Effingham County Correction Deed Form (Illinois)

All Effingham County specific forms and documents listed below are included in your immediate download package:

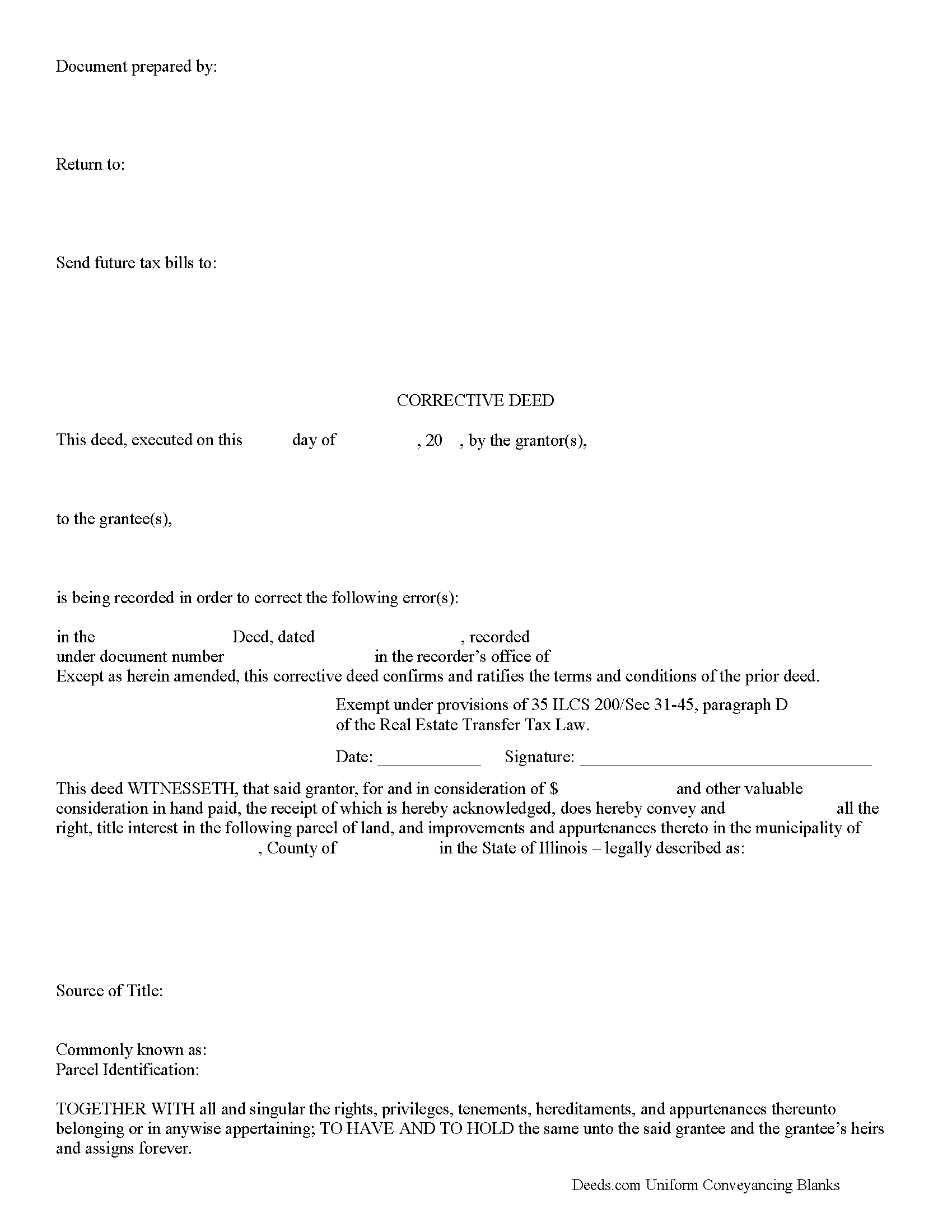

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Effingham County compliant document last validated/updated 12/4/2024

