New Haven County Mortgage Deed Form Form (Connecticut)

All New Haven County specific forms and documents listed below are included in your immediate download package:

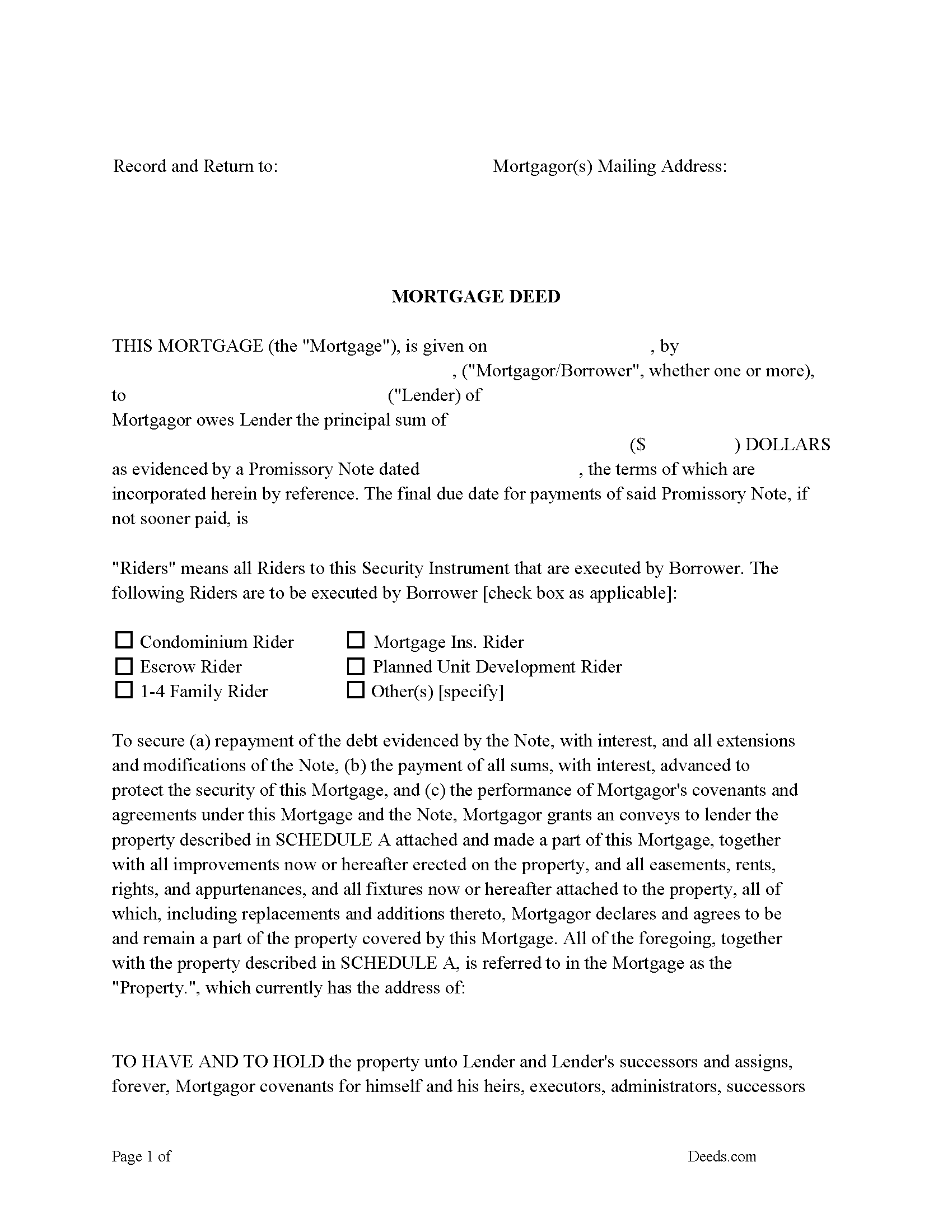

Mortgage Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included New Haven County compliant document last validated/updated 11/15/2024

