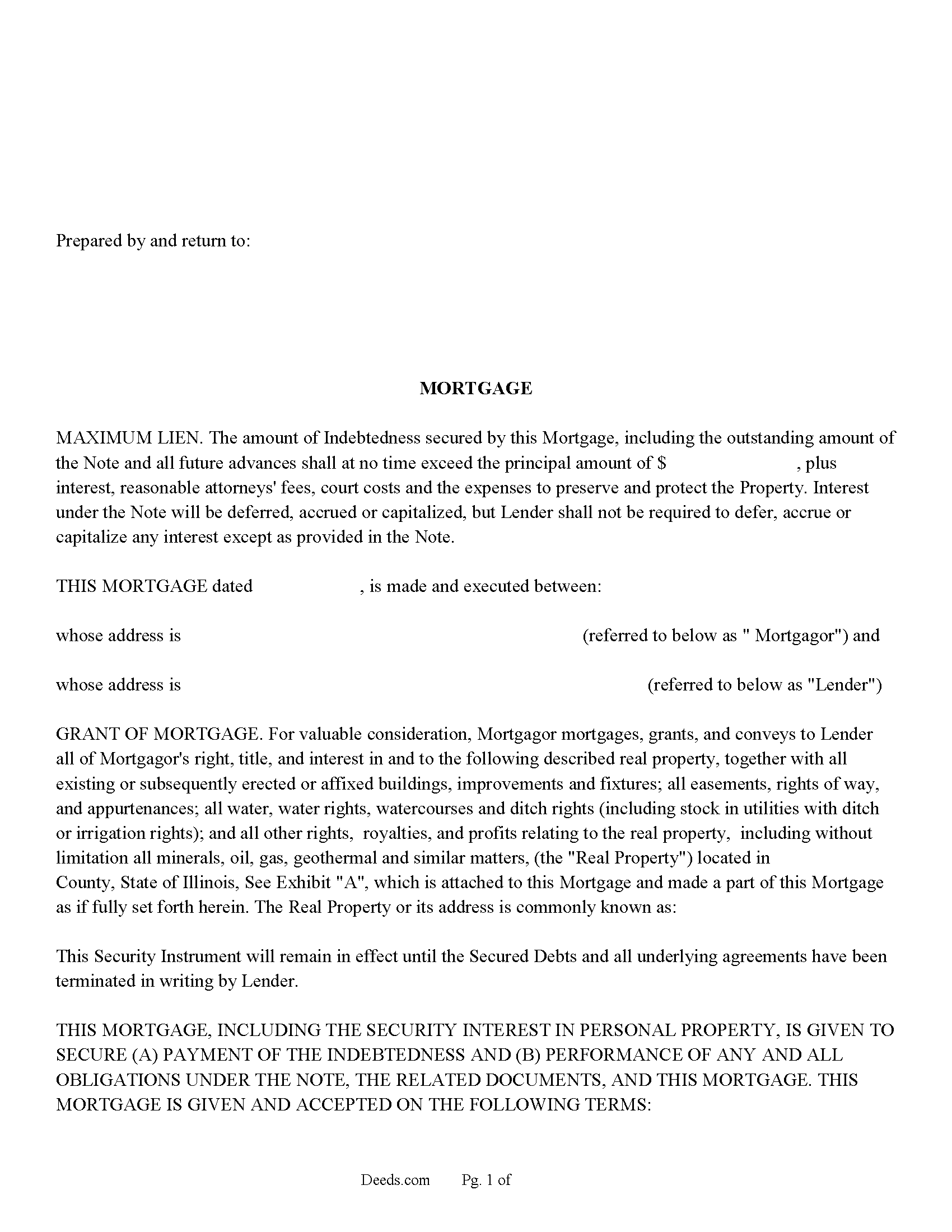

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Kankakee County compliant document last validated/updated 10/24/2024

