Livingston County Mineral Deed with Quitclaim Covenants Form (Illinois)

All Livingston County specific forms and documents listed below are included in your immediate download package:

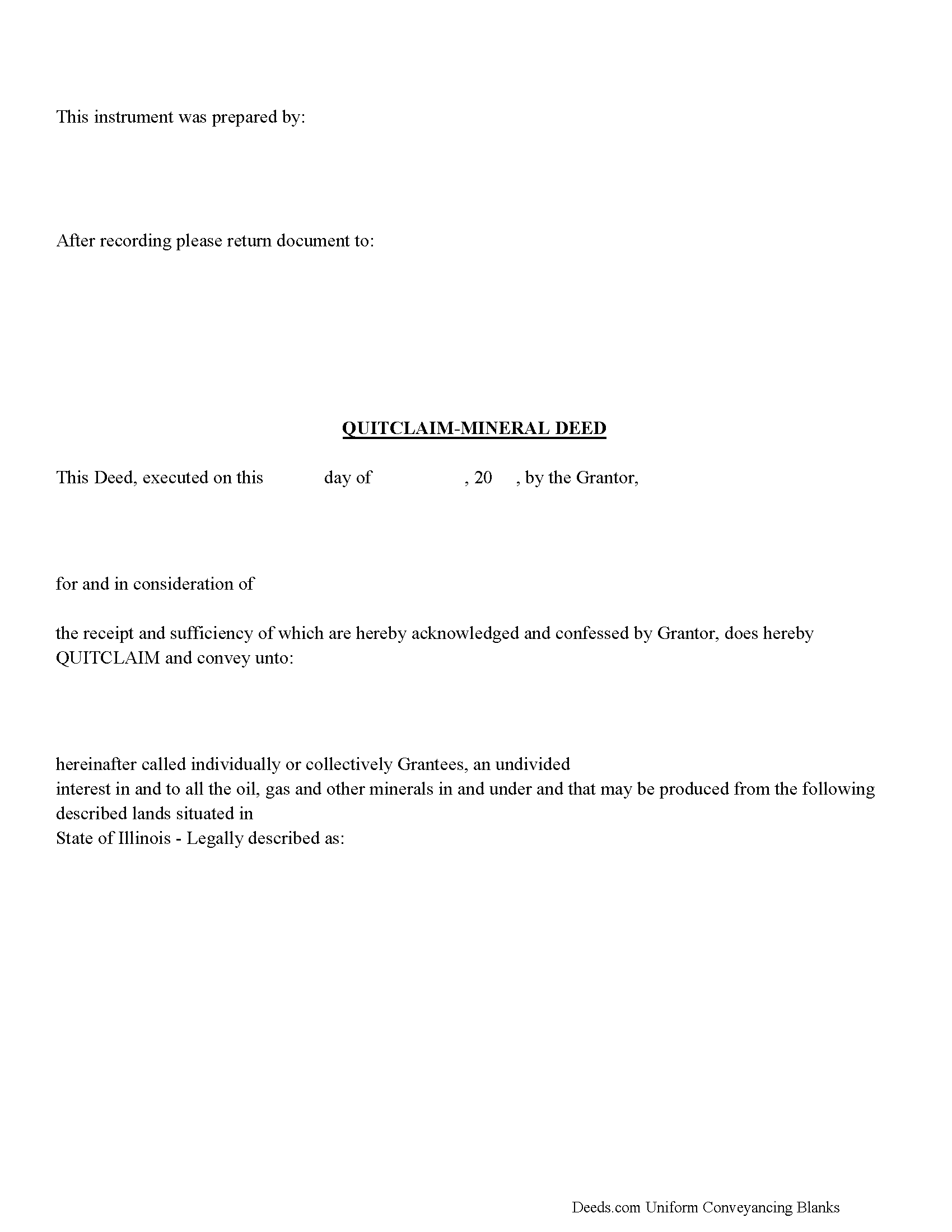

Mineral Deed with Quitclaim Covenants Form

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Illinois recording and content requirements.