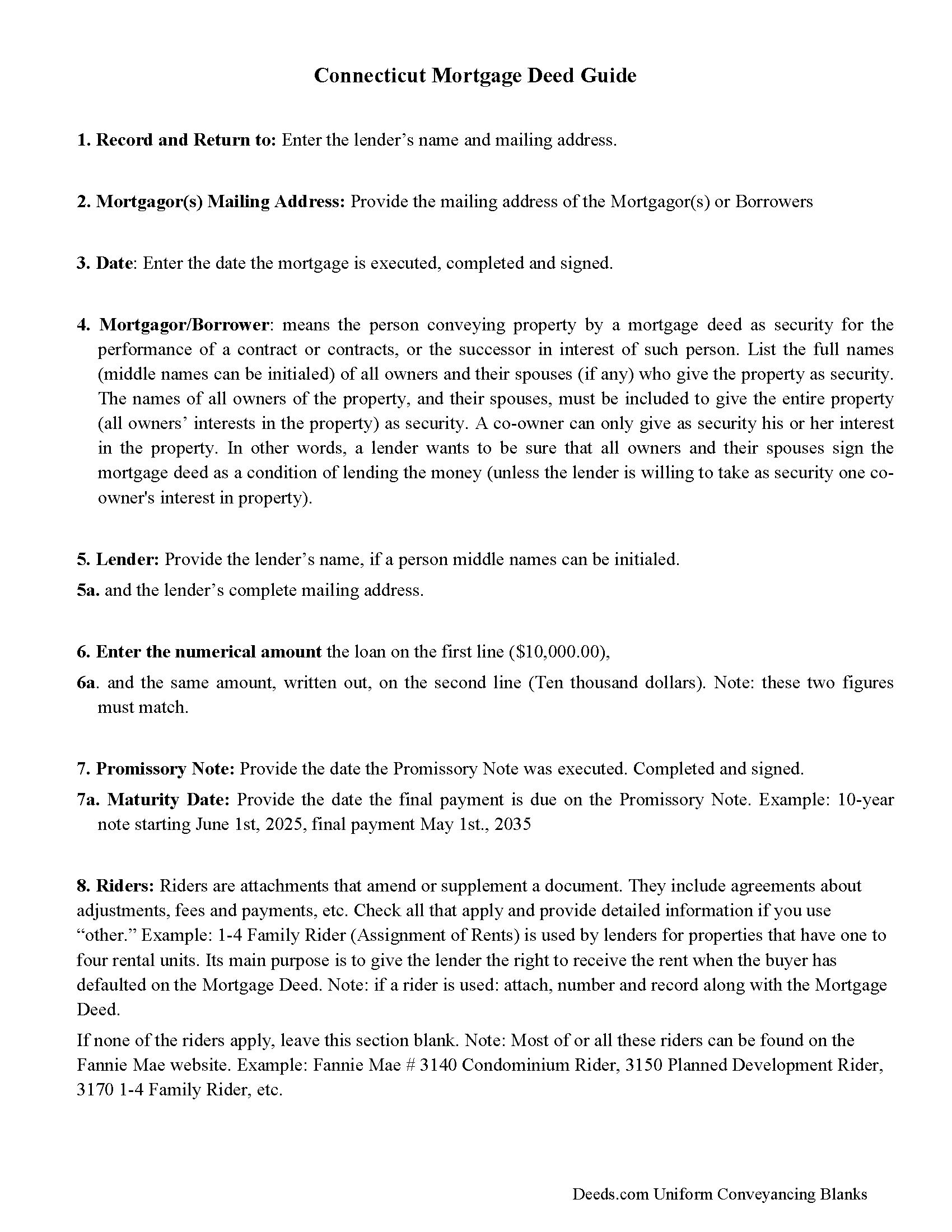

Mortgage Deed Guidelines

Line by line guide explaining every blank on the form.

