Download District Of Columbia Gift Deed Legal Forms

District Of Columbia Gift Deed Overview

Gifts of Real Property in the District of Columbia

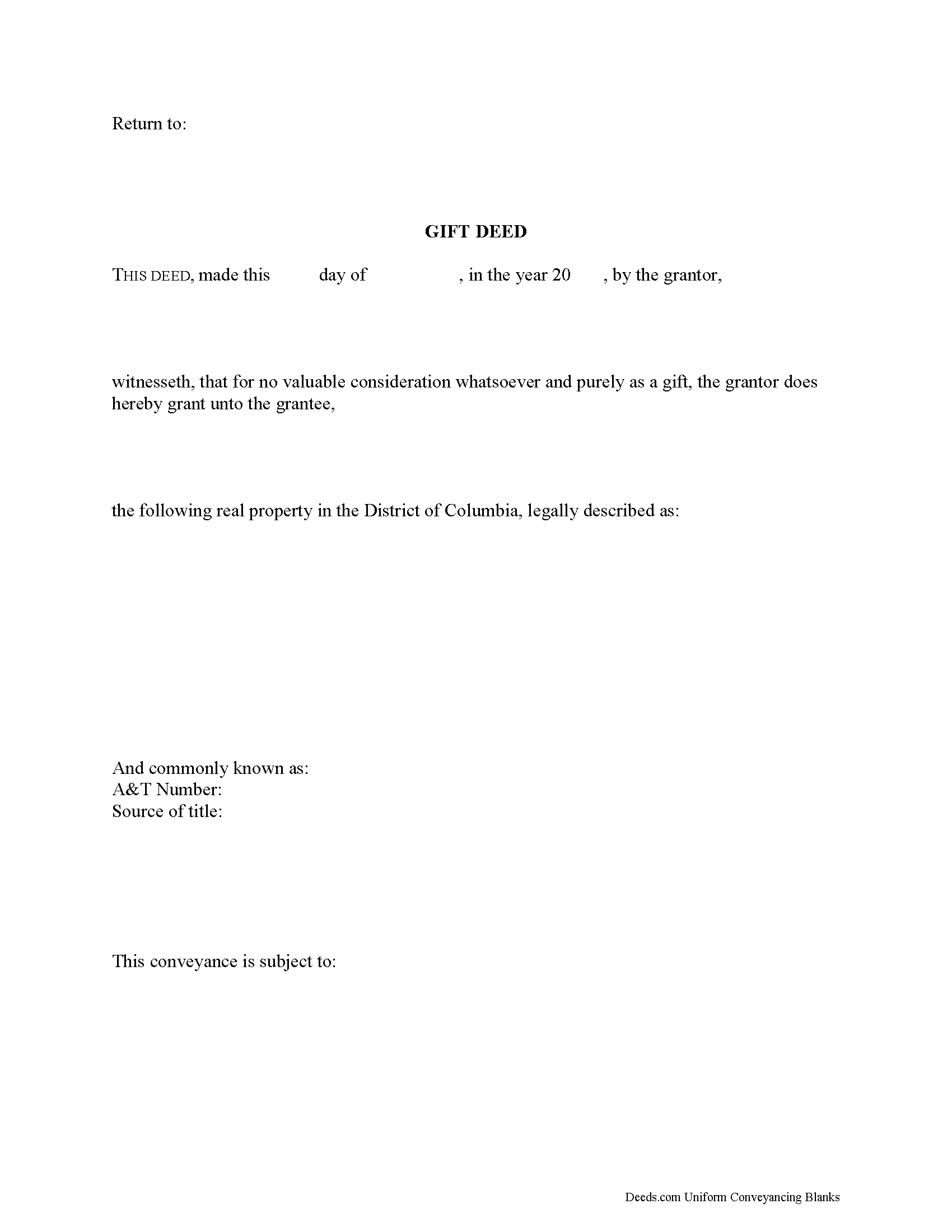

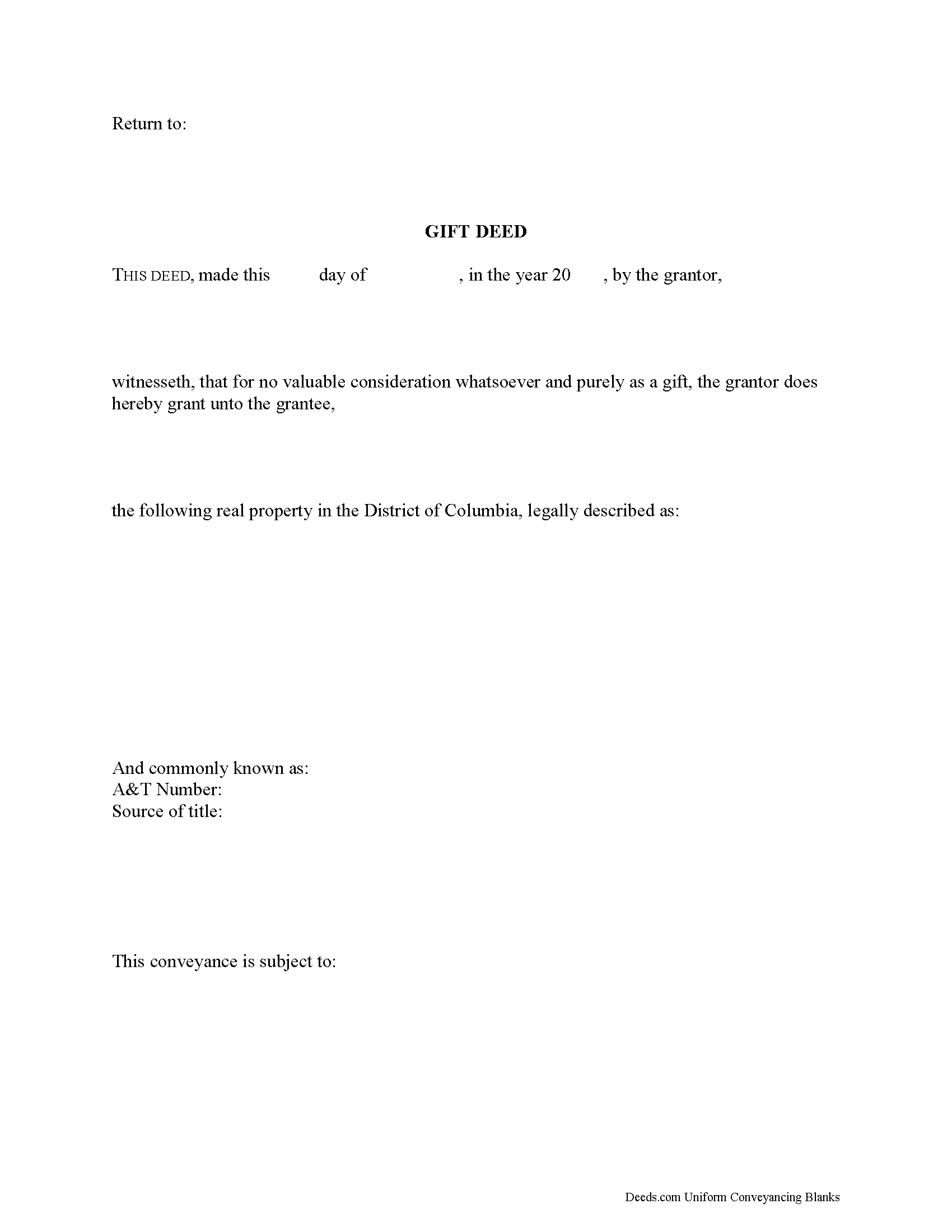

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or co-ownership. For District of Columbia residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. An estate conveyed to two or more people is presumed a tenancy in common, unless otherwise specified (D.C. Code 42-516).

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Per the Recorder of Deeds, a complete legal description includes the lot number, square number, subdivision, and reference information as recorded with the Office of the Surveyor. Recite the source of title to maintain a clear chain of title, and detail any restrictions associated with the property. Each grantor must sign the deed in the presence of a notary public for a valid transfer. All signatures must be original.

In the District of Columbia, all conveyances of real property require both a document intake sheet and a completed Real Property Recordation and Transfer Tax Form (FP 7/C). The latter form should be completed by both the grantor and the grantee, and submitted with the deed for recording. Record the completed gift deed, along with additional materials, with the Recorder of Deeds office. Contact the same office to verify recording fees and accepted forms of payment.

With gifts of real property, the recipient of the gift (grantee or donee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the grantee is responsible for paying the requisite state and federal income tax [1].

Gifts of real property in the District of Columbia are subject to the federal gift tax. The person or entity making the gift (grantor or donor) is responsible for paying the tax; however, if the donor does not pay the gift tax, the done (grantee) will be held liable [1]. For questions regarding state tax laws, consult a tax specialist.

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that gifts valued below $15,000 do not require a federal gift tax return (Form 709). However, if the gift's value could possibly be disputed by the IRS, a donor may benefit from filing a Form 709 [2].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a District of Columbia lawyer with any questions about gift deeds or other issues related to the transfer of real property.

[1] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[2] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes