New Castle County Grant Deed Form (Delaware)

All New Castle County specific forms and documents listed below are included in your immediate download package:

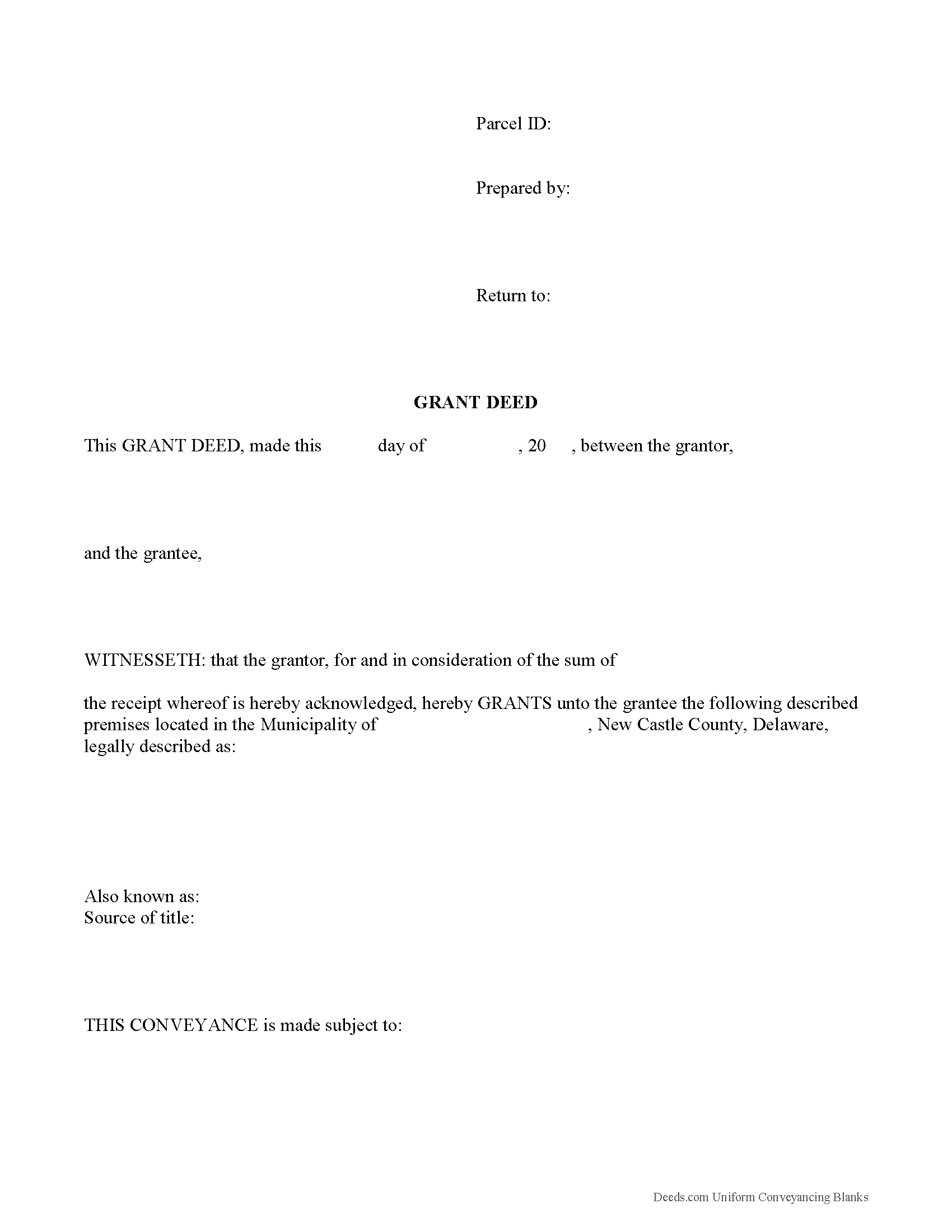

Grant Deed Form

Fill in the blank Grant Deed form formatted to comply with all Delaware recording and content requirements.

