Palm Beach County Conditional Waiver and Release of Lien upon Final Payment Form (Florida)

All Palm Beach County specific forms and documents listed below are included in your immediate download package:

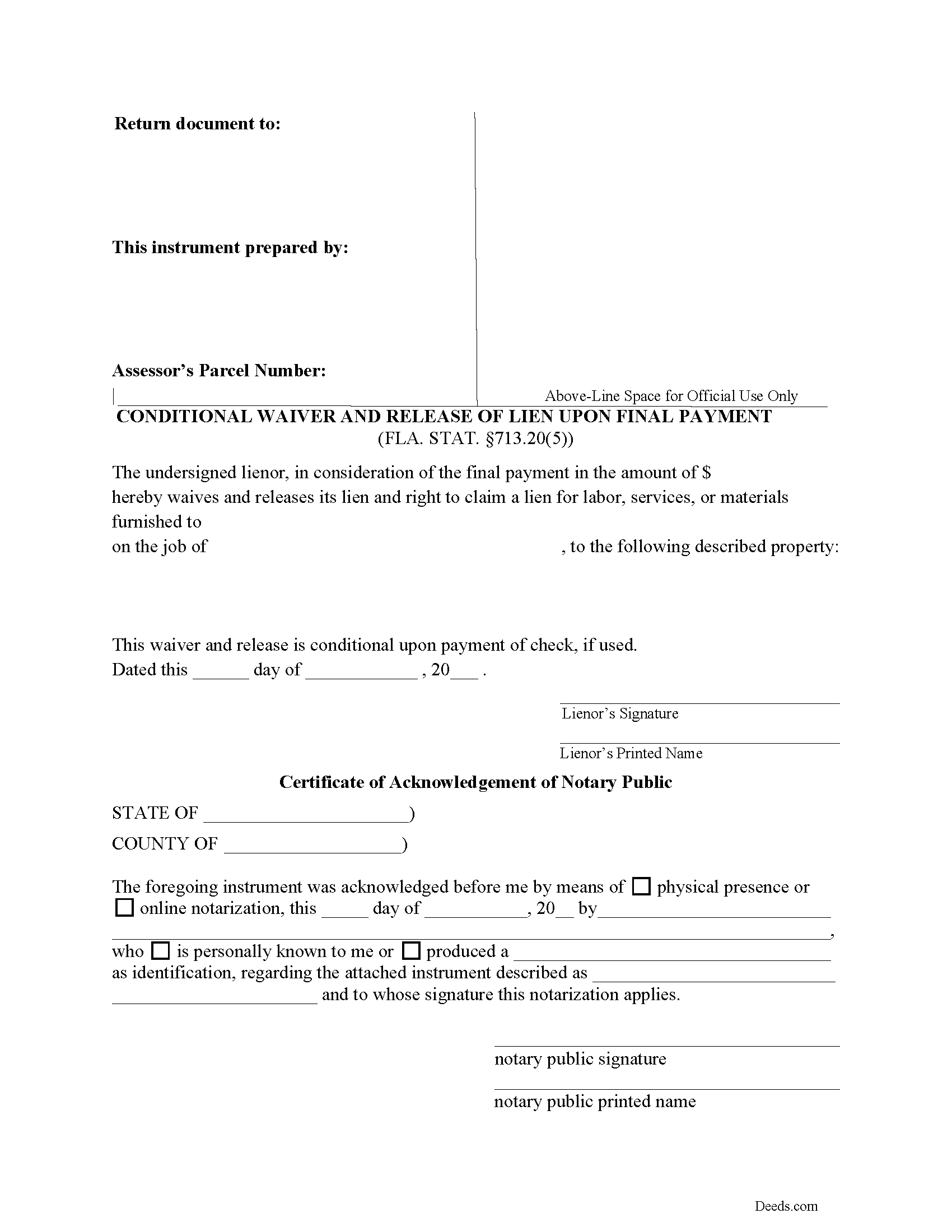

Conditional Waiver and Release of Lien upon Final Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Palm Beach County compliant document last validated/updated 10/18/2024

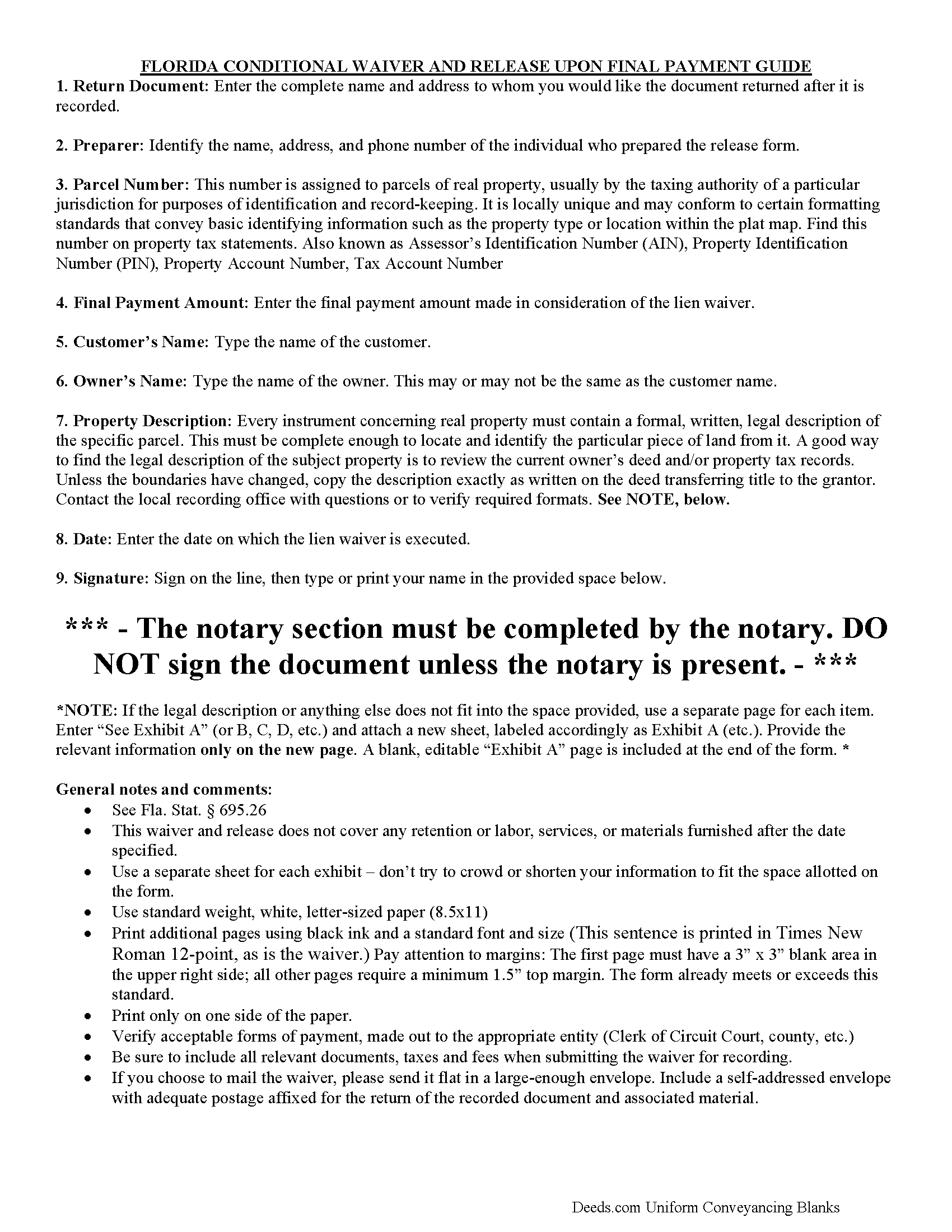

Conditional Waiver and Release of Lien upon Final Payment Guide

Line by line guide explaining every blank on the form.

