Bay County Agreement for Deed Form (Florida)

All Bay County specific forms and documents listed below are included in your immediate download package:

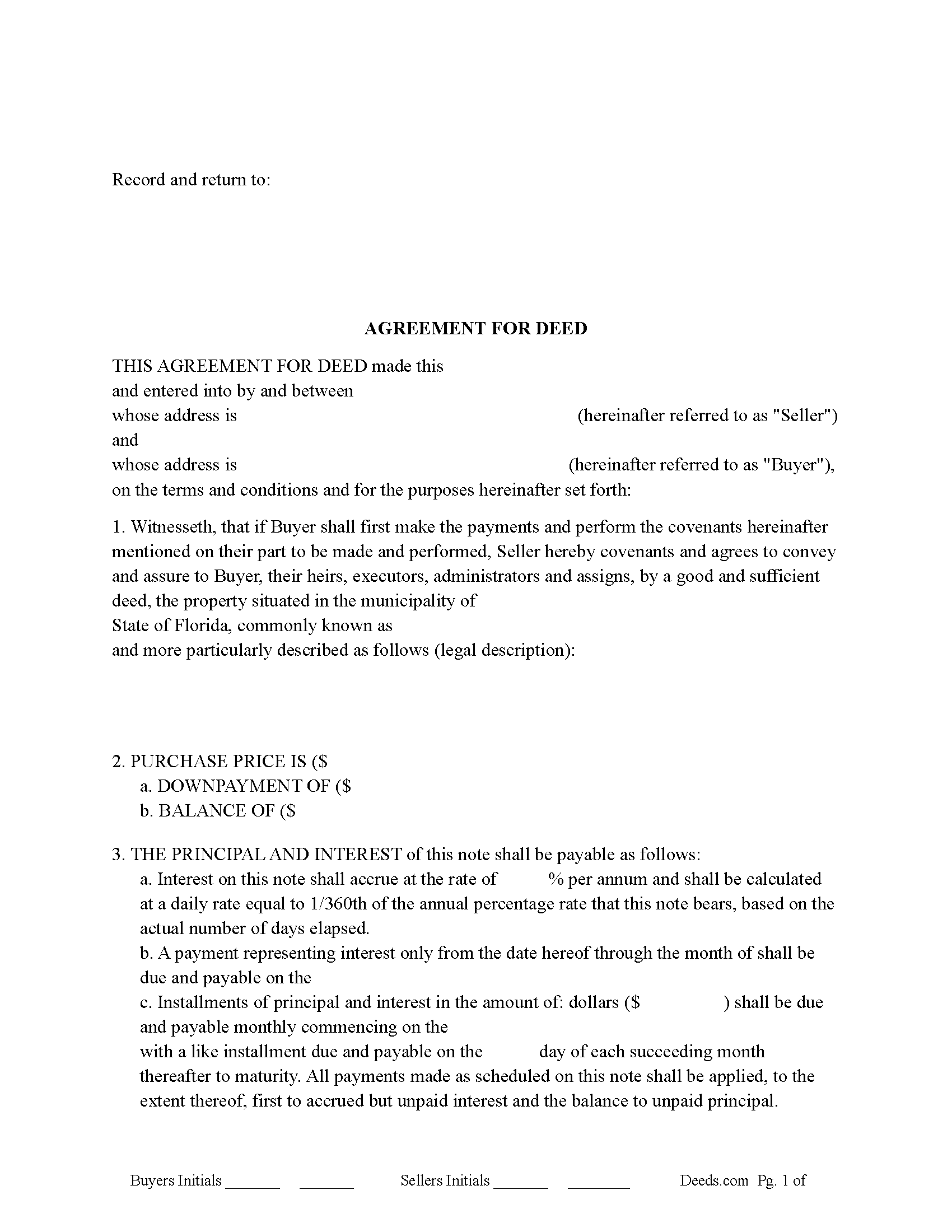

Agreement for Deed Form

Fill in the blank Agreement for Deed form formatted to comply with all Florida recording and content requirements.