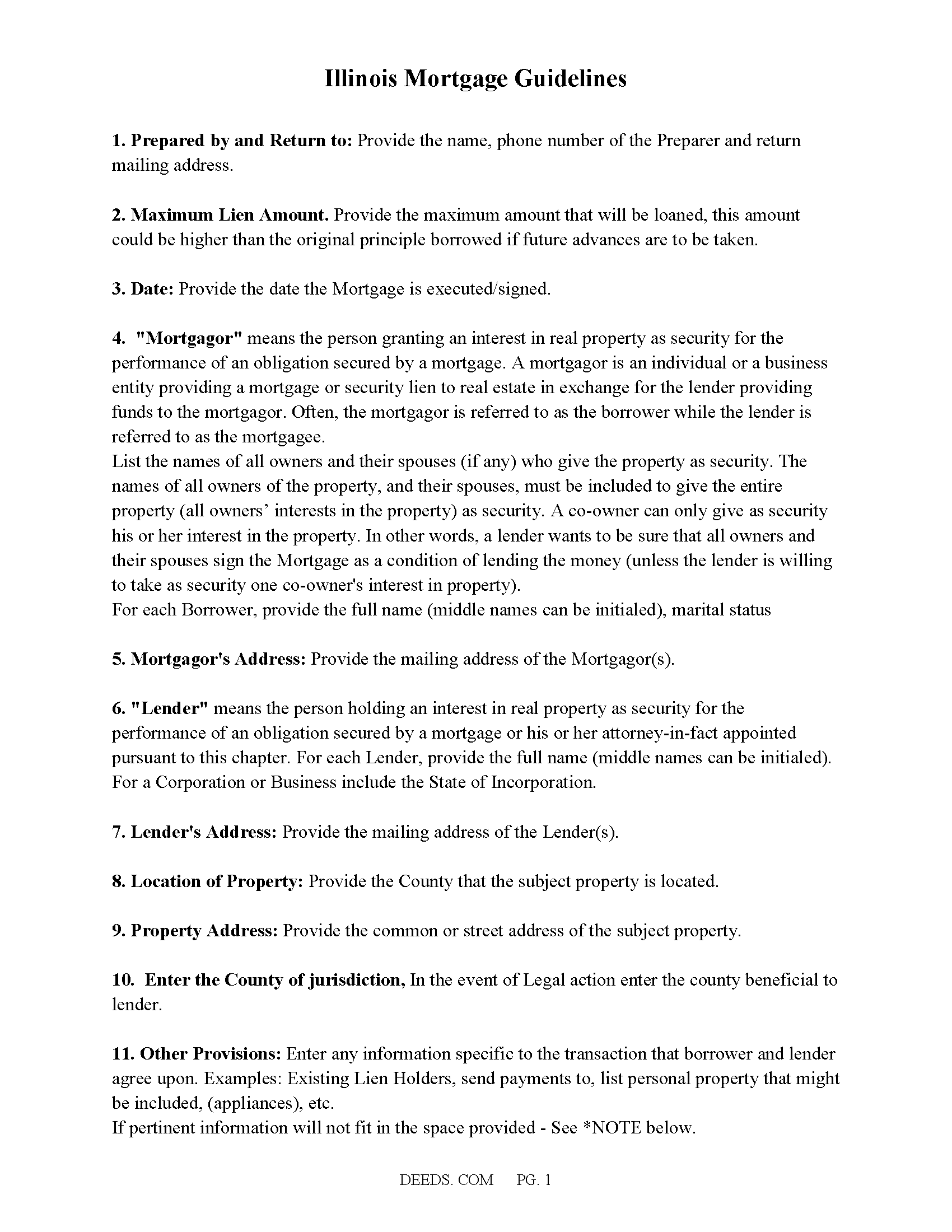

Mortgage Guide

Fill in the blank form formatted to comply with all recording and content requirements.