Included New Haven County compliant document last validated/updated 11/11/2024

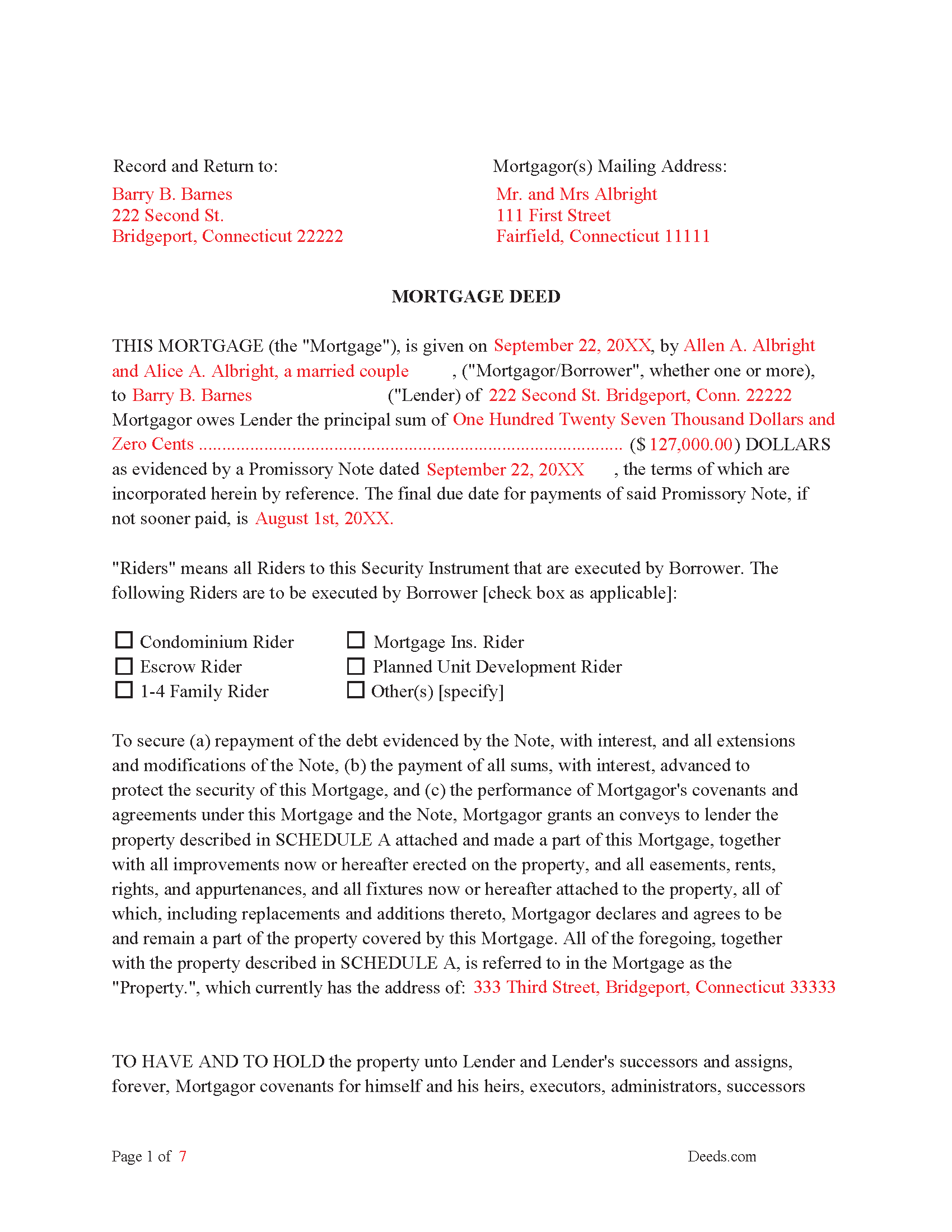

Completed Example of the Mortgage Deed

Example of a properly completed form for reference.

Included New Haven County compliant document last validated/updated 10/8/2024

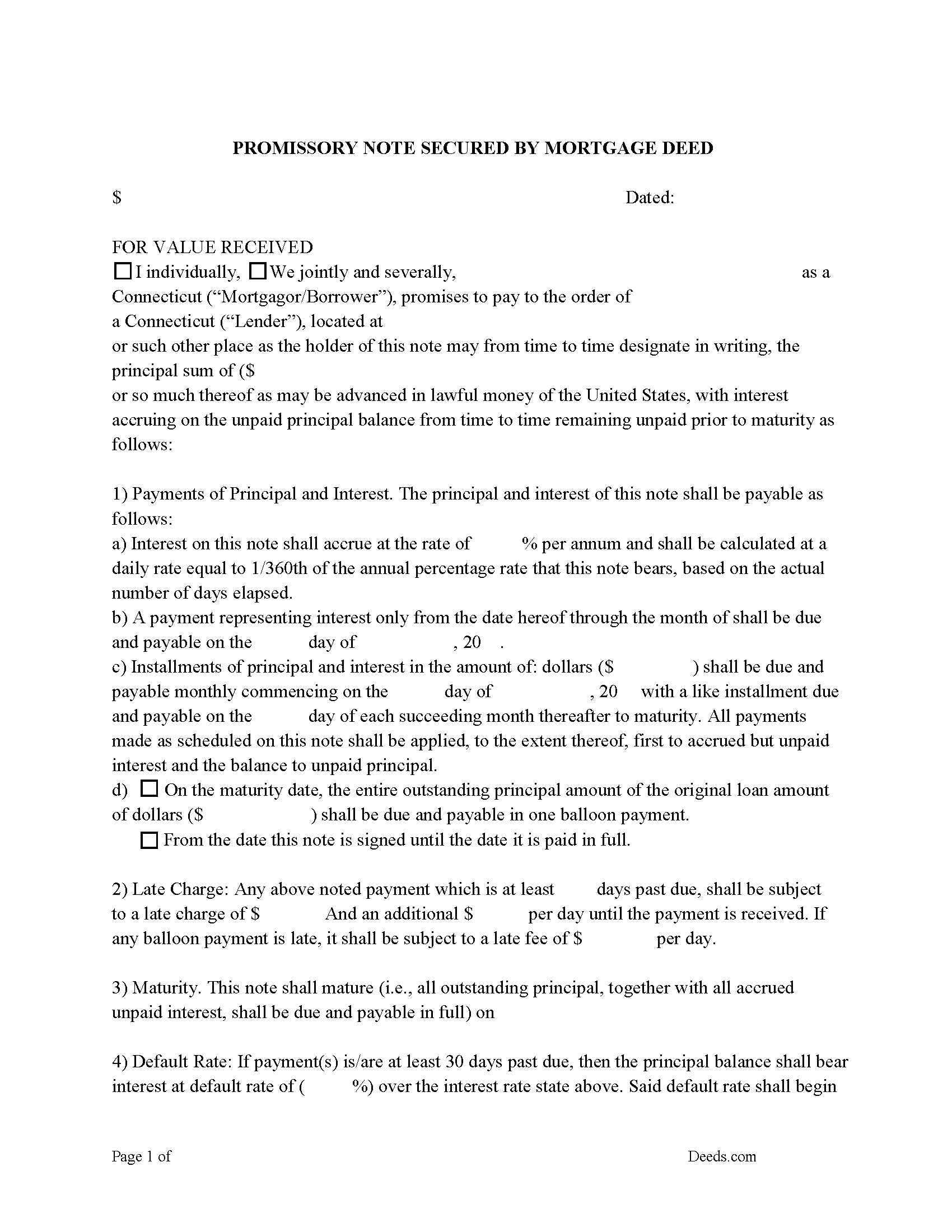

Promissory Note Form

Note that is secured by the Mortgage Deed. Can be used for traditional installments or balloon payment.

