Citrus County Unconditional Waiver and Release of Lien upon Progress Payment Form (Florida)

All Citrus County specific forms and documents listed below are included in your immediate download package:

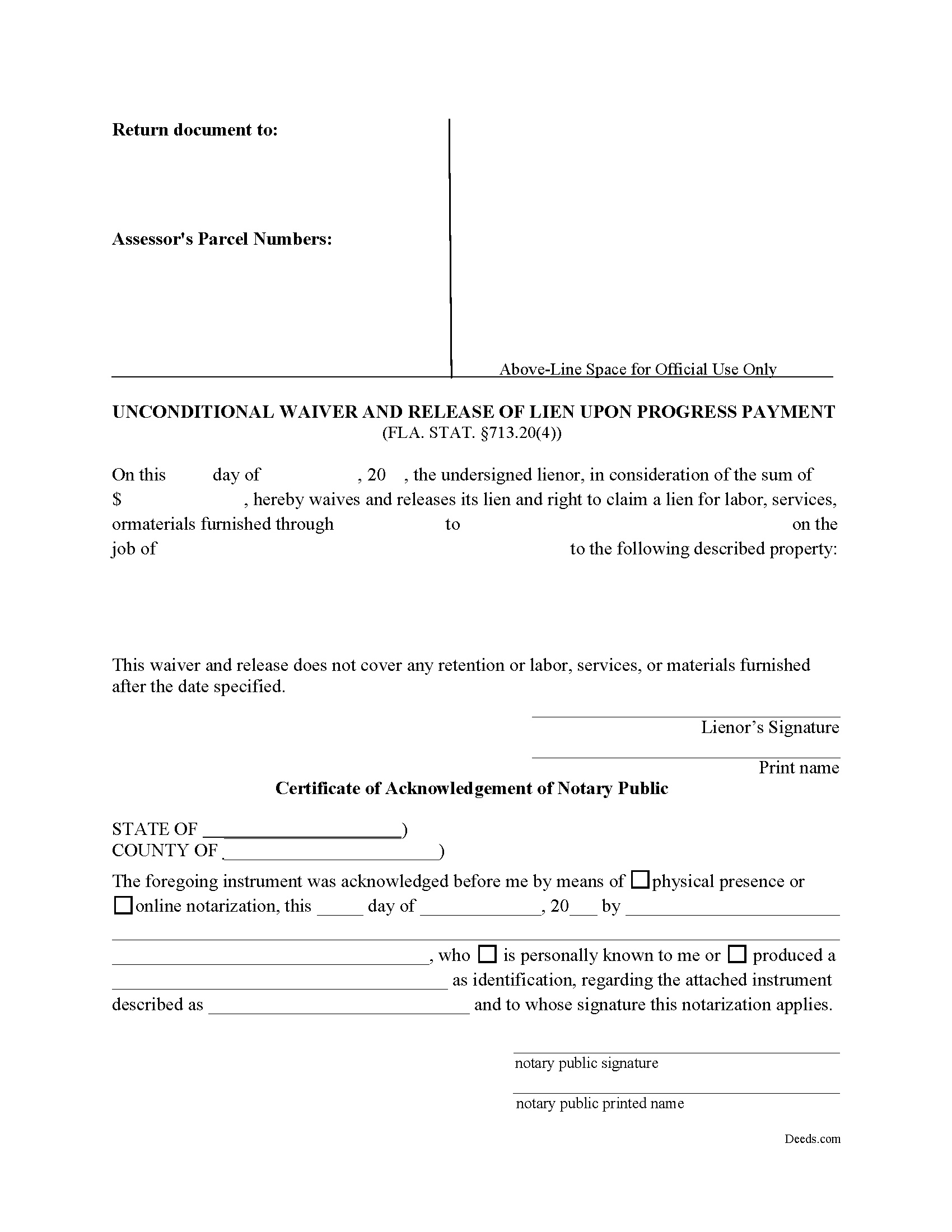

Unconditional Waiver and Release of Lien upon Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Citrus County compliant document last validated/updated 9/26/2024

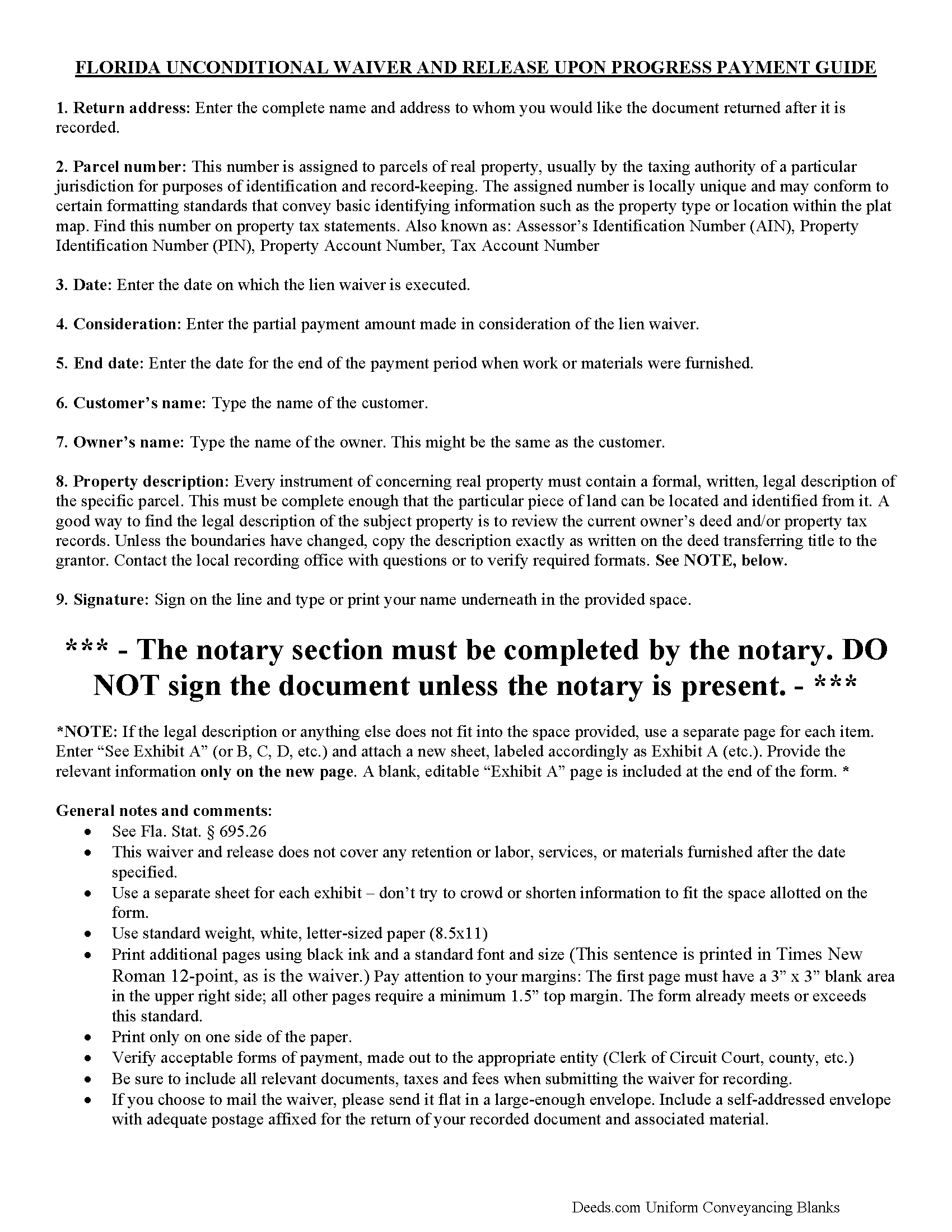

Unconditional Waiver and Release of Lien upon Progress Payment Guide

Line by line guide explaining every blank on the form.

