Broward County Notice of Nonpayment Form (Florida)

All Broward County specific forms and documents listed below are included in your immediate download package:

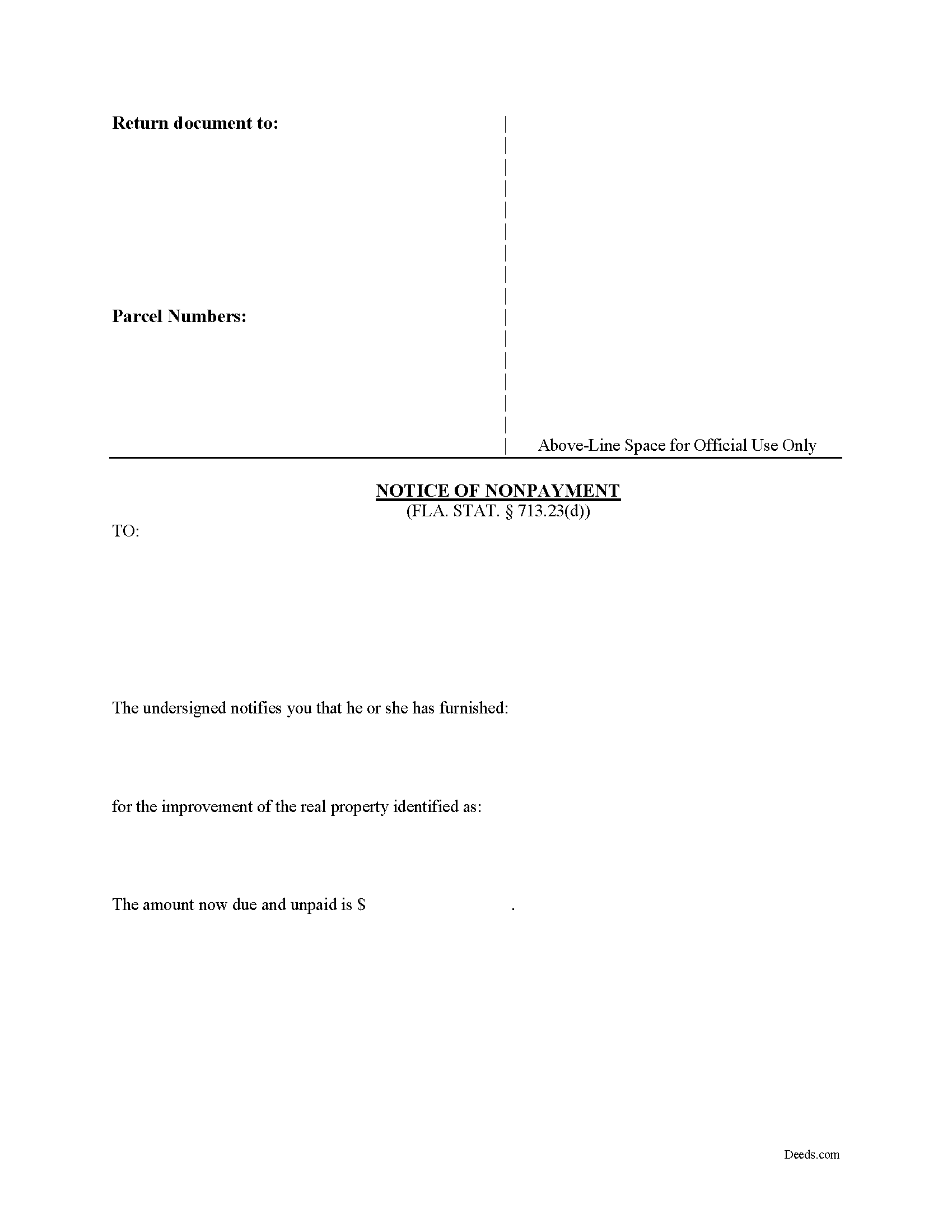

Notice of Nonpayment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Broward County compliant document last validated/updated 12/6/2024

