Douglas County Gift Deed Form (Colorado)

All Douglas County specific forms and documents listed below are included in your immediate download package:

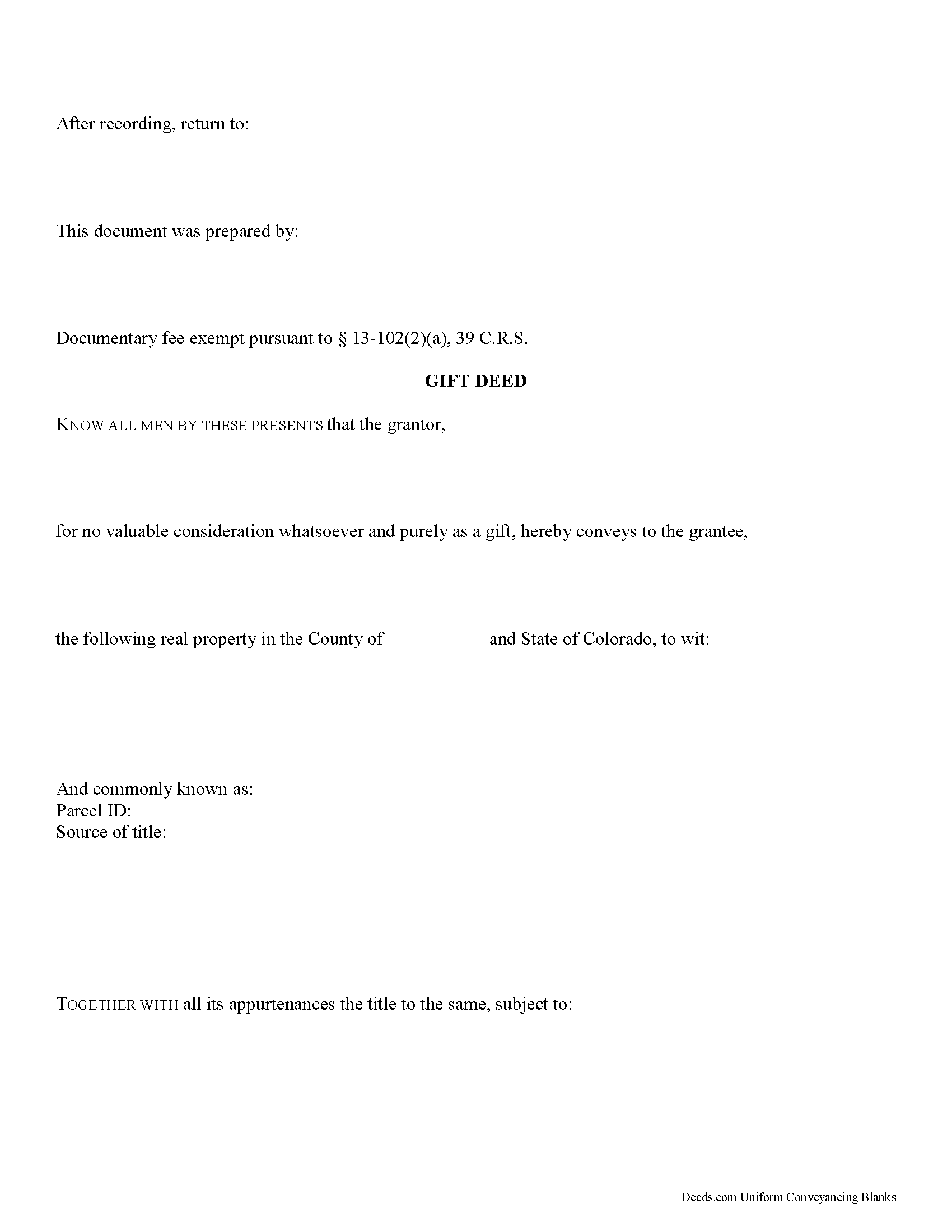

Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Douglas County compliant document last validated/updated 10/18/2024