Included Citrus County compliant document last validated/updated 9/5/2024

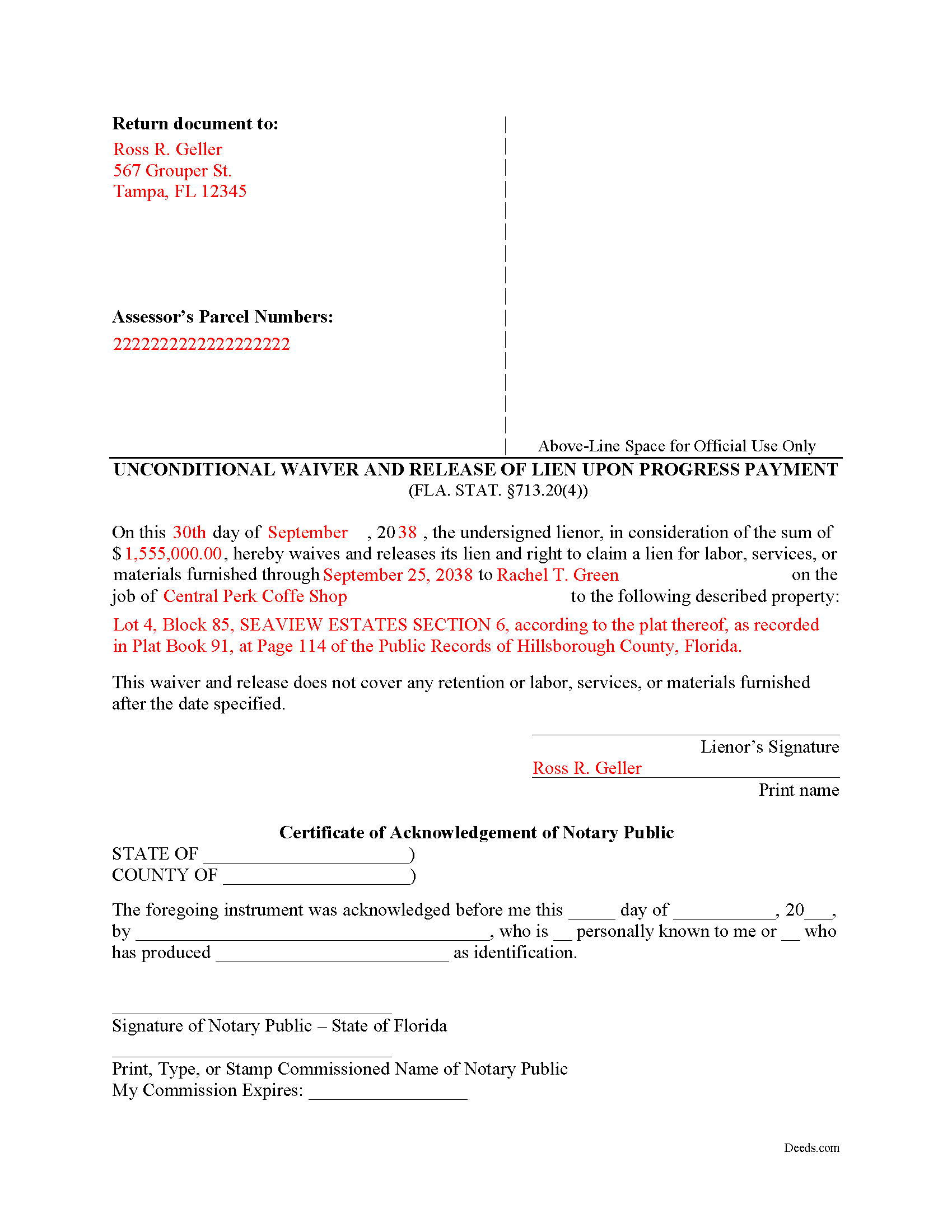

Completed Example of the Unconditional Waiver and Release of Lien upon Progress Payment Form

Example of a properly completed form for reference.

