Power County Substitution of Trustee and Deed of Full Reconveyance Form (Idaho)

All Power County specific forms and documents listed below are included in your immediate download package:

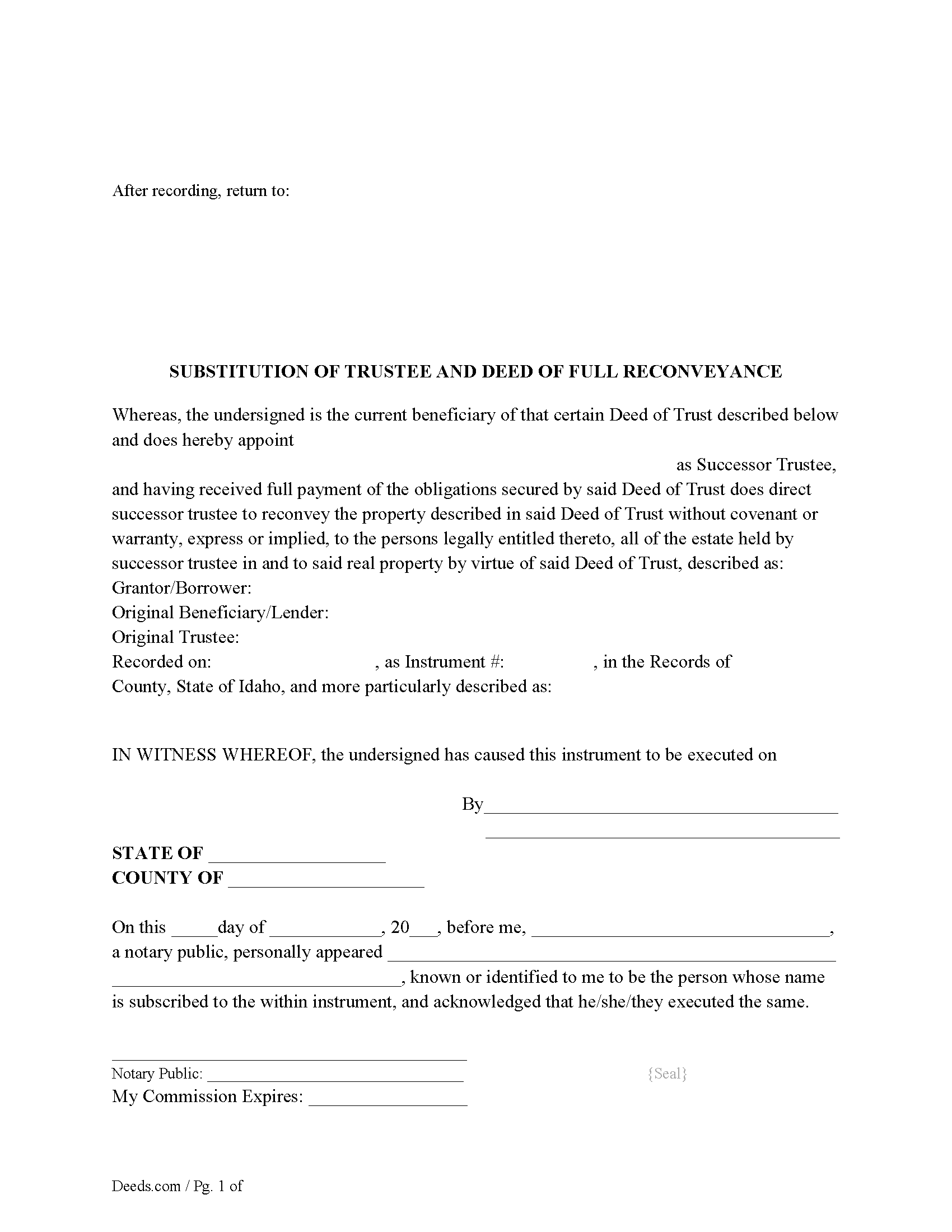

Substitution of Trustee and Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Power County compliant document last validated/updated 9/6/2024

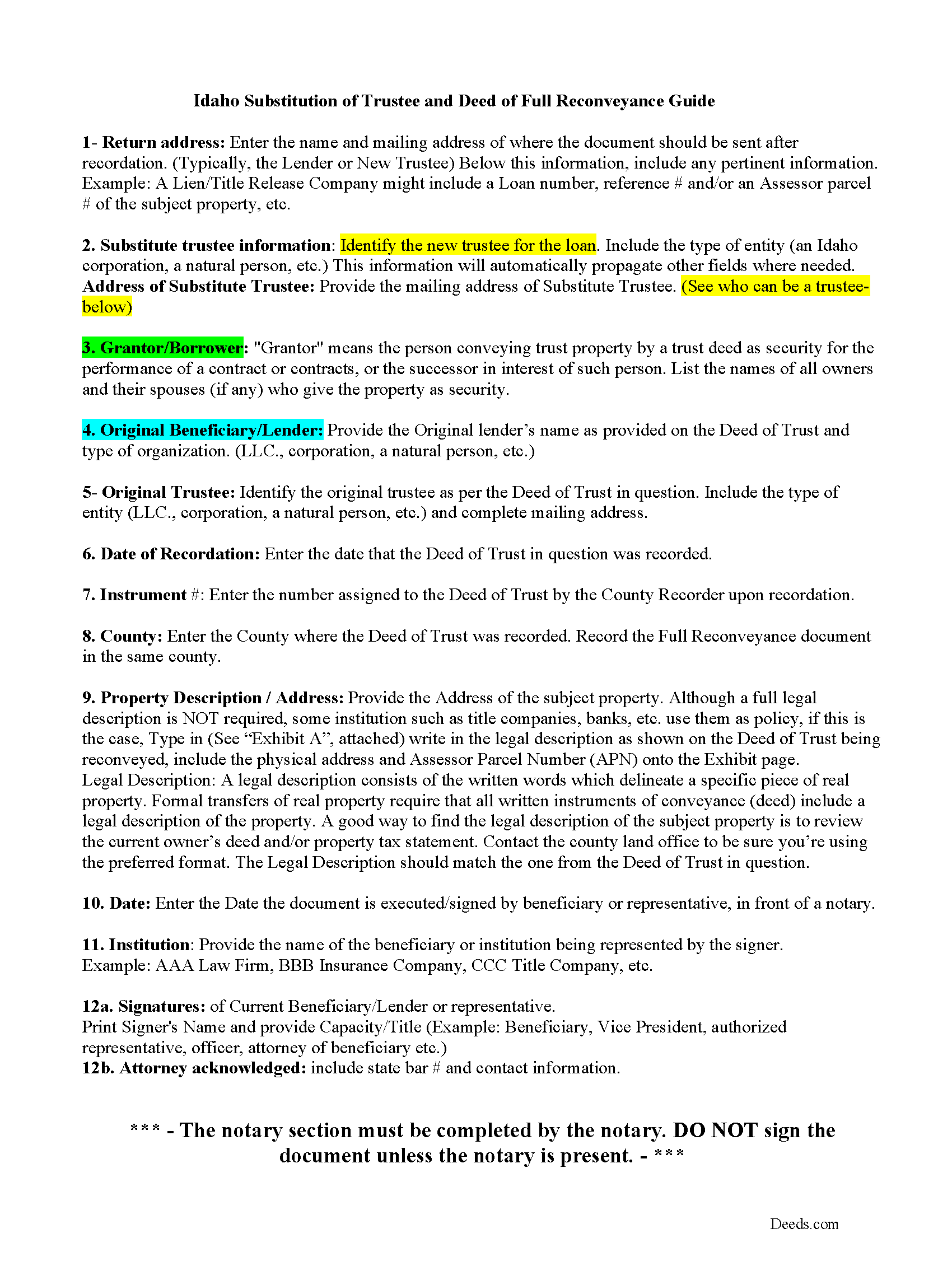

Guidelines for Substitution of Trustee and Deed of Full Reconveyance Form

Line by line guide explaining every blank on the form.

