Jenkins County Statutory Power of Attorney Form (Georgia)

All Jenkins County specific forms and documents listed below are included in your immediate download package:

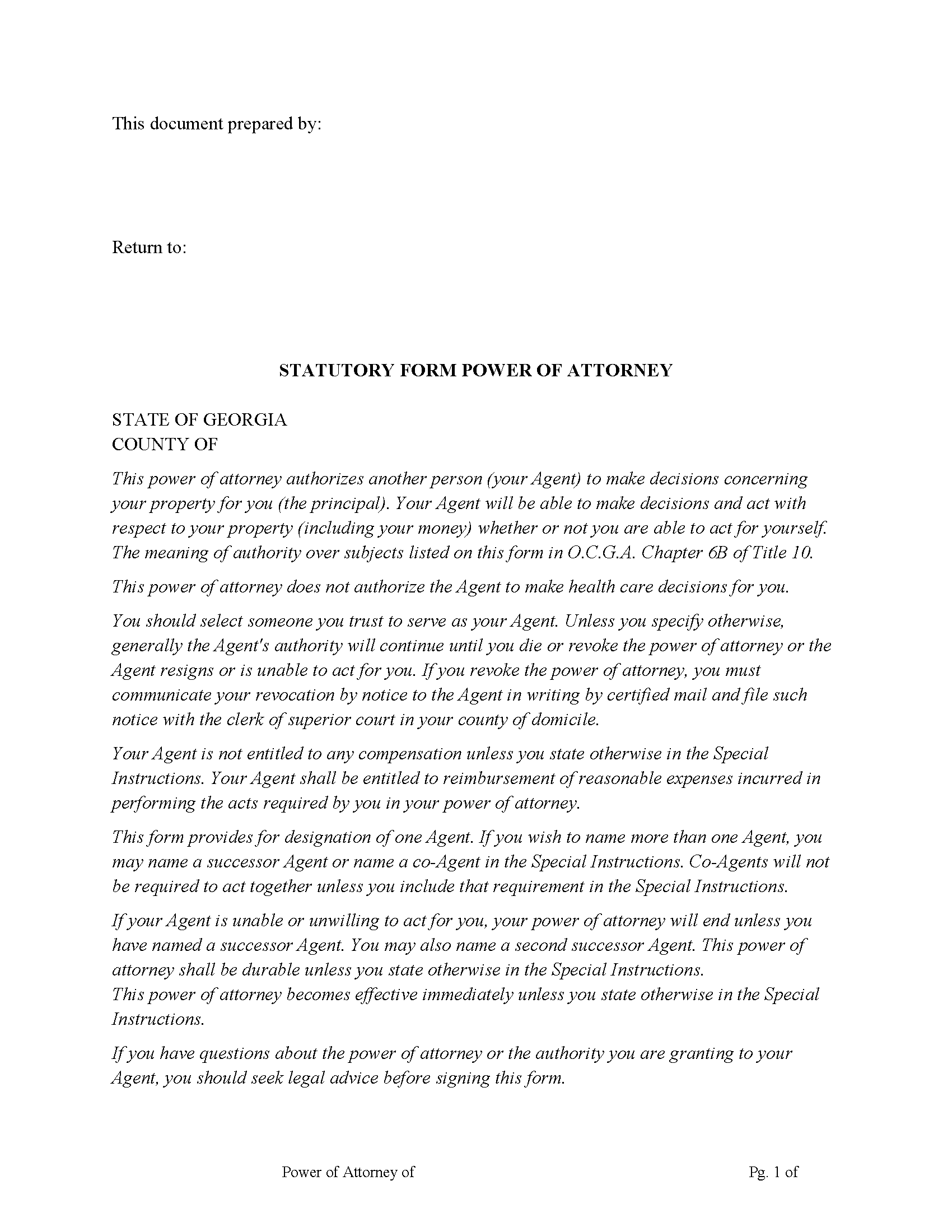

Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Jenkins County compliant document last validated/updated 4/16/2024

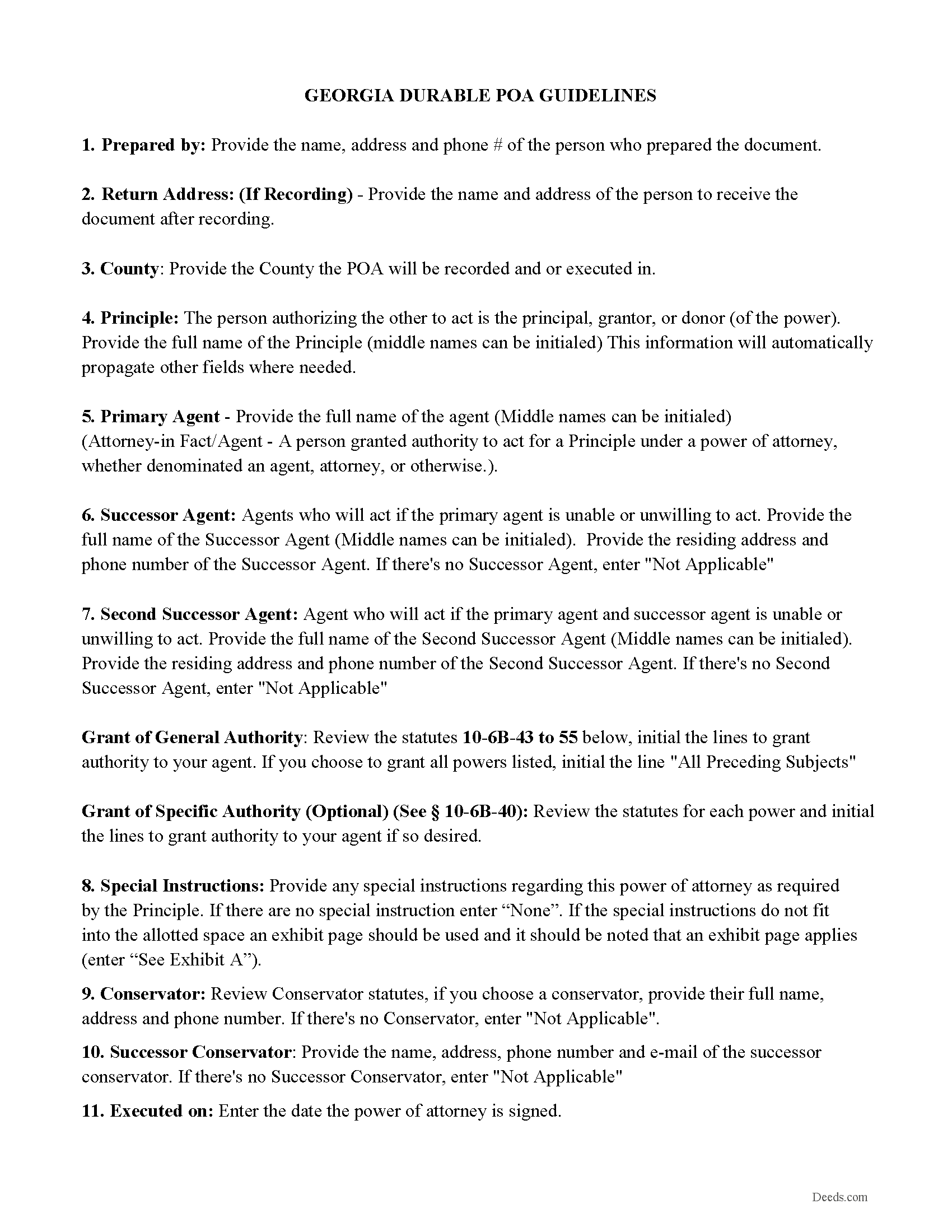

Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

Included Jenkins County compliant document last validated/updated 11/29/2024

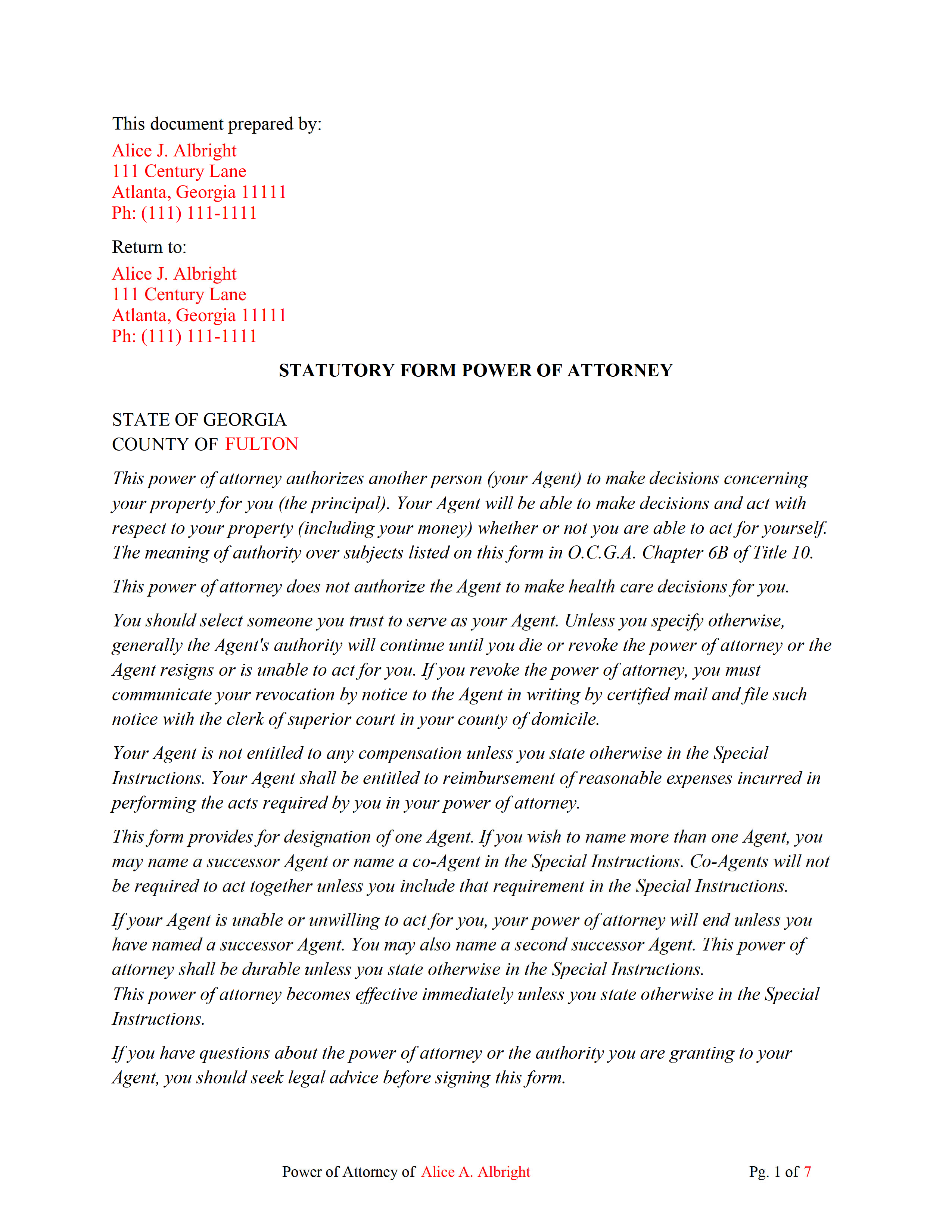

Completed Example of the Power of Attorney

Example of a properly completed form for reference.

Included Jenkins County compliant document last validated/updated 8/29/2024

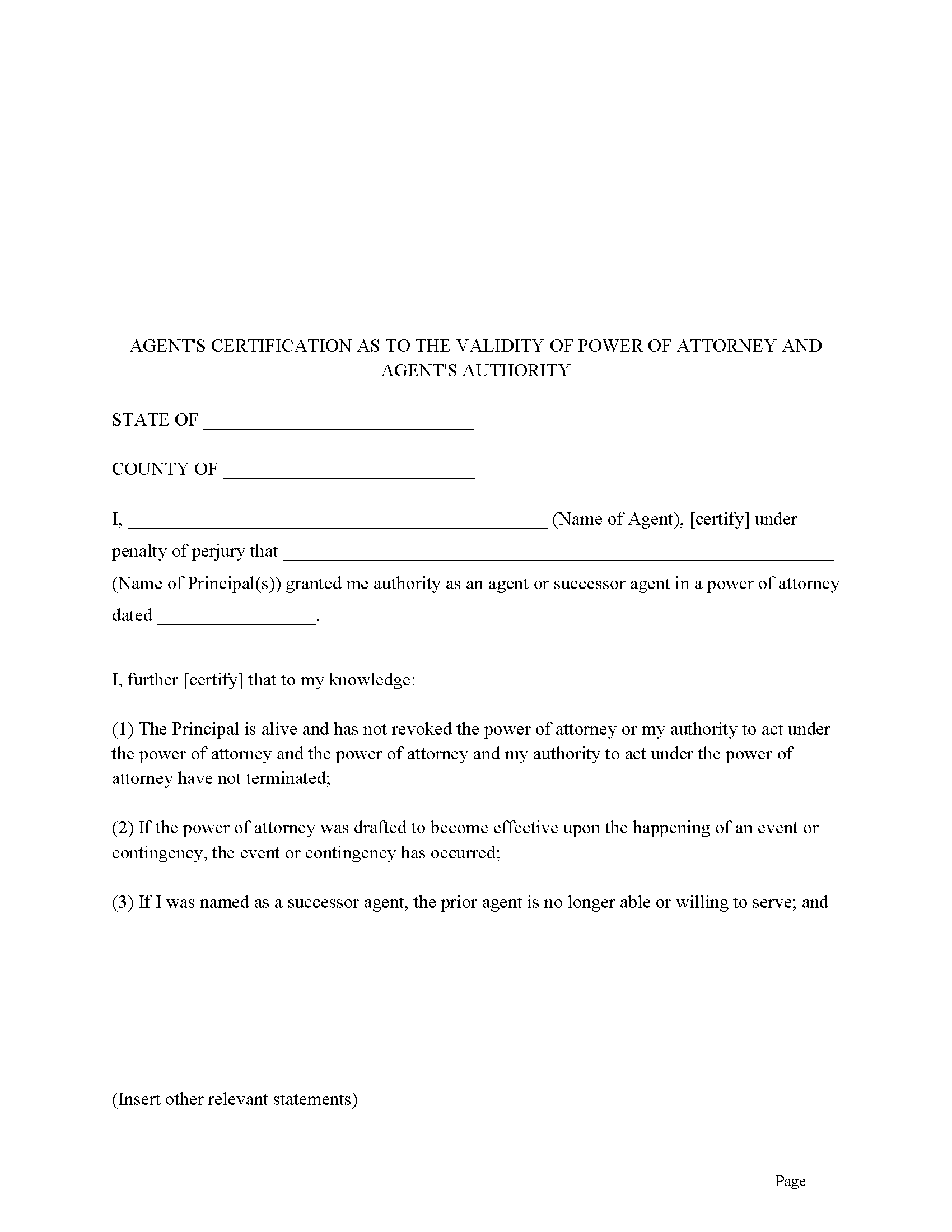

Agents Certification Form

Agent certifies he/she is authorized to act. Often required by third parties.

Included Jenkins County compliant document last validated/updated 11/12/2024

The following Georgia and Jenkins County supplemental forms are included as a courtesy with your order:

When using these Statutory Power of Attorney forms, the subject real estate must be physically located in Jenkins County. The executed documents should then be recorded in the following office:

Clerk of Superior Court

212 Harvey St / PO Box 659, Millen , Georgia 30442

Hours: 8:30 to 5:00 M-F

Phone: (478) 982-4683

Local jurisdictions located in Jenkins County include:

- Millen

- Perkins

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Jenkins County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Jenkins County using our eRecording service.

Are these forms guaranteed to be recordable in Jenkins County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jenkins County including margin requirements, content requirements, font and font size requirements.

Can the Statutory Power of Attorney forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Jenkins County that you need to transfer you would only need to order our forms once for all of your properties in Jenkins County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Georgia or Jenkins County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Jenkins County Statutory Power of Attorney forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Georgia Statutory Form cited under the ("Uniform Power of Attorney Act.") ( 10-6B-1) fully formatted for recording, includes an addendum page to add real property descriptions.

(This power of attorney is durable) unless you expressly provide in the special instructions section that is not. ["Durable" means NOT terminated by the principal's incapacity.] (10-6B-4) [ 10-6B-2 (2)]

In this power of attorney, the principal appoints Agent(s), has the option of appointing Successor Agent(s) and Second Successor Agent(s).

10-6B-11 (a) A principal may designate two or more persons to act as coagents. Unless the power of attorney otherwise provides, coagents shall exercise their authority independently.

10-6B-11 (b) (1) A principal may designate one or more successor agents to act if an agent resigns, dies, becomes incapacitated, is no longer qualified to serve, has declined to serve, or dies. A principal may grant authority to designate one or more successor agents to an agent or other person designated by name, office, or function. Unless the power of attorney otherwise provides, a successor agent shall:

General authority, the Principal may grant any or all of these subjects, by initialing the subject.

10-6B-43. Real property

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to real property shall authorize the agent to:

o (1) Demand, buy, lease, receive, accept as a gift or as security for an extension of credit, or otherwise acquire or reject an interest in real property or a right incident to real property;

o (2) Sell; exchange; convey with or without covenants, representations, or warranties; quitclaim; release; surrender; retain title for security; encumber; partition; consent to partitioning; subject to an easement or covenant; subdivide; apply for zoning or other governmental permits; plat or consent to platting; develop; grant an option concerning; lease; sublease; contribute to an entity in exchange for an interest in that entity; or otherwise grant or dispose of an interest in real property or a right incident to real property;

o (3) Pledge or mortgage an interest in real property or right incident to real property as security to borrow money or pay, renew, or extend the time of payment of a debt of the principal or a debt guaranteed by the principal;

o (4) Release, assign, satisfy, or enforce by litigation or otherwise a mortgage, deed of trust, conditional sale contract, encumbrance, lien, or other claim to real property which exists or is asserted;

o (5) Manage or conserve an interest in real property or a right incident to real property owned or claimed to be owned by the principal, including:

(A) Insuring against liability or casualty or other loss;

(B) Obtaining or regaining possession of or protecting the interest or right by litigation or otherwise;

(C) Paying, assessing, compromising, or contesting taxes or assessments or applying for and receiving refunds in connection with such taxes or assessments; and

(D) Purchasing supplies, hiring assistance or labor, and making repairs or alterations to the real property;

o (6) Use, develop, alter, replace, remove, erect, or install structures or other improvements upon real property in or incident to which the principal has, or claims to have, an interest or right;

o (7) Participate in a reorganization with respect to real property or an entity that owns an interest in or right incident to real property and receive, and hold, and act with respect to stocks and bonds or other property received in a plan of reorganization, including:

(A) Selling or otherwise disposing of them;

(B) Exercising or selling an option, right of conversion, or similar right with respect to them; and

(C) Exercising any voting rights in person or by proxy;

o (8) Change the form of title of an interest in or right incident to real property; and

o (9) Dedicate to public use, with or without consideration, easements or other real property in which the principal has, or claims to have, an interest.

10-6B-44. Tangible personal property

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to tangible personal property shall authorize the agent to:

o (1) Demand, buy, receive, accept as a gift or as security for an extension of credit, or otherwise acquire or reject ownership or possession of tangible personal property or an interest in tangible personal property;

o (2) Sell; exchange; convey with or without covenants, representations, or warranties; quitclaim; release; surrender; create a security interest in; grant options concerning; lease; sublease; or otherwise dispose of tangible personal property or an interest in tangible personal property;

o (3) Grant a security interest in tangible personal property or an interest in tangible personal property as security to borrow money or pay, renew, or extend the time of payment of a debt of the principal or a debt guaranteed by the principal;

o (4) Release, assign, satisfy, or enforce by litigation or otherwise, a security interest, lien, or other claim on behalf of the principal, with respect to tangible personal property or an interest in tangible personal property;

o (5) Manage or conserve tangible personal property or an interest in tangible personal property on behalf of the principal, including:

(A) Insuring against liability or casualty or other loss;

(B) Obtaining or regaining possession of or protecting the property or interest, by litigation or otherwise;

(C) Paying, assessing, compromising, or contesting taxes or assessments or applying for and receiving refunds in connection with such taxes or assessments;

(D) Moving the property from place to place;

(E) Storing the property for hire or on a gratuitous bailment; and

(F) Using and making repairs, alterations, or improvements to the property; and

o (6) Change the form of title of an interest in tangible personal property.

10-6B-45. Stocks and bonds Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to stocks and bonds shall authorize the agent to:

(1) Buy, sell, and exchange stocks and bonds;

(2) Establish, continue, modify, or terminate an account with respect to stocks and bonds;

(3) Pledge stocks and bonds as security to borrow, pay, renew, or extend the time of payment of a debt of the principal;

(4) Receive certificates and other evidences of ownership with respect to stocks and bonds; and

(5) Exercise voting rights with respect to stocks and bonds in person or by proxy, enter into voting trusts, and consent to limitations on the right to vote.

10-6B-46. Commodities and options

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to commodities and options shall authorize the agent to:

o (1) Buy, sell, exchange, assign, settle, and exercise commodity futures contracts and call or put options on stocks or stock indexes traded on a regulated option exchange; and

o (2) Establish, continue, modify, and terminate option accounts.

10-6B-47. Banks and other financial institutions

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to banks and other financial institutions shall authorize the agent to:

o (1) Continue, modify, and terminate an account or other banking arrangement made by or on behalf of the principal;

o (2) Establish, modify, and terminate an account or other banking arrangement with a bank, trust company, savings and loan association, credit union, thrift company, brokerage firm, or other financial institution selected by the agent;

o (3) Contract for services available from a financial institution, including renting a safe deposit box or space in a vault;

o (4) Withdraw, by check, order, electronic funds transfer, or otherwise, money or property of the principal deposited with or left in the custody of a financial institution;

o (5) Receive statements of account, vouchers, notices, and similar documents from a financial institution and act with respect to them;

o (6) Enter a safe deposit box or vault and withdraw or add to the contents;

o (7) Borrow money and pledge as security personal property of the principal necessary to borrow money or pay, renew, or extend the time of payment of a debt of the principal or a debt guaranteed by the principal;

o (8) Make, assign, draw, endorse, discount, guarantee, and negotiate promissory notes, checks, drafts, and other negotiable or nonnegotiable paper of the principal or payable to the principal or the principal's order, transfer money, receive the cash or other proceeds of those transactions, and accept a draft drawn by a person upon the principal and pay it when due;

o (9) Receive for the principal and act upon a sight draft, warehouse receipt, or other document of title whether tangible or electronic, or other negotiable or nonnegotiable instrument;

o (10) Apply for, receive, and use letters of credit, credit and debit cards, electronic transaction authorizations, and traveler's checks from a financial institution and give an indemnity or other agreement in connection with letters of credit; and

o (11) Consent to an extension of the time of payment with respect to commercial paper or a financial transaction with a financial institution.

10-6B-48. Operation of entity or business

* Subject to the terms of a document or an agreement governing an entity or an entity ownership interest, and unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to operation of an entity or business shall authorize the agent to:

o (1) Operate, buy, sell, enlarge, reduce, or terminate an ownership interest;

o (2) Perform a duty or discharge a liability and exercise in person or by proxy a right, power, privilege, or option that the principal has, may have, or claims to have;

o (3) Enforce the terms of an ownership agreement;

o (4) Initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to litigation to which the principal is a party because of an ownership interest;

o (5) Exercise in person or by proxy, or enforce by litigation or otherwise, a right, power, privilege, or option the principal has or claims to have as the holder of stocks and bonds;

o (6) Initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to litigation to which the principal is a party concerning stocks and bonds;

o (7) With respect to an entity or business owned solely by the principal:

(A) Continue, modify, renegotiate, extend, and terminate a contract made by or on behalf of the principal with respect to the entity or business before execution of the power of attorney;

(B) Determine:

(i) The location of its operation;

(ii) The nature and extent of its business;

(iii) The methods of manufacturing, selling, merchandising, financing, accounting, and advertising employed in its operation;

(iv) The amount and types of insurance carried; and

(v) The mode of engaging, compensating, and dealing with its employees and accountants, attorneys, or other advisors;

(C) Change the name or form of organization under which the entity or business is operated and enter into an ownership agreement with other persons to take over all or part of the operation of the entity or business; and

(D) Demand and receive money due or claimed by the principal or on the principal's behalf in the operation of the entity or business and control and disburse the money in the operation of the entity or business;

o (8) Put additional capital into an entity or business in which the principal has an interest;

o (9) Join in a plan of reorganization, consolidation, conversion, domestication, or merger of the entity or business;

o (10) Sell or liquidate all or part of an entity or business;

o (11) Establish the value of an entity or business under a buy-out agreement to which the principal is a party;

o (12) Prepare, sign, file, and deliver reports, compilations of information, returns, or other papers with respect to an entity or business and make related payments; and

o (13) Pay, compromise, or contest taxes, assessments, fines, or penalties and perform any other act to protect the principal from illegal or unnecessary taxation, assessments, fines, or penalties, with respect to an entity or business, including attempts to recover, in any manner permitted by law, money paid before or after the execution of the power of attorney.

10-6B-49. Insurance and annuities

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to insurance and annuities shall authorize the agent to:

o (1) Continue, pay the premium or make a contribution on, modify, exchange, rescind, release, or terminate a contract procured by or on behalf of the principal which insures or provides an annuity to either the principal or another person, whether or not the principal is a beneficiary under the contract;

o (2) Procure new, different, and additional contracts of insurance and annuities for the principal and the principal's spouse, children, and other dependents, and select the amount, type of insurance or annuity, and mode of payment;

o (3) Pay the premium or make a contribution on, modify, exchange, rescind, release, or terminate a contract of insurance or annuity procured by the agent;

o (4) Apply for and receive a loan secured by a contract of insurance or annuity;

o (5) Surrender and receive the cash surrender value on a contract of insurance or annuity;

o (6) Exercise an election;

o (7) Exercise investment powers available under a contract of insurance or annuity;

o (8) Change the manner of paying premiums on a contract of insurance or annuity;

o (9) Change or convert the type of insurance or annuity with respect to which the principal has or claims to have authority described in this Code section;

o (10) Apply for and procure a benefit or assistance under a law or regulation to guarantee or pay premiums of a contract of insurance on the life of the principal;

o (11) Collect, sell, assign, hypothecate, borrow against, or pledge the interest of the principal in a contract of insurance or annuity;

o (12) Select the form and timing of the payment of proceeds from a contract of insurance or annuity; and

o (13) Pay, from proceeds or otherwise, compromise or contest, and apply for refunds in connection with, a tax or assessment levied by a taxing authority with respect to a contract of insurance or annuity or its proceeds or liability accruing by reason of such tax or assessment.

10-6B-50. Estates, trusts, and other beneficial interests

* (a) As used in this Code section, the term "estate, trust, or other beneficial interest" means a trust, probate estate, guardianship, conservatorship, escrow, or custodianship or a fund from which the principal is, may become, or claims to be, entitled to a share or payment.

* (b) Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to estates, trusts, and other beneficial interests shall authorize the agent to:

o (1) Accept, receive, receipt for, sell, assign, pledge, or exchange a share in or payment from an estate, trust, or other beneficial interest;

o (2) Demand or obtain money or any other thing of value to which the principal is, may become, or claims to be, entitled by reason of an estate, trust, or other beneficial interest, by litigation or otherwise;

o (3) Exercise for the benefit of the principal a presently exercisable general power of appointment held by the principal;

o (4) Initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to litigation to ascertain the meaning, validity, or effect of a deed, will, declaration of trust, or other instrument or transaction affecting the interest of the principal;

o (5) Initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to litigation to remove, substitute, or surcharge a fiduciary;

o (6) Conserve, invest, disburse, or use anything received for an authorized purpose;

o (7) Transfer an interest of the principal in real property, stocks and bonds, accounts with financial institutions or securities intermediaries, insurance, annuities, and other property to the trustee of a revocable trust created by the principal as settlor; and

o (8) Reject, renounce, disclaim, release, or consent to a reduction in or modification of a share in or payment from an estate, trust, or other beneficial interest.

10-6B-51. Claims and litigation

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to claims and litigation shall authorize the agent to:

o (1) Assert and maintain before a court or administrative agency a claim, claim for relief, cause of action, counterclaim, offset, recoupment, or defense, including an action to recover property or any other thing of value, recover damages sustained by the principal, eliminate or modify tax liability, or seek an injunction, specific performance, or other relief;

o (2) Bring an action to determine adverse claims or intervene or otherwise participate in litigation;

o (3) Seek an attachment, garnishment, order of arrest, or other preliminary, provisional, or intermediate relief and use an available procedure to effect or satisfy a judgment, order, or decree;

o (4) Make or accept a tender, offer of judgment, or admission of facts, submit a controversy on an agreed statement of facts, consent to examination, and bind the principal in litigation;

o (5) Submit to alternative dispute resolution, settle, and propose or accept a compromise;

o (6) Waive the issuance and service of process upon the principal, accept service of process, appear for the principal, designate persons upon which process directed to the principal may be served, execute and file or deliver stipulations on the principal's behalf, verify pleadings, seek appellate review, procure and give surety and indemnity bonds, contract and pay for the preparation and printing of records and briefs, receive, execute, and file or deliver a consent, waiver, release, confession of judgment, satisfaction of judgment, notice, agreement, or other instrument in connection with the prosecution, settlement, or defense of a claim or litigation;

o (7) Act for the principal with respect to bankruptcy or insolvency, whether voluntary or involuntary, concerning the principal or some other person, or with respect to a reorganization, receivership, or application for the appointment of a receiver or trustee which affects an interest of the principal in property or any other thing of value;

o (8) Pay a judgment, award, or order against the principal or a settlement made in connection with a claim or litigation; and

o (9) Receive money or any other thing of value paid in settlement of or as proceeds of a claim or litigation.

10-6B-52. Personal and family maintenance

* (a) Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to personal and family maintenance shall authorize the agent to:

o (1) Perform the acts necessary to maintain the customary standard of living of the principal, the principal's spouse, and the following individuals, whether living when the power of attorney is executed or later born:

(A) The principal's minor children;

(B) The principal's adult children who are pursuing a postsecondary school education and are under 25 years of age;

(C) The principal's parents or the parents of the principal's spouse, if the principal had established a pattern of such payments; and

(D) Any other individuals legally entitled to be supported by the principal;

o (2) Make periodic payments of child support and other family maintenance required by a court or governmental agency or an agreement to which the principal is a party;

o (3) Provide living quarters for the individuals described in paragraph (1) of this subsection by:

(A) Purchase, lease, or other contract; or

(B) Paying the operating costs, including interest, amortization payments, repairs, improvements, and taxes, for premises owned by the principal or occupied by those individuals;

o (4) Provide normal domestic help, usual vacations and travel expenses, and funds for shelter, clothing, food, appropriate education, including postsecondary and vocational education, and other current living costs for individuals described in paragraph (1) of this subsection to enable such individuals to maintain their customary standard of living;

o (5) Pay expenses for necessary health care and custodial care on behalf of the individuals described in paragraph (1) of this subsection;

o (6) Act as the principal's personal representative pursuant to the Health Insurance Portability and Accountability Act, Sections 1171 through 1179 of the Social Security Act, 42 U.S.C. Section 1320d, in effect on February 1, 2017, and applicable regulations in effect on February 1, 2017, in making decisions related to the past, present, or future payment for the provision of health care consented to by the principal or anyone authorized under the laws of this state to consent to health care on behalf of the principal;

o (7) Continue any provision made by the principal for automobiles or other means of transportation, including registering, licensing, insuring, and replacing them, for the individuals described in paragraph (1) of this subsection;

o (8) Maintain credit and debit accounts for the convenience of the individuals described in paragraph (1) of this subsection and open new accounts; and

o (9) Continue payments incidental to the membership or affiliation of the principal in a religious institution, club, society, order, or other organization or to continue contributions to those organizations.

* (b) Authority with respect to personal and family maintenance shall be neither dependent upon, nor limited by, authority that an agent may or may not have with respect to gifts under this chapter.

10-6B-53. Benefits from governmental programs or civil or military service

* (a) As used in this Code section, the term "benefits from governmental programs or civil or military service" means any benefit, program, or assistance provided under a law or regulation, including Social Security, medicare, and Medicaid.

* (b) Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to benefits from governmental programs or civil or military service shall authorize the agent to:

o (1) Execute vouchers in the name of the principal for allowances and reimbursements payable by the United States or a foreign government or by a state or political subdivision of a state to the principal, including allowances and reimbursements for transportation of the individuals described in paragraph (1) of subsection (a) of Code Section 10-6B-52, and for shipment of their household effects;

o (2) Take possession and order the removal and shipment of property of the principal from a post, warehouse, depot, dock, or other place of storage or safekeeping, either governmental or private, and execute and deliver a release, voucher, receipt, bill of lading, shipping ticket, certificate, or other instrument for such purpose;

o (3) Enroll in, apply for, select, reject, change, amend, or discontinue, on the principal's behalf, a benefit or program;

o (4) Prepare, file, and maintain a claim of the principal for a benefit or assistance, financial or otherwise, to which such principal may be entitled under a law or regulation;

o (5) Initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to litigation concerning any benefit or assistance the principal may be entitled to receive under a law or regulation; and

o (6) Receive the financial proceeds of a claim described in paragraph (4) of this subsection and conserve, invest, disburse, or use for a lawful purpose anything so received.

10-6B-54. Retirement plans

* (a) As used in this Code section, the term "retirement plan" means a plan or account created by an employer, the principal, or another individual to provide retirement benefits or deferred compensation of which such principal is a participant, beneficiary, or owner, including a plan or account under the following sections of the Internal Revenue Code:

o (1) An individual retirement account under Internal Revenue Code Section 408, 26 U.S.C. Section 408, in effect on February 1, 2017;

o (2) A Roth individual retirement account under Internal Revenue Code Section 408A, 26 U.S.C. Section 408A, in effect on February 1, 2017;

o (3) A deemed individual retirement account under Internal Revenue Code Section 408(q), 26 U.S.C. Section 408(q), in effect on February 1, 2017;

o (4) An annuity or mutual fund custodial account under Internal Revenue Code Section 403(b), 26 U.S.C. Section 403(b), in effect on February 1, 2017;

o (5) A pension, profit-sharing, stock bonus, or other retirement plan qualified under Internal Revenue Code Section 401(a), 26 U.S.C. Section 401(a), in effect on February 1, 2017;

o (6) A plan under Internal Revenue Code Section 457(b), 26 U.S.C. Section 457(b), in effect on February 1, 2017; and

o (7) A nonqualified deferred compensation plan under Internal Revenue Code Section 409A, 26 U.S.C. Section 409A, in effect on February 1, 2017.

* (b) Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to retirement plans shall authorize the agent to:

o (1) Select the form and timing of payments under a retirement plan and withdraw benefits from a plan;

o (2) Make a rollover, including a direct trustee-to-trustee rollover, of benefits from one retirement plan to another;

o (3) Establish a retirement plan in the principal's name;

o (4) Make contributions to a retirement plan;

o (5) Exercise investment powers available under a retirement plan; and

o (6) Borrow from, sell assets to, or purchase assets from a retirement plan.

