Download Connecticut Assignment of Mortgage Legal Forms

Connecticut Assignment of Mortgage Overview

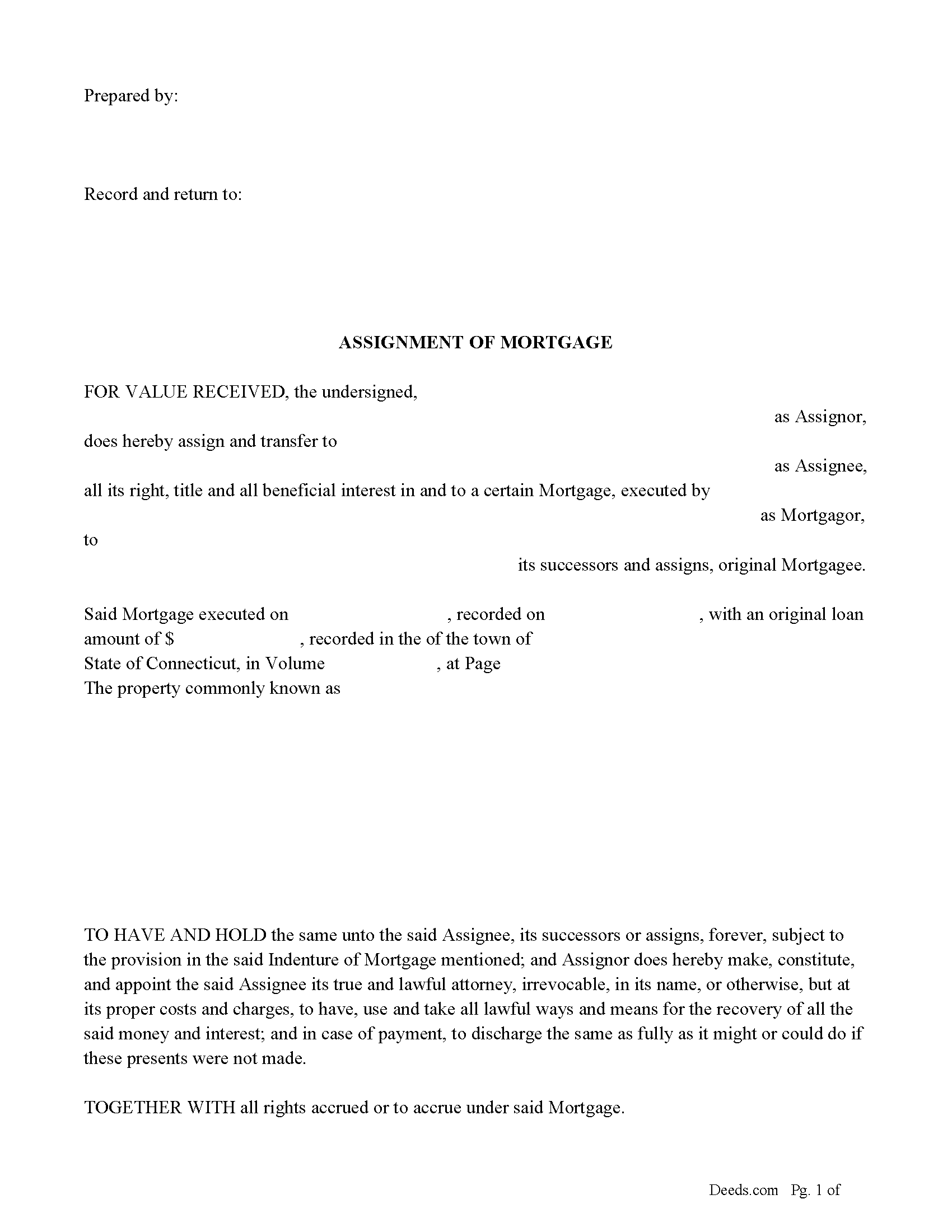

This form is used to assign ("mortgage debt" secured by mortgage) form the current lender to new creditor. (Sec. 49-10.(a))

(If a mortgage debt is assigned, a party obliged to pay such mortgage debt may discharge it, to the extent of the payment, by paying the assignor until the party obliged to pay receives sufficient notice in accordance with subsection (f) of this section that the mortgage debt has been assigned and that payment is to be made to the assignee. In addition to such notice, if requested by the party obliged to pay, the assignee shall furnish reasonable proof that the assignment has been made, and until the assignee does so, the party obliged to pay may pay the assignor. For purposes of this subsection, "reasonable proof" means (1) written notice of assignment signed by both the assignor and the assignee, (2) a copy of the assignment instrument, or (3) other proof of the assignment as agreed to by the party obliged to pay such mortgage debt.) (Sec. 49-10.(d))

Whenever any mortgage debt is assigned by an instrument in writing containing a sufficient description to identify the mortgage, assignment of rent or assignment of interest in a lease, given as security for the mortgage debt, and that assignment has been executed, attested and acknowledged in the manner prescribed by law for the execution, attestation and acknowledgment of deeds of land, the title held by virtue of the mortgage, assignment of rent or assignment of interest in a lease, shall vest in the assignee. An instrument substantially in the following form is sufficient for such assignment:

Know all Men by these Presents, That .... of .... in the county of .... and state of .... does hereby grant, bargain, sell, assign, transfer and set over a certain (mortgage, assignment of rent or assignment of interest in a lease) from .... to .... dated .... and recorded in the records of the town of .... county of .... and state of Connecticut, in book .... at page ....

In Witness Whereof .... have hereunto set .... hand and seal, this .... day of .... A.D. ....

Signed, sealed and delivered

in the presence of

(SEAL)

(Acknowledged) (Sec. 49-10.(b))

In addition to the requirements of subsection (b) of this section, whenever an assignment of any residential mortgage loan (1) made by a lending institution organized under the laws of or having its principal office in any other state, and (2) secured by mortgage on residential real estate located in this state is made in writing, the instrument shall contain the name and business or mailing address of all parties to such assignment.

.... of .... for consideration paid, assign to .... all interest in a mortgage from .... to .... dated .... and recorded in Volume .... at Page .... of the .... Connecticut Land Records.

Signed this .... day of ...., 20...

Witnessed by:

(Acknowledgment) (Sec. 49-10.(c))

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Mortgage" forms.

The Truth and lending act requires that borrowers be notified when their mortgage debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

For use in Connecticut only.