Included New Haven County compliant document last validated/updated 10/7/2024

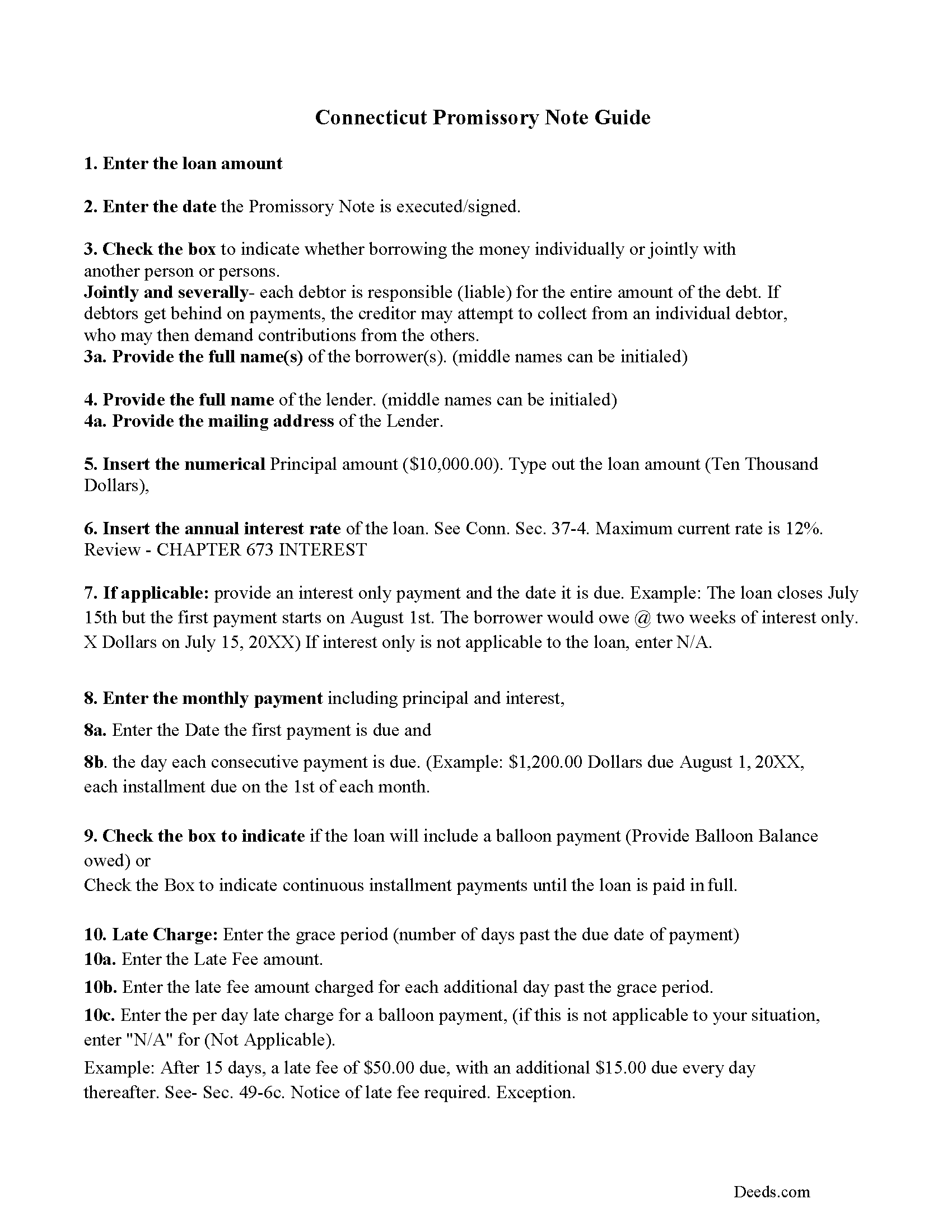

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included New Haven County compliant document last validated/updated 11/25/2024