Included Bay County compliant document last validated/updated 10/17/2024

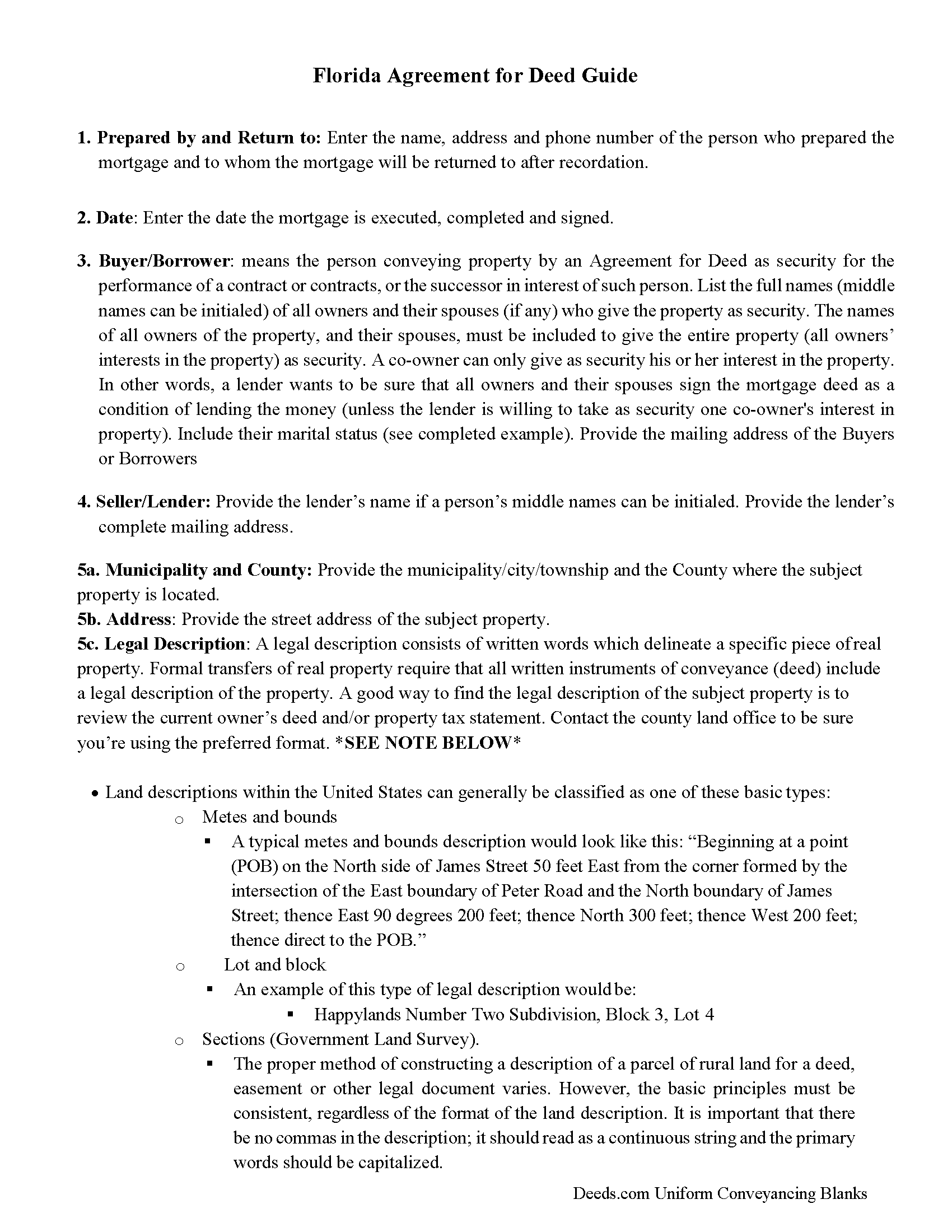

Agreement for Deed Guide

Line by line guide explaining every blank on the Agreement for Deed form.

