Saint Johns County Conditional Waiver and Release of Lien upon Progress Payment Form (Florida)

All Saint Johns County specific forms and documents listed below are included in your immediate download package:

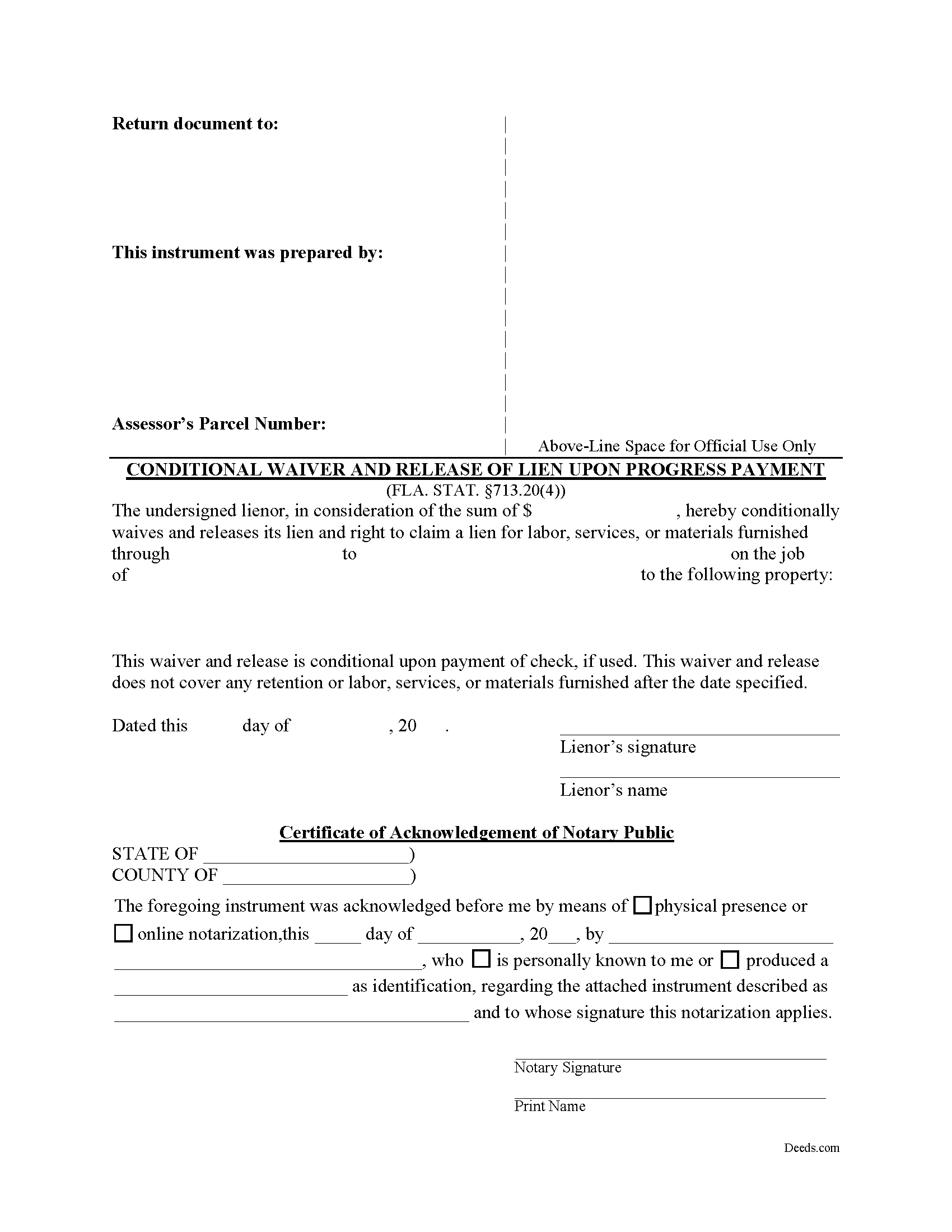

Conditional Waiver and Release of Lien upon Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Saint Johns County compliant document last validated/updated 10/21/2024