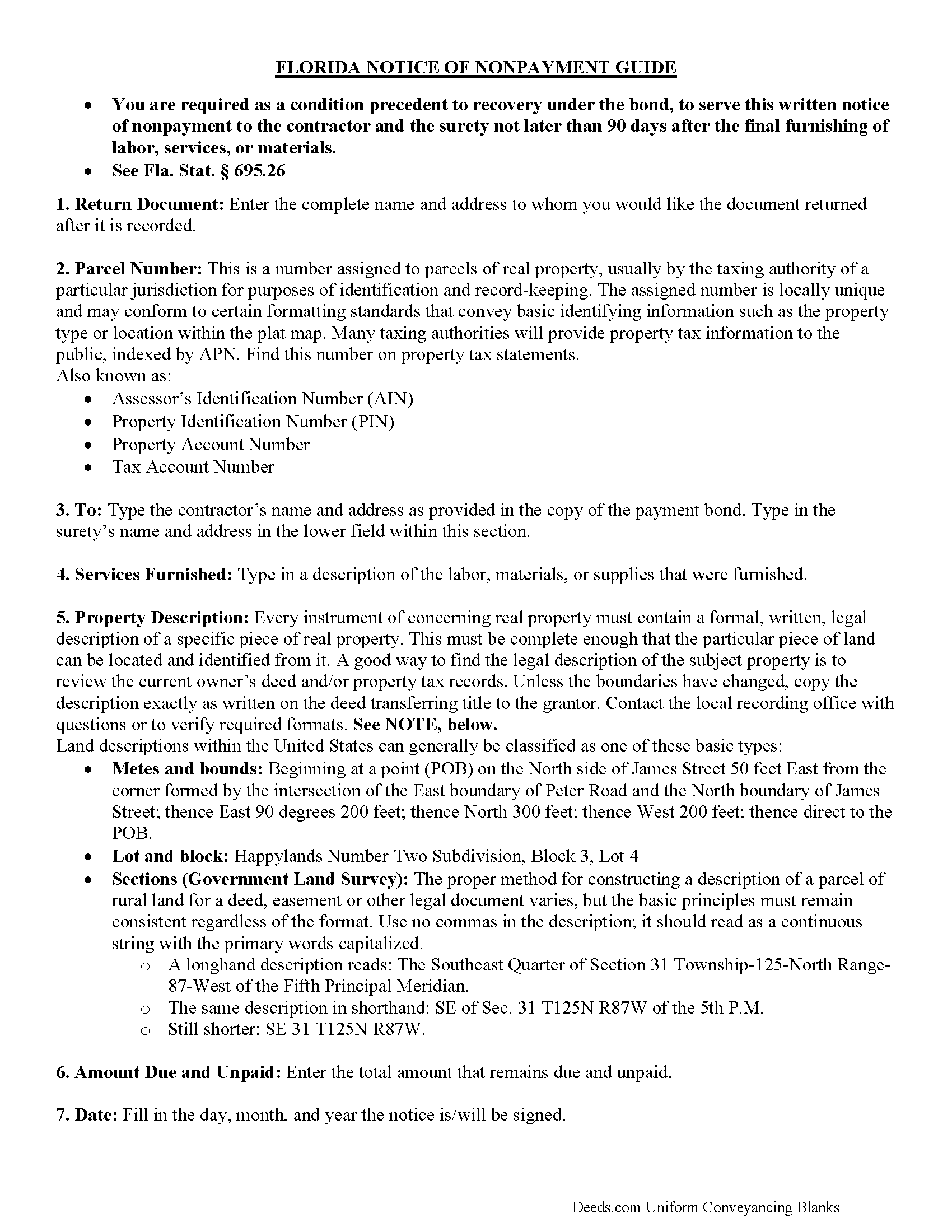

Notice of Nonpayment Guide

Line by line guide explaining every blank on the form.