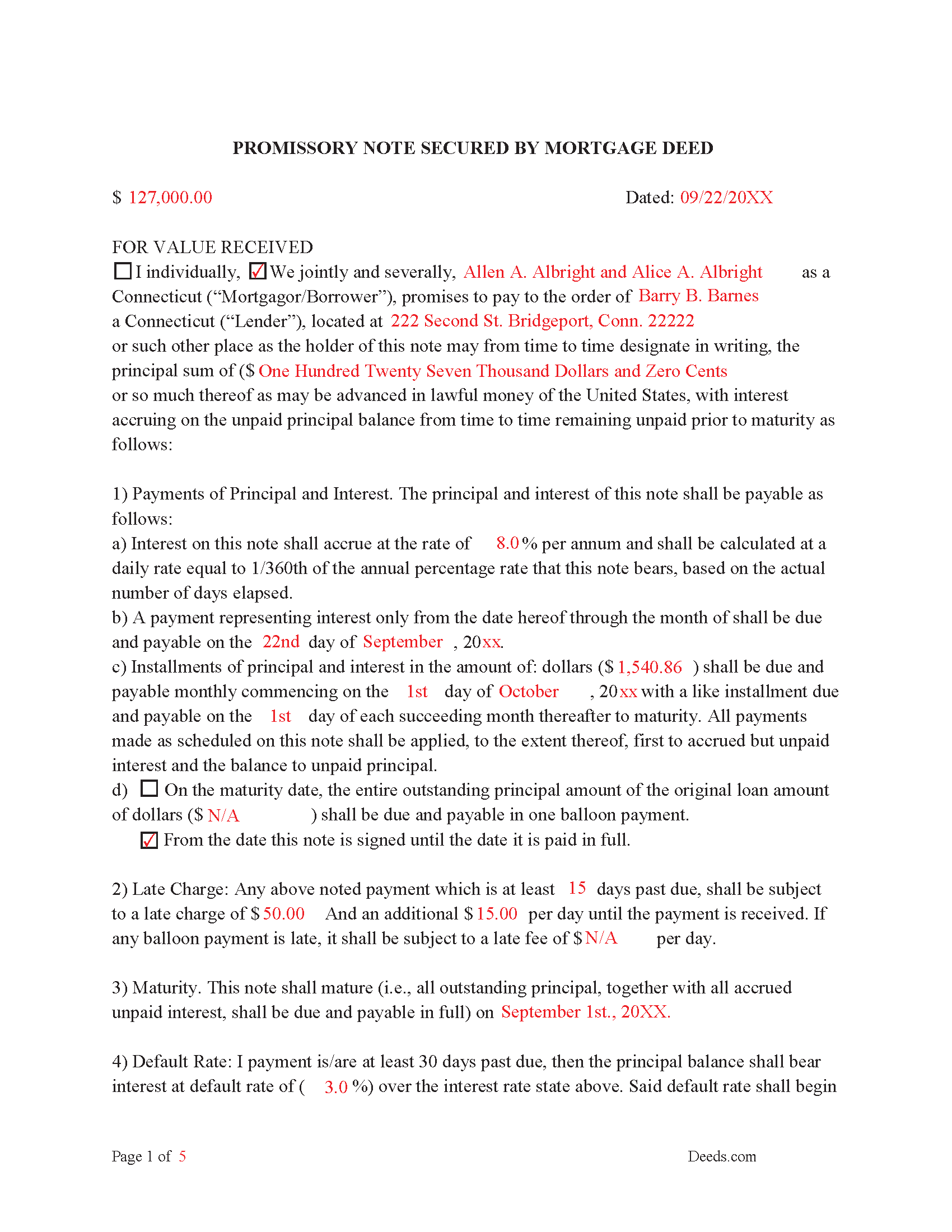

Completed Example of the Promissory Note

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included New Haven County compliant document last validated/updated 8/2/2024

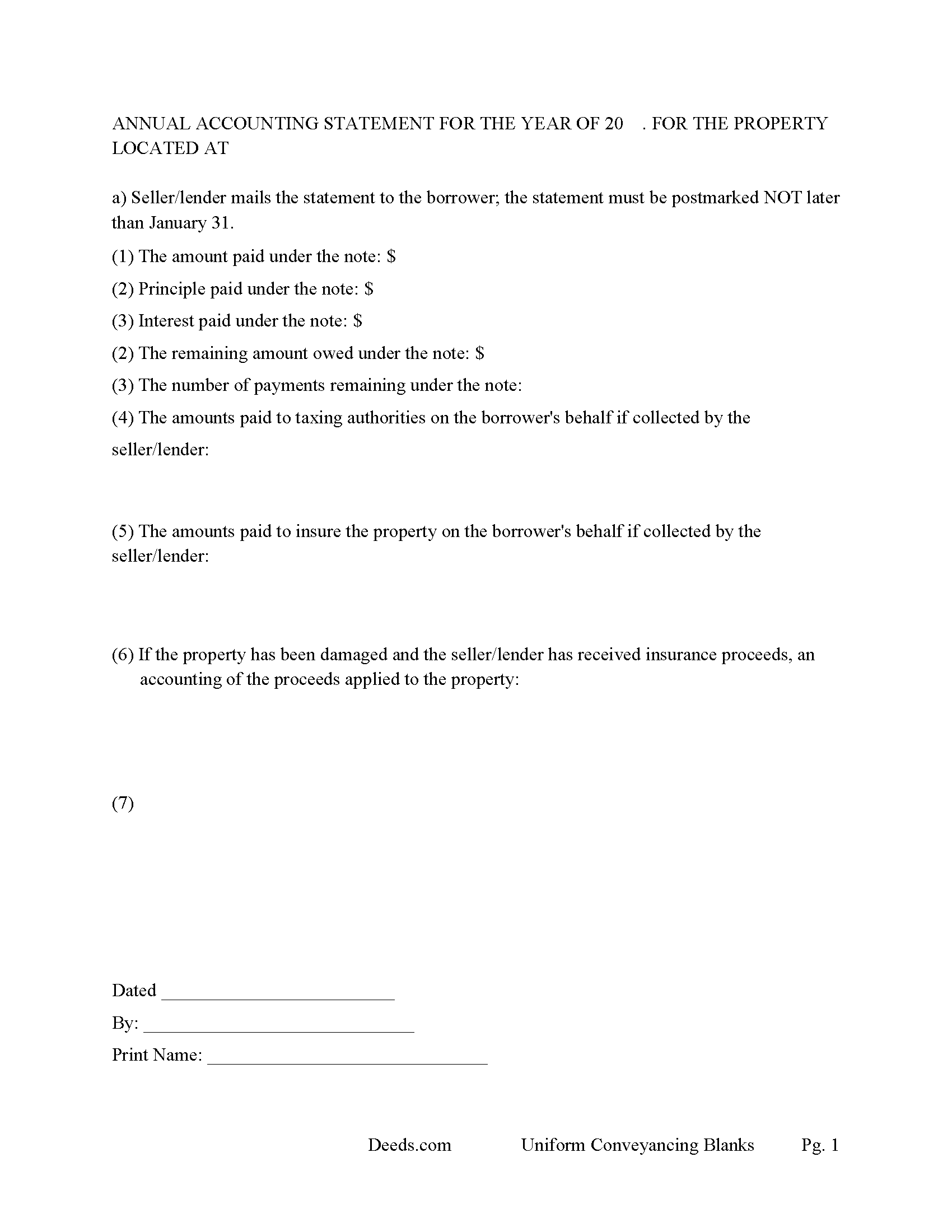

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included New Haven County compliant document last validated/updated 11/18/2024