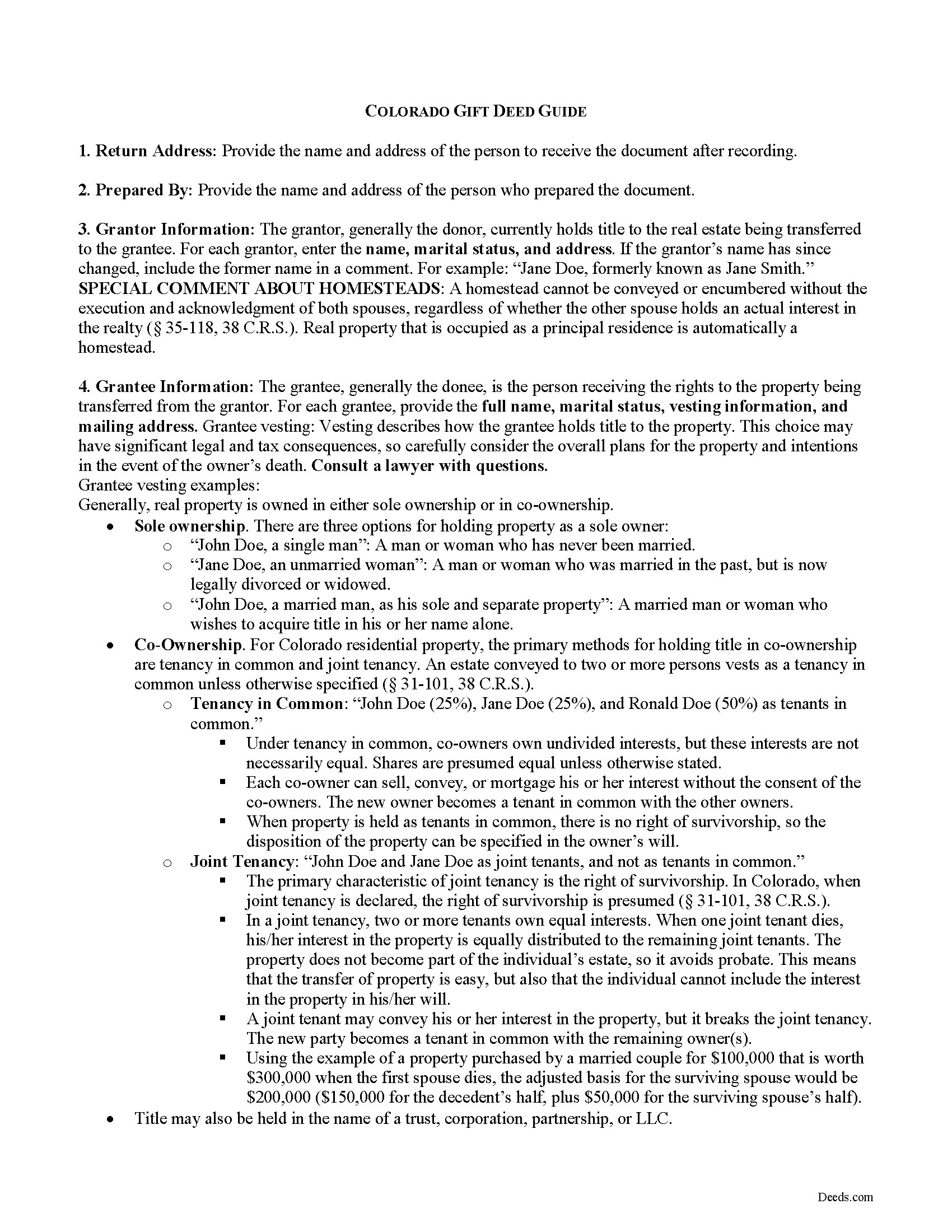

Gift Deed Guide

Line by line guide explaining every blank on the form.

Included Douglas County compliant document last validated/updated 10/21/2024

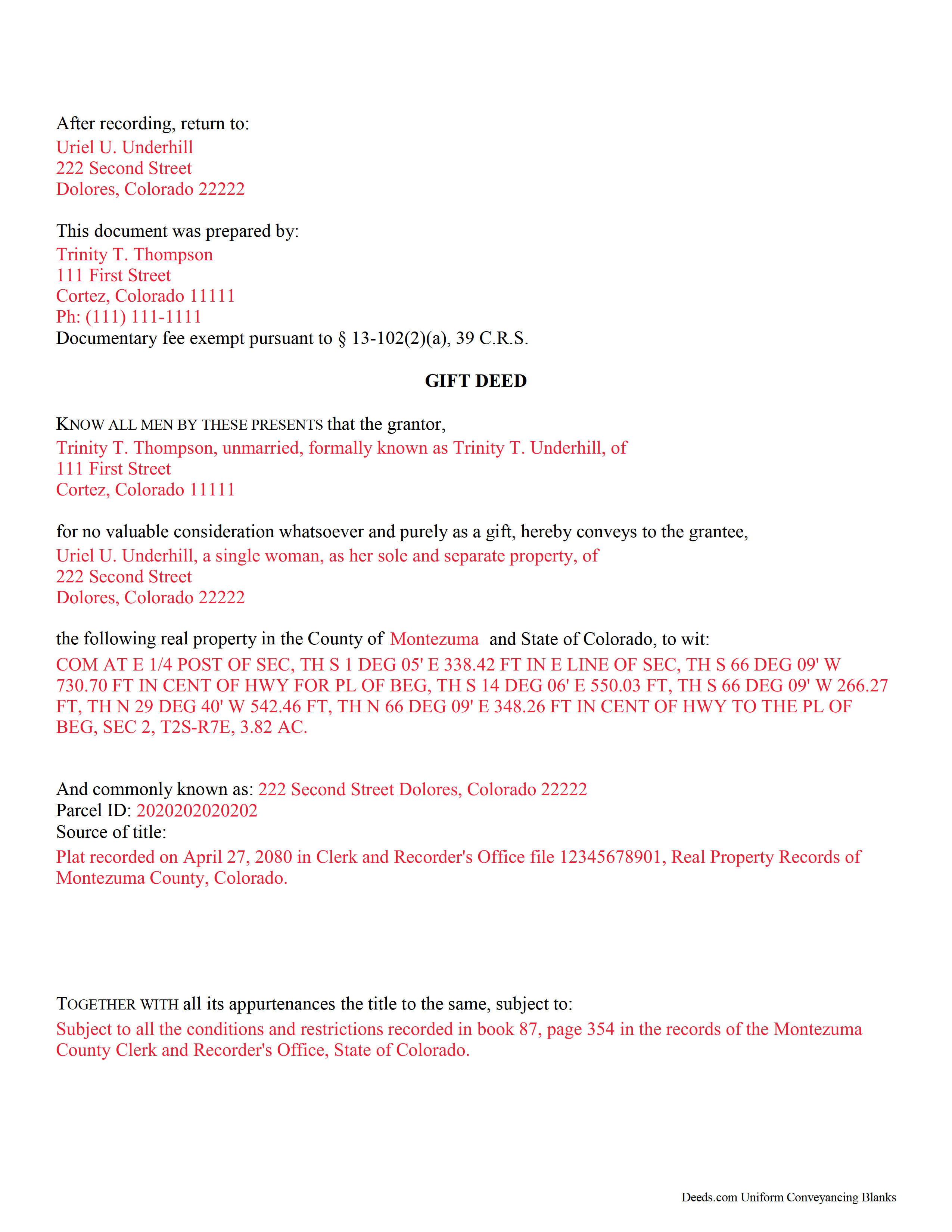

Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

Included Douglas County compliant document last validated/updated 7/12/2024

The following Colorado and Douglas County supplemental forms are included as a courtesy with your order:

When using these Gift Deed forms, the subject real estate must be physically located in Douglas County. The executed documents should then be recorded in the following office:

Douglas County Clerk and Recorder

301 Wilcox St / PO Box 1360, Castle Rock, Colorado 80104

Hours: 8:00am to 5:00pm Monday through Friday

Phone: (303) 660-7446

Local jurisdictions located in Douglas County include:

- Castle Rock

- Franktown

- Larkspur

- Littleton

- Louviers

- Parker

- Sedalia

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Douglas County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Douglas County using our eRecording service.