Included Kankakee County compliant document last validated/updated 11/5/2024

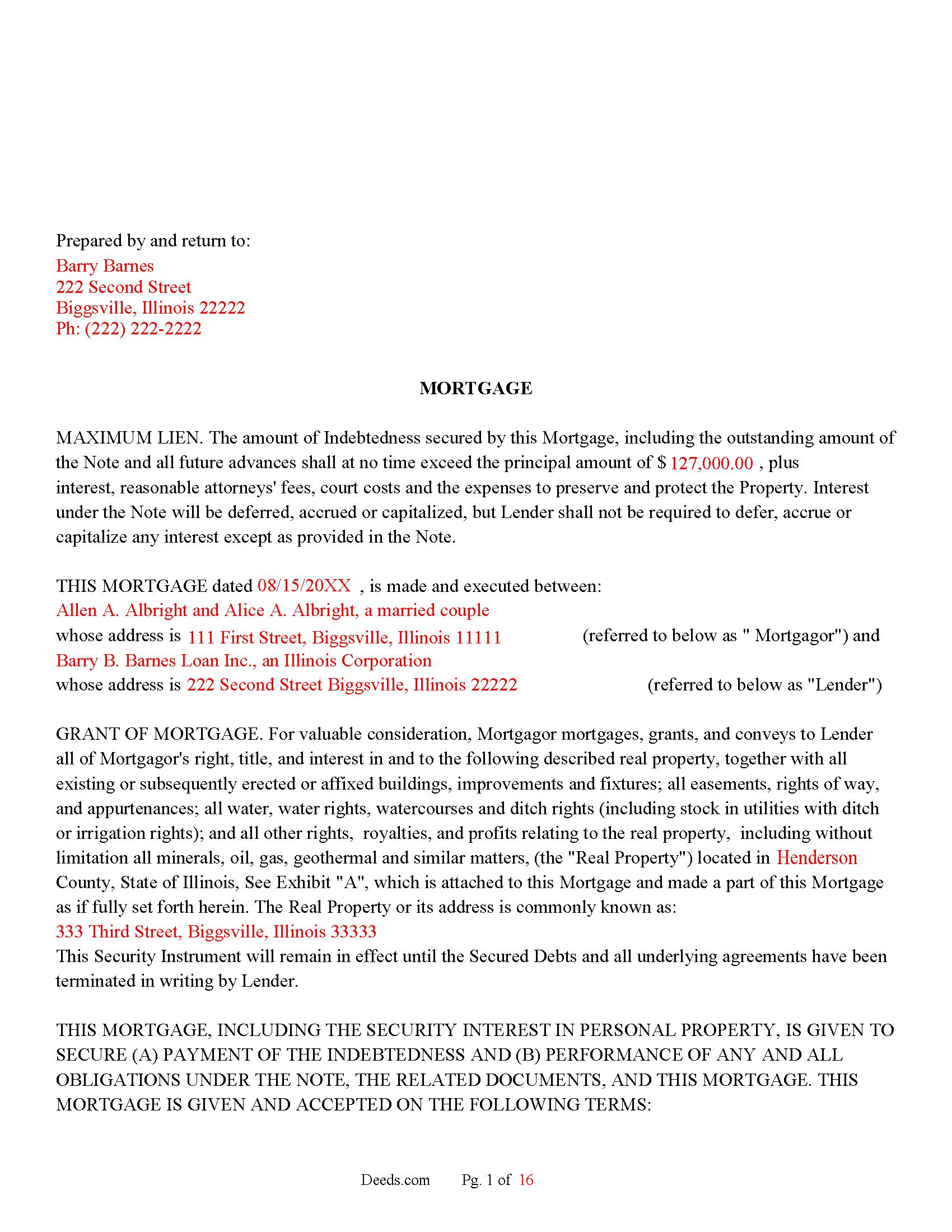

Completed Example of the Mortgage Document

Line by line guide explaining every blank on the form.