Included Broward County compliant document last validated/updated 11/28/2024

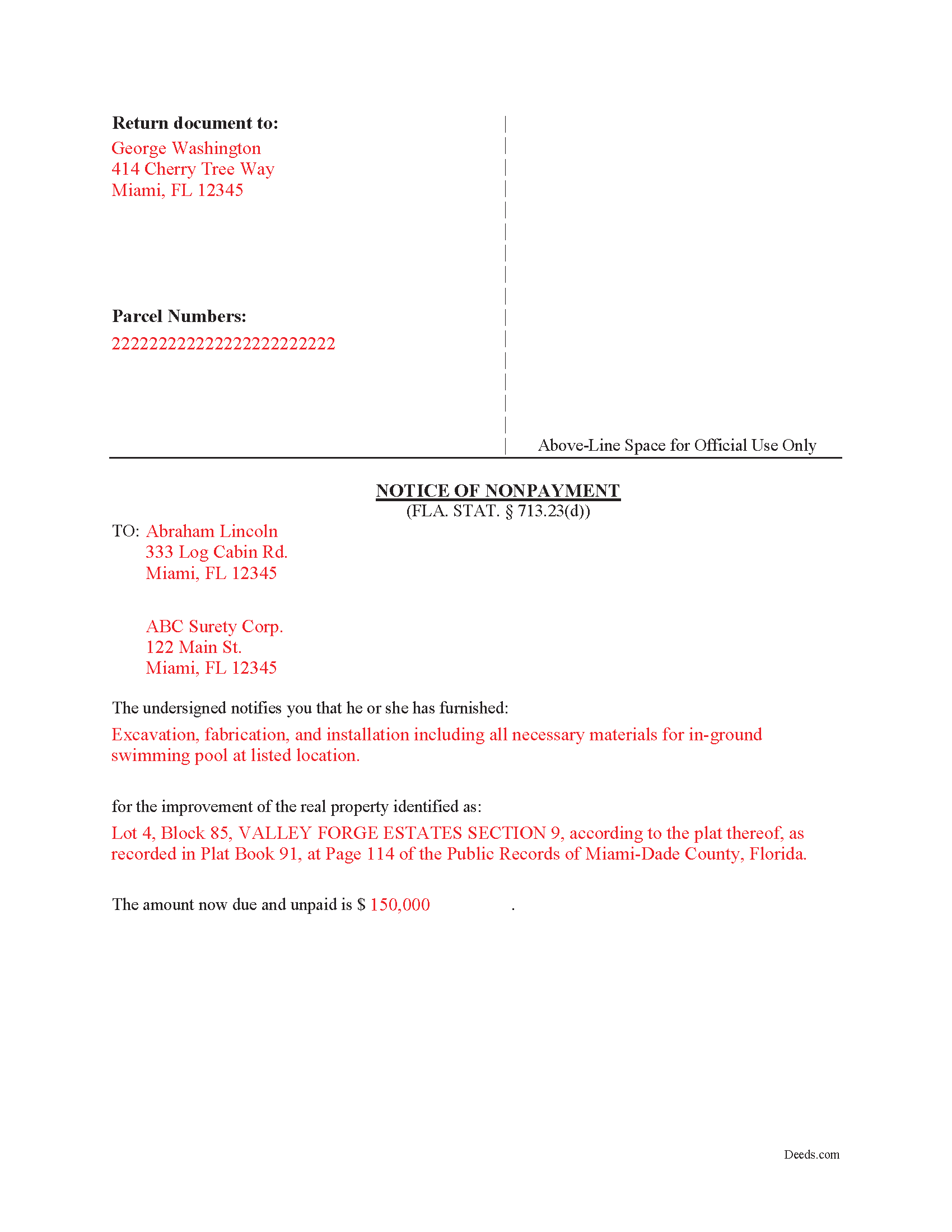

Completed Example of the Notice of Nonpayment Document

Example of a properly completed form for reference.