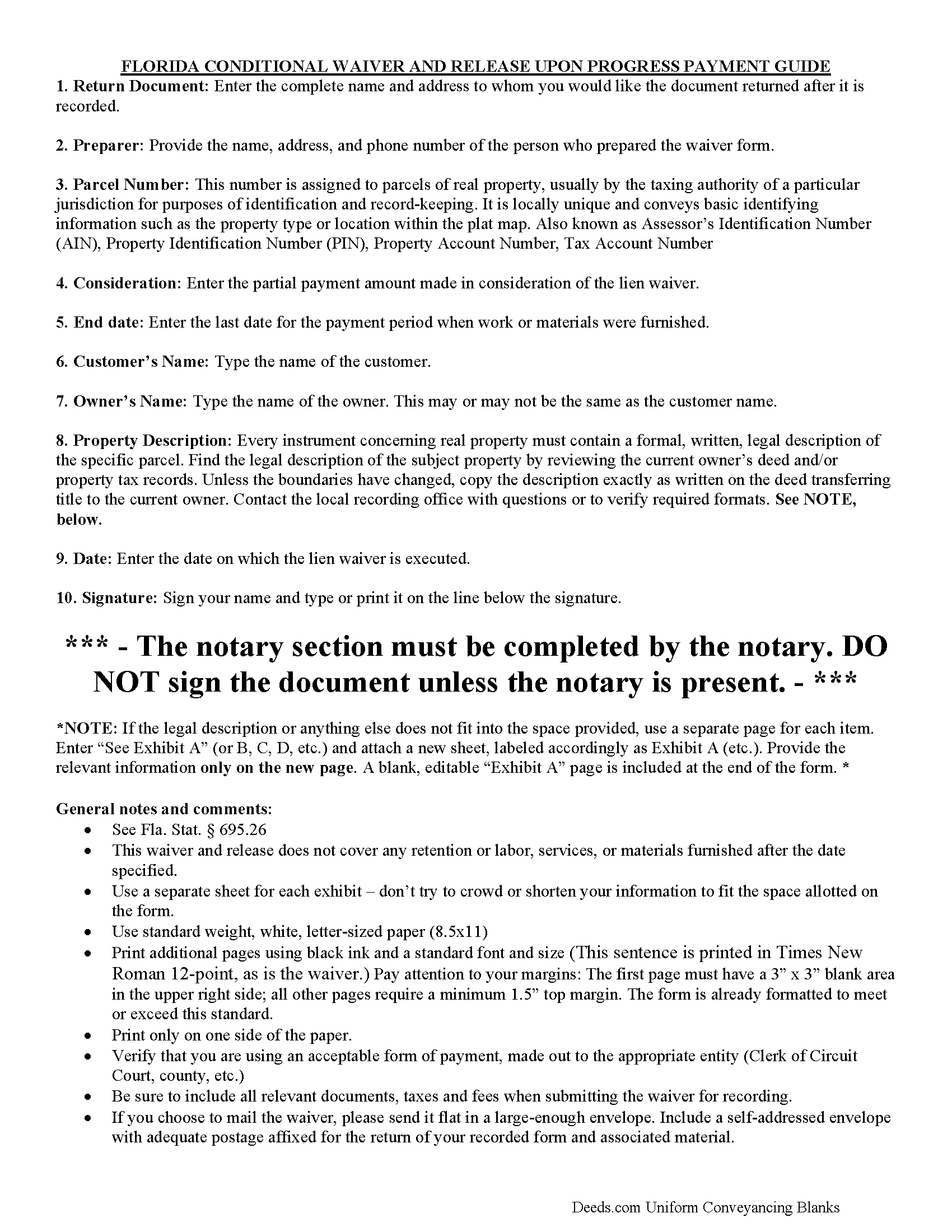

Conditional Waiver and Release of Lien upon Progress Payment Guide

Line by line guide explaining every blank on the form.