Included Power County compliant document last validated/updated 11/6/2024

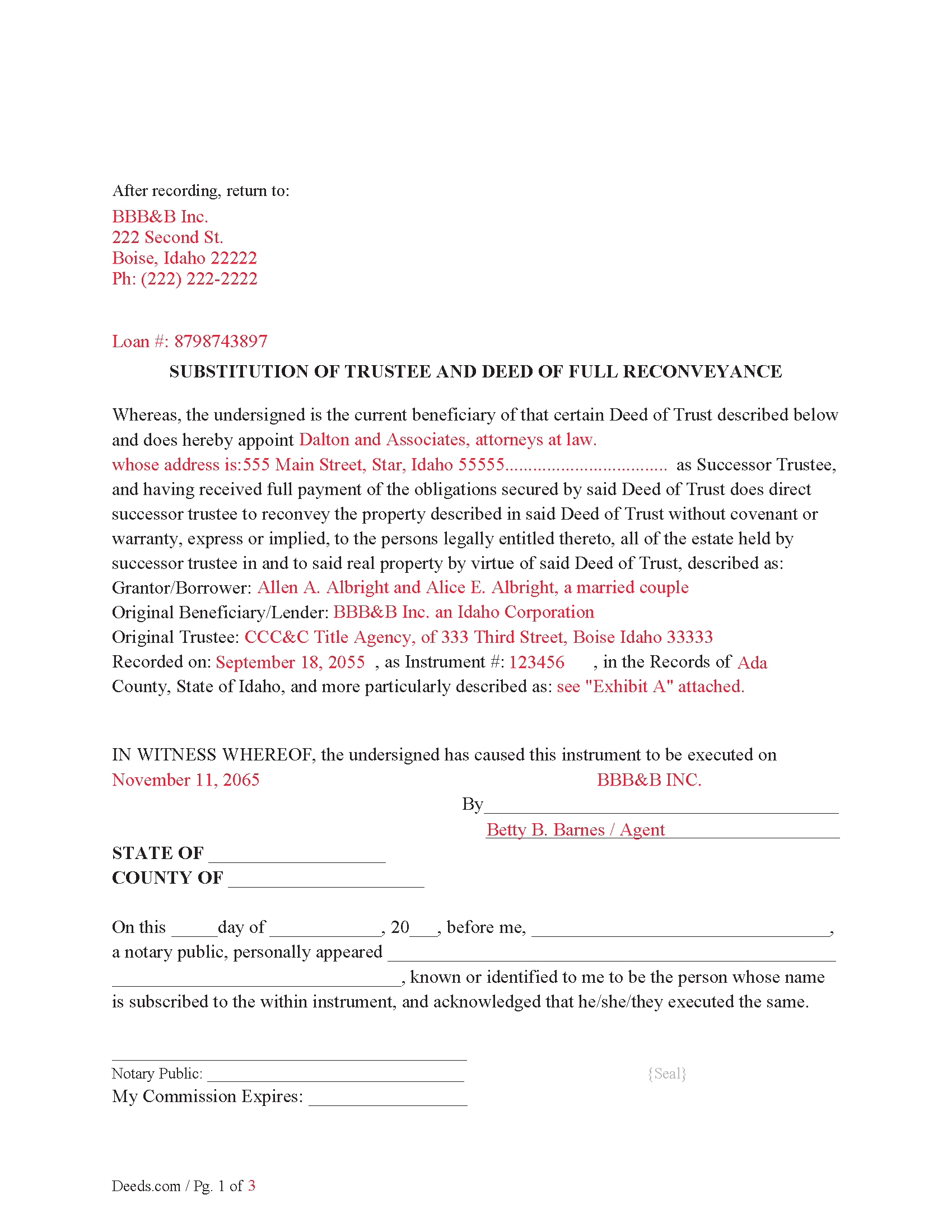

Completed Example of the Substitution of Trustee and Deed of Reconveyance Document

Example of a properly completed form for reference.

