De Soto County Decedent Interest in Homestead Affidavit Form (Florida)

All De Soto County specific forms and documents listed below are included in your immediate download package:

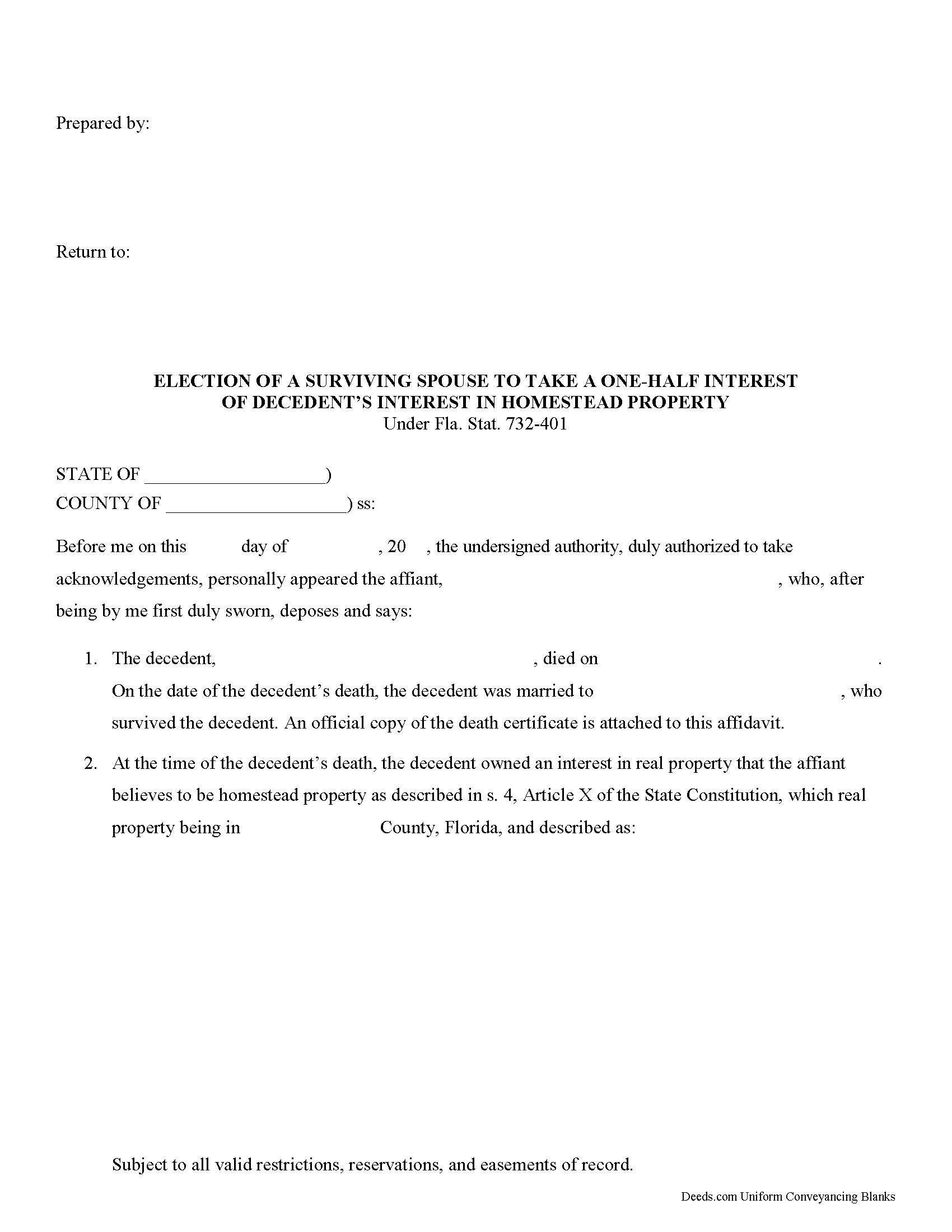

Decedent Interest in Homestead Affidavit Form

Fill in the blank Decedent Interest in Homestead Affidavit form formatted to comply with all Florida recording and content requirements.

