Morgan County Grant Deed Form (Georgia)

All Morgan County specific forms and documents listed below are included in your immediate download package:

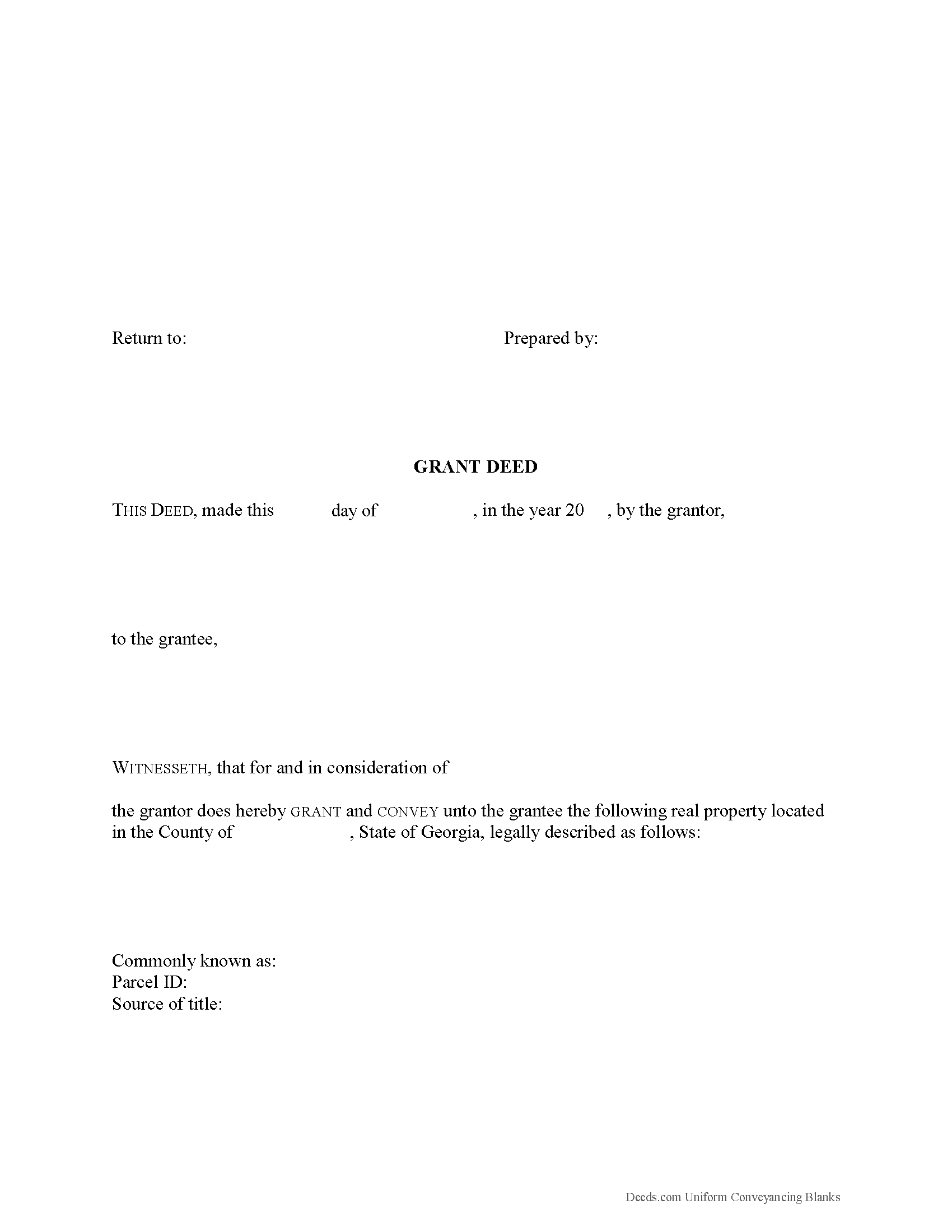

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Morgan County compliant document last validated/updated 8/29/2024