The following Connecticut and New Haven County supplemental forms are included as a courtesy with your order:

When using these Mortgage Deed Form forms, the subject real estate must be physically located in New Haven County. The executed documents should then be recorded in one of the following offices:

Ansonia Town & City Clerk

City Hall - 253 Main St, Ansonia, Connecticut 06401

Hours: Mon-Wed 8:30 to 4:30; Thu 8:30 to 5:00; Fri 8:30 to 1:00

Phone: (203) 736-5980

Beacon Falls Town Clerk

Town Hall - 10 Maple St, Beacon Falls, Connecticut 06403

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 729-8254

Bethany Town Clerk

Town Hall - 40 Peck Rd, Bethany, Connecticut 06524-3338

Hours: Mon-Fri 9:00 to 4:30; Mon eve 6:30 to 7:30

Phone: (203) 393-2100 Ext 104, 105, 106

Branford Town Clerk

Town Hall - 1019 Main St, Branford , Connecticut 06405

Hours: Mon-Fri 8:30 to 4:30 / Recording 9:00 to 4:00

Phone: (203) 315-0678

Cheshire Town Clerk

Town Hall - 84 South Main St, Cheshire, Connecticut 06410

Hours: Mon-Fri 8:30 to 4:00

Phone: (203) 271-6601

Derby Town/City Clerk

City Hall - 1 Elizabeth St, Derby, Connecticut 06418

Hours: Mon-Fri 9:00 to 5:00

Phone: (203) 736-1462

East Haven Town Clerk

Town Hall - 250 Main St, East Haven, Connecticut 06512

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 468–3201, 3202

Guilford Town Clerk

31 Park St, Guilford, Connecticut 06437

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 453-8001

Hamden Town Clerk

Government Center - 2750 Dixwell Ave, Hamden, Connecticut 06518

Hours: Mon-Fri 8:45 to 4:15

Phone: (203) 287-7028

Madison Town Clerk

8 Campus Dr, Madison, Connecticut 06443

Hours: Mon-Fri 8:30 to 4:00

Phone: (203) 245-5672

Meriden City Clerk

City Hall - 142 East Main St, Meriden, Connecticut 06450

Hours: Mon-Fri 8:30 to 5:00

Phone: (203) 630-4030

Middlebury Town Clerk

Town Hall - 1212 Whittemore Rd, Middlebury, Connecticut 06762

Hours: Mon-Fri 8:00 to 4:00

Phone: (203) 758-2557

Milford City Clerk

70 W River St, Milford, Connecticut 06460

Hours: Mon-Fri 8:30 to 5:00 / Recording until 4:30

Phone: (203) 783-3210

Naugatuck Town Clerk

229 Church St, 2nd Floor, Naugatuck, Connecticut 06770

Hours: Mon-Fri 8:30 to 4:00 / Recording until 3:30

Phone: (203) 720-7055

New Haven City/Town Clerk

200 Orange St, New Haven, Connecticut 06510

Hours: Mon-Fri 9:00 to 5:00 / Recording until 4:00

Phone: (203) 946-8346

North Branford Town Clerk

909 Foxon Rd, North Branford , Connecticut 06471

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 484-6015

North Haven Town Clerk

Memorial Town Hall - 18 Church St, North Haven, Connecticut 06473

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 239-5321 Ext 630

Orange Town Clerk

Town Hall - 617 Orange Center Rd, Orange, Connecticut 06477

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 891-4717, 4728, 4729, 4730

Oxford Town Clerk

Town Hall - 486 Oxford Rd, Oxford, Connecticut 06478

Hours: Mon 9:00 to 7:00; Tue-Thu 9:00 to 5:00; Fri 9:00 to 12:00 & 1:00 to 5:00

Phone: (203) 888-2543 Ext 3024, 3025, 3026

Prospect Town Clerk

Town Hall - 36 Center St, Prospect, Connecticut 06712

Hours: Mon-Fri 8:30 to 4:00

Phone: (203) 758-4461

Seymour Town Clerk

Town Hall - 1 First St, Seymour, Connecticut 06483

Hours: Mon-Thu 8:00 to 4:30; Fri 8:00 to 12:00

Phone: (203) 888-0519

Southbury Town Clerk

501 Main St South, Rm 202, Southbury, Connecticut 06488

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 262-0657

Wallingford Town Clerk

45 S Main St, Rm #108, Wallingford, Connecticut 06492

Hours: Mon-Fri 9:00 to 5:00 / Recording until 4:45

Phone: (203) 294-2145

Waterbury Town Clerk

235 Grand St, 1st Floor, Waterbury, Connecticut 06702

Hours: Mon-Fri 8:30 to 4:30

Phone: (203) 574-6806

West Haven City Clerk

City Hall - 355 Main St, 1st Floor, West Haven, Connecticut 06516

Hours: Mon-Fri 9:00 to 5:00

Phone: (203) 937-3535

Wolcott Town Clerk

Town Hall - 10 Kenea Ave, Wolcott, Connecticut 06716

Hours: Mon-Wed 8:00 to 4:30; Thu 8:00 to 5:30; Fri 8:00 to 12:00 / Recording until 30 mins to closing

