Washington County Mechanics Lien Preliminary 90 Day Notice Form (Illinois)

All Washington County specific forms and documents listed below are included in your immediate download package:

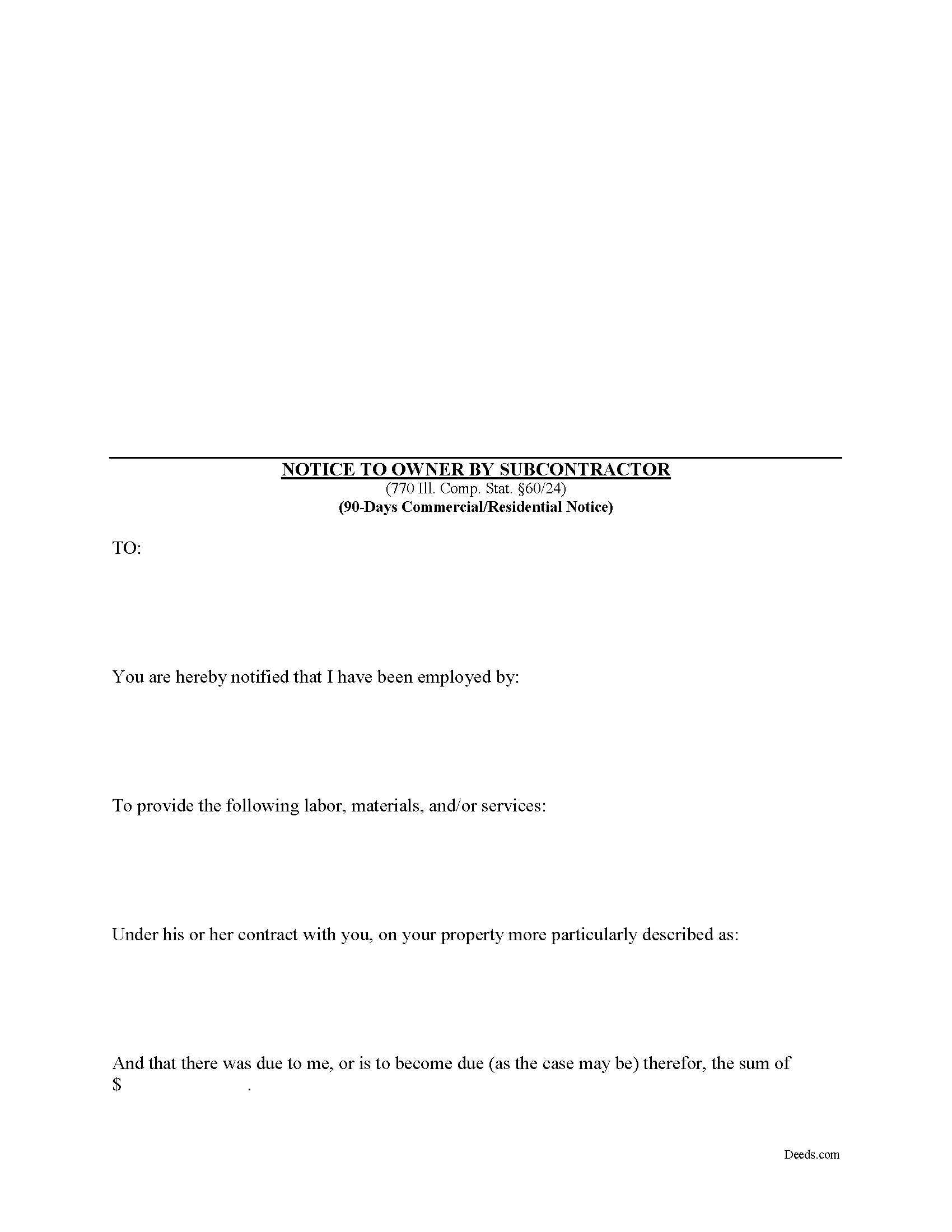

Mechanics Lien Preliminary 90 Day Notice Form

Fill in the blank Mechanics Lien Preliminary 90 Day Notice form formatted to comply with all Illinois recording and content requirements.