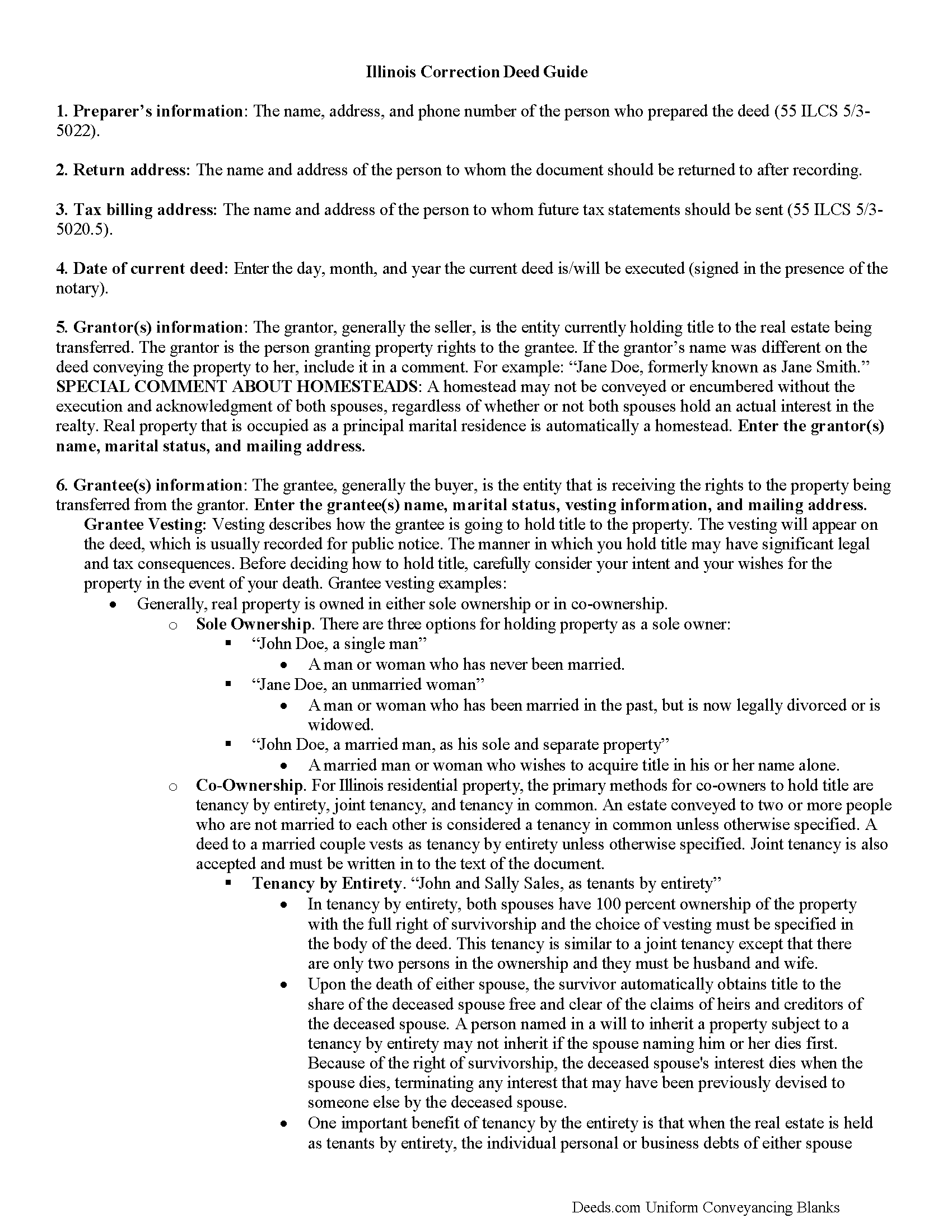

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Effingham County compliant document last validated/updated 11/8/2024