Included Kankakee County compliant document last validated/updated 12/9/2024

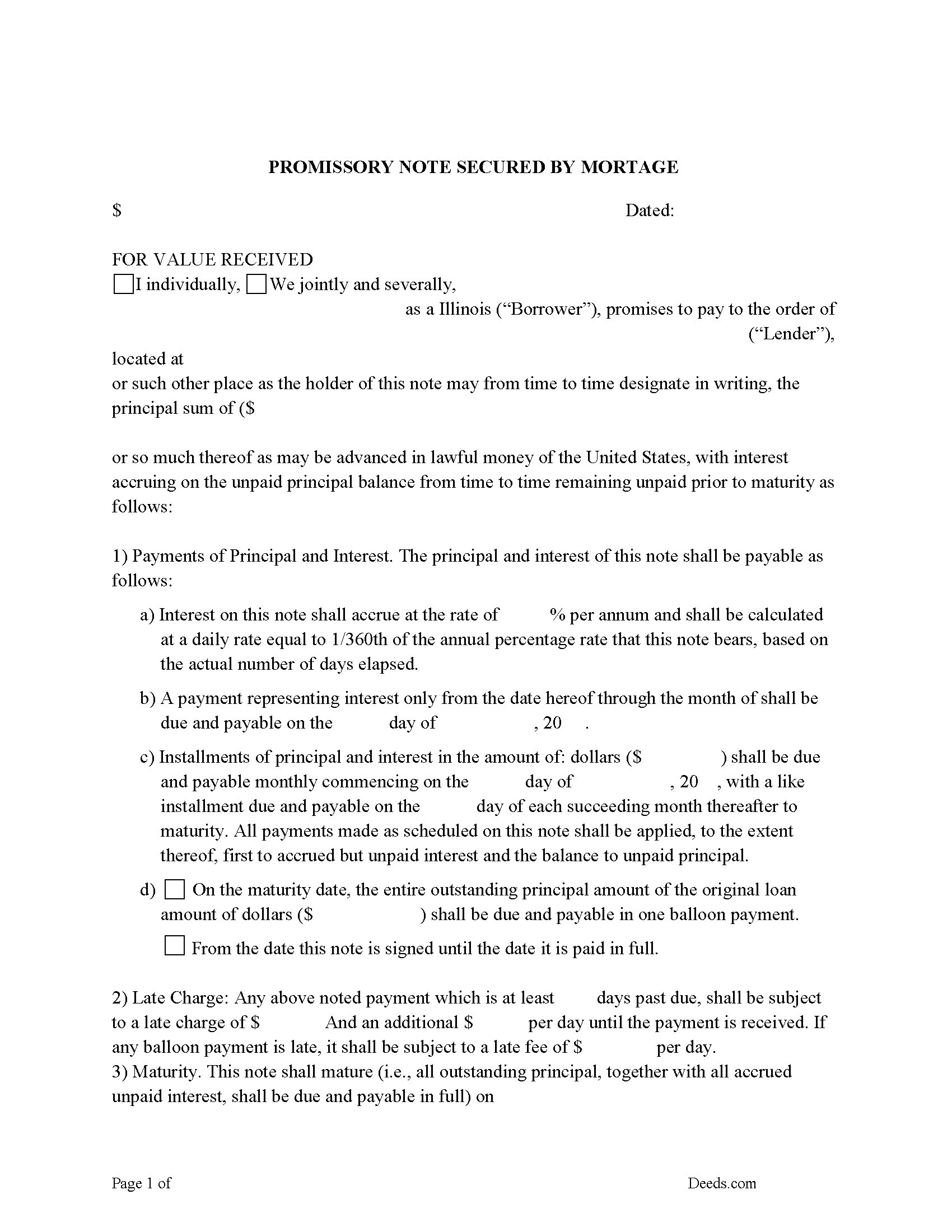

Promissory Note Form

Fill in the Blank Promissory Note secured by Mortgage