Included Washington County compliant document last validated/updated 12/2/2024

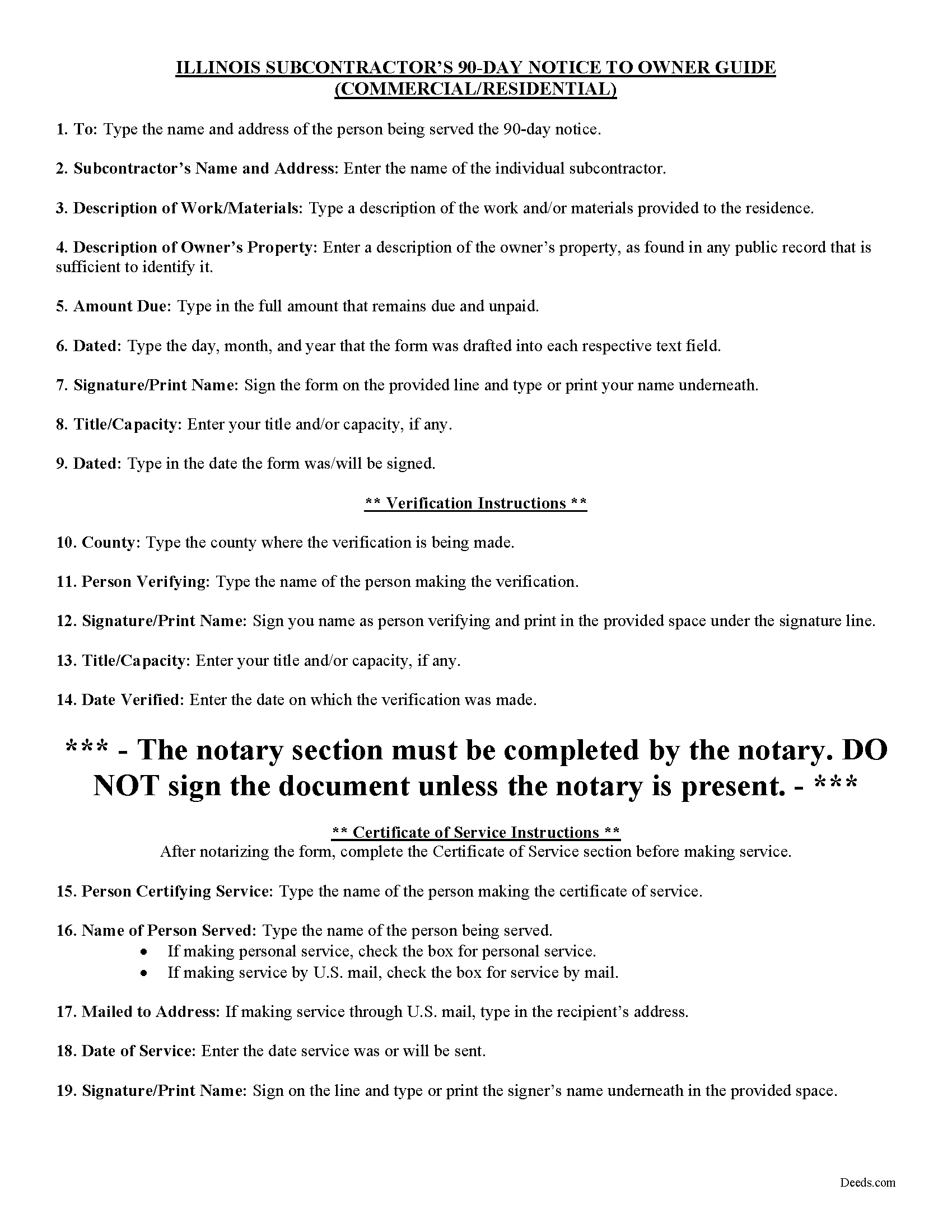

Preliminary 90 Day Notice Guide

Line by line guide explaining every blank on the form.