Included De Soto County compliant document last validated/updated 11/25/2024

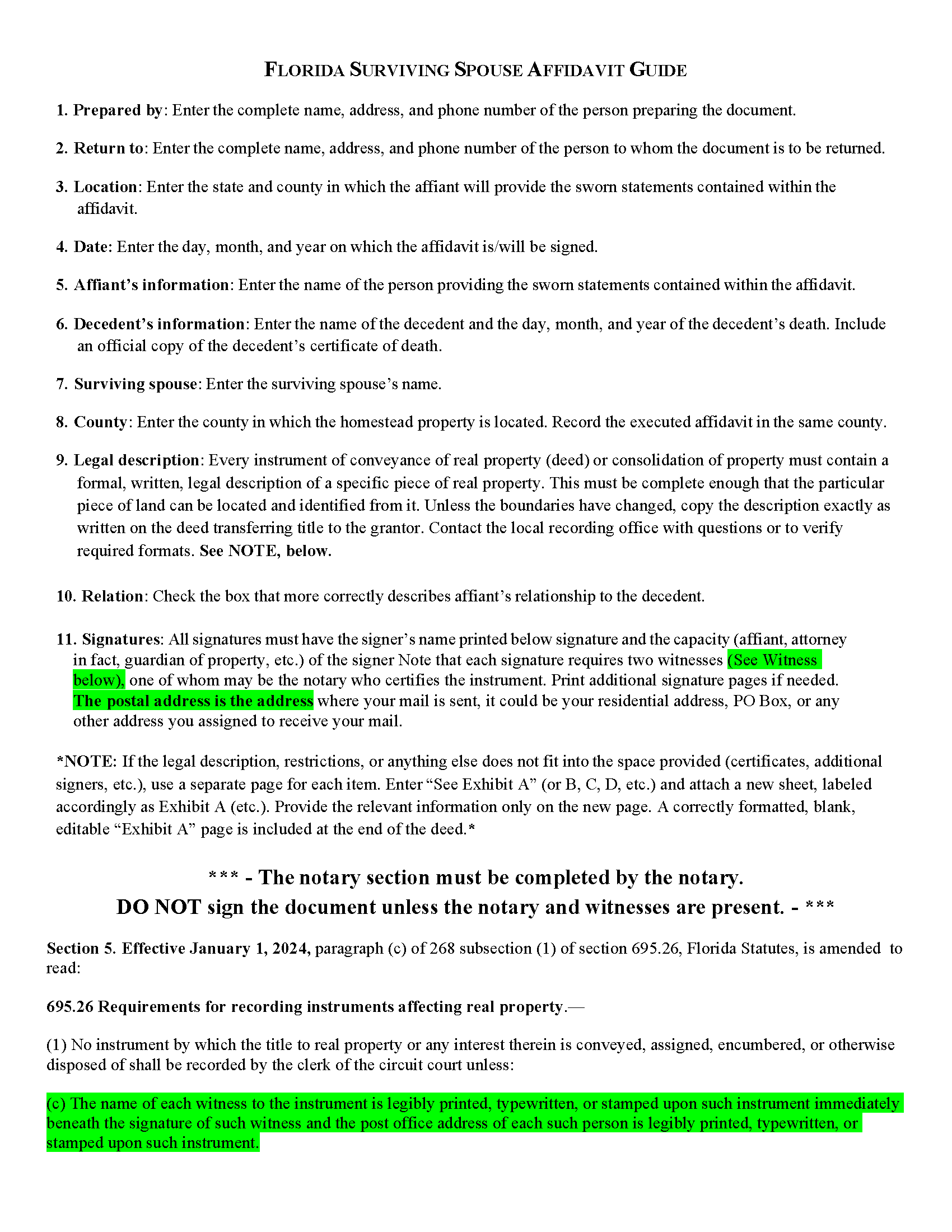

Decedent Interest in Homestead Affidavit Guide

Line by line guide explaining every blank on the Decedent Interest in Homestead Affidavit form.

