Eagle County Beneficiary Deed Form (Colorado)

All Eagle County specific forms and documents listed below are included in your immediate download package:

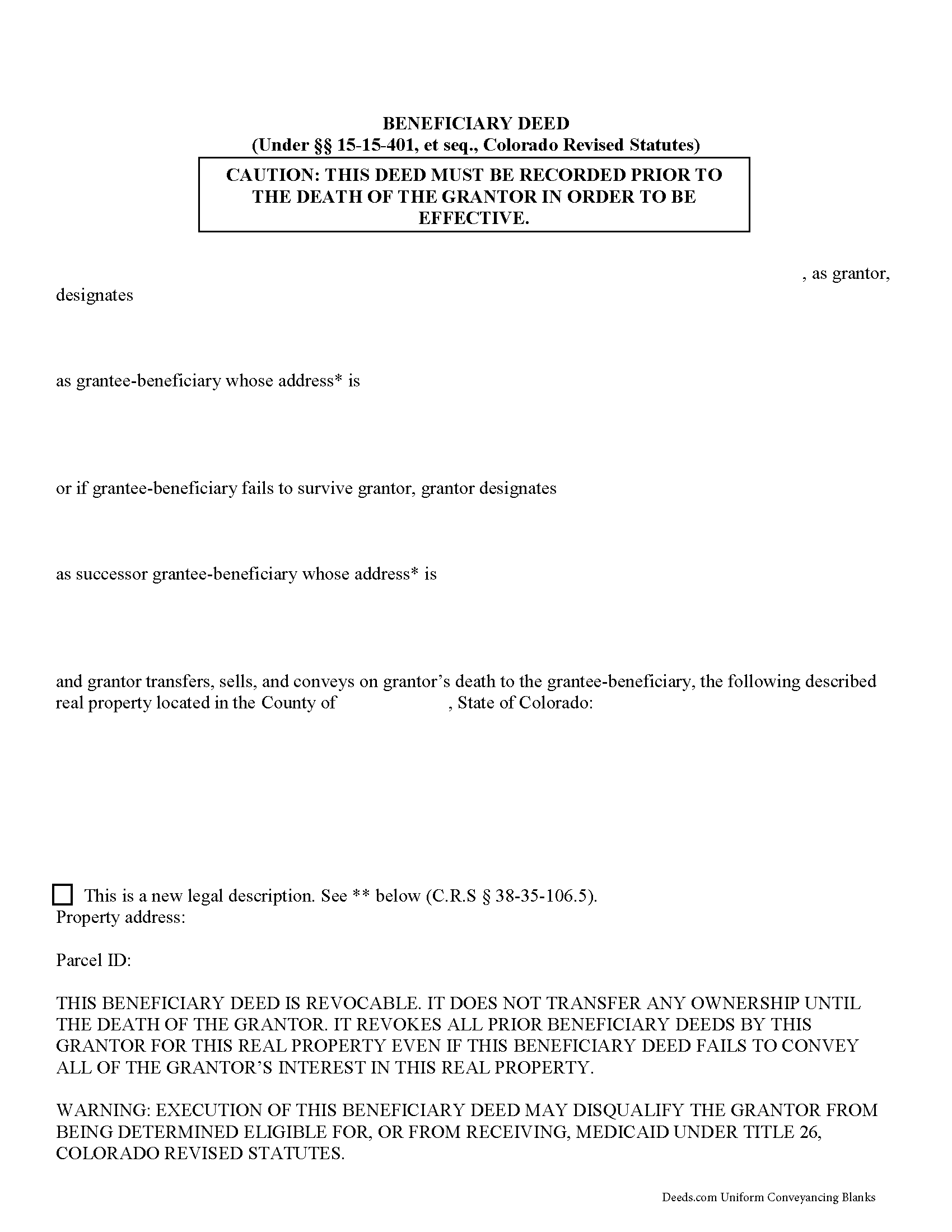

Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Eagle County compliant document last validated/updated 11/18/2024