Included Kankakee County compliant document last validated/updated 12/3/2024

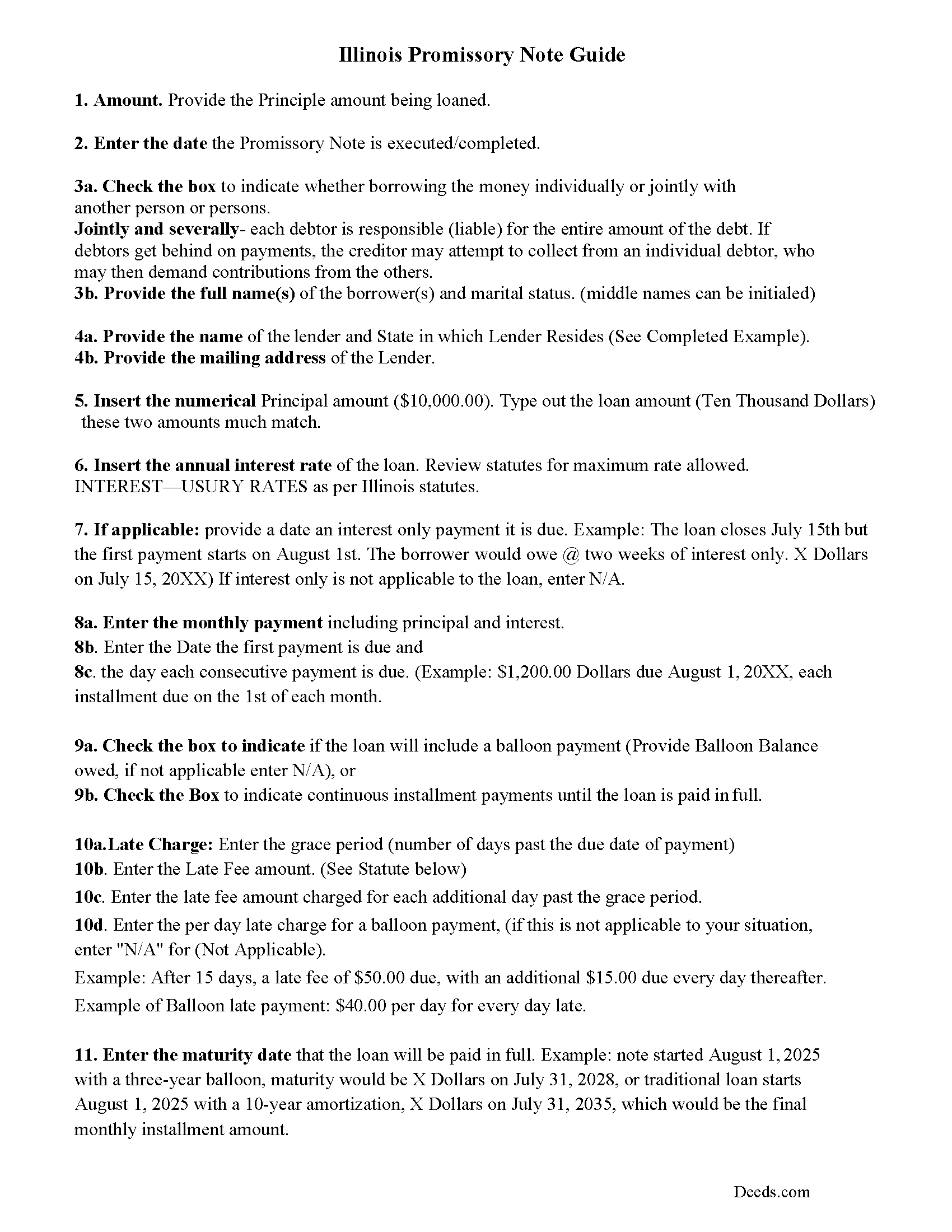

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Kankakee County compliant document last validated/updated 7/2/2024