Included De Soto County compliant document last validated/updated 11/25/2024

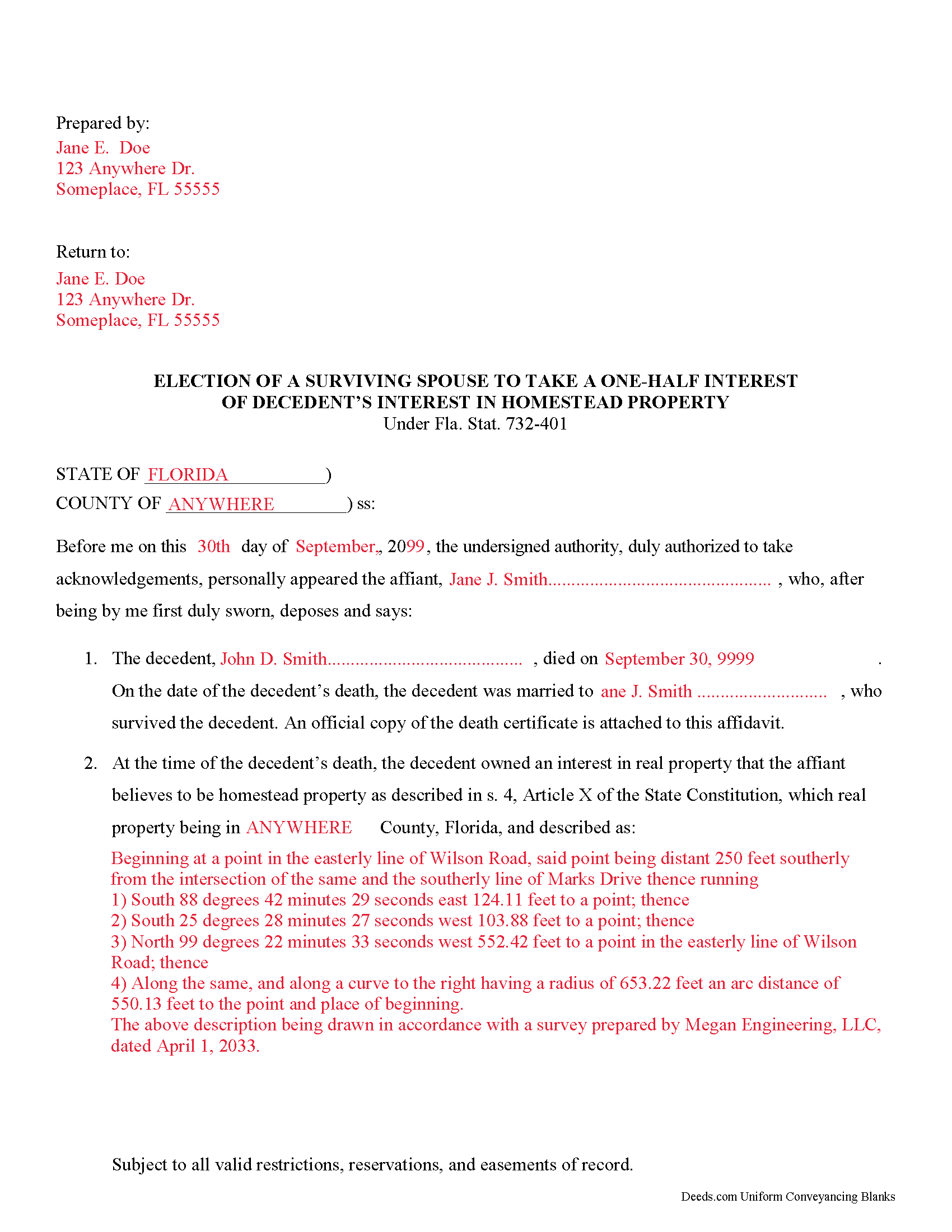

Completed Example of the Decedent Interest in Homestead Affidavit Document

Example of a properly completed Florida Decedent Interest in Homestead Affidavit document for reference.

Included De Soto County compliant document last validated/updated 8/28/2024

The following Florida and De Soto County supplemental forms are included as a courtesy with your order:

When using these Decedent Interest in Homestead Affidavit forms, the subject real estate must be physically located in De Soto County. The executed documents should then be recorded in the following office:

Clerk of the Circuit Court - County Courthouse

115 East Oak St, Rm 101, Arcadia, Florida 34266

Hours: 8:00 to 4:30 M-F

Phone: (863) 993-4876

Local jurisdictions located in De Soto County include:

- Arcadia

- Fort Ogden

- Nocatee

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the De Soto County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in De Soto County using our eRecording service.

Are these forms guaranteed to be recordable in De Soto County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by De Soto County including margin requirements, content requirements, font and font size requirements.

Can the Decedent Interest in Homestead Affidavit forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in De Soto County that you need to transfer you would only need to order our forms once for all of your properties in De Soto County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or De Soto County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our De Soto County Decedent Interest in Homestead Affidavit forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Decedent's interest in homestead affidavit

Under Florida law, real estate that is identified as a homestead but is not included in a deceased owner's will passes to beneficiaries in the same manner as other intestate property. If the decedent is survived by a spouse and one or more descendants, however, the surviving spouse has three main options as set out in section 732.401 of the Florida Statutes:

- take a life estate in the homestead, with a vested remainder to the descendants alive at the time of the decedent's death per stirpes (according to Black's Law Dictionary, 8th ed., "proportionately divided between beneficiaries according to their deceased ancestor's share").

- take an undivided one-half interest in the late spouse's homestead as a tenant in common, with the remaining one-half interest held by any descendants per stirpes.

- disclaim the interest as directed in chapter 739.

When a surviving spouse chooses to take the one-half interest in the property, he/she files a decedent's interest in homestead affidavit. This document allows the spouse to waive the marital rights to a life estate in the property. Instead, the surviving spouse and any descendants hold title as tenants in common. As tenants in common, each party can independently sell his/her interests to the property without notice or joinder from the others.

In most cases, the affidavit must be filed within six months of the decedent's death. The affidavit can be made by the surviving spouse him/herself or, with the court's approval, an attorney in fact or guardian of the property of the surviving spouse. The document is then filed in the county or counties in which the homestead property is located. Once recorded, the surviving spouse's decision is irrevocable.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Product description:

Use this document when the owner of homestead property dies without including the real estate in the will and the surviving spouse elects to forego his/her life estate interest in favor of one-half share and convert his/her interest in a life estate to a tenancy in common with the descendants.

(Florida Decedent Interest in Homestead Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the De Soto County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your De Soto County Decedent Interest in Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan M.

September 3rd, 2020

Outstanding service. Docs delivered to recorder as expected without issue. Happy our recorder recommended Deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet M.

May 4th, 2021

Was fairly easy to complete but my situation wasn't covered so I had to make a call to get help. Will see if it gets filed successfully.

Thank you!

Dreama R.

May 7th, 2019

Awesome! I had to correct a quit claim deed and the form on your site made it very easy.

Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wilma E.

July 18th, 2022

Very satisfied with service and form. Completed form, printed, and submitted to county for processing. Everything went well.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheilah C.

November 24th, 2020

So far very good. I will know more when I complete the forms and submit them.

Thank you!

Lori A.

February 2nd, 2024

My county accessors office recommended this site. My Uncle passed away and did not leave a will and I needed to have his deed transferred into my name. I was able to do it using the sample Deeds.com provided. I used it as a guide to fill out the paperwork that I printed off of the Deeds.com site. I had no problem when I went to the county and turned in the paperwork and the clerk said everything looked great.

Thank you so much for taking the time to share your experience Lori. We are deeply sorry for your loss and understand how challenging managing affairs can be during such a difficult time. It's heartening to hear that our resources were helpful to you in transferring your uncle's deed into your name.

We strive to make complex processes more accessible and manageable, and your feedback affirms the value of our work. Knowing that the county assessor's office recommended us and that the clerk found everything in order with your paperwork is incredibly gratifying.

Lori W.

December 2nd, 2020

Great resource! Nice to have these forms and information available. No problems at the recorder, in fact it was the recorder that referred me to deeds.com they like their forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Missie R.

June 17th, 2020

Very fast and professionally handled.

Thank you!

Meg R.

August 19th, 2020

Good system fairly easy to use

Thank you!

Linda D.

September 23rd, 2024

very efficient and easy to use online platform. I reviewed several different sites before I settle on this one. Took my deed to the courthouse today and recorded it with no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darrell J.

February 22nd, 2021

Easy to use, rapid response, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!