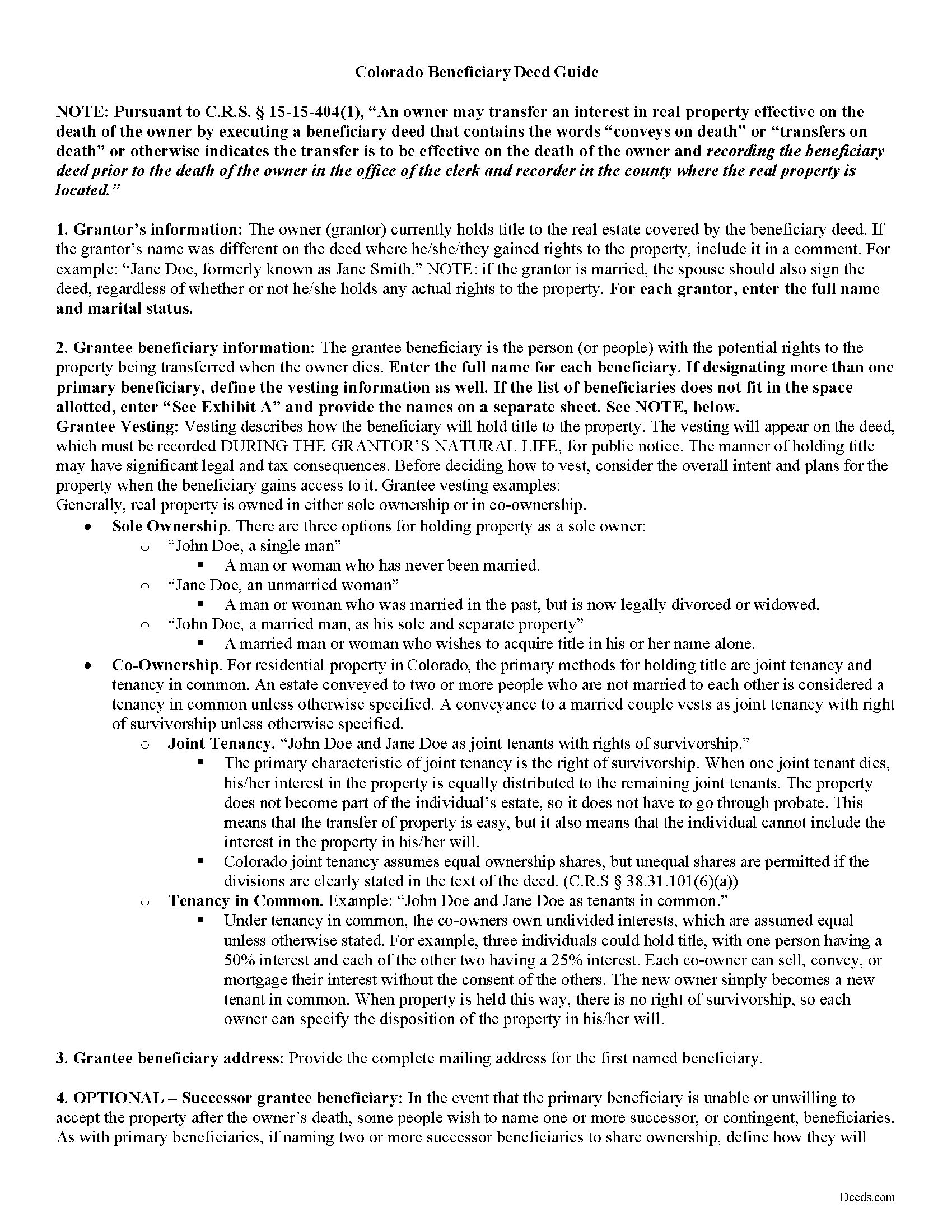

Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

Included Eagle County compliant document last validated/updated 10/23/2024

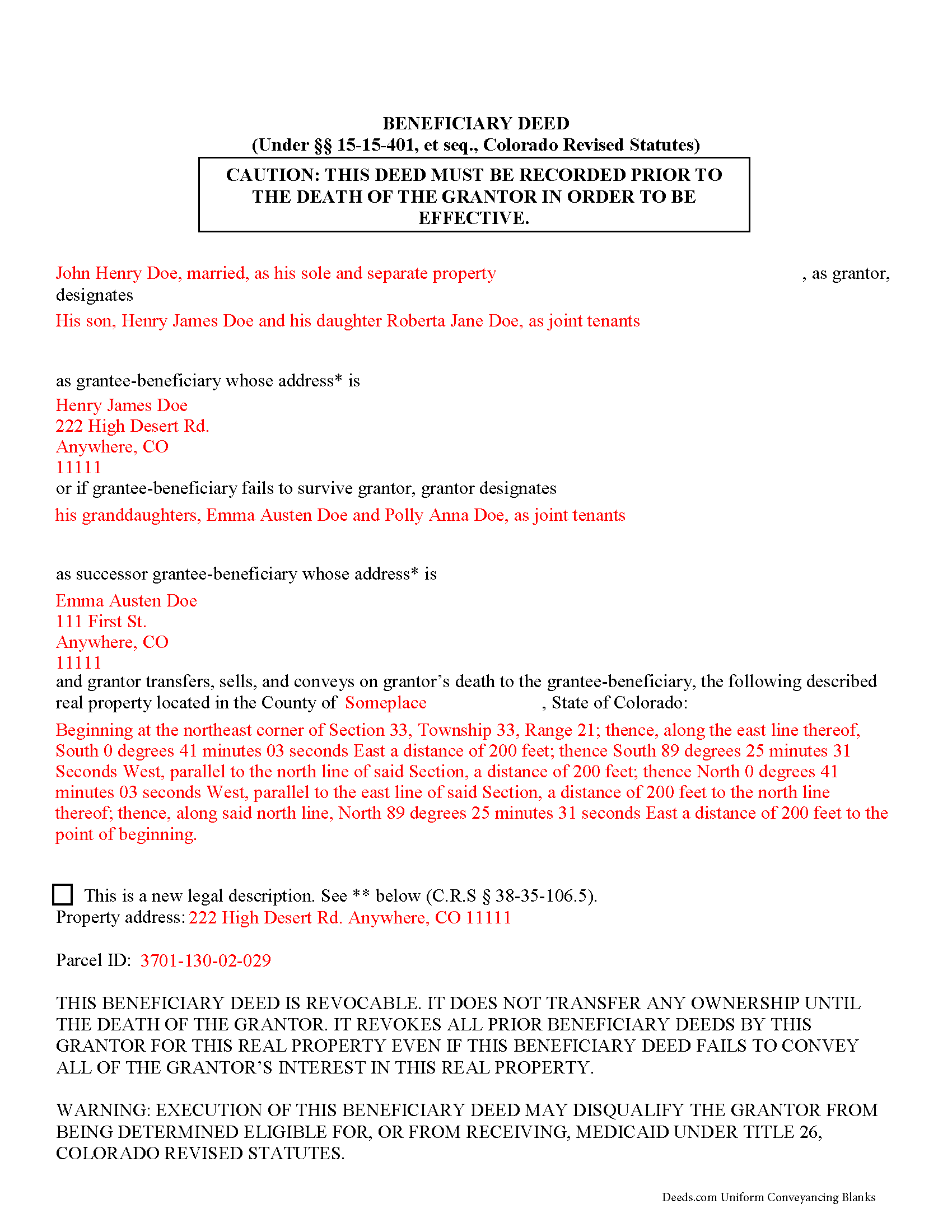

Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

Included Eagle County compliant document last validated/updated 11/8/2024

The following Colorado and Eagle County supplemental forms are included as a courtesy with your order:

When using these Beneficiary Deed forms, the subject real estate must be physically located in Eagle County. The executed documents should then be recorded in one of the following offices:

Eagle County Clerk and Recorder

500 Broadway, Suite 101 / PO Box 537, Eagle, Colorado 81631

Hours: 8:00am to 5:00pm Monday through Friday

Phone: (970) 328-8723

El Jebel Annex

0020 Eagle County Dr, Suite A, El Jebel, Colorado 81623

Hours: 8:00am to 5:00pm Monday through Friday

Phone: 970-328-9570

Local jurisdictions located in Eagle County include:

- Avon

- Basalt

- Bond

- Burns

- Eagle

- Edwards

- Gypsum

- Mc Coy

- Minturn

- Red Cliff

- Vail

- Wolcott

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Eagle County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Eagle County using our eRecording service.

Are these forms guaranteed to be recordable in Eagle County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Eagle County including margin requirements, content requirements, font and font size requirements.

Can the Beneficiary Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Eagle County that you need to transfer you would only need to order our forms once for all of your properties in Eagle County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Colorado or Eagle County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Eagle County Beneficiary Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Beneficiary deeds in Colorado are governed by C.R.S. 15-15-401, et seq. (2012).

Under this statute, which was signed into law in 2004, a beneficiary deed is defined as "a deed, subject to revocation by the owner, which conveys an interest in real property and which contains language that the conveyance is to be effective upon the death of the owner and which may be in substantially the form described in section 15-15-404" (15-15-401(1)). To expand on this rather bare-bones definition, beneficiary