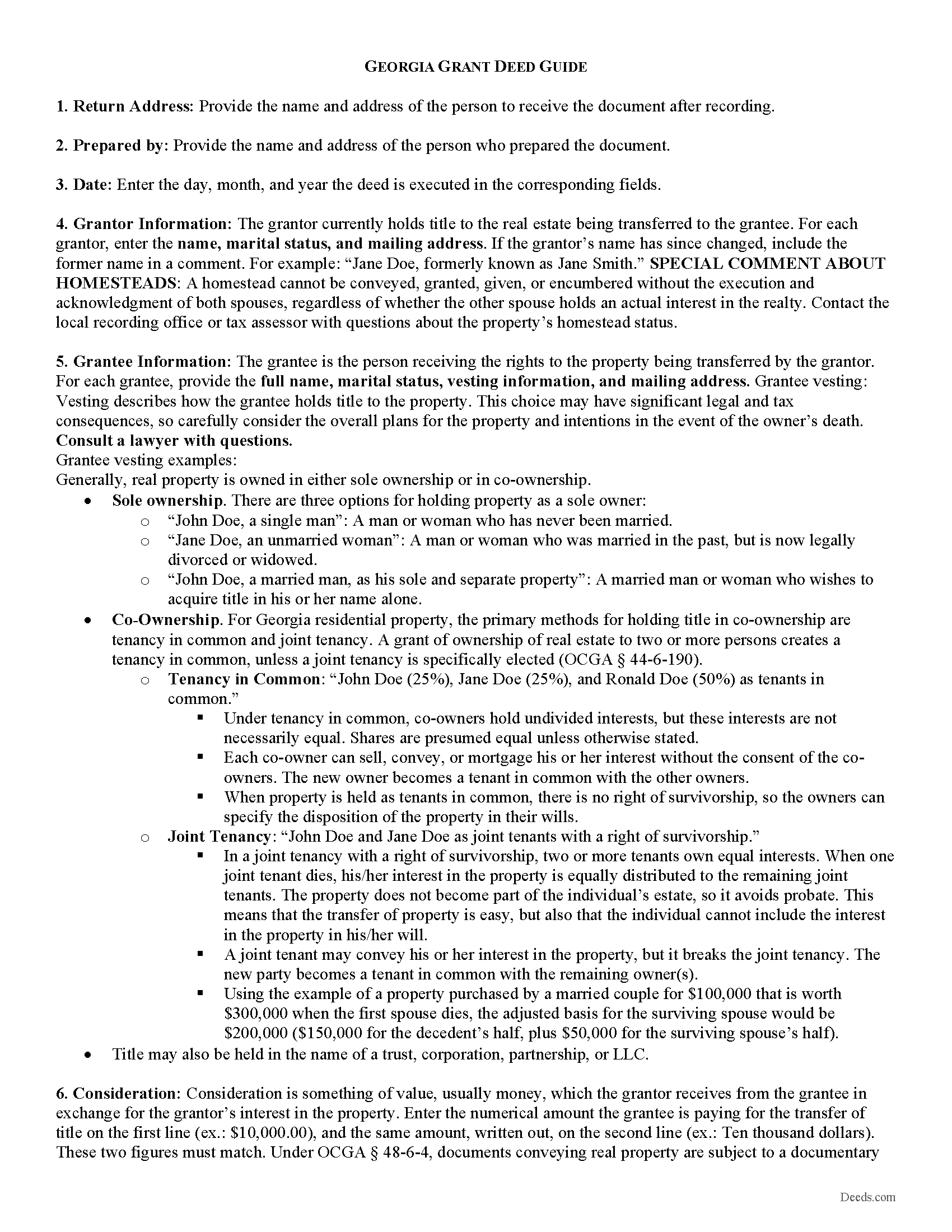

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Morgan County compliant document last validated/updated 10/29/2024