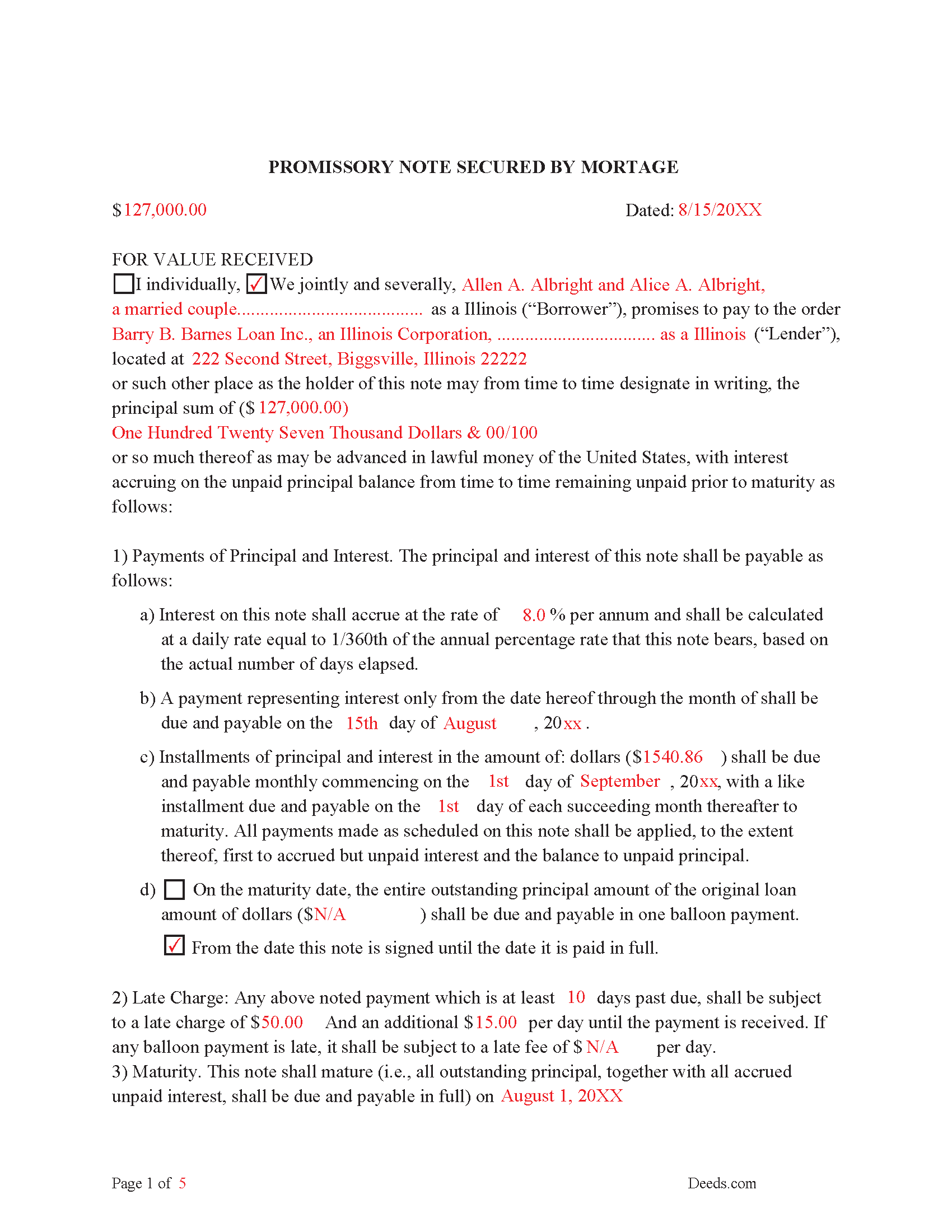

Completed Example of the Promissory Note Document

Line by line guide explaining every blank on the form.