Included Washington County compliant document last validated/updated 11/25/2024

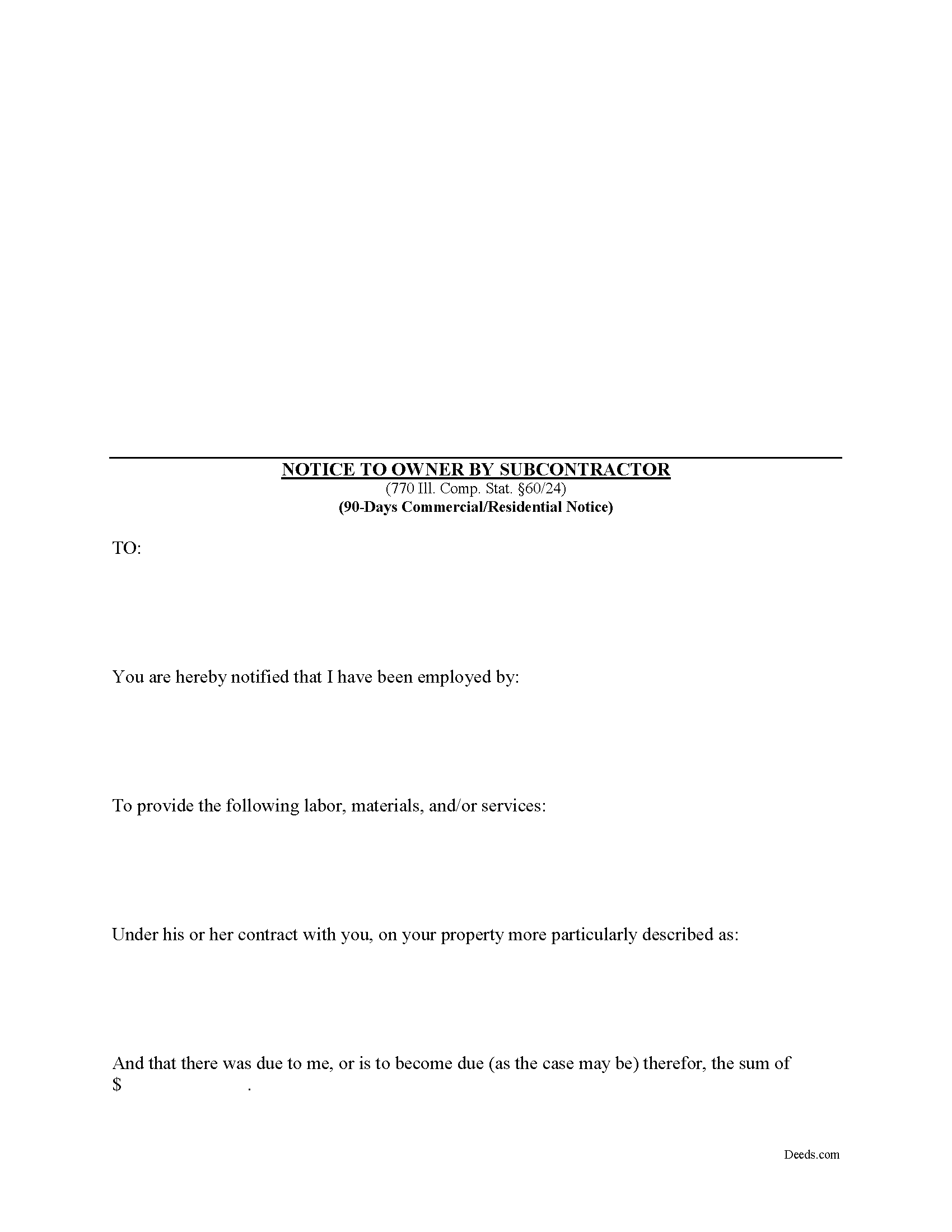

Completed Example of the Preliminary 90 Day Notice Document

Example of a properly completed form for reference.