Phone: (203) 879-8100

Woodbridge Town Clerk

11 Meetinghouse Lane, Woodbridge, Connecticut 06525

Hours: Mon-Fri 8:30 to 4:00 / Recording until 3:30

Phone: (203) 389-3422

Local jurisdictions located in New Haven County include:

- Ansonia

- Beacon Falls

- Bethany

- Branford

- Cheshire

- Derby

- East Haven

- Guilford

- Hamden

- Madison

- Meriden

- Middlebury

- Milford

- Naugatuck

- New Haven

- North Branford

- North Haven

- Northford

- Orange

- Oxford

- Prospect

- Seymour

- South Britain

- Southbury

- Wallingford

- Waterbury

- West Haven

- Wolcott

- Woodbridge

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the New Haven County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in New Haven County using our eRecording service.

Are these forms guaranteed to be recordable in New Haven County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by New Haven County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Deed Form forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in New Haven County that you need to transfer you would only need to order our forms once for all of your properties in New Haven County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Connecticut or New Haven County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our New Haven County Mortgage Deed Form forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This is a Connecticut Mortgage Deed given to secure a debt on real property. This form can be used to finance a house, rental property (up to 4 units) or Condominium. This form secures repayment of a debt, with interest. evidenced by a Promissory Note. A Mortgage Deed with strong default clauses can be beneficial when selling and/or financing a property.

MORTGAGOR also known as BORROWER(S), WARRANTS AND COVENANTS AS FOLLOWS:

1. PROMISE TO PAY. Borrower shall pay the indebtedness evidenced by the Note and secured by this Mortgage.

2. CHARGES, LIENS, ESCROW. Borrower shall promptly pay all taxes, assessments, fines, impositions and other charges against the Property.

3. HAZARD INSURANCE AND CONDEMNATION. Borrower shall insure the Property against loss by fire, and such other hazards as Lender may require and in such amounts.

4. CONDOMINIUMS, PLANNED UNIT DEVELOPMENTS, COMMON INTEREST COMMUNITIES. If this Mortgage is on a unit in a condominium, a planned unit development or any common interest community (as that term is defined in Section 47-202(7) of the Connecticut General Statutes

5. PRESERVATION AND MAINTENANCE OF PROPERTY. Borrower shall maintain the property in good condition and repair

6. ASSIGNMENT OF RENTS. To further secure the indebtedness secured hereby, Borrower hereby assigns, transfers and sets over to Lender all of the rents and profits now due or which may hereafter become due from the Property.

7. INSPECTION. Lender may make or cause to be made reasonable entries upon and inspection of the Property.

8. FORBEARANCE BY LENDER NOT A WAIVER.

9. COMPLIANCE WITH REGULATIONS. Mortgagor has obtained all permits and approvals

10. ALTERATION OR DEMOLITION. No building or other improvement on the Property shall be structurally altered, removed or demolished without Lender's prior written consent.

11. LEASE RATIFICATION. Borrower shall furnish Lender at any time, upon demand, with a lease ratification and estoppel agreement as to any lease affecting the Property,

12. REMEDIES CUMULATIVE. Each remedy provided in this Mortgage is distinct from and cumulative with any other right or remedy hereunder, or afforded by law or equity, and may be exercised concurrently, independently or successively.

13. SUCCESSORS AND ASSIGNS; CAPTIONS. The covenants and agreements contained in this Mortgage shall bind, and the rights under this Mortgage shall inure to, Mortgagor's and Lender's respective heirs, executors, administrators, successors and assigns.

14. NOTICE. Any notice provided for in this Mortgage shall be deemed to have been given to Mortgagor or to Lender when given in the manner designated herein.

15. GOVERNING LAW; SEVERABILITY. This mortgage shall be governed by the laws of the State of Connecticut.

16. MODIFICATION OR EXTENSION. Lender reserves the right, together with Mortgagor, to amend or modify in any way the terms of this Mortgage and to extend the term hereof or time for making any payment hereunder, all without the consent of any subsequent encumbrancer.

17. ACCELERATION; REMEDIES. All sums secured by this Mortgage shall immediately become due and payable, at Lender's option, without necessity for demand or notice, if: (a) any installment or payment required under this Mortgage or the Note is not paid when due; (b) Mortgagor shall convey any interest in the Property or be deprived of the same by process or operation of law; (c) Mortgagor or any accommodation maker, endorser or guarantor of the Note (1) becomes generally unable to pay its debts as they become due, (2) admits its inability to pay its debts as they become due, (3) makes a general assignment for the benefit of its creditors, (4) files or becomes the subject of a petition in bankruptcy, for an arrangement with its creditors or for reorganization under any federal or state bankruptcy or other insolvency law, or (5) files or becomes the subject of a petition for the appointment of a receiver, custodian, trustee or liquidator of the party or of all or substantially all of its assets under any federal or state bankruptcy or other insolvency law; (d) Mortgagor or any accommodation maker, endorser or guarantor of the Note shall fail to perform any other covenant or agreement contained in this Mortgage, the Note or any guaranty securing the Note; or (e) Mortgagor shall fail to perform for a period of ten (10) days any covenant or agreement contained in any other mortgage securing the Property. If Lender declares all sums secured by this Mortgage immediately due and payable, Lender may invoke any remedies permitted by applicable law.

