Gem County Correction Deed Form (Idaho)

All Gem County specific forms and documents listed below are included in your immediate download package:

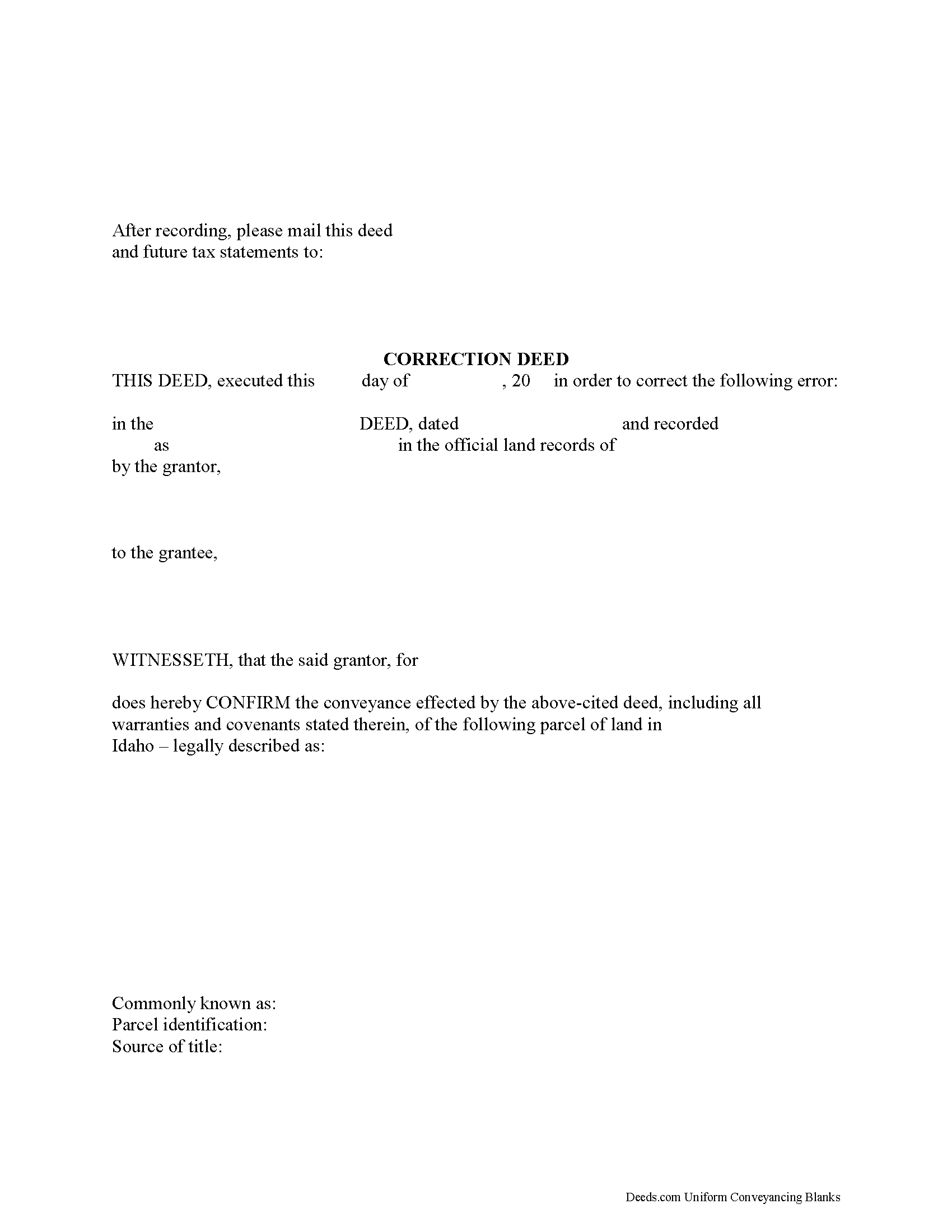

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Gem County compliant document last validated/updated 11/28/2024