Included Citrus County compliant document last validated/updated 11/22/2024

The following Florida and Citrus County supplemental forms are included as a courtesy with your order:

When using these Unconditional Waiver and Release of Lien upon Progress Payment forms, the subject real estate must be physically located in Citrus County. The executed documents should then be recorded in one of the following offices:

Main Office - Inverness Courthouse

110 N Apopka Ave, Inverness, Florida 34450

Hours: 7:30am to 5:00pm M-F, with extended hours until 6pm on Tuesdays.

Phone: (352) 341-6424

West Citrus Government Center

1540 N Meadowcrest Blvd, Ste 300, Crystal River, Florida 34429

Hours: 8:00am - 5:00pm M-F

Phone: (352) 341-6424

Local jurisdictions located in Citrus County include:

- Beverly Hills

- Crystal River

- Dunnellon

- Floral City

- Hernando

- Holder

- Homosassa

- Homosassa Springs

- Inverness

- Lecanto

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Citrus County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Citrus County using our eRecording service.

Are these forms guaranteed to be recordable in Citrus County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Citrus County including margin requirements, content requirements, font and font size requirements.

Can the Unconditional Waiver and Release of Lien upon Progress Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Citrus County that you need to transfer you would only need to order our forms once for all of your properties in Citrus County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Citrus County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Citrus County Unconditional Waiver and Release of Lien upon Progress Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Florida's Construction Lien Law codifies statutory waivers at section 713.20.

A lien waiver operates by waiving (disclaiming) the lienor's right to all or part of an established lien. Lien waivers can be conditional, or only effective when the payment is actually received, or unconditional, meaning the lien is waived upon execution of the form, regardless of any remaining balance due. s. 713.20(7) Fla. Stat. (2016). They can also release a lien based on partial or full payment.

This form unconditionally releases a portion of the lien based on an agreed-upon progress payment. It requires a return address, the parcel identifier and legal description for the property being improved, the lienor's name, the customer's name, the owner's name, the amount paid, and an ending date for the period of time covered by the payment. 713.20(4).

Exercise caution when using unconditional waivers. If the lienor suspects for any reason that the payment is or will be invalid, he or she should consider a conditional waiver instead.

Each case is unique. Contact an attorney for complex situations or with questions about using an unconditional waiver and release of lien upon progress payment, or any other issues relating to Florida's Construction Lien Law.

Our Promise

The documents you receive here will meet, or exceed, the Citrus County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Citrus County Unconditional Waiver and Release of Lien upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

John D.

September 30th, 2020

I was quite impressed by the quality of your documents and the ease of the download.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine C.

February 26th, 2021

This was great. Happy I found you!

Thank you!

MARILYN T.

January 8th, 2021

Deed.com was so easy to use to file my Quit Claim deed. They instructed me on how to send them my documents and it was a breeze. The cost was minimal and saved me tons of time.

Thank you!

Laura B.

December 2nd, 2019

Downloaded and completed these quit claim forms in less than one cup of coffee, quick easy and stress free.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jo Anne C.

February 1st, 2021

Excellent documentation. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John L B.

November 2nd, 2020

I ordered the Deed package for my state of NJ and the county I needed to prepare the documents. I was able to complete everything that is required to close on an investment property. Fast easy with step by step instructions no matter your situation. Definitely will recommend to family & friends. Save $ instead of paying others to do the same thing you can do yourself.

Thank you for your feedback. We really appreciate it. Have a great day!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!

Stephenie A.

January 11th, 2019

No review provided.

Thank you!

JOYCE R.

June 25th, 2019

I am a tax attorney and had worked as a Valuation Engineer with Internal Revenue Service. I can access (almost immediately) complete title reports and transactions history of real estate transfers. It is a joy to have access to your valuable service.

JOYCE REBHUN,JD,MBA,PhD,EA

Thank you for your feedback. We really appreciate it. Have a great day!

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!