Included Livingston County compliant document last validated/updated 9/27/2024

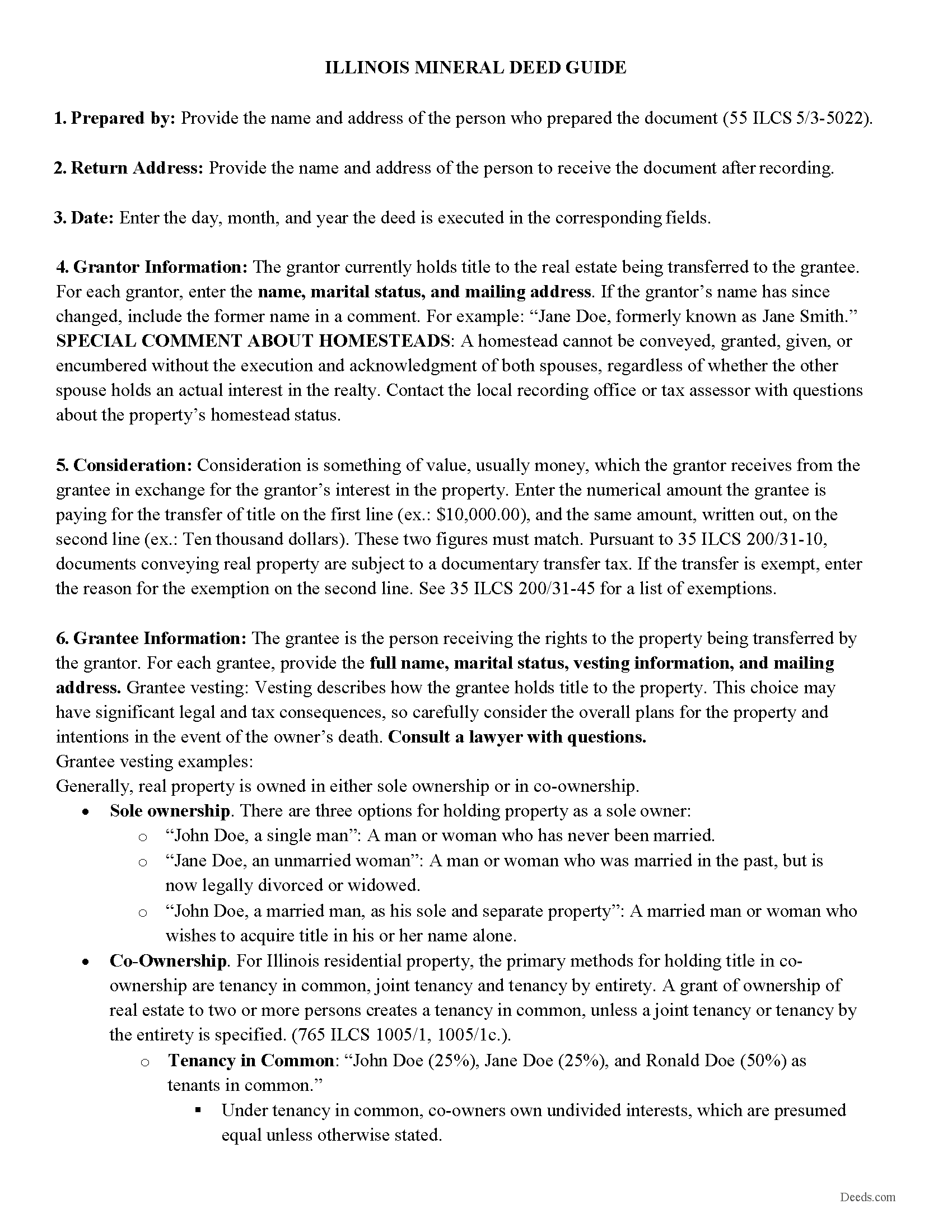

Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

Included Livingston County compliant document last validated/updated 12/4/2024

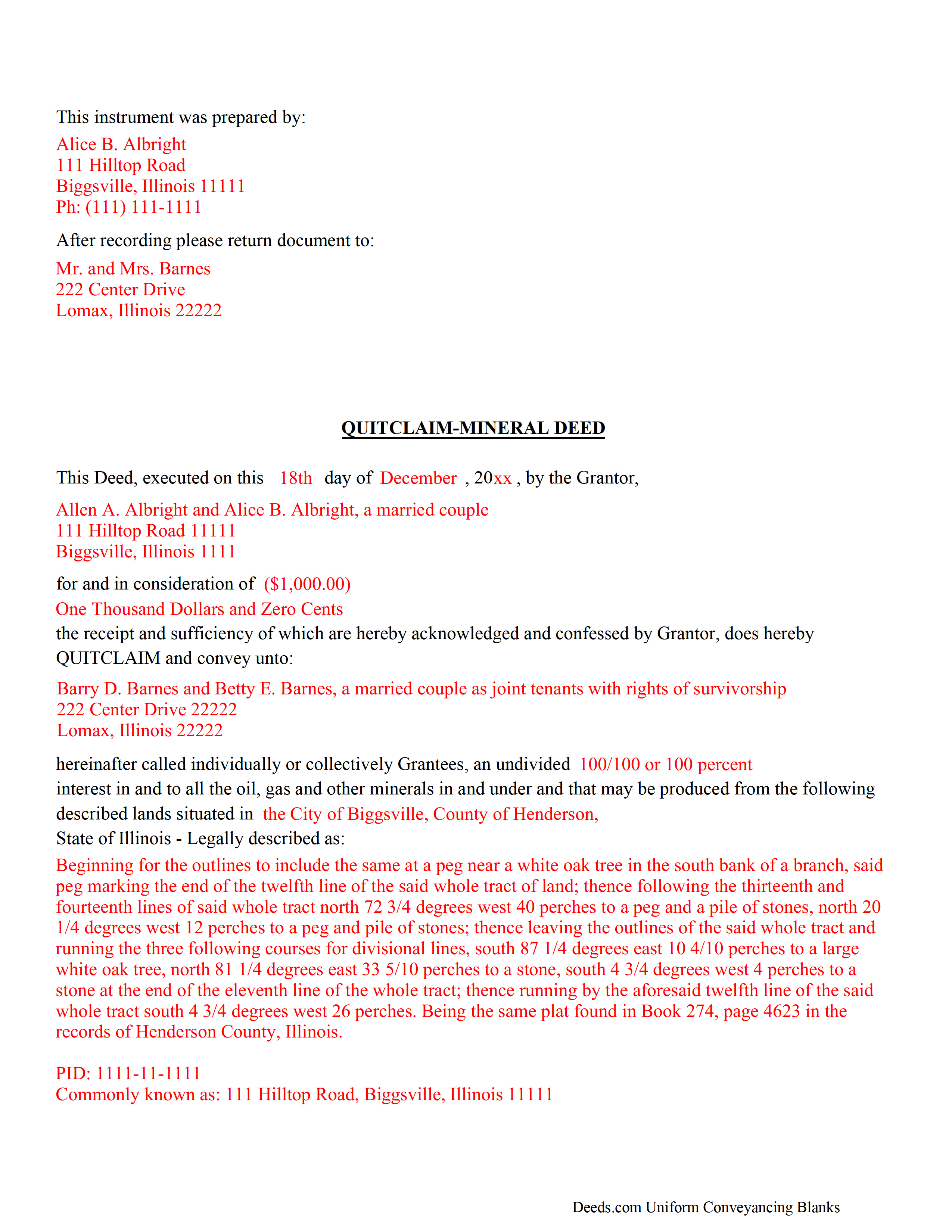

Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Illinois Mineral Deed with Quitclaim Covenants document for reference.

Included Livingston County compliant document last validated/updated 12/18/2024

The following Illinois and Livingston County supplemental forms are included as a courtesy with your order:

When using these Mineral Deed with Quitclaim Covenants forms, the subject real estate must be physically located in Livingston County. The executed documents should then be recorded in the following office:

Livingston County Clerk

112 W Madison St / PO Box 618, Pontiac, Illinois 61764-0618

Hours: 8:30 to 4:30 Monday through Friday

Phone: (815) 844-2006

Local jurisdictions located in Livingston County include:

- Ancona

- Blackstone

- Campus

- Chatsworth

- Cornell

- Cullom

- Dwight

- Emington

- Fairbury

- Flanagan

- Forrest

- Graymont

- Long Point

- Odell

- Pontiac

- Saunemin

- Strawn

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Livingston County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Livingston County using our eRecording service.

Are these forms guaranteed to be recordable in Livingston County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Livingston County including margin requirements, content requirements, font and font size requirements.

Can the Mineral Deed with Quitclaim Covenants forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Livingston County that you need to transfer you would only need to order our forms once for all of your properties in Livingston County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Livingston County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Livingston County Mineral Deed with Quitclaim Covenants forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The General Mineral Deed in Illinois Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Illinois Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Livingston County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Livingston County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Westcliffe C.

November 3rd, 2022

Like the setup

