Muscogee County Transfer on Death Deed Form (Georgia)

All Muscogee County specific forms and documents listed below are included in your immediate download package:

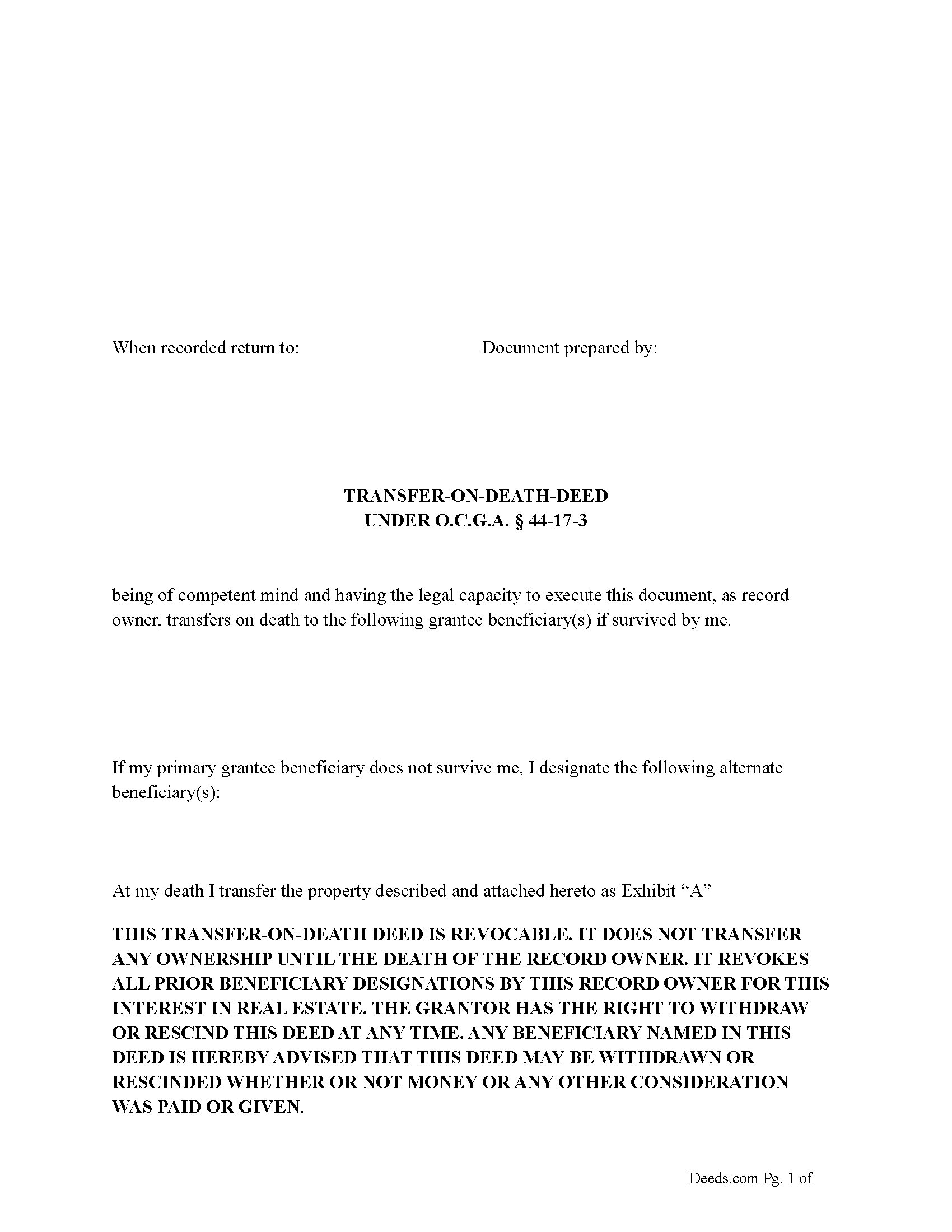

Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

Included Muscogee County compliant document last validated/updated 12/12/2024

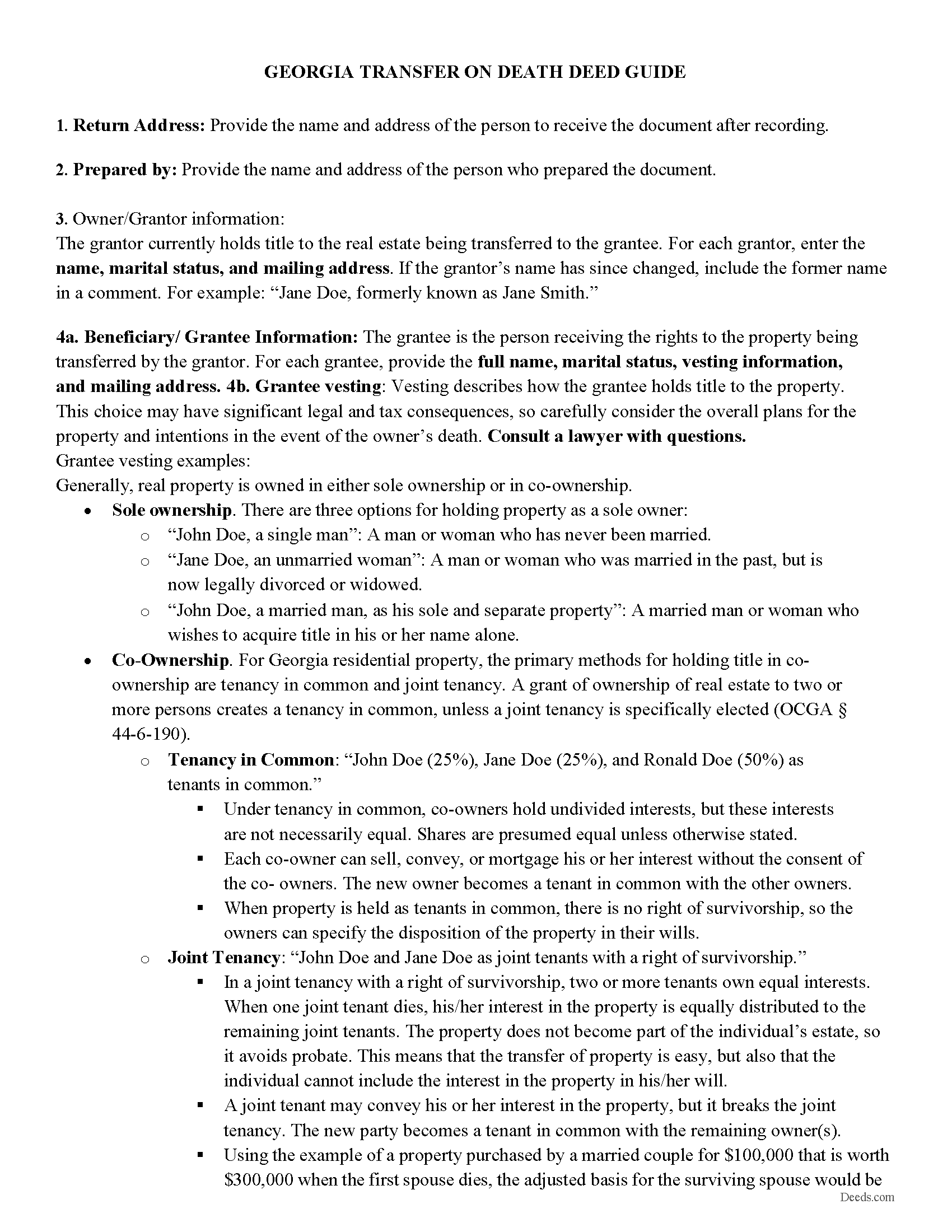

Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

Included Muscogee County compliant document last validated/updated 9/3/2024

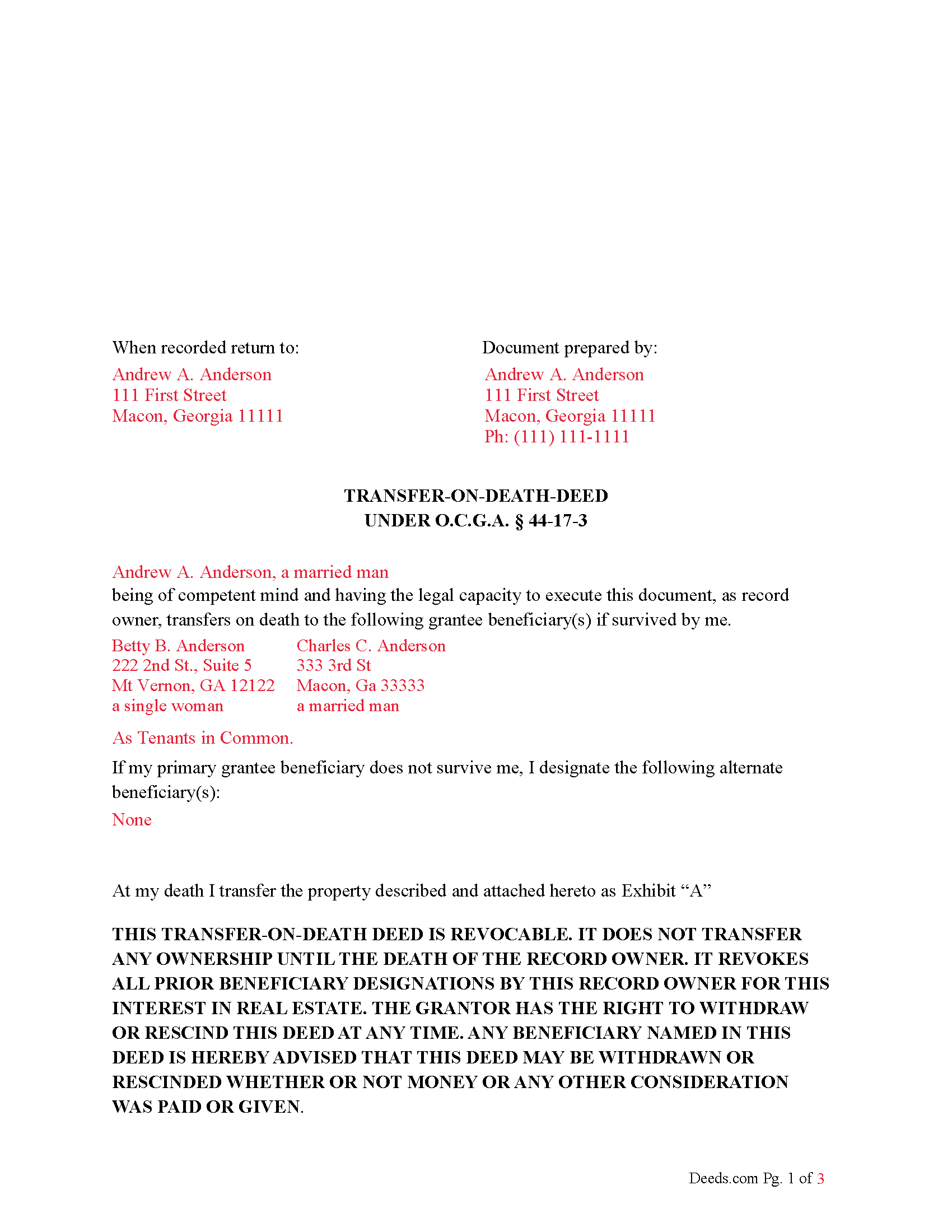

Completed Example of the Transfer on Death Deed Document

Example of a properly completed Georgia Transfer on Death Deed document for reference.

Included Muscogee County compliant document last validated/updated 9/13/2024

The following Georgia and Muscogee County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Muscogee County. The executed documents should then be recorded in the following office:

Clerk of Superior Court

Columbus Government Center - 100 Tenth Street, 2nd floor / PO Box 2145, Columbus, Georgia 31901

Hours: 8:30 to 5:00 M-F

Phone: (706) 653-4358 & 4370