Are these forms guaranteed to be recordable in Douglas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Douglas County including margin requirements, content requirements, font and font size requirements.

Can the Gift Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Douglas County that you need to transfer you would only need to order our forms once for all of your properties in Douglas County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Colorado or Douglas County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Douglas County Gift Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Gifts of Real Property in Colorado

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Colorado residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. An estate conveyed to two or more persons vests as a tenancy in common unless otherwise specified ( 31-101, 38 C.R.S.). The primary characteristic of joint tenancy is the right of survivorship. In Colorado, when joint tenancy is declared, the right of survivorship is presumed ( 31-101, 38 C.R.S.).

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Recite the source of title to maintain a clear chain of title, and detail any restrictions associated with the property. Each grantor must sign the deed in the presence of a notary public for a valid transfer. All signatures must be original.

A documentary fee is typically imposed on an instrument based on the amount of consideration paid for the transfer ( 13-102, 39 C.R.S.). However, since no consideration is exchanged when gifting real property, these conveyances are exempt ( 13-102(2)(a), 39 C.R.S.). This exemption should be indicated on the first page of the instrument.

In Colorado, a real property transfer declaration (TD-1000) is required for all conveyance documents. This form can be completed by either the grantor or the grantee, and it must be filed with the instrument ( 14-102(1)(a), 39 C.R.S.). Record the completed deed, along with any additional materials, in the clerk and recorder's office of the county where the property is located. Contact the same office to verify accepted forms of payment.

With gifts of real property, the recipient of the gift (grantee or donee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the grantee is responsible for paying the requisite state and federal income tax.

In Colorado, there is no state gift tax. For questions regarding state taxation laws, consult a tax specialist. Gifts of real property in Colorado are, however, subject to the federal gift tax. The person or entity making the gift (grantor or donor) is responsible for paying the federal gift tax; however, if the donor does not pay the gift tax, the donee will be held liable.

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a donor may benefit from filing a Form 709.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Colorado lawyer with any questions about gift deeds or other issues related to the transfer of real property.

(Colorado Gift Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Douglas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Douglas County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda B.

March 26th, 2022

the forms are easy to understand. How do I go about getting the deed recorded and is there a charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Michele B.

June 9th, 2022

It was a wonderful experience. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Giustino C.

May 27th, 2020

I am pleased with this electronic service in making a time sensitive deed transfer since very few options exist currently with the Covid 19 Crisis. This was the only rapid and available option to record the deed transfer and the fee was reasonable. I was able to upload my notarized and executed document and had a record number as well as the official document within 24 hours. It was simple and easy to use. Thank you deeds.com!!

Thank you Giustino, glad we could help.

Roy M.

November 4th, 2021

Excellent service. Easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Magdy G.

July 13th, 2020

Very fast and efficient service. Everything was done online. Did not need any help.

Thank you!

Jean W.

April 21st, 2021

helpful if there was a space so one could type in the exemption # on the blank form before printing

Thank you for your feedback. We really appreciate it. Have a great day!

John H.

June 8th, 2020

This was pretty easy especially for a old guy like me.

Thanks John, glad we could help!

Janis H.

February 13th, 2020

Amazing! Great forms - created the quitclaim fairly easy, recorded with no issues. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Kay I.

December 11th, 2019

Very easy to use. However, the "sample" filled in red ink did not print for me to refer to. Is that the correct desire, not to print?

Thank you for your feedback. We really appreciate it. Have a great day!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Herman B.

May 19th, 2022

Special Warranty Deed I can't seem to type all my info in the blank spaces. It won't allow me to type any more. Maybe you should consider either allowing typists to type more (leaving more space) or allowing more room to type more.

Thank you!