Included Bay County compliant document last validated/updated 9/17/2024

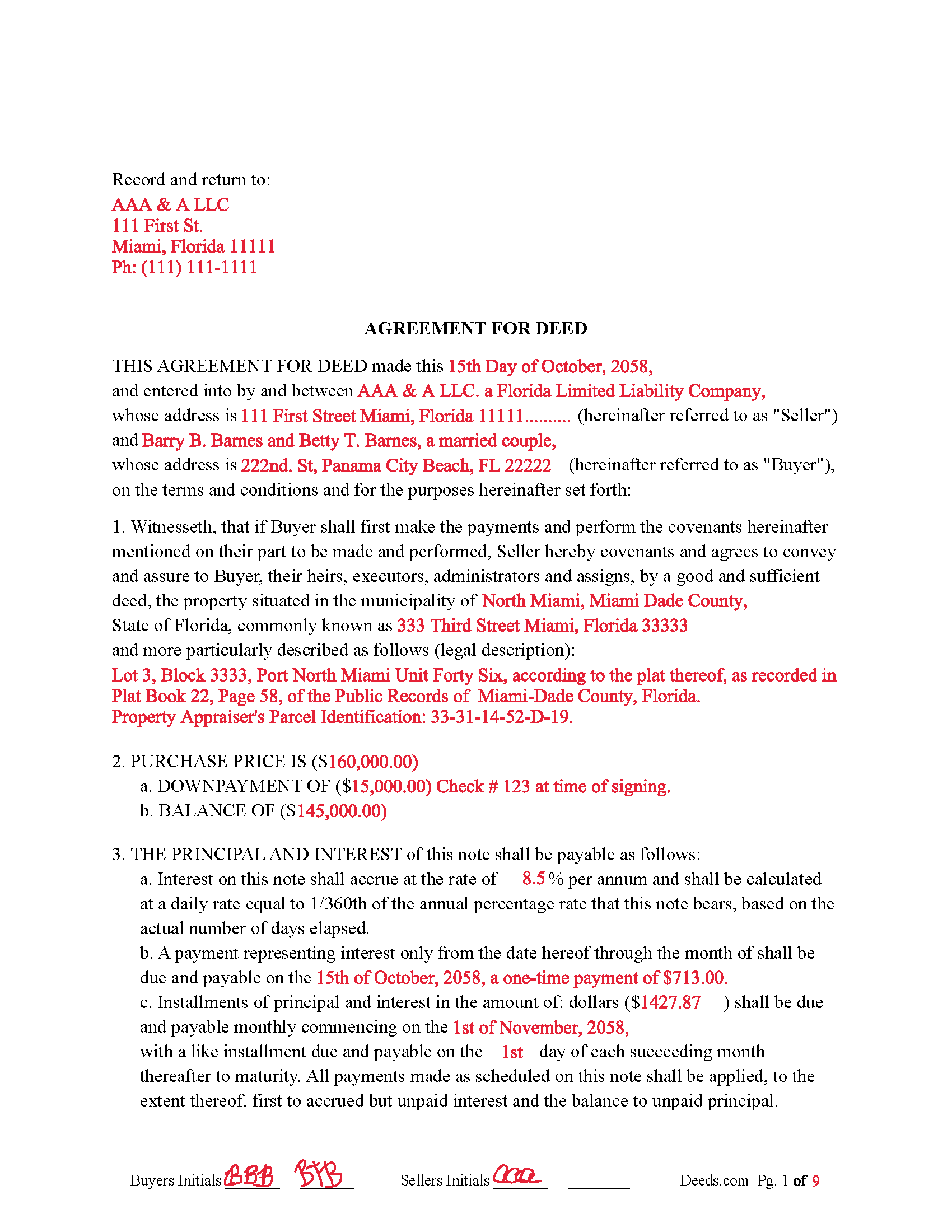

Completed Example of the Agreement for Deed Document

Example of a properly completed Florida Agreement for Deed document for reference.

Included Bay County compliant document last validated/updated 11/19/2024

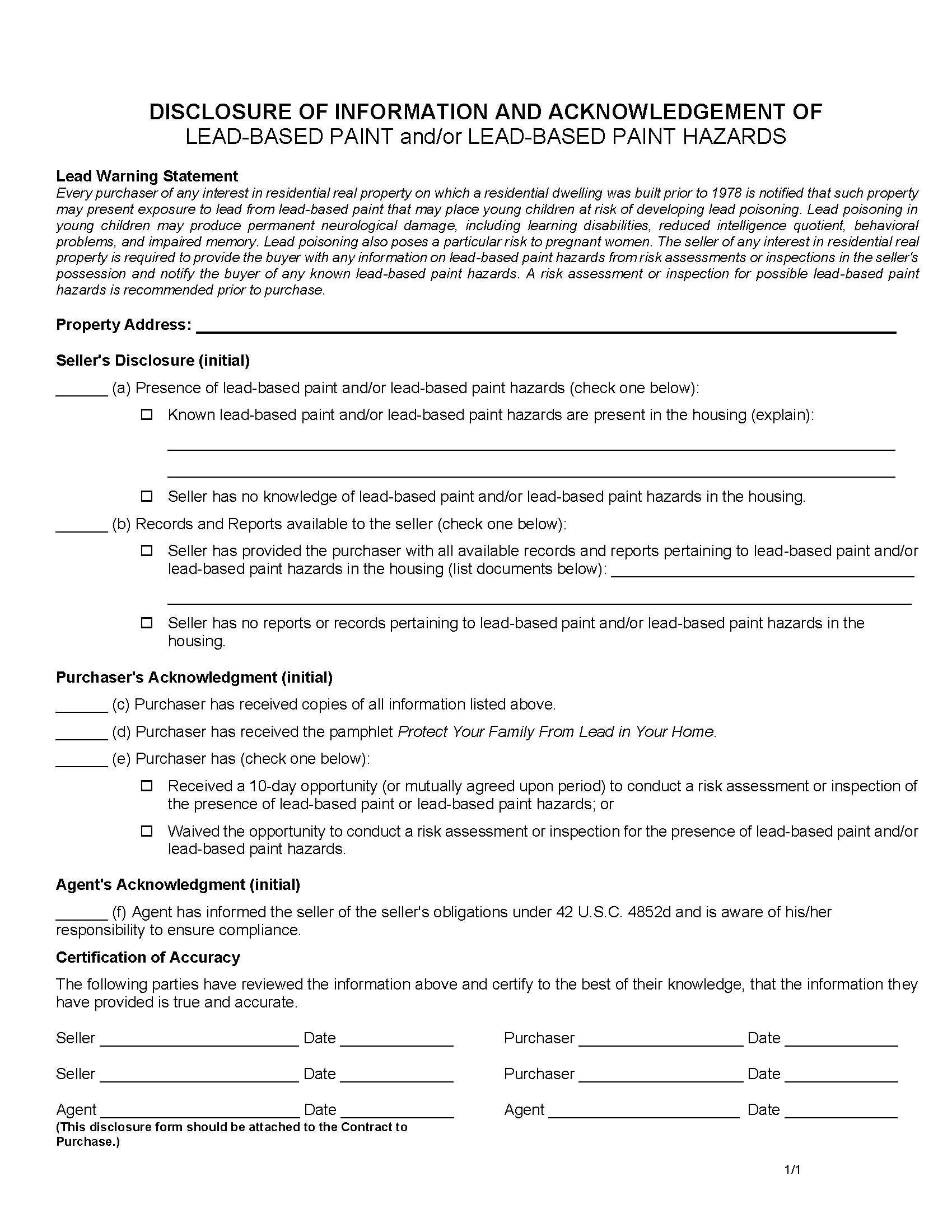

Lead Based Paint Disclosure Form

Required for residential property built before 1978.

Included Bay County compliant document last validated/updated 10/11/2024

Residential Property Disclosure

Required form for residential property.

Included Bay County compliant document last validated/updated 11/29/2024

The following Florida and Bay County supplemental forms are included as a courtesy with your order:

When using these Agreement for Deed forms, the subject real estate must be physically located in Bay County. The executed documents should then be recorded in the following office:

Bay County Clerk of the Court

300 East 4th St, Panama City, Florida 32401

Hours: 8:00am - 4:30pm M-F

Phone: (850) 763-9061

Local jurisdictions located in Bay County include:

- Fountain

- Lynn Haven

- Mexico Beach

- Panama City

- Panama City Beach

- Youngstown

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Bay County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Bay County using our eRecording service.

Are these forms guaranteed to be recordable in Bay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bay County including margin requirements, content requirements, font and font size requirements.

Can the Agreement for Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Bay County that you need to transfer you would only need to order our forms once for all of your properties in Bay County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Bay County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Bay County Agreement for Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An "Agreement for Deed," also known as a land contract or contract for deed, is a financing arrangement where the seller retains the legal title to the property until the buyer fulfills the terms of the agreement, typically by paying the purchase price over time. In Florida, this type of agreement can be useful in specific situations:

When to Use an Agreement for Deed in Florida

1. Buyers with Limited Financing Options:

Credit Issues: Buyers who may have difficulty obtaining traditional mortgage financing due to poor credit scores or lack of credit history can use an Agreement for Deed.

Self-Employed or Irregular Income: Buyers with irregular income or those who are self-employed and may not meet traditional lending criteria can benefit from this arrangement.

2. Seller Financing:

Investment Strategy: Sellers who prefer to receive steady payments over time rather than a lump sum can use an Agreement for Deed as a form of seller financing.

Retaining Title: Sellers who wish to retain legal title until the buyer has paid in full can protect their interest in the property through this method.

3. Ease of Transfer:

Simplified Process: This type of agreement can simplify the process of property transfer, avoiding some of the complexities and costs associated with traditional mortgages and closing procedures.