Local jurisdictions located in Muscogee County include:

- Columbus

- Fort Benning

- Fortson

- Midland

- Upatoi

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Muscogee County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Muscogee County using our eRecording service.

Are these forms guaranteed to be recordable in Muscogee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Muscogee County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Muscogee County that you need to transfer you would only need to order our forms once for all of your properties in Muscogee County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Georgia or Muscogee County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Muscogee County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Georgia Law 496, effective July 1, 2024, introduced Chapter 17 regarding Transfer on Death (TOD) deeds. This new chapter affects the creation, execution, and enforcement of TOD deeds in the state. Here's how Chapter 17 affects TOD deeds:

Creation and Execution of TOD Deeds:

Property owners can now create a TOD deed to designate a beneficiary who will receive the property upon the owner’s death. The TOD deed must be executed with the same formalities as a regular deed, meaning it must be signed, witnessed, and notarized. The deed must clearly state that the transfer is to occur upon the owner’s death.

Recording Requirements: To be effective, a TOD deed must be recorded in the county where the property is located before the owner’s death. Failure to record the TOD deed properly may result in it being invalid, and the property would then be subject to probate.

Revocability: The owner retains the right to revoke the TOD deed at any time during their lifetime. Revocation must be executed and recorded in the same manner as the TOD deed itself. The revocation can be made by executing a new TOD deed that expressly revokes the previous one or by recording an instrument of revocation.

Effect on Ownership and Rights: During the owner’s lifetime, the TOD deed does not affect the owner’s rights or the property’s ownership. The owner retains full control of the property and can sell, mortgage, or otherwise manage the property without the beneficiary's consent. The TOD deed only takes effect upon the owner’s death.

Impact on Spouses and Joint Owners: If the property is jointly owned with right of survivorship, the TOD deed will only take effect after the death of the last surviving owner. Both joint owners must sign the TOD deed to ensure it accurately reflects their intentions. In the case of sole ownership, the consent of the non owning spouse may not be legally required but is advisable to prevent potential legal challenges based on marital property or homestead rights.

Priority and Creditor Claims: The TOD deed does not shield the property from the owner’s creditors. Any liens or debts must be settled before the beneficiary can take full ownership of the property. The property remains subject to any existing mortgages or liens, and the beneficiary will inherit the property subject to these encumbrances.

Homestead Rights: Georgia’s homestead rights and exemptions may affect the TOD deed. It’s essential to consider these rights, especially in cases where the property is the primary residence and may involve spousal consent.

Probate Avoidance: The primary advantage of the TOD deed under Chapter 17 is the avoidance of probate. Upon the owner’s death, the property transfers directly to the designated beneficiary without the need for probate proceedings.

Chapter 17 of Georgia Law 496, which governs Transfer on Death (TOD) deeds, includes definitions critical to understanding the application and implications of the law. Here are the explanations for the terms as used in this chapter:

((1) 'Interest in real estate' means any estate or interest in, over or under land, including surface, minerals, structures, fixtures, and easements. (GA 44-17-1(1))

This term is broadly defined to include any type of ownership or stake in real property. It encompasses:

Surface: Ownership or rights related to the surface of the land, including any structures or improvements on it.

Minerals: Subsurface rights, which can include the extraction of minerals, oil, or gas.

Structures: Any buildings or permanent improvements attached to the land.

Fixtures: Items that were once personal property but have been attached to the land or structures in a way that they are considered part of the real estate (e.g., a furnace or built-in cabinetry).

Easements: Rights to use another person’s land for a specific purpose (e.g., utility easements or access roads).

This broad definition ensures that TOD deeds can apply to a wide range of real estate interests, not just traditional ownership of land and buildings.

((2) 'Joint owner' means a person that owns an interest in real estate as a joint tenant with right of survivorship.) This term specifically refers to a person who co-owns an interest in real estate with one or more other people, where the ownership includes the right of survivorship.)

Joint Tenancy with Right of Survivorship: A form of co-ownership where each owner (joint tenant) has an equal share in the property. Upon the death of one joint tenant, their share automatically passes to the surviving joint tenant(s), rather than being distributed according to a will or through probate.

This definition is important for TOD deeds because it clarifies how ownership interests are managed when there are multiple owners. In the context of a TOD deed, if the property is owned as joint tenants with right of survivorship, the TOD deed would only take effect after the death of the last surviving joint owner. Both joint owners must agree and sign the TOD deed to designate a beneficiary who will receive the property upon the death of the surviving owner. (44-17-1(2))

Our Promise

The documents you receive here will meet, or exceed, the Muscogee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Muscogee County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqueline G.

October 10th, 2019

Great site, user friendly. Exactly what we needed and the detailed instructions/completed sample were a nice touch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Conrad R.

January 28th, 2023

Easy to obtain form, easy to use. Came with instrucions and references to state statutes. Very Helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ron S.

April 5th, 2019

Fair price and beneficiary deed was recorded without issue. Completion instructions provided were insufficient in some cases.

Thank you!

reed w.

February 26th, 2022

Great service that saved me a lot of time for under 30 bucks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raad A.

November 25th, 2022

Not easy to navigate

Thank you for your feedback.

Richard T.

January 21st, 2019

This was a complete set of the necessary forms, with instructions. It will be very useful. Instant download was great.

We appreciate your feedback Richard. Have a wonderful day!

Marjorie D.

November 1st, 2021

The process was easy and efficient. I will definitely be using this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Elaine L.

July 21st, 2020

5 STAR, THIS WAS A GREAT EXPERIENCE, FAST VERY RESOURCEFUL TOOL TO PROVIDE FOR MY CLIENTS. Thank you

Thank you!

Ann B.

December 27th, 2019

Works perfect. Saved money hiring someone to do this work.

Thank you!

Richard W.

December 18th, 2020

I found that the product wasn't what I was looking for. But ordering the product was smooth and easy and when I notified them it wasn't the right product for my situation, they promptly refunded my credit card. If looking for docs again, I will try deeds.com again.

Thank you!

Robert A.

August 5th, 2020

A well constructed site, easy to navigate and a pleasure to use. I'd give it a 10 on 10

Thank you for your feedback. We really appreciate it. Have a great day!