Good idea on forms that help at a great price

Thank you for your feedback. We really appreciate it. Have a great day!

Anna C.

February 9th, 2021

It was more detailed than the forms on other website, plus cheaper. I do not have date it was recorded in 2000 but did have date of warranty deed. Will that be ok with Recorder? Also did not want to date it today till I know when and where the Recorders office is located.

Thank you for your feedback. We really appreciate it. Have a great day!

Reida S.

September 29th, 2020

Have used two times. Smooth transaction both times. Fast, simple and easy to use system. Would use them again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne W.

April 8th, 2021

3 stars for ease of use on the website. Subracted 2 stars for the forms being PDFs that you are unable to complete online, they have to be printed. Very inefficient.

Thank you for your feedback. We really appreciate it. Have a great day!

Phyllis M.

August 3rd, 2019

Using your site was very easy. I found what my friend said she wanted easily and downloaded it to retype her quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard W.

March 25th, 2019

Very nice web site with available forms. Being out of state we appreciated instruction sheet details.

Rick and Jean Weber, Chicago

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia H.

February 20th, 2023

The entire process was simple and easy, from purchasing, downloading and saving the documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorothea B.

October 2nd, 2019

The Affidavit- Death of Joint Tenant form you provided is not the same form as showed on the Los Angeles County property tax website.

It appears that the LA county form requires entering additional info that is not included in your form.

Thank you!

Veda J.

September 11th, 2020

Good Work!

Thank you!

brenda S.

March 1st, 2019

Excellent instructions very easy to follow!

Thank you!

donald h.

August 1st, 2022

good, however, I haven't figured out how to save my filled out form

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie K.

December 27th, 2019

Great service! Super easy to use! I used the service to download a deed notice to do a TOD on a property in Fairfax County, VA. Just a heads up that Fairfax County required me to add the last deed book and page # onto the deed notice but otherwise all was just as they required!

Thank you!