Included Washington County compliant document last validated/updated 12/12/2024

The following Illinois and Washington County supplemental forms are included as a courtesy with your order:

When using these Mechanics Lien Preliminary 90 Day Notice forms, the subject real estate must be physically located in Washington County. The executed documents should then be recorded in the following office:

Washington County Clerk/Recorder

101 East St. Louis St, Nashville, Illinois 62263

Hours: 8:00 to 4:00 M-F

Phone: (618) 327-4800 Ext 300

Local jurisdictions located in Washington County include:

- Addieville

- Ashley

- Du Bois

- Hoyleton

- Irvington

- Nashville

- Oakdale

- Okawville

- Radom

- Richview

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Washington County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Washington County using our eRecording service.

Are these forms guaranteed to be recordable in Washington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washington County including margin requirements, content requirements, font and font size requirements.

Can the Mechanics Lien Preliminary 90 Day Notice forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Washington County that you need to transfer you would only need to order our forms once for all of your properties in Washington County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Washington County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Washington County Mechanics Lien Preliminary 90 Day Notice forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This statutory form is meant for use by subcontractors or others who are not directly contracted for work with the property owner.

For residential, owner-occupied projects, the 90-day notice form is the second preliminary notice sent in anticipation of filing a lien (the 60-day notice must be served beforehand sent via certified mail within 60 days from the first furnishing). For a commercial project, the 90-day form is the first notice sent to the owner. Either way, both commercial and residential jobs require the 90-day notice prior to filing a lien. 770 Ill. Comp. Stat. 60/24(a).

The 90-day notice is a demand for payment that must be sent by all contractors, subcontractors, laborers, and material/equipment suppliers who have not directly contracted with the owner or the owner's agent. Note that all eligible workers must send the notice within 90 days after the final furnishing of work or delivery of materials to the jobsite. Id. Any substantial additional or extra work can enlarge the time, but mere corrections of previously completed work will not affect the end date. Be aware the time is 90 days, not three months, so count 90 days from the date labor or materials were last furnished.

Serve the notice either through personal service by using a process server, or use the easier and less expensive option of certified mail. The notice does not have to be recorded but keep track of all dates and confirmations of receipt of service to help create a paper trail if a lien becomes necessary. If the deadlines are near, consider a process server. If mailing, serve the notice by certified mail, return receipt requested on the owner, the mortgage lenders, and the general contractor.

The 90-day notice must be verified which means the contractor's signature represents the contents of the notice are accurate and true. The notice must also be notarized by signing it in front of a licensed Notary Public who affixes his or her seal to the document.

This article is provided for informational purposes only and does not constitute legal advice. If you have any questions about mechanic's liens, including the preliminary notices, please consult an attorney.

Our Promise

The documents you receive here will meet, or exceed, the Washington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washington County Mechanics Lien Preliminary 90 Day Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4443 Reviews )

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!

Maura M.

January 15th, 2020

Easy user friendly website

Thank you!

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Paula M.

October 15th, 2021

So far it seems good. I am still trying to send information to this company so they can help me with the deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Adriana V.

July 2nd, 2020

Excellent and a very fast way to release important documents. Thank you very much.

Thank you!

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Linda K.

July 5th, 2019

This service was easy, quick, and to the point.

It was a lifesaver! Downloaded quickly and without issues. I was able to fill out a soecifice form for my state and county, which saved me from making errors from a universal form.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary K.

July 26th, 2019

Easy to use site. Good job, it works with no stress.

Thank you!

Johanna R.

April 21st, 2022

As soon as payment was received the forms were downloaded, printed and were useable. The guide was helpful and I was able to get my forms filled out and filed with no problem here in Linn County Oregon. I would recommend the site to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Louise M.

August 31st, 2023

Amazing fast service. From the U.K. I was unable to get a check in U.S. dollars. This solved my problem as I was able to make payment with a card. So much faster than sending the documents from the U.K. via the postal service. rnEasy to use site, very quickly processed. rnHighly recommend

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa M.

October 28th, 2021

This is super convenient however, I wish I knew which forms I needed for my Affidavit Death of Joint Tenant situation. That would help.

Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy C.

January 19th, 2022

Excellent service. Pay your fee, download the form and fill out according to specific instructions. Then, again according to instructions, take it to the county clerk's office and have it recorded. It could not be easier.

Thank you!