Included New Castle County compliant document last validated/updated 11/19/2024

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included New Castle County compliant document last validated/updated 10/11/2024

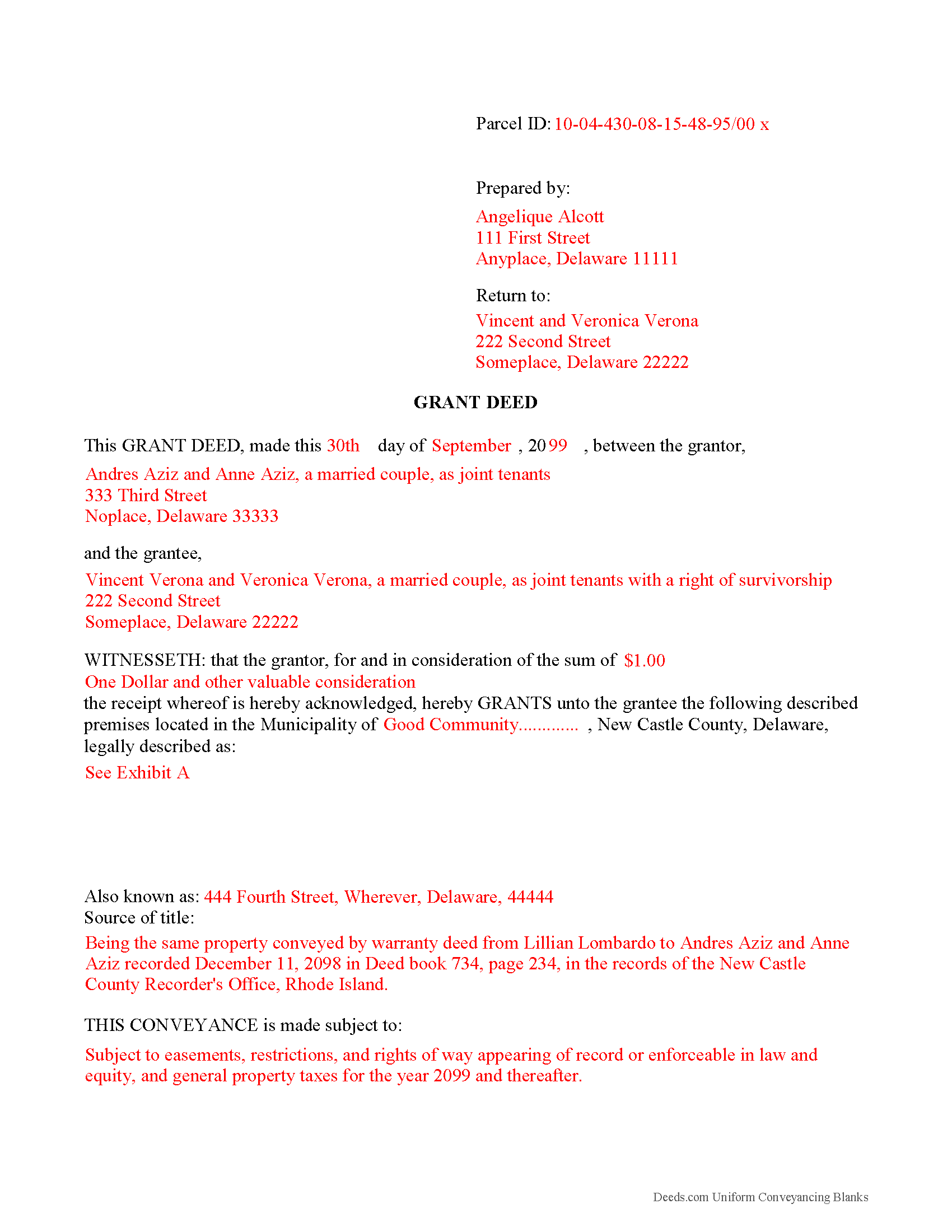

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included New Castle County compliant document last validated/updated 7/22/2024

The following Delaware and New Castle County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in New Castle County. The executed documents should then be recorded in the following office:

Recorder of Deeds

Louis L Redding Bldg - 800 N French St, 4th floor, Wilmington, Delaware 19801

Hours: 8:30 to 4:00 Monday - Friday / Recording until 3:45

Phone: (302) 395-7700

Local jurisdictions located in New Castle County include:

- Bear

- Claymont

- Delaware City

- Hockessin

- Kirkwood

- Middletown

- Montchanin

- New Castle

- Newark

- Odessa

- Port Penn

- Rockland

- Saint Georges

- Townsend

- Wilmington

- Winterthur

- Yorklyn

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the New Castle County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in New Castle County using our eRecording service.