Included Saint Johns County compliant document last validated/updated 11/4/2024

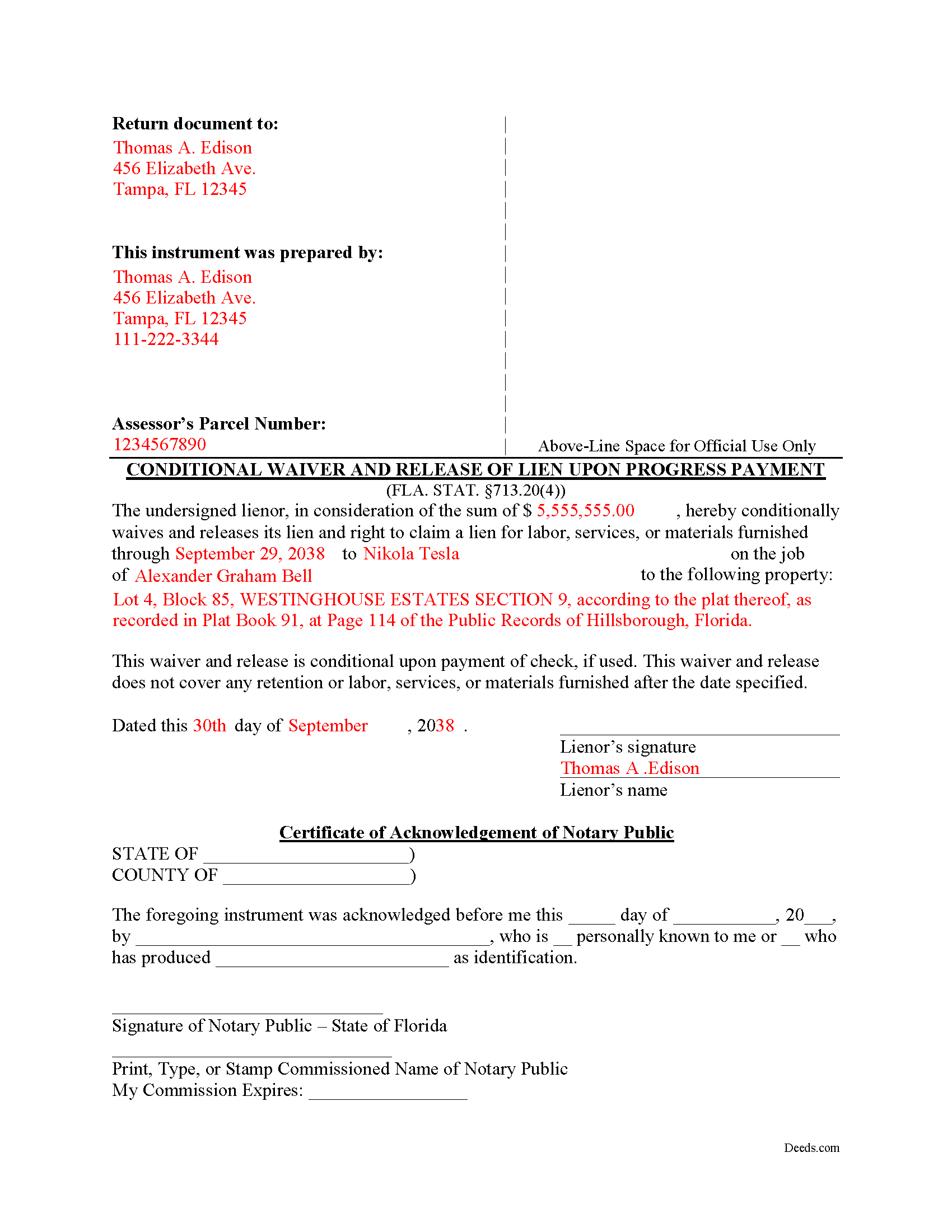

Completed Example of the Conditional Waiver and Release of Lien upon Progress Payment Form

Example of a properly completed form for reference.

Included Saint Johns County compliant document last validated/updated 10/28/2024

The following Florida and Saint Johns County supplemental forms are included as a courtesy with your order:

When using these Conditional Waiver and Release of Lien upon Progress Payment forms, the subject real estate must be physically located in Saint Johns County. The executed documents should then be recorded in the following office:

St. Johns County Clerk of Courts

4010 Lewis Speedway, St. Augustine, Florida 32084

Hours: 8:00am-5:00pm M-F

Phone: (904) 819-3600 Press 6 for Recording

Local jurisdictions located in Saint Johns County include:

- Elkton

- Hastings

- Jacksonville

- Ponte Vedra

- Ponte Vedra Beach

- Saint Augustine

- Saint Johns

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Saint Johns County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Saint Johns County using our eRecording service.

Are these forms guaranteed to be recordable in Saint Johns County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Johns County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Waiver and Release of Lien upon Progress Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Saint Johns County that you need to transfer you would only need to order our forms once for all of your properties in Saint Johns County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Saint Johns County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Saint Johns County Conditional Waiver and Release of Lien upon Progress Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Lien waivers or releases are used to surrender the right to a lien, either in full or in part depending on what type of lien release form is used. Florida's Construction Lien Law authorizes statutory waivers at 713.20 Fla. Stat. (2016).

Under 713.20(4), lienors may waive, on condition of payment, part of a lien they already delivered against the owner's interest in the improved property. Such a release contains information about the lienor, the customer, the property owner, the property description, the payment amount, and a date to mark the end of the work period covered by the waiver.

Each case is unique, so contact an attorney with specific questions or any other issues related to Florida Construction Liens.

Our Promise

The documents you receive here will meet, or exceed, the Saint Johns County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Johns County Conditional Waiver and Release of Lien upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4429 Reviews )

Deidre E.

November 18th, 2024

Best thing since sliced bread. Do your homework. Find the documents with Deeds.com and bypass expensive and unnecessary lawyers fees.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Joseph D.

November 14th, 2024

Easy to use and a quick turnaround rnDeed was recorded and retuned within 24 hours

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Angela M.

November 14th, 2024

Great communication and always on timely manner unless issue appears with the document.rnI like their customer service, very helpful and assisting when necessary.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

Ronald S.

May 20th, 2019

got what i wanted

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

September 5th, 2020

Pretty good stuff, not exactly clear on the deed transfer costs and all

Thank you for your feedback. We really appreciate it. Have a great day!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Scott S.

November 20th, 2020

This is the best resource I have found for documents related to beneficiary deeds!

Thank you!

Marcus W.

May 16th, 2024

The Service was excellent the county recorder’s can sometimes cause issues and or delays because of certain filing requirements , but overall I am more than satisfied with DEEDS.com fast friendly services.

Thank you Marcus, we appreciate you.

Ralph L.

April 19th, 2022

Thank you.Very good.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Donna D.

March 20th, 2020

Easy to use. Good information. Would use again.

Thank you!

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value.

In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dwayne H.

November 3rd, 2020

The Oregon TODD transfer on death deed template worked great and was easy to use. They had instructions and a guide that had good pointers to filling everything out. It took about 2 weeks to mail in my filled TODD and receive it back from the county with their stamp. Would definitely use this service for other documents

We appreciate your business and value your feedback. Thank you. Have a wonderful day!