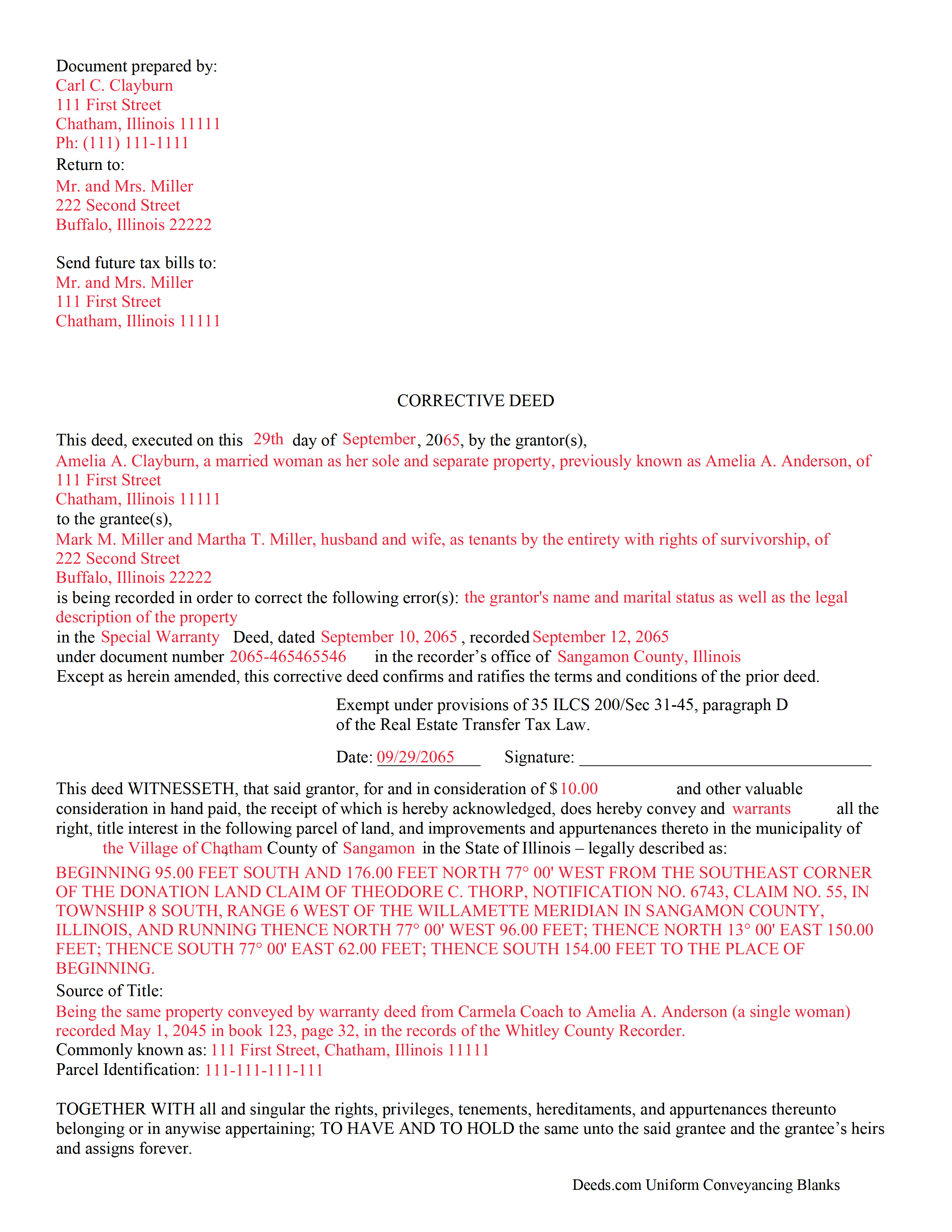

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Effingham County compliant document last validated/updated 9/16/2024

The following Illinois and Effingham County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Effingham County. The executed documents should then be recorded in the following office:

Clerk and Recorder

County Office Building - 101 N Fourth St / PO Box 628, Effingham, Illinois 62401

Hours: 8:30 to 4:30 M-F

Phone: (217) 342-6535

Local jurisdictions located in Effingham County include:

- Altamont

- Beecher City

- Dieterich

- Edgewood

- Effingham

- Mason

- Montrose

- Shumway

- Teutopolis

- Watson

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Effingham County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Effingham County using our eRecording service.

Are these forms guaranteed to be recordable in Effingham County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Effingham County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Effingham County that you need to transfer you would only need to order our forms once for all of your properties in Effingham County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Effingham County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Effingham County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use a correction or corrective deed to clear up a title flaw in a deed recorded in Illinois. This form allows for correction of errors in one or multiple sections of the deed.

When correcting an error in a deed in Illinois, there are two basic options: 1) re-record the original deed with corrections made on the face of it by striking out the wrong item; or 2) record a correction or corrective deed. While some counties prefer re-recording the original deed, others recommend the cleaner recording of a new deed. So it is always a good idea to check with the local recorder's office. The gravity of the error and correction it requires also will determine which option to choose. Use the re-recording of the original deed primarily for smaller typographical mistakes.

When correcting a minor error and re-recording the prior deed, use the original deed only, strike through the wrong information, and write the correction down close to it and by hand. Usually, a cover page must be added, stating the important identifiers, as well as the reason for re-recording. For a more involved error, the correction deed might be a better option. Except for the corrected error, it restates and confirms all information of the prior deed, referencing it by date, recording number, and identifying the corrected error by type. In terms of recording fees, there may be a small difference between the two options in some counties.

A corrective deed is exempt from transfer tax according to 35 ILCS 200/35-41 (d). Add a sentence stating this exemption to the cover page when re-recording the original deed. On the corrective deed form, a tax statement, along with a line for the signature of the buyer, seller, or a representative, serves that purpose.

(Illinois Correction Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Effingham County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Effingham County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Randall S.

September 19th, 2021

I have had great success with this so far. The site had the correct forms and I was able complete the documents. It seems like a great resource!

Thank you for your feedback. We really appreciate it. Have a great day!

Janalee T.

April 17th, 2020

Fast, easy. quickly accepted by county recorder.

Thank you!

Charles B.

November 20th, 2023

The support received was far above expectations.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Hilda R.

January 16th, 2019

It very convenient and fast.

Thank you

Hilda Reyes

Thanks so much Hilda, have a great day!

Daniel S.

July 6th, 2020

So far, so good. Waiting for the County Recorder to accept and record my document, but use of the Deeds.com system has been easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason P.

April 8th, 2021

Price is fair and system is so user friendly. Highly recommend

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gina B.

June 26th, 2019

Super easy to use! Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey T.

July 19th, 2019

Lots of great information. Might need to view it again but found it very helpful!

Thank you!

Willie T.

March 8th, 2019

Great

Thank you for your feedback. We really appreciate it. Have a great day!

SheRon F.

March 21st, 2022

It was a quick and easy process and deeds.com was very helpful and dealt with a very stressful situation, painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

March 20th, 2019

Very timely service and retrieved information I was looking for

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maricarol F.

March 6th, 2019

Found the site very easy to use. My fault I did not answer back right away. What was found is almost what I needed... Thanks.

Thank you for the feedback Maricarol, we really appreciate it.