Included Broward County compliant document last validated/updated 11/28/2024

The following Florida and Broward County supplemental forms are included as a courtesy with your order:

When using these Notice of Nonpayment forms, the subject real estate must be physically located in Broward County. The executed documents should then be recorded in the following office:

Records, Taxes and Treasury Division

115 S Andrews Ave, Rm 114, Ft. Lauderdale, Florida 33301-1873

Hours: 7:30am to 5:00pm M-F

Phone: (954) 831-6716 / 954-831-4000

Local jurisdictions located in Broward County include:

- Coconut Creek

- Dania

- Deerfield Beach

- Fort Lauderdale

- Hallandale

- Hollywood

- Lighthouse Point

- Pembroke Pines

- Pompano Beach

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Broward County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Broward County using our eRecording service.

Are these forms guaranteed to be recordable in Broward County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Broward County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Nonpayment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Broward County that you need to transfer you would only need to order our forms once for all of your properties in Broward County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Broward County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Broward County Notice of Nonpayment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

What is a Notice of Nonpayment?

Codified at FLA. STAT. 713.23(d), the Notice of Nonpayment form is used to provide the contractor or surety with notice that the lienor has furnished certain labor, services or materials for improvement of real property and to notify each party of the amount that remains due and unpaid.

After the completion (or termination) of the furnishing of labor or materials on a bonded project for which you are still owed payment, you should complete and record this form. The Notice is like a lien but instead of attaching to the subject property, it attaches to the payment bond.

To recover an outstanding balance under the bond, the lienor must serve the contractor with a notice of nonpayment in addition to a notice to contractor form. The lienor must serve this written notice no later than 90 days after the final furnishing of labor, services, or materials. Remember that the time for serving the written notice of nonpayment is ONLY measured from the last day that the lienor furnishes labor, services, or materials. Id.

A valid notice of nonpayment form must include both the contractor's and surety's name and address, a description of the labor or materials furnished, a property description, and the amount owed and unpaid.

Each case is unique, so contact an attorney with specific questions or for complex situations relating to a notice of nonpayment or other issues with Florida mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Broward County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Broward County Notice of Nonpayment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LAWRENCE S.

January 9th, 2022

I am mostly satisfied with my Deeds.Com experience. Not sure if you can do anything about this, but since it is fairly common, I thought the Quit Claim Form would have a section specifically for adding spouse to a deed.

Thank you for your feedback. We really appreciate it. Have a great day!

O. Peter P.

June 21st, 2019

I find your forms hard to use, inasmuch as the forms cannot be converted to a Word Document. Editing and deleting of extra lines is not possible, making for a deed with large blank spaces.

Document that results is not usable for me.

Sorry to hear that we did not meet your expectations. We have canceled your order and payment. We do hope you find something more suitable to your needs elsewhere. Have a wonderful day.

Edwina L.

June 24th, 2020

Awesomeness a true life saver I'm very appreciative.

Thank you!

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!

David H.

August 21st, 2019

Rapid, excellent service.

This definitely beats the old way of trying to obtain public documents from LA County.

Great improvement!

Thank you!

Harman F.

April 7th, 2024

I was able to find the document I very much needed to get my process started. I really appreciate that there was a website to assist me in finding what I needed . I'm very Thankful that this website was available!

We are delighted to have been of service. Thank you for the positive review!

Nora B.

April 15th, 2019

VERY NICE SERVICE

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph E.

January 15th, 2023

At first I didn't trust all the 5 star reviews. So, I contacted lawyers to check their prices. The price being well over one hundred dollars made my mind up. I gave it a go, the form isn't hard and the directions are easy to follow. 5/5

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine R.

August 7th, 2019

What a great way to put my mind at ease. It was easy to fill out and printed out nicely.

Thank you for your feedback. We really appreciate it. Have a great day!

SUZANNE W.

December 29th, 2020

Very quick and efficient. Received recorded document within hours after beginning the process.

Very reasonable fees.

Highly recommended!

Thank you!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

lindsey r.

October 18th, 2021

easy to use

Thank you!