deeds are useful estate planning tools that allow an individual who owns real estate in Colorado to pass that property to one or more designated grantee beneficiaries, but only after the owner's death. Note that this is a non-testamentary transfer, however, which means it is not included in a will, nor can it be cancelled by one (15-15-404(1), 15-15-405(4)). In addition, the conveyance is finalized without need for probate supervision.

The aspect of beneficiary deeds that makes them unique (and differentiates them from an ordinary life estate or joint tenancy deed) is the fact that the owner retains absolute ownership of and control over the property during his/her lifetime, and may revoke or change the beneficiary designation at will, without any obligation to notify the current grantee beneficiary (15-15-402). There is generally no consideration involved with these instruments because the future interest is not guaranteed. In fact, there is not even an obligation to inform the grantee beneficiary about the deed in the first place.

To revoke an executed and recorded beneficiary deed, the owner has two options:

1. Complete and record a revocation form (15-15-405(1)).

2. Complete and record another beneficiary deed, granting the land to someone else when the owner dies (15-15-405(2)).

Both options require that the revised instruments must be recorded during the owner's life to take effect, and any changes to the beneficiary designation are applied in order of execution, not by the recording date (15-15-405(3)). Even so, an unrecorded but executed revocation or modified beneficiary deed is void.

While beneficiary deeds are relatively straightforward instruments, there are a few important things to keep in mind about them:

- To take effect, the executed beneficiary deed must be recorded "prior to the death of the owner in the office of the clerk and recorder in the county where the real property is located" (15-15-404(1)).

- According to 15-15-403, no "person who is an applicant for or recipient of medical assistance for which it would be permissible for the department of health care policy and financing to assert a claim pursuant to section 25.5-4-301 or 25.5-4-302, C.R.S., shall be entitled to such medical assistance if the person has in effect a beneficiary deed. Notwithstanding the provisions of section 15-15-402 (1), the execution of a beneