Gordon County Revocation of Transfer on Death Deed Form (Georgia)

All Gordon County specific forms and documents listed below are included in your immediate download package:

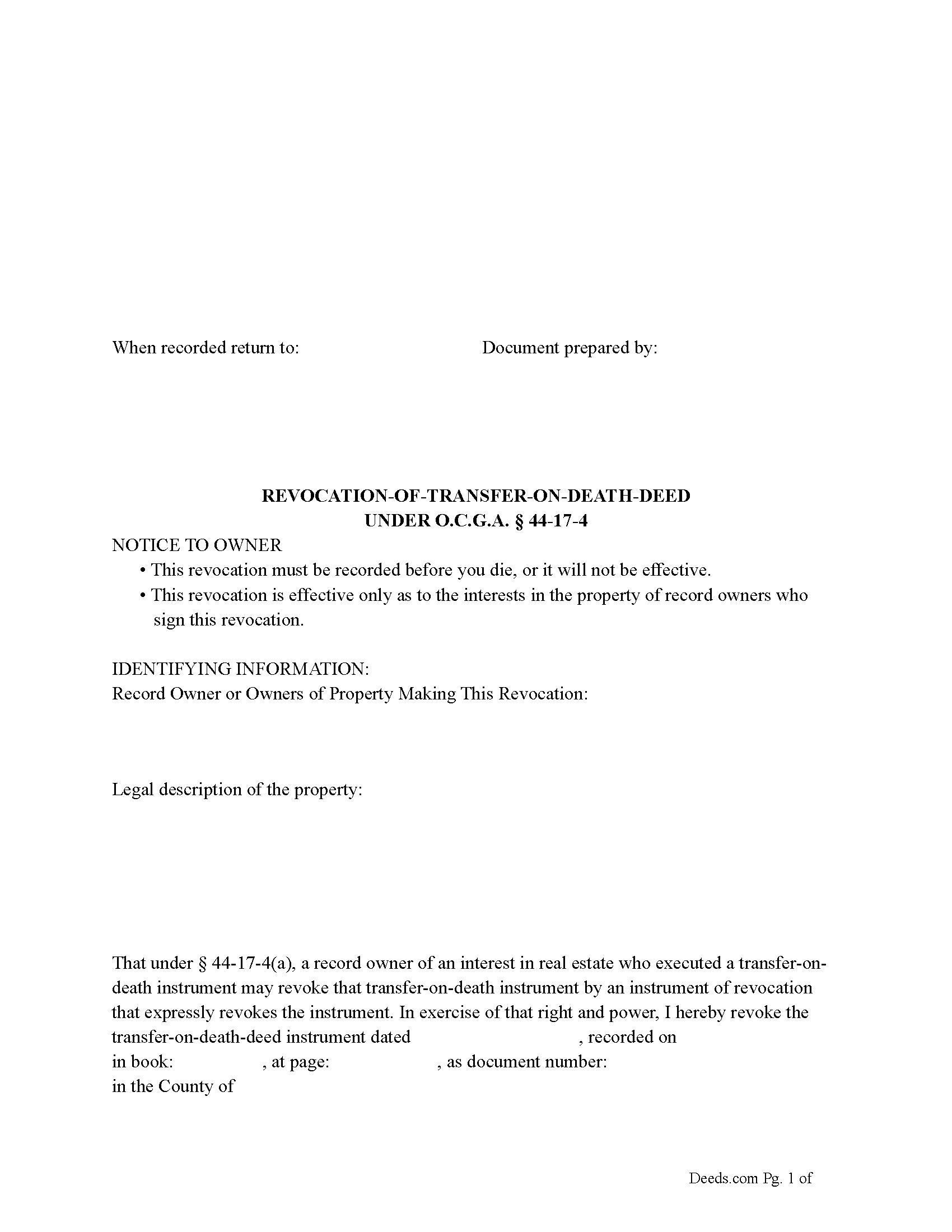

Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

Included Gordon County compliant document last validated/updated 9/18/2024

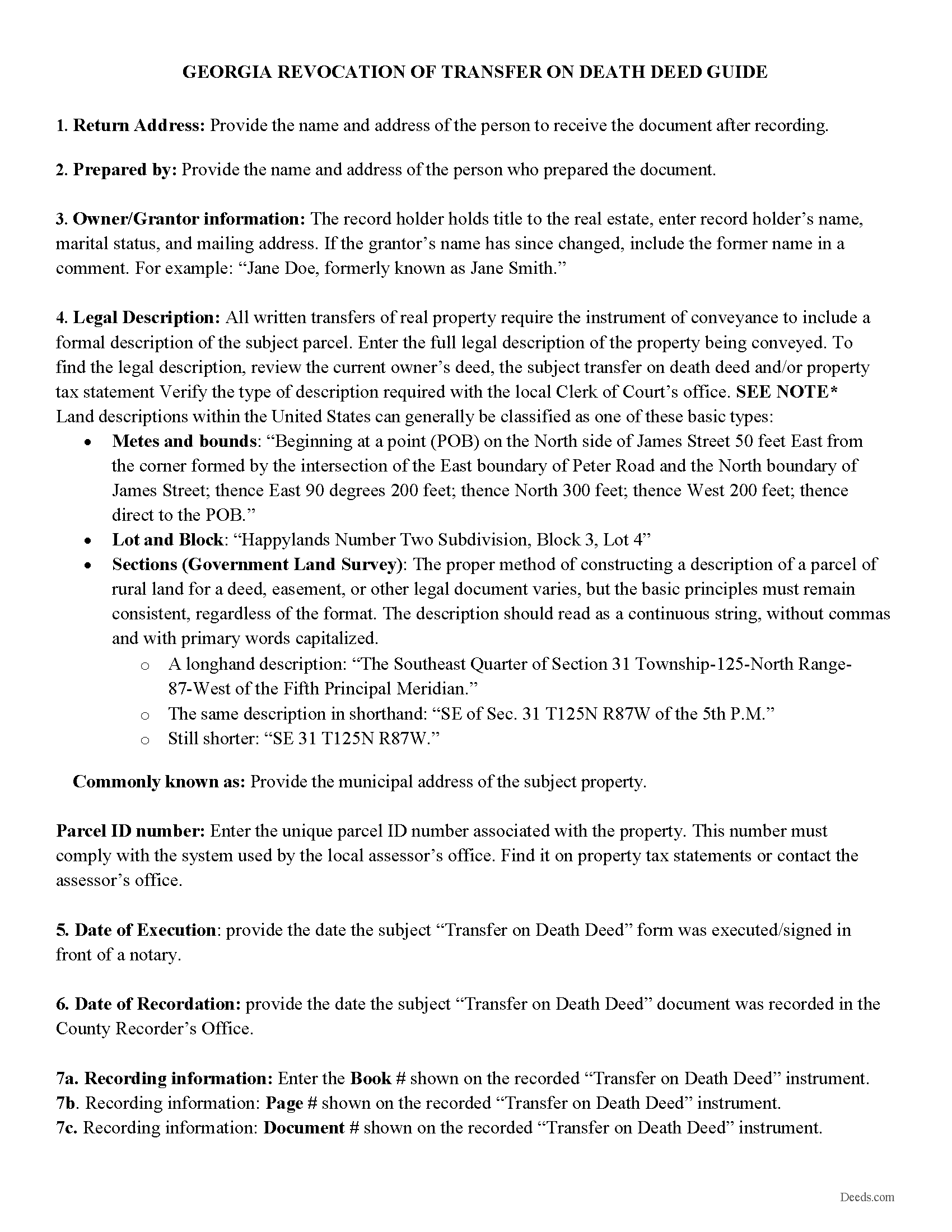

Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

Included Gordon County compliant document last validated/updated 10/11/2024

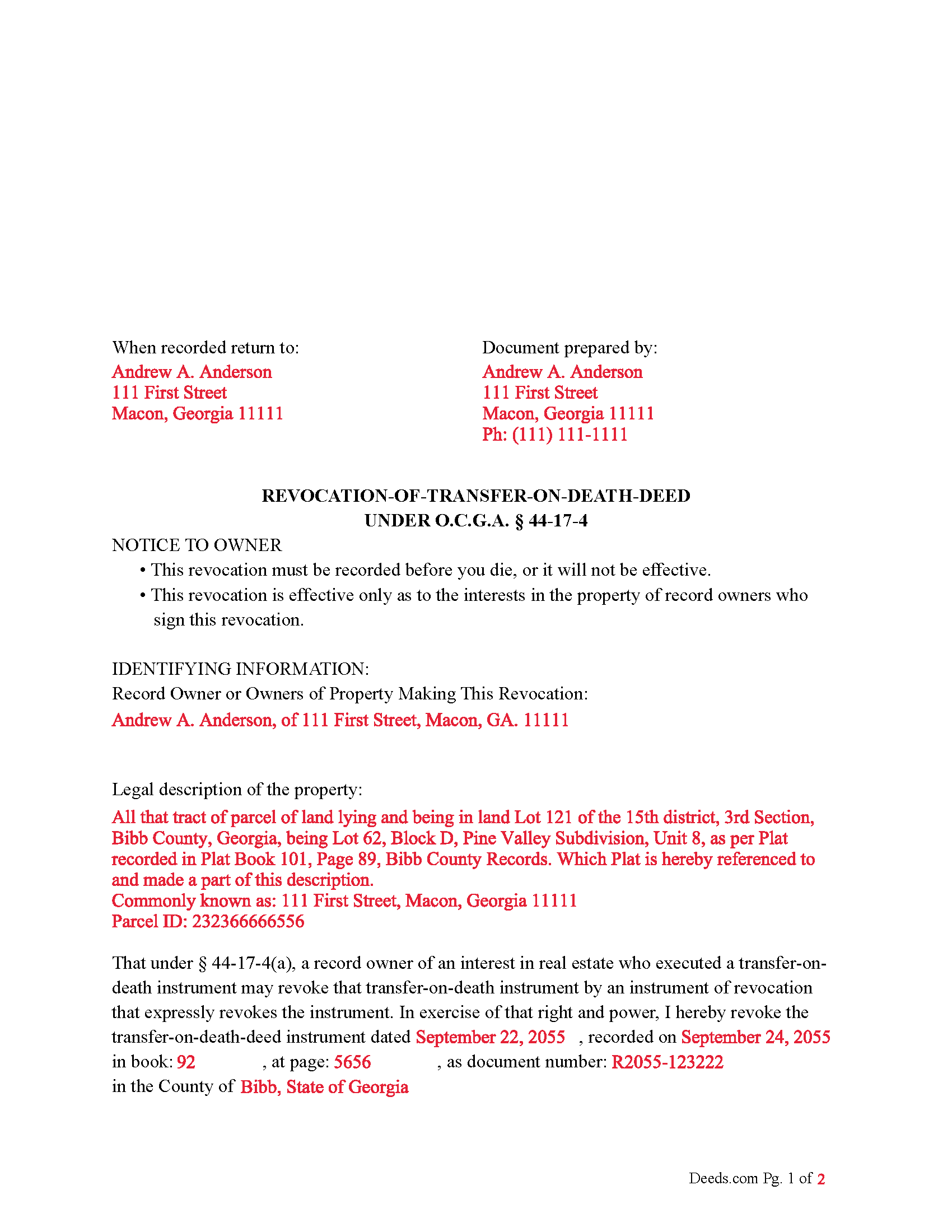

Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

Included Gordon County compliant document last validated/updated 10/29/2024

The following Georgia and Gordon County supplemental forms are included as a courtesy with your order:

When using these Revocation of Transfer on Death Deed forms, the subject real estate must be physically located in Gordon County. The executed documents should then be recorded in the following office:

Clerk of Superior Court

Courthouse - 100 South Wall St, First Floor, Calhoun, Georgia 30701

Hours: 8:30 to 5:00 M-F

Phone: 706-879-2299

Local jurisdictions located in Gordon County include:

- Calhoun

- Fairmount

- Oakman

- Plainville

- Ranger

- Resaca

- Sugar Valley

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Gordon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Gordon County using our eRecording service.

Are these forms guaranteed to be recordable in Gordon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gordon County including margin requirements, content requirements, font and font size requirements.