Included Power County compliant document last validated/updated 10/15/2024

The following Idaho and Power County supplemental forms are included as a courtesy with your order:

When using these Substitution of Trustee and Deed of Full Reconveyance forms, the subject real estate must be physically located in Power County. The executed documents should then be recorded in the following office:

Power County Clerk-Auditor-Recorder

543 Bannock Ave, American Falls, Idaho 83211

Hours: 9:00am to 5:00pm M-F

Phone: (208) 226-7611

Local jurisdictions located in Power County include:

- American Falls

- Arbon

- Rockland

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Power County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Power County using our eRecording service.

Are these forms guaranteed to be recordable in Power County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Power County including margin requirements, content requirements, font and font size requirements.

Can the Substitution of Trustee and Deed of Full Reconveyance forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Power County that you need to transfer you would only need to order our forms once for all of your properties in Power County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Idaho or Power County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Power County Substitution of Trustee and Deed of Full Reconveyance forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This form is used by the current beneficiary/lender to substitute an existing trustee with a successor trustee who then has the power to reconvey the Deed of Trust back to the grantor/borrower(s). This is typically performed when the loan/note has been satisfied and the current trustee can't or won't act, or the beneficiary/lender decides to choose a different trustee to reconvey the Deed of Trust in question. This form includes the required written request from the beneficiary to the trustee to reconvey the property. Acknowledgments are required from the current beneficiary/lender and the appointed successor trustee, included are two notary statements, allowing flexibility of the beneficiary acknowledging at one time and place and the successor trustee acknowledging at another time and place if need be.

45-1514. RECONVEYANCE UPON SATISFACTION OF OBLIGATION.

Upon performance of the obligation secured by the deed of trust, the trustee upon written request of the beneficiary shall reconvey the estate of real property described in the deed of trust to the grantor; providing that in the event of such performance and the refusal of any beneficiary to so request or the trustee to so reconvey, as above provided, such beneficiary or trustee shall be liable as provided by law in the case of refusal to execute a discharge or satisfaction of a mortgage on real property.

For use in Idaho only.

Our Promise

The documents you receive here will meet, or exceed, the Power County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Power County Substitution of Trustee and Deed of Full Reconveyance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl C.

September 1st, 2021

Very pleased. I spent a fair amount of time chasing a blank form only to be told it couldn't be given to me - I had to go through my attorney.

Going thru the deeds.com was a breeze; the blank form looked exactly like one I had filed before :-)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bill S.

March 10th, 2021

Very convenient and reasonably priced service. Excellent. A++

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald R.

December 30th, 2022

first tinme use, good buy=t expensive

Thank you!

Andrea H.

February 10th, 2022

Easy! Reasonable cost over and above the actual recording cost. Will save me the time I would have spent driving to the county offices.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! rnI do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat.rnFortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Leslie Y.

December 10th, 2019

I had my doubts going in but was pleasantly surprised at the thoroughness of the documents and information provided. Will use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenny H.

January 14th, 2020

The forms are extremely helpful. They could use some updating. Promissory note "...in the form of cash, check or money order." is a bit outdated. My note is with my son and we have an automatic bank transfer set up for payments. He could Venmo me. There are many other options and likely to be more changes in the future, so I know this is difficult to maintain.

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

James A.

June 18th, 2024

Very easy to navigate and start your process.

Thank you for your positive words! We’re thrilled to hear about your experience.

Celestine U.

February 24th, 2020

Very well done

Thank you!

KELLY S.

May 31st, 2022

Thank you for being here. very easy to understand and your site is great. I will always use you.

Thank you for your feedback. We really appreciate it. Have a great day!

A R M.

May 1st, 2021

Great so far. Just downloaded all the documents, and they seem to be easy to save and are fillable.

A R M

Thank you for your feedback. We really appreciate it. Have a great day!