Peoria County Executor Deed Form (Illinois)

All Peoria County specific forms and documents listed below are included in your immediate download package:

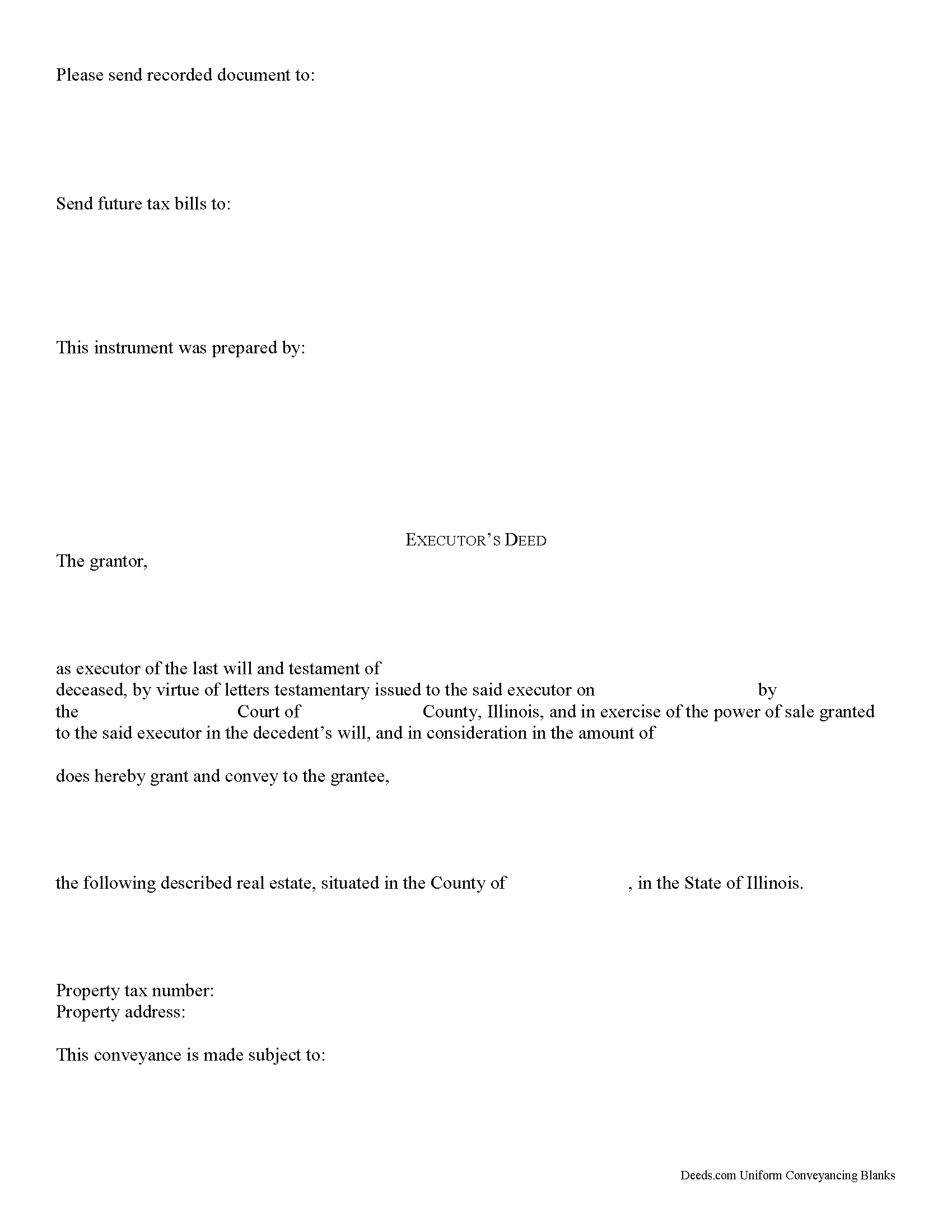

Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Peoria County compliant document last validated/updated 6/14/2024

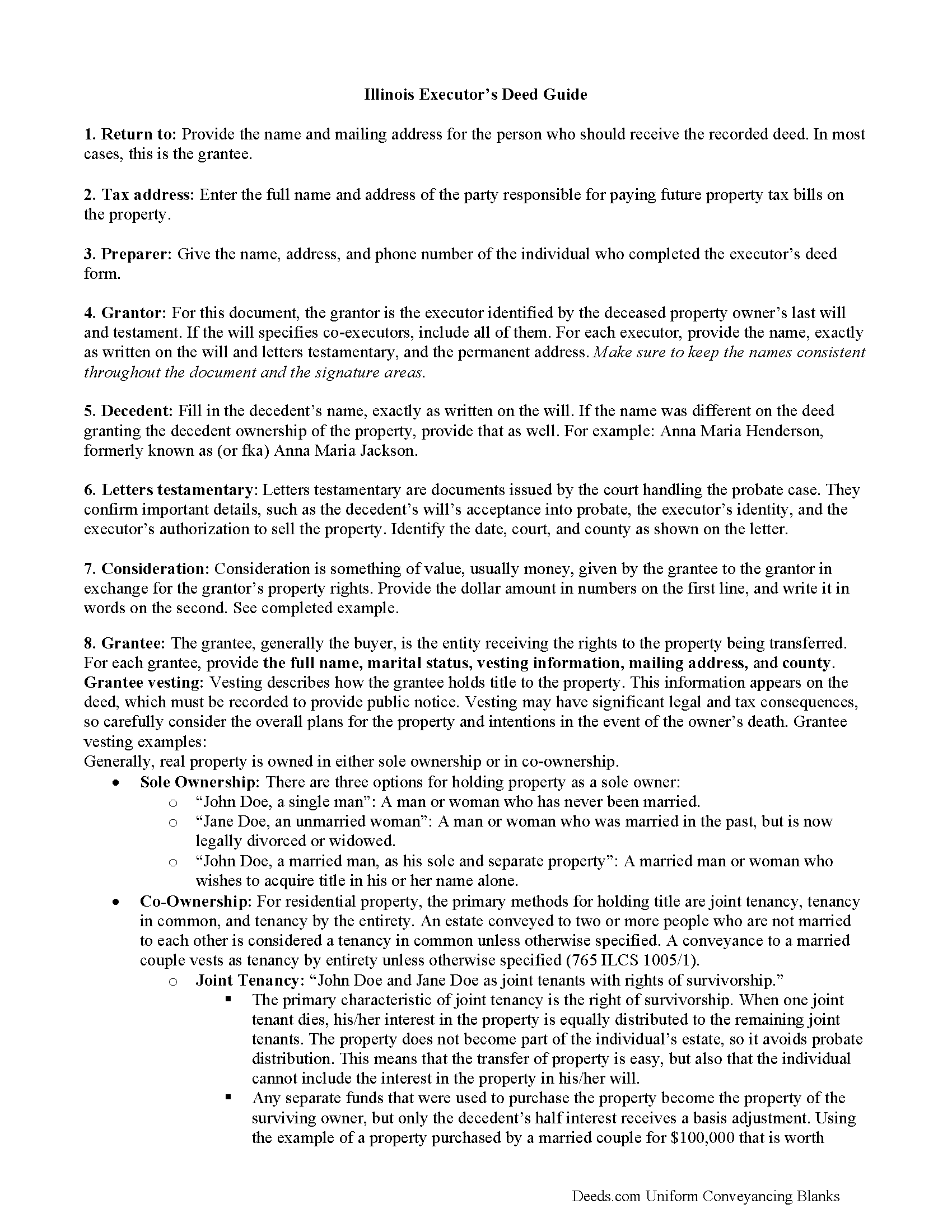

Executor Deed Guide

Line by line guide explaining every blank on the form.

Included Peoria County compliant document last validated/updated 9/5/2024

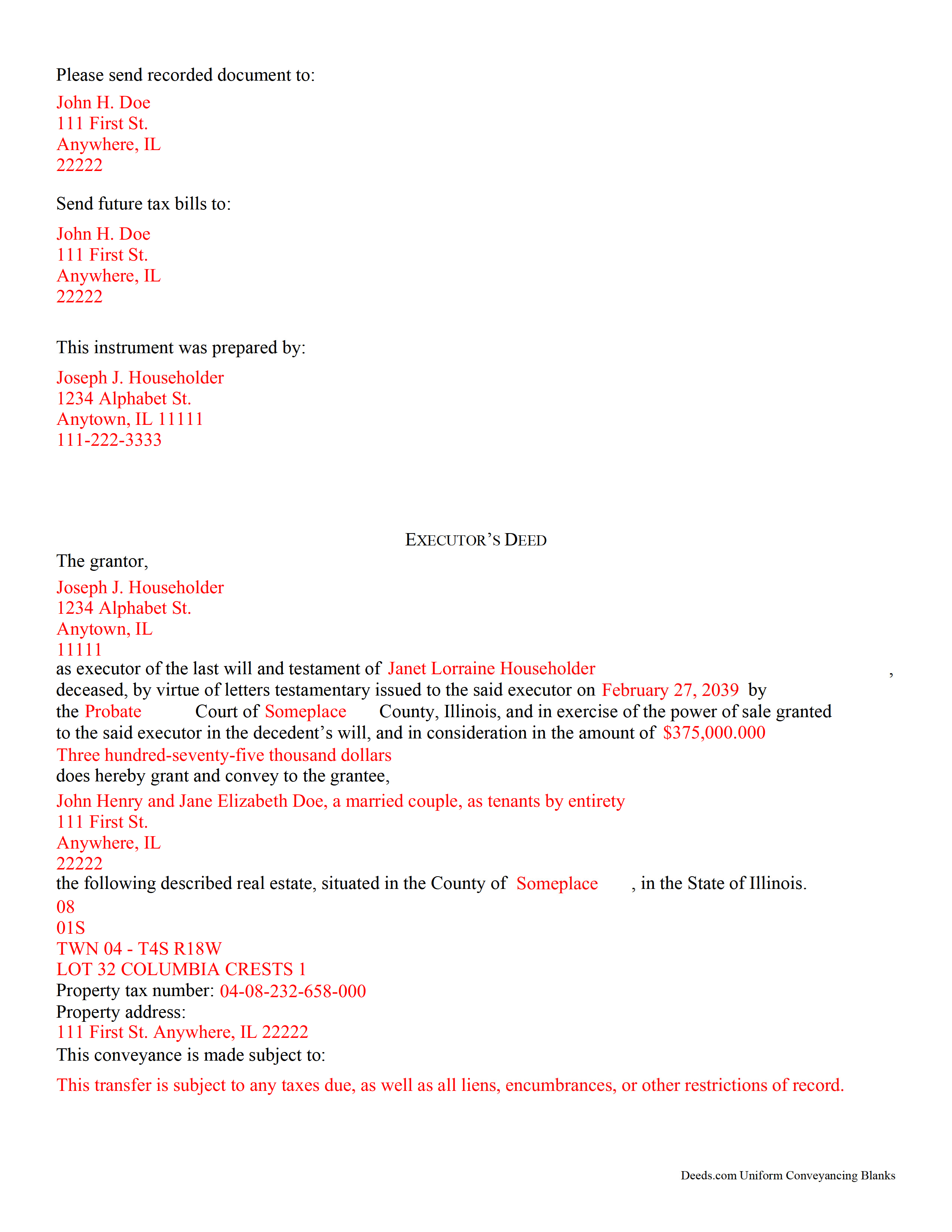

Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

Included Peoria County compliant document last validated/updated 8/27/2024

The following Illinois and Peoria County supplemental forms are included as a courtesy with your order:

When using these Executor Deed forms, the subject real estate must be physically located in Peoria County. The executed documents should then be recorded in the following office:

Recorder of Deeds

County Courthouse - 324 Main St, Room 101, Peoria, Illinois 61602

Hours: Office Hours: Monday–Friday 8:30am–5:00pm / Recording Hours: Monday–Friday 8:30am–4:30pm

Phone: (309) 672-6090

Local jurisdictions located in Peoria County include:

- Brimfield

- Chillicothe

- Dunlap

- Edelstein

- Edwards

- Elmwood

- Glasford

- Hanna City

- Kingston Mines

- Laura

- Mapleton

- Mossville

- Peoria

- Peoria Heights

- Princeville

- Rome

- Trivoli

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Peoria County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Peoria County using our eRecording service.

Are these forms guaranteed to be recordable in Peoria County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Peoria County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Peoria County that you need to transfer you would only need to order our forms once for all of your properties in Peoria County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Peoria County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Peoria County Executor Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Find the laws governing the probate administration of real estate at 755 ILCS 5/20.

The executor of an estate is a person named in the decedent's will to manage the distribution of the estate's assets.

An executor's deed is a special document used by the executor of a decedent's estate to transfer real property out of that estate. This document must meet the same form and content standards as so-called "regular" warranty or quitclaim deeds, and incorporate additional information related to the specific transaction. The details may vary based on the situation, but typically include facts about the decedent and the nature of the probate case. (765 ILCS 5/12)

Depending on the case, the executor might include documents such as letters from the probate court or a certified copy of the death certificate when recording the deed. Consult with the court officer or attorney supervising the distribution to confirm which, if any, supporting documentation might be required. After the deed is executed (signed in front of a notary), confirm it with the court if necessary, then file it in the public records for the Illinois county where the property is located.

This information applies to many, but not all, situations. Contact an attorney or the probate court officer responsible for the case with specific questions.

(Illinois Executor Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Peoria County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Peoria County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4428 Reviews )

Joseph D.

November 14th, 2024

Easy to use and a quick turnaround rnDeed was recorded and retuned within 24 hours

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Angela M.

November 14th, 2024

Great communication and always on timely manner unless issue appears with the document.rnI like their customer service, very helpful and assisting when necessary.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Fritz C.

August 27th, 2020

Quick and complete info

Thank you!

Tammy C.

September 24th, 2020

Was very easy to use and i would recommend it

Thank you!

Dallas S.

July 19th, 2023

Very easy

Thank you!

Carol R.

February 19th, 2023

I found the site to be useful,informative and very accessable. Thank You

Thank you!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Catherine B.

October 26th, 2021

Was looking for information and forms relating to a trust my parents created, but what I purchased seems geared toward trusts containing real estate only, which is not what I needed. Clearly I missed something prior to purchasing something I can not use. Perhaps additional clarification for us without any experience is this area would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

John M.

August 18th, 2022

I ordered my gift deed forms one evening, filled them out the next day, and registered them with the register of deeds the next morning. Boom. Done! Easy peasy, no lawyer expense!

Thank you!

Aaron H.

April 3rd, 2023

Excellent service! Easy to use interface and quick response post-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Noble Mikhail F.

October 2nd, 2020

The system is wonderful, and makes recording and searching simple, thanks a lot

Thank you!

Norma M.

October 19th, 2020

this is great because it saves money and gets the job done

Thank you for your feedback. We really appreciate it. Have a great day!