Included Kankakee County compliant document last validated/updated 11/11/2024

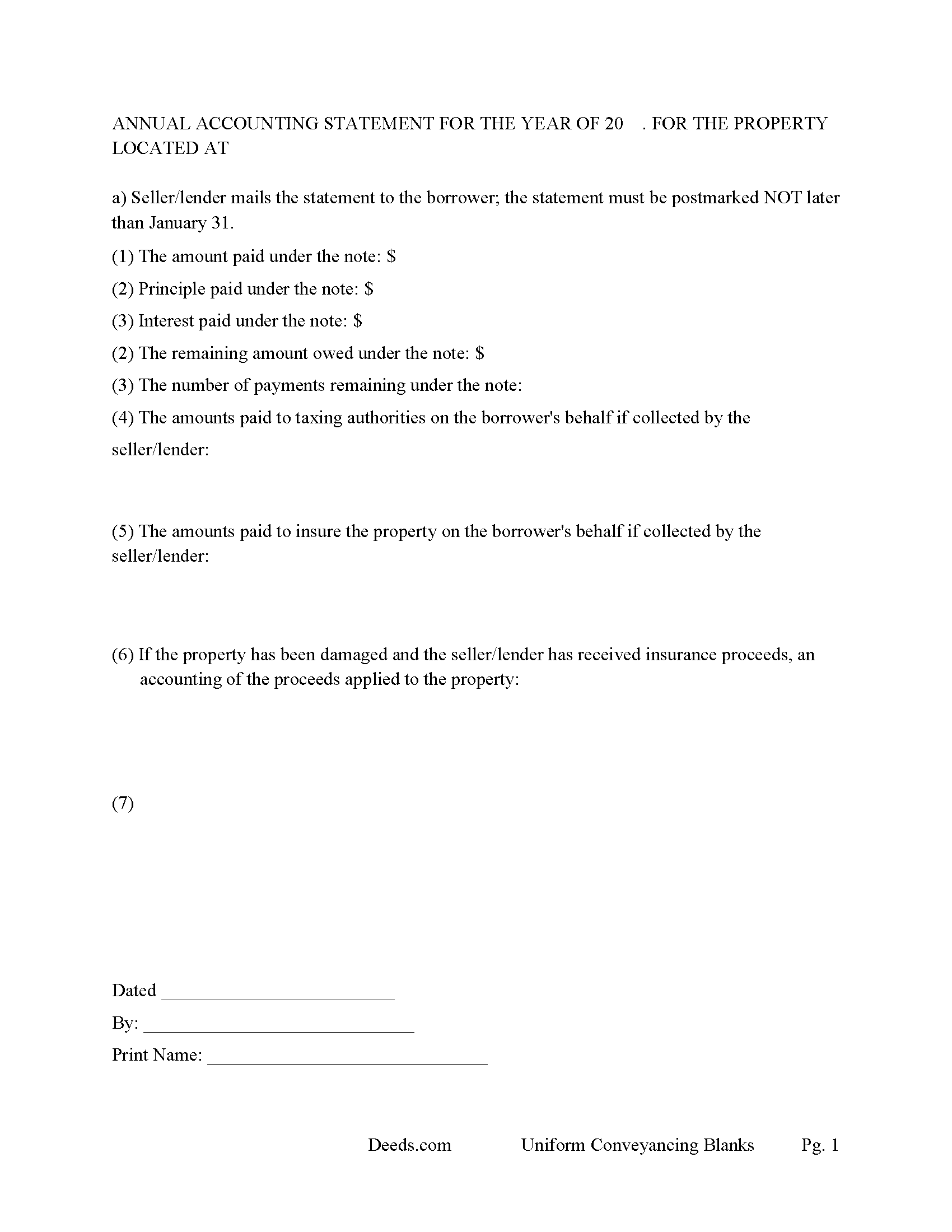

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Kankakee County compliant document last validated/updated 11/5/2024

The following Illinois and Kankakee County supplemental forms are included as a courtesy with your order:

When using these Mortgage Secured by Promissory Note forms, the subject real estate must be physically located in Kankakee County. The executed documents should then be recorded in the following office:

Kankakee County Recorder of Deeds

189 East Court St, Rm. 201, Kankakee, Illinois 60901

Hours: 8:30 to 12:30 & 1:30 to 4:30 M-F

Phone: (815) 937-2980

Local jurisdictions located in Kankakee County include:

- Aroma Park

- Bonfield

- Bourbonnais

- Bradley

- Buckingham

- Essex

- Grant Park

- Herscher

- Hopkins Park

- Kankakee

- Manteno

- Momence

- Reddick

- Saint Anne

- Union Hill

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Kankakee County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Kankakee County using our eRecording service.