Are these forms guaranteed to be recordable in New Castle County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by New Castle County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in New Castle County that you need to transfer you would only need to order our forms once for all of your properties in New Castle County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Delaware or New Castle County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our New Castle County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The possession of land, tenements, and hereditaments in Delaware can be transferred by a deed in writing. The legal estate will accompany the use and pass with it (25 Del. C. 101). A form for the conveyance of real estate is presented in 121 of the Delaware Revised Statutes. This form, if duly executed and acknowledged, is sufficient for the conveyance of real estate.

The words "grant and convey" in any deed will, unless specifically limited or restricted, operate as a special warranty against the grantor and the grantor's heirs and all persons claiming under the grantor (121). A grant deed contains some covenants of warranty, but is not as extensive as a warranty deed. In this type of deed, the grantor warrants that he or she has not previously conveyed the estate being granted and has not encumbered the property except as may be stated in the deed.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or co-ownership. For Delaware residential property, the primary methods for holding title are tenancy in common and joint tenancy. An estate conveyed to two or more people is presumed a tenancy in common, unless a joint tenancy is specified (25 Del. C. 701).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the source of title to maintain a clear chain of title, and detail any restrictions associated with the property. Each grantor must sign the deed in the presence of a notary public for a valid transfer. All signatures must be original. Finally, the form must meet all state and local standards for recorded documents. Note that each of Delaware's three counties requires a different format, so make sure to check before recording.

In Delaware, all conveyances of real property require a completed Realty Transfer Tax Return and Affidavit of Gain and Value (9 Del. C. 9605(d)). This form must be completed by both the grantor and the grantee, and it must be submitted with the deed for recording.

Property in Kent County requires a New Property Owner Information Form. This form must be completed by the grantee. Kent County also requires the payment of all state and municipal realty transfer taxes upon the transfer, except for the City of Dover realty transfer tax (See 9 Del. C. 9605(i)).

In Sussex County, include an Affidavit of Realty Transfer Tax. It must be signed by the grantor and submitted with the deed.

Before a grant deed can be recorded by a county recorder in Delaware, it must be signed and acknowledged by the grantor. Acknowledgments can take place in any county in Delaware, by any party to the deed. Acknowledgements in this state may be made in the Superior Court, before any judge in Delaware, notary public, before two justices of the peace for the same county, or before the mayor of the city of Wilmington. A grant deed can also be proved in the court by one or more of the subscribing witnesses (122). The acknowledgement or proof of an instrument should be certified by a certificate attached to the deed or endorsed on it (123). If a grant deed is acknowledged out of state, acknowledgements can be taken by any of the officers listed under 129 of the Delaware Revised Statutes. A recorder will not receive a grant deed for recordation unless it is accompanied by an affidavit of residence (9605).

The recording statute in Delaware is a pure race statute. A grant deed, once acknowledged or proved and certified as provided, should be recorded in the recorder's office in the county where such lands are located ( 151). The recording of a deed for one county will take effect only in respect to lands or tenements mentioned in the deed situated in such county (152). Priority of instruments will be determined by the time of recording (153).

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Delaware lawyer with any questions about grant deeds or other issues related to the transfer of real property.

Our Promise

The documents you receive here will meet, or exceed, the New Castle County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your New Castle County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

DENISE E.

February 25th, 2021

I just submitted a beneficiary deed and it was accepted immediate and then recorded the next day! I like that I receive email messages notifying me of the process. The process was super easy and seamless. It's saved me so much time that I did not have to drive to downtown Phoenix to have this document record it. I love Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Eldridge S.

August 5th, 2019

very pleased to attain this important document

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem.

Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description!

Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen M.

June 10th, 2019

I was quite pleased with Deeds.com. I got the information I requested instantly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jane N.

February 17th, 2022

Good morning,

It seems to be easy to navigate and print out the form I needed. Great!!!

Jane

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William S.

June 4th, 2021

Contents were well done. Could not remove and replace the "Deeds/" footer, rendering the form unusable for filing with a court and county deed records. This should be corrected.

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca M.

December 28th, 2023

Great service! fast turnaround! I’ve used Deeds.com multiple times, and the software interface is easy to use. I was able to get Deeds for Nevada re-recorded (errors on my lawyers part), quickly with Deeds.com support. Thanks Deeds.com!!

It was a pleasure serving you. Thank you for the positive feedback!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Yvonne A.

April 25th, 2021

love your Deeds.com website...

Thank you!