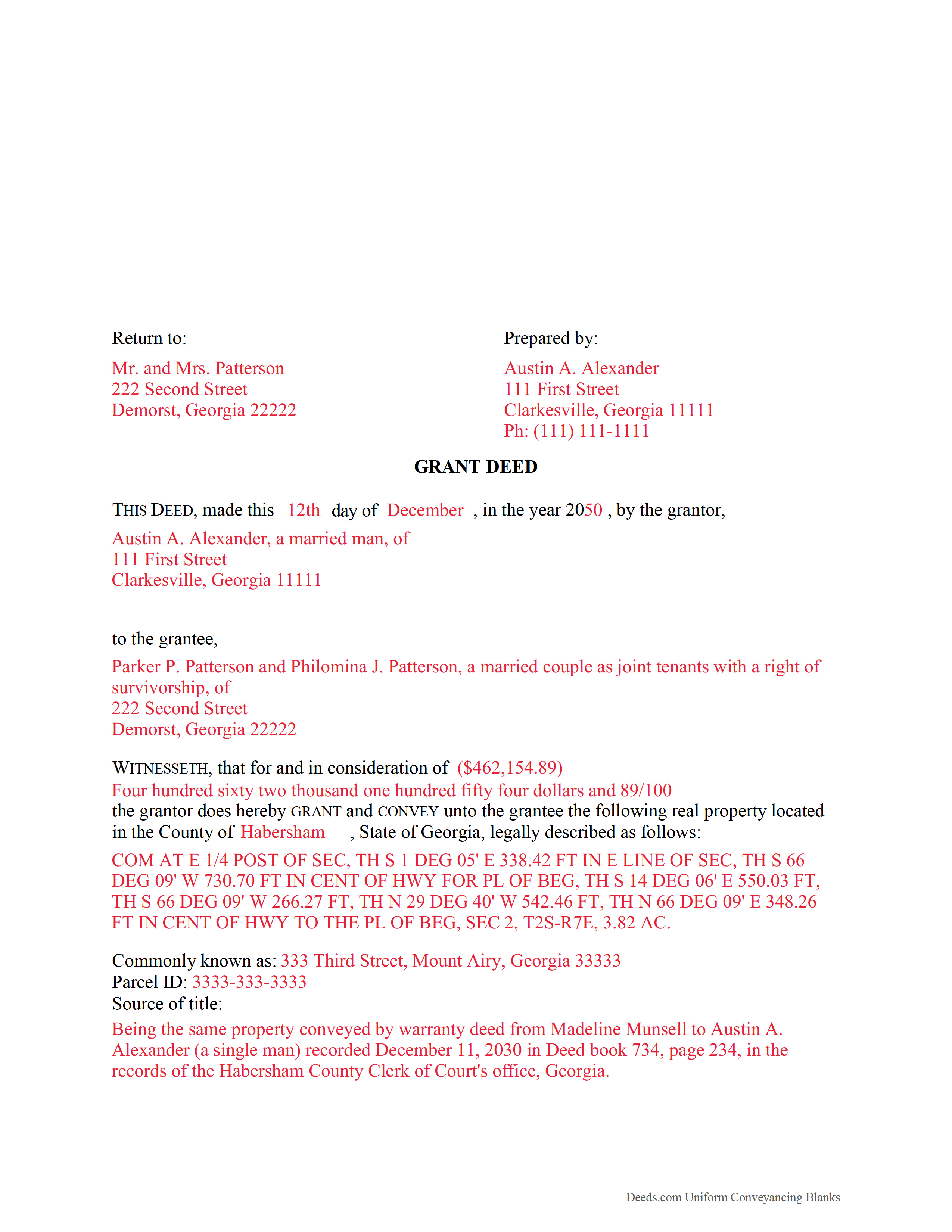

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Morgan County compliant document last validated/updated 9/12/2024

The following Georgia and Morgan County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Morgan County. The executed documents should then be recorded in the following office:

Clerk of Superior Court

384 Hancock St / PO Drawer 551, Madison, Georgia 30650

Hours: 9:00am to 5:00pm M-F

Phone: (706) 342-3605

Local jurisdictions located in Morgan County include:

- Bostwick

- Buckhead

- High Shoals

- Madison

- Rutledge

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Morgan County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Morgan County using our eRecording service.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Morgan County that you need to transfer you would only need to order our forms once for all of your properties in Morgan County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Georgia or Morgan County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Morgan County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A grant deed is a real estate deed that is used to transfer real property in Georgia from one entity to another. There are no statutory forms provided for a grant deed in Georgia. If a deed sufficiently makes known the transaction between the parties, no want of form will invalidate it ( 44-5-33). In a grant deed, the grantor warrants and forever defends the right and title to the described property unto the grantee and the grantee's heirs and assigns against the claims of all persons owning, holding, and claiming by, through, or under the grantor.

When submitting a grant deed for recordation, it must be an original, signed by the grantor, and should be attested or acknowledged as required by law ( 44-2-14). Grant deeds executed in Georgia may be attested by a judge of a court of record, including a judge of a municipal court, or by a magistrate, a notary public, or a clerk or deputy clerk of a superior court or of a city court created by a special act of the General Assembly. With the exception of notaries public and judges of courts of record, such officers may only attest instruments only in the county in which they respectively hold their offices ( 44-2-15). In order to record a grant deed that has been executed out of state, the deed must be attested or acknowledged before one of the officers listed in 44-2-21 and must be attested before two witnesses, one of whom may be the official taking acknowledgments ( 44-2-21). Grant deeds executed in Georgia also require two witnesses. A grant deed must also be accompanied by a completed real estate transfer tax form.

A grant deed should be recorded in the office of the clerk of the superior court in the county where the property is located. The recording act in Georgia is a race-notice act. A grant deed can be recorded at any time, but a prior unrecorded deed will lose its priority over a subsequent recorded deed from the same vendor when the purchaser takes such deed without notice of the existence of the prior deed ( 44-2-1). Deeds, mortgages, and liens of all kinds that are required by law to be recorded in the office of the clerk of the superior court and which are against the interests of third parties who have acquired a transfer or lien binding the same property and who are acting in good faith and without notice will take effect only from the time they are filed for record in the clerk's office ( 44-2-2b).

(Georgia Grant Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Edith T.

August 20th, 2021

this was wonderful. I found everything very easy to understand. And great examples.

Thank you!

Rubin C.

July 19th, 2020

Very good forms and the online recording was a blessing.

Thank you for your feedback. We really appreciate it. Have a great day!

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Don M.

February 17th, 2023

The process was easy going. The process is one thing, the results another. I have attempting to resolve this matter, of claiming sole ownership of the property for several YEARS. I lost my Bride of 65 years in 2015. A lawyer I hired failed in his attempt, so I'm waiting to see the actual results.

I also have two parcels in New Mexico under the same situation, so if this is successful, I'll gladly be back. Thank You so very much. Don Martin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erika K.

July 3rd, 2020

Very Easy to use, especially since the county recorder's office is closed due to COVID-19

Thank you!

Robert I.

May 9th, 2023

This site was easy to use with full instructions on how to fill out and file forms very good

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George R.

September 29th, 2021

Your website worked but I am waiting for answers for two questions.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda A.

April 21st, 2022

This was perfect for providing the necessary forms. Easy to enter needed information. I would recommend this for legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property.

My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

David M.

August 9th, 2023

A real boon to those of us who are not attorneys but wish to protect our assets and avoid probate court issues. Thank you for a great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara M.

August 2nd, 2020

Easy to do.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!