4. Negotiable Terms:

Flexibility: The terms of an Agreement for Deed can be tailored to fit the needs of both the buyer and seller, including down payment amount, interest rate, and payment schedule.

5. Quick Sale:

Market Advantage: Sellers can use this agreement to attract buyers in a sluggish real estate market by offering more flexible financing options.

Legal Considerations and Requirements

• Documentary Stamp Tax: As mentioned, Florida law considers an Agreement for Deed a transfer of interest in real property, subject to documentary stamp tax at the time of recording the contract. Imposition of Documentary Stamp Tax: Florida law considers the execution of a land contract as a transfer of interest in real property. Consequently, the documentary stamp tax applies to the full purchase price outlined in the land contract. This tax is similar to the tax imposed on traditional deeds.

• Timing of Tax Payment: The documentary stamp tax must be paid at the time the land contract is recorded. The responsibility for this tax typically falls on the seller, but the terms can vary depending on the agreement between the buyer and seller.

• Tax Calculation: The tax is calculated based on the purchase price of the property. As of now, the rate is $0.70 per $100 of the total purchase price, although this rate can change, and there may be additional surtaxes in certain counties.

• Default and Foreclosure: If the buyer defaults, the seller may need to follow formal foreclosure procedures to reclaim the property.

• Consumer Protection: Florida law requires certain disclosures and protections for buyers in these agreements, such as the right to cancel within seven business days of execution without penalty. 498.028 CONTRACTS AND CONVEYANCE INSTRUMENTS.--The contract for purchase of subdivided lands shall contain, and the subdivider shall comply with, the following provisions:

(1) The purchaser shall have an absolute right to cancel the contract for any reason whatsoever for a period of 7 business days following the date on which the contract was executed by the purchaser.

(2) In the event the purchaser elects to cancel within the period provided, all funds or other property paid by the purchaser shall be refunded without penalty or obligation within 20 days of the receipt of the notice of cancellation by the developer.

(3) If the property is sold under an agreement for deed or a contract for deed where title to the property is not conveyed to the purchaser within 180 days or if the promised improvements to the property have not been completed, the agreement or contract shall contain the following language in conspicuous type immediately above the line for the purchaser's signature:

YOU MAY NOT RECEIVE YOUR LAND UNDER THIS CONTRACT IF THE SUBDIVIDER FILES FOR BANKRUPTCY PROTECTION OR OTHERWISE IS UNABLE TO PERFORM UNDER THE TERMS OF THIS CONTRACT PRIOR TO YOUR RECEIVING A DEED EVEN IF YOU HAVE MADE ALL THE PAYMENTS PROVIDED FOR UNDER THIS CONTRACT. IF YOU HAVE ANY QUESTIONS ABOUT THE MEANING OF THIS DOCUMENT, CONSULT AN ATTORNEY.

• Recording the Agreement: To protect both parties, the Agreement for Deed should be recorded with the county recorder's office.

Use for residential, vacant land, rental property, condominiums and planned unit developments. For use in Florida only.

Our Promise

The documents you receive here will meet, or exceed, the Bay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bay County Agreement for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Michael F.

May 12th, 2021

I'm not too bright and I made a mess of things when I tried to create my own deed. It was lucky that I found the forms here after so many of my personal failures. It's good that the pros know what they are doing.

Such kind words Michael, thank you.

Deborah C.

February 1st, 2019

I would recommend these forms to others.

Thank you!

Robert F.

December 1st, 2021

Great, quick and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

April C.

May 18th, 2021

Spot on forms and process. YMMV but way more efficient and cost effective than contacting an ambulance... attorney.

Thank you!

Gina I.

June 14th, 2021

Found the forms I needed with no problem and easy to fill out thanks to the guide that is with it. Big help!

Thank you for your feedback. We really appreciate it. Have a great day!

Billie W.

April 23rd, 2021

Excellent way to do this kind of transaction.

Thank you!

Darrell W.

November 10th, 2021

Fast and easy to use. Nice to have available online.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth B.

October 26th, 2023

Your site provided all I needed. Thank you!

It was a pleasure serving you. Thank you for the positive feedback!

Robert J D.

December 19th, 2018

No feedback

Thank you for your feedback. We really appreciate it. Have a great day!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Kathleen S.

September 30th, 2020

The process was easy and the Staff was very helpful. Document was recorded quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy v.

February 3rd, 2022

Amazing! So easy to get all the forms. Very impressive!

Thank you!