Can the Revocation of Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Gordon County that you need to transfer you would only need to order our forms once for all of your properties in Gordon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Georgia or Gordon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Gordon County Revocation of Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Our Promise

The documents you receive here will meet, or exceed, the Gordon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gordon County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Ronald L.

January 21st, 2021

There is not enough room on the form to describe my property which was taken directly from the previous deed. Other than that worked as expected.

Thank you for your feedback. We really appreciate it. Have a great day!

JAVIER B.

February 11th, 2021

EXCELLENT JOB DEEDS.COM

I AM SO PROUD I WAS ABLE TO RECEIVE A COPY OF THE REAL ESTATE DEED FROM MY OLD HOME OUT OF TOWN. HIGHLY RECOMMEND!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

January 30th, 2023

Had the forms i needed for illinois. More than i expected. Most companies would charge per form.

Thank you!

Lynne Z.

April 22nd, 2022

not enough room for legal description. Wouldn't allow me to enter widow status in owner box. Not clear who to send it to so I printed it out and will ask the notary who I use for recording it.

Thank you!

Joni Y.

November 25th, 2019

Deeds.com is a very up to date & easy instruction website. I recommend this site to all who are looking for forms dealing with deeds. Thank you for making life easy in this aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matilde A.

October 25th, 2021

Very easy to navigate... will be back to use!

Thank you for your feedback. We really appreciate it. Have a great day!

Ray L.

February 8th, 2019

Thank you, I am very satisfied with the process and will provide a final review after the documents are completed and accepted by the state.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth L.

November 5th, 2019

Used this site and the forms a few times now and always a good experience. It's so nice to be able to download these forms to my computer and work on them there. So many others want you to do everything online, pain in my opinion. Thank you Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Jeannette C.

October 22nd, 2021

Very useful service!

This was easy and quick. It guides you through each step and emails update you during the process.

Will use again!

Thank you!

Greg G.

January 7th, 2021

Easiest Filing I've ever done, and filed in 24 hours.

Thank you!

Linda s.

October 10th, 2020

This was such an easy process and even tho you had to pay a $15 - to me it was well worth not having to drive downtown etc or take the risk of mailing the documents (fearing that they would get lost). I'll be using this from now on...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John S.

April 22nd, 2021

The website is very user-friendly. Easily to download forms.

Thank you!