Are these forms guaranteed to be recordable in Kankakee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kankakee County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Secured by Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kankakee County that you need to transfer you would only need to order our forms once for all of your properties in Kankakee County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Kankakee County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Kankakee County Mortgage Secured by Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This Mortgage has stringent default provisions that is typically suited for a private Lender with financing of residential property, small business property, Rental units (up to 4 units), Condominiums, planned unit development and vacant land.

EVENTS OF DEFAULT. Each of the following, at Lender's option, shall constitute an Event of Default under this Mortgage:

Payment Default. Mortgagor fails to make any payment when due under the Indebtedness.

Default on Other Payments.

Other Defaults.

Default in Favor of Third Parties.

False Statements.

Defective Collateralization.

Death or Insolvency.

Creditor or Forfeiture Proceedings.

Events Affecting Guarantor.

Adverse Change.

RIGHTS AND REMEDIES ON DEFAULT. Upon the occurrence of an Event of Default and at any time thereafter, Lender, at Lender's option, may exercise any one or more of the following rights and remedies, in addition to any other rights or remedies provided by law:

Accelerate Indebtedness.

UCC Remedies.

Appoint Receiver.

Judicial Foreclosure.

Nonjudicial Sale.

Deficiency Judgment.

Tenancy at Sufferance.

Other Remedies - Lender shall have all other rights and remedies provided in this Mortgage or the Note or available at law or in equity.

Sale of the Property.

Notice of Sale.

Election of Remedies

Attorneys' Fees; Expenses.

Promissory Note can be used for installment or balloon payments.

Includes default rates (interest rate that occurs when borrower is in default)

In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a)one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty(30)days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b)two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty(60)days after the Maturity Date.

Late Payment Fees. Any payment which is at least ___ days past due, shall be subject to a late charge of $___ And an additional $___ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $___ per day.

(Illinois Mortgage Package includes forms, guidelines, and completed examples) For Use in Illinois Only.

Our Promise

The documents you receive here will meet, or exceed, the Kankakee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kankakee County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4443 Reviews )

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Pietrina P.

December 18th, 2020

Recording with Deeds.com was a seamless experience. Communications were timely, clear and professional. When I had a question, I received a prompt email reply. Overall an excellent experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine A.

September 25th, 2022

Very good site, easy to get around, very thourough, easy to use. Definately will use again. I give you 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Robert L.

September 28th, 2020

It was easy for me to open an account and upload a document for recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Dee R.

November 14th, 2019

Quick, Simple order process with many options of forms to download!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JAY W.

June 17th, 2021

ok

Thank you!

Cynthia B.

July 21st, 2023

So simple to e-record my two documents. The communication was fast and very helpful. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

January 8th, 2021

Very straightforward website. Helpful in getting county specific documents.

Thank you!

Kevin P.

March 19th, 2023

Just what my parents and I have been looking for to do a Quit Deed to transfer property into my name.

Thank you!

Donnajean L.

October 9th, 2024

The site is user friendly and uncomplicated.

Thank you!

Linda D C.

August 26th, 2021

This was so easy to use. I appreciated the finished sample to guide me and the proper attachments necessary to process my Quit Claim Deed. I am gifting it to my nephew as I am too old to run farm and I live in a different state now. I tried other websites but their info was not up to date or accurate. Thank you so much. 71 Y/O Nana.

Thank you for your feedback. We really appreciate it. Have a great day!

Miles B.

June 15th, 2019

Fast, professional work at a great price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharom B.

October 1st, 2021

Easy to navigate site and download forms to PC!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!