Included Palm Beach County compliant document last validated/updated 12/3/2024

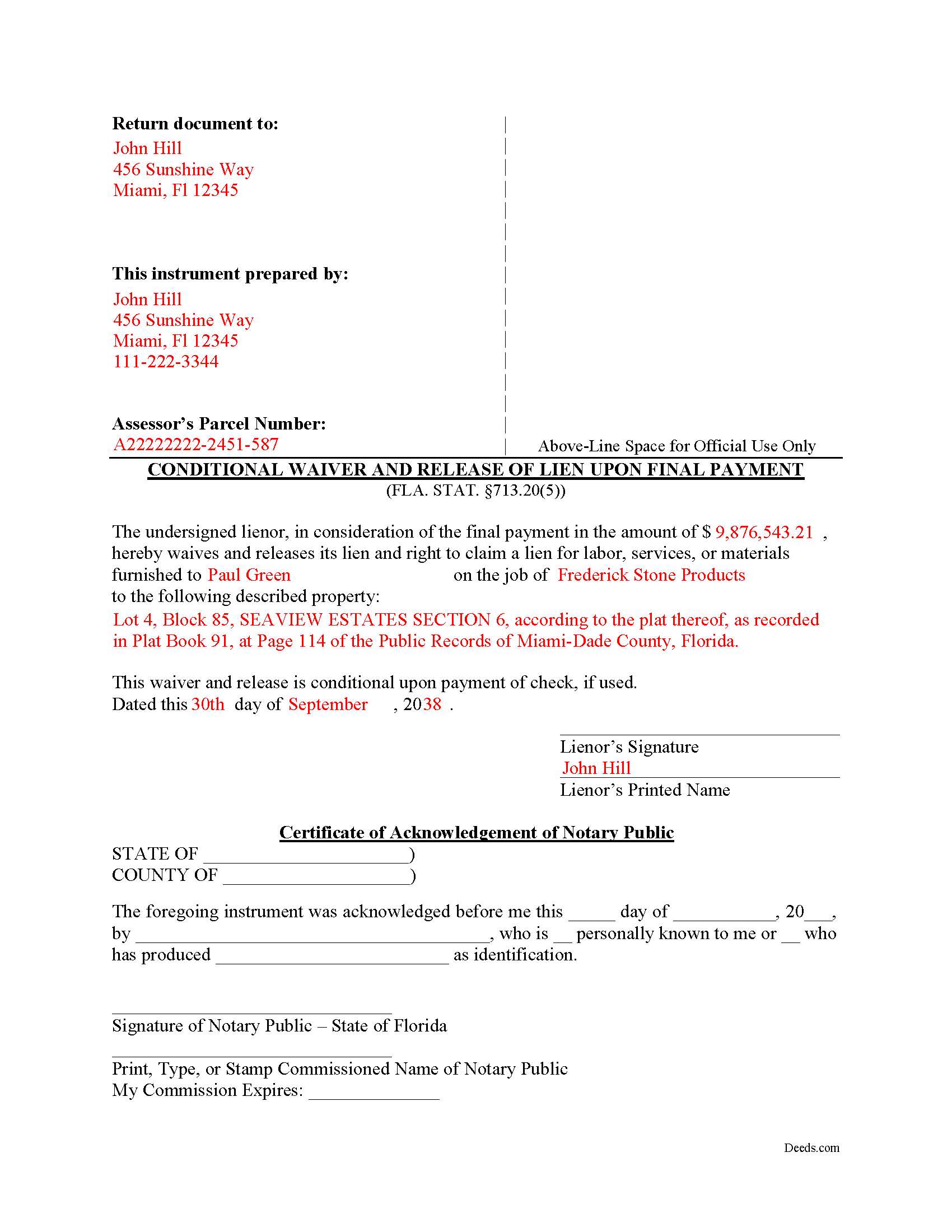

Completed Example of the Conditional Waiver and Release of Lien upon Final Payment Document

Example of a properly completed form for reference.