18. PAYMENTS AND PROCEEDS. Any payment made with respect to the Note and any amount received by Lender may be applied by Lender to accrued interest,

Fully formatted for recording.

PROMISSORY NOTE SECURED BY MORTGAGE DEED

Promissory Note guided by Connecticut Law, includes the option of accepting installment loan payments or a balloon payment, Balloon payments are often used to cash out when selling and financing a property. Example: 3 years of payments, followed by a balloon payment of $$$. Late payments and default rates are charged to protect Lender(s). The Borrower in this note has the option of paying the loan off early, with no penalty, if so desired.

FOR VALUE RECEIVED

A Connecticut ("Mortgagor/Borrower"), promises to pay a Connecticut ("Lender"), located at YYYYY or such other place as the holder of this note may from time to time designate in writing, the principal sum of ($ $$$$$) or so much thereof as may be advanced in lawful money of the United States, with interest accruing on the unpaid principal balance from time to time remaining unpaid prior to maturity as follows:

1) Payments of Principal and Interest. The principal and interest of this note shall be payable as follows:

2) Late Charge: Any above noted payment which is at least XX days past due, shall be subject to:

3) Maturity. This note shall mature (i.e., all outstanding principal, together with all accrued interest:

4) Default Rate: I payment is/are at least 30 days past due, then the principal balance shall bear

5) This Note shall be secured by a Mortgage Deed to real property commonly known as:

6) Failure to pay this Note or any of the Additional Obligations at maturity, or the failure of

7) Prepayment. Borrower shall have the right to prepay, without penalty, all or part of the unpaid balance of this Note

8) Default. If any of the following events of default occur, this Note and any other obligations of the Borrower to the Lender, shall become due immediately, without demand or notice:

a)the failure of the Borrower to pay the principal and any accrued interest when due;

b)the filing of bankruptcy proceedings involving the Borrower as a debtor;

c)the application for the appointment of a receiver for the Borrower;

d)the making of a general assignment for the benefit of the Borrower's creditors;

e)the insolvency of the Borrower;

f)a misrepresentation by the Borrower to the Lender for the purpose of obtaining or extending credit.

9)In addition, the Borrower shall be in default if there is a sale, transfer, assignment, or any other disposition of any real estate pledged as collateral for the payment of this Note, or if there is a default in any security agreement which secures this Note.

10) All payments due under this Note shall be paid when due,

11) In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee

12) The obligations of Borrower to Lender under this Note and the Additional Obligations herein remain in full force and effect until Lender has received payment in full of all obligations. The

13) Borrowers agree that the interest rate contracted for includes the interest rate set forth herein and any other charges, fees, costs and expenses incidental to this transaction paid by Borrowers to the extent the same are deemed interest under applicable law. If, for any circumstance

14) In case of renewal or extension of this Note, at any or times, all of the provisions of the Loan Documents shall remain in full force and effect as security for the payment of the renewed or extended Note and for the performance of the obligations of Borrower under the Loan Documents.

15) Governing Law: Lender; Joint and Several Obligation. This Note will be governed by the laws of the State of Connecticut. The Borrower agrees to pay this Note as written to the order of the Lender as defined above.

16) Service of Process. BORROWER HEREBY CONSENTS TO THE JURISDICTION OF

ANY STATE OR FEDERAL COURT LOCATED WITHIN CONNECTICUT, AND

17) Waiver of Jury Trial. BORROWER HEREBY WAIVES TRIAL BY JURY IN ANY SUIT,

Our Promise

The documents you receive here will meet, or exceed, the New Haven County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your New Haven County Mortgage Deed Form form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Duane S.

June 5th, 2019

Really glad to find your site. Made filing so much easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Darren G.

December 10th, 2021

Your beneficiary deed sample contains a error of the LDPS designation. I copied the designation of LPDS instead of the correct designation

Thank you for your feedback. We really appreciate it. Have a great day!

AMY J.

February 16th, 2022

Very easy user friendly thank you for that

Thank you!

Dapo L.

June 3rd, 2021

The team is very responsive and gets the job done. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

Carlos T.

September 15th, 2021

Site was easy to use and forms were exactly what I needed. Will use this in the future for other needed forms. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

January 18th, 2019

Liked the fact that the forms were fill in the blank. Good to have the option of re-doing them if needed, and I needed ;)

Thank you for your feedback. We really appreciate it. Have a great day!

Anitra C.

July 10th, 2021

This was so easy and the instructions were great.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis D.

November 7th, 2019

Thanks for the efficient process and instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Jack S.

March 5th, 2019

Excellent and timely responses. Do you offer an annual rate? Thank you.

Thanks again Jack. Unfortunately we do not offer any annual rates or subscriptions, sorry.

Lisa P.

October 23rd, 2020

Your forms are worth the investment. The guide and example were very helpful and thorough.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!