10-6B-55. Taxes

* Unless the power of attorney otherwise provides, language in a power of attorney granting general authority with respect to taxes shall authorize the agent to:

o (1) Prepare, sign, and file federal, state, local, and foreign income, gift, payroll, property, Federal Insurance Contributions Act, and other tax returns, claims for refunds, requests for extension of time, petitions regarding tax matters, and any other tax-related documents, including receipts, offers, waivers, consents, including consents and agreements under Internal Revenue Code Section 2032A, 26 U.S.C. Section 2032A, in effect on February 1, 2017, closing agreements, and any power of attorney required by the Internal Revenue Service or other taxing authority with respect to a tax year upon which the statute of limitations has not run and the following 25 tax years;

o (2) Pay taxes due, collect refunds, post bonds, receive confidential information, and contest deficiencies determined by the Internal Revenue Service or other taxing authority;

o (3) Exercise any election available to the principal under federal, state, local, or foreign tax law; and

o (4) Act for the principal in all tax matters for all periods before the Internal Revenue Service, or other taxing authority.

Your agent SHALL NOT do any of the following specific acts for you UNLESS you have INITIALED the specific authority listed below: (CAUTION: Granting any of the following will give your agent the authority to take actions that could significantly reduce your property or change how your property is distributed at your death.

GA Code 10-6B-40 Agent authority that requires specific grant; granting of general authority

(a) An agent under a power of attorney may do the following on behalf of the principal or with the principal's property only if the power of attorney expressly grants the agent the authority and exercise of the authority is not otherwise prohibited by another agreement or instrument to which the authority or property is subject:

(1) Create, amend, revoke, or terminate an inter vivos trust;

(2) Make a gift;

(3) Create or change rights of survivorship;

(4) Create or change a beneficiary designation;

(5) Delegate authority granted under the power of attorney;

(6) Waive the principal's right to be a beneficiary of a joint and survivor annuity, including a survivor benefit under a retirement plan;

(7) Exercise fiduciary powers that the principal has authority to delegate;

(8) Exercise authority over the content of electronic communications, as defined in 18 U.S.C. Section 2510(12), in effect on February 1, 2017, sent or received by the principal; or

(9) Disclaim property, including a power of appointment.

(b) Notwithstanding a grant of authority to do an act described in subsection (a) of this Code section, unless the power of attorney otherwise provides, an agent that is not an ancestor, spouse, or descendant of the principal, shall not exercise authority under a power of attorney to create in the agent, or in an individual to whom the agent owes a legal obligation of support, an interest in the principal's property, whether by gift, right of survivorship, beneficiary designation, disclaimer, or otherwise.

(c) Subject to subsections (a), (b), (d), and (e) of this Code section, if a power of attorney grants to an agent authority to do all acts that a principal could do, the agent has the general authority described in Code Sections 10-6B-43 through 10-6B-55.

(d) Unless the power of attorney otherwise provides, a grant of authority to make a gift shall be subject to Code Section 10-6B-56.

(e) Subject to subsections (a), (b), and (d) of this Code section, if the subjects over which authority is granted in a power of attorney are similar or overlap, the broadest authority shall control.

(f) Authority granted in a power of attorney is exercisable with respect to property that the principal has when the power of attorney is executed or acquires later, whether or not the property is located in this state and whether or not the authority is exercised or the power of attorney is executed in this state.

(g) An act performed by an agent pursuant to a power of attorney shall have the same effect and inures to the benefit of and binds the principal and the principal's successors in interest as if the principal had performed the act.

(Georgia Statutory POA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Jenkins County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jenkins County Statutory Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Omid B.

January 14th, 2021

Super efficient, extremely responsive , and above all quick turnaround. Thank you! Will definitely use your services again!

Thank you!

Stanley S.

September 23rd, 2022

Extremely convenient and easy to execute the document. Instructions and example are very helpful. I have bookmarked the site and will surely use again. 5 stars!!

Thank you!

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Marsha D.

September 25th, 2020

Outstanding product and so easy to use! Highly recommend this product. We successfully used the Virginia deeds. Thank you.

Thank you!

Sue D.

November 28th, 2019

Great program

Thank you!

Jesse H.

November 8th, 2021

Good & friendly software, complete & clear instructions & guidance, generates proper forms that were readily accepted @ Clerk & Recorder Office, all of this @ reasonable cost. Five Stars!

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda M. K.

August 2nd, 2020

Great service

Easy to do

Efficient

Thank you for your feedback. We really appreciate it. Have a great day!

Cecelia S.

July 31st, 2021

I was looking for a copy of my deed and was able to complete the request and get copy fast.

Thank you!

Prentis T.

September 9th, 2019

So far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen U.

December 5th, 2020

This is another great deal that has come out of the quarantine for covid. Saved me hours and days of time. and provides a way to file deeds that really isn't done effectively anyway else. It was also very inexpensive that you would not expect. I didn't even have to leave home.

Thank you for your feedback. We really appreciate it. Have a great day!

Iryna D.

March 31st, 2020

Exelent work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!