Included Palm Beach County compliant document last validated/updated 12/16/2024

The following Florida and Palm Beach County supplemental forms are included as a courtesy with your order:

When using these Conditional Waiver and Release of Lien upon Final Payment forms, the subject real estate must be physically located in Palm Beach County. The executed documents should then be recorded in one of the following offices:

County Clerk/Comptroller: Recording Dept - Main Courthouse

205 North Dixie Hwy, Rm 4.25 / PO Box 4177, West Palm Beach, Florida 33401 / 33402-4177

Hours: 8:00am - 4:00pm M-F

Phone: (561) 355-2991

North County Courthouse

3188 PGA Blvd, Palm Beach Gardens, Florida 33410

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

South County Courthouse

200 W Atlantic Ave, Delray Beach, Florida 33444

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

West County Courthouse

2950 State Rd 15, Belle Glade, Florida 33430

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

Midwestern Community Service Center

200 Civic Center Way, Suite 500, Royal Palm Beach, Florida 33411

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

Local jurisdictions located in Palm Beach County include:

- Belle Glade

- Boca Raton

- Boynton Beach

- Bryant

- Canal Point

- Delray Beach

- Jupiter

- Lake Harbor

- Lake Worth

- Loxahatchee

- North Palm Beach

- Pahokee

- Palm Beach

- Palm Beach Gardens

- Royal Palm Beach

- South Bay

- West Palm Beach

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Palm Beach County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Palm Beach County using our eRecording service.

Are these forms guaranteed to be recordable in Palm Beach County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Palm Beach County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Waiver and Release of Lien upon Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Palm Beach County that you need to transfer you would only need to order our forms once for all of your properties in Palm Beach County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Palm Beach County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Palm Beach County Conditional Waiver and Release of Lien upon Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Lien waivers or releases are used to surrender the right to a lien, either in full or in part depending on the type of lien release form selected. Florida's Construction Lien Law authorizes statutory waivers at 713.20 Fla. Stat. (2016).

Under 713.20(5), lienors may waive, on condition of payment, a lien they already filed against the owner's interest in the improved property. The release contains information about the lienor, the customer, the property owner, the property description, the payment amount, and a date to finalize the work covered by the waiver.

Each case is unique, so contact an attorney with specific questions on lien waivers or any other issues related to Florida Construction Liens.

Our Promise

The documents you receive here will meet, or exceed, the Palm Beach County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Palm Beach County Conditional Waiver and Release of Lien upon Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Susan S.

November 26th, 2021

What a delight to find this Website. Professionally done and easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

Byron G.

June 23rd, 2022

So easy to use. Would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

David P.

February 12th, 2024

This service and company are THE best. We are out of State and needed to efile, and we got it done for the closing. Thanks Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather F.

January 13th, 2019

Quality forms and information. Everything went smoothly.

Great to hear Heather. Have a fantastic day!

Andrea R.

December 25th, 2020

I was pleasantly surprised as I didn't even know you can record a quit claim deed digitally. I am in the mortgage business so I will gladly refer all my clients to this website! Deeds.com was prompt and fast with the entire process. My document was recorded and completed in less than 24 hours! Thank you again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandrs T.

August 27th, 2020

It would be good to be able to print several documents at 1 time by highlighting them in the list without having to do one document at a time.

Thank you for your feedback. We really appreciate it. Have a great day!

ELIZABETH M.

January 10th, 2020

Great service! Training was fast and we went over very detail.

Thank you!

Thomas B.

March 17th, 2022

Spent several weeks searching the net for warranty deeds. For the money and correctness, IMHO, Deeds.com is far and away the best.

Thank you for your feedback. We really appreciate it. Have a great day!

Willie S.

January 5th, 2021

So easy and fast. Since covid-19 is here, this option is perfect.

Thank you!

Ashley H.

September 21st, 2020

Thank you for the quick response time messaging back and forth to get this completed, and also the fairly speedy e-recording! Excellent customer service!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vanessa G.

January 9th, 2024

Quick, painless, and they communicated with me during the entire process. I will certainly be suing them again.

We are delighted to have been of service. Thank you for the positive review!

Edward S.

November 9th, 2021

Easy to use and comprehensive in content. Would recommend to anyone that is looking for a cheaper alternative to a lawyer. (They hate services that cut into their business)

Thank you!