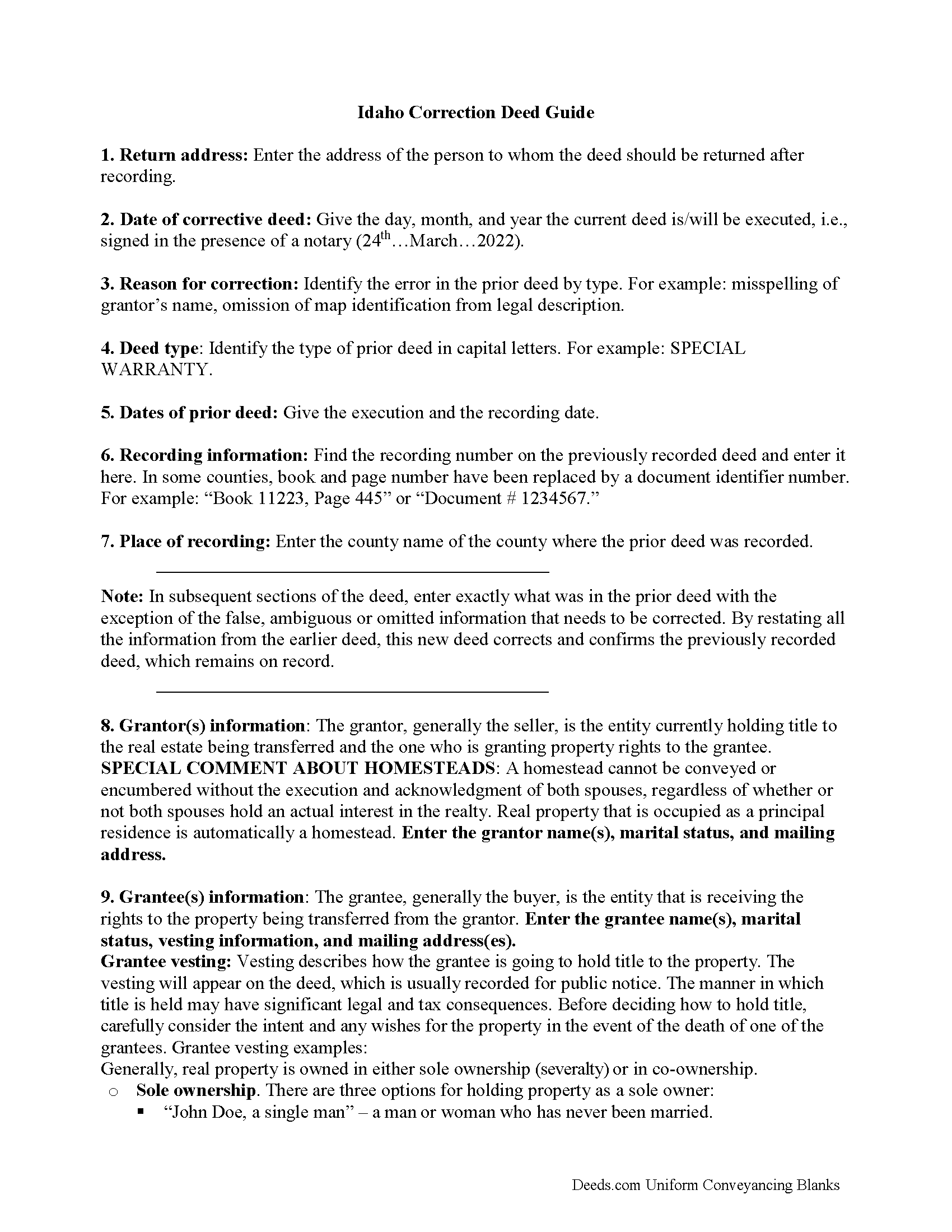

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Gem County compliant document last validated/updated 11/28/2024

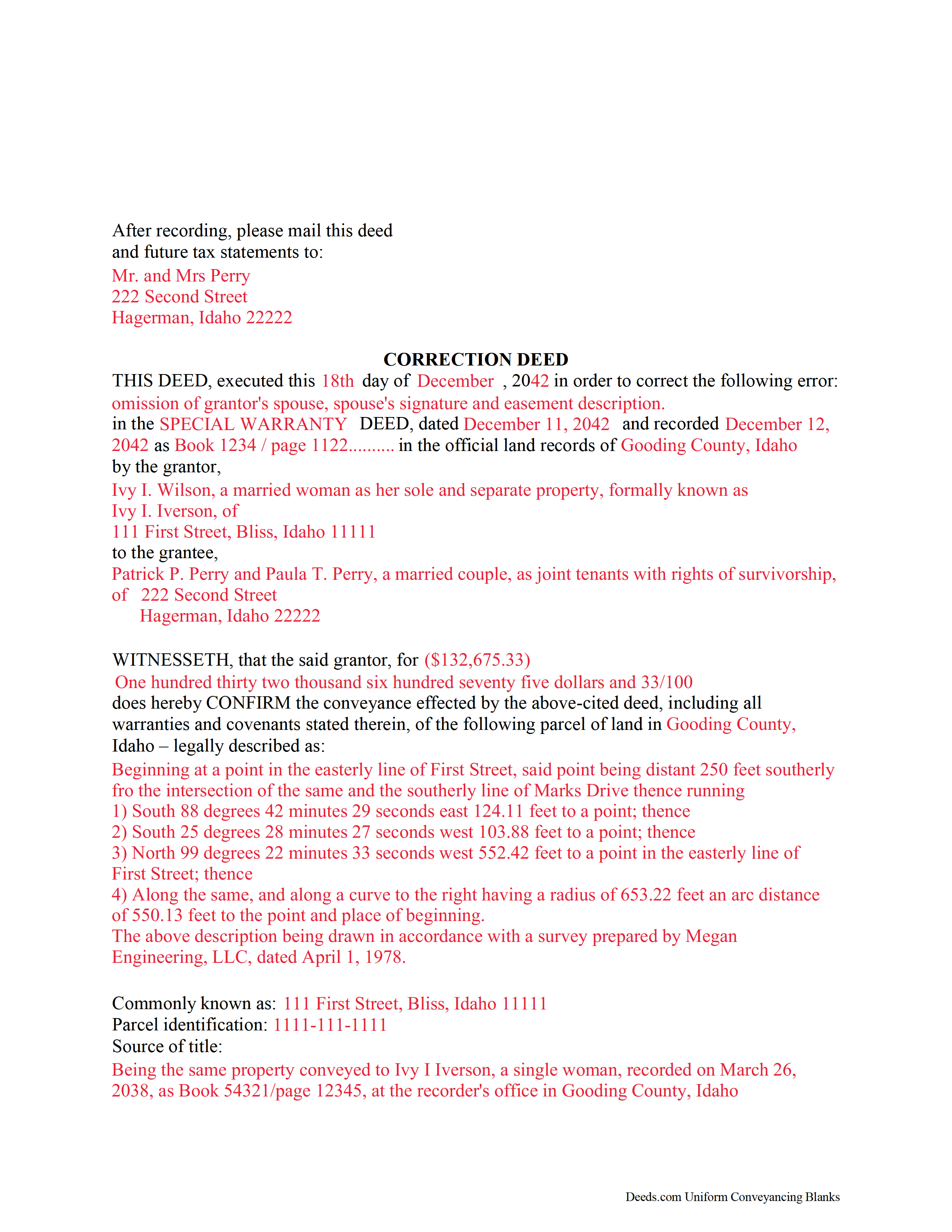

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Gem County compliant document last validated/updated 12/20/2024

The following Idaho and Gem County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Gem County. The executed documents should then be recorded in the following office:

Gem County Clerk-Auditor-Recorder

415 East Main St, Emmett, Idaho 83617-3096

Hours: 8:00 a.m. – 5:00 p.m. Monday-Friday

Phone: (208) 365-4561

Local jurisdictions located in Gem County include:

- Emmett

- Letha

- Ola

- Sweet

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Gem County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Gem County using our eRecording service.

Are these forms guaranteed to be recordable in Gem County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gem County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Gem County that you need to transfer you would only need to order our forms once for all of your properties in Gem County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Idaho or Gem County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Gem County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the correction deed to correct an error in a previously recorded quitclaim, warranty or grant deed in Idaho.

Errors in a previously recorded deed can be corrected by re-recording the corrected deed or by preparing and recording a new correction deed. This helps to prevent title flaws, which may cause problems when the current owner attempts to sell the property. The correction deed does not convey title but confirms the prior conveyance.

For small errors, corrections can be made directly on the original deed and initialed by the signors before the deed is re-recorded. For lengthier errors, the best option is to prepare and record a new corrective deed, executed from the original grantor to the original grantee. Apart from supplying the corrected information, it must identify the reason for correcting and reference the prior deed by date, recording number and title.

When correcting the legal description or plat identification, both the grantor and the grantee should sign the corrective deed. If the original grantor is not available for some reason, an affidavit, signed by the grantee and indexed under the name of both the grantor and grantee, may be the best way to effect a correction.

For certain types of changes, however, a correction deed may not be appropriate. Adding or removing a grantee, for example, or changing the manner in which title is held, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance instead of a correcting the original deed. When in doubt about how to correct an error, consult with a lawyer.

Our Promise

The documents you receive here will meet, or exceed, the Gem County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gem County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Johnny H.

September 15th, 2022

The format presented is exactly what is needed to produce a perfect listing in the registry of The Maricopa County Office of the Recorder. Thanks for an effective solution to a very important document.

Thank you!

Connie B.

October 6th, 2020

Needed to remove a deceased person from my mother's title. I live in another state. Deeds.com made it SO EASY to accomplish. I loved the example forms showing me how to fill out the forms that were provided. It went incredibly well at the County offices (all 3 departments!). Definitely will use Deeds.com again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

FELISA J.

December 18th, 2019

I liked the ease of locating the document I needed and the sample document was extremely helpful. I would have liked the acknowledgement to be on the same page as the rest of the document. It costs for each page recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Denise B.

September 3rd, 2020

Quick and easy!

Thank you Denise. We appreciate you.

DENNIS M.

January 18th, 2023

very simple and complete

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roy C.

January 25th, 2021

Great Product no problems filing

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel D.

February 9th, 2020

Well done. A little pricy.

Thank you!

DeBe W.

January 27th, 2024

Thanks for the quick response. That really helps when you're under a time deadline.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Raymundo M.

November 1st, 2023

Very fast and smooth process, thank you for your quick answers and follow up.

Thank you for your feedback. We really appreciate it. Have a great day!

Maria S.

February 26th, 2021

The website made it very easy to navigate and order what I needed. Thank you.

Thank you!

Donald W.

July 28th, 2023

Well organized document preparation. Great way to save on legal fees

Thank you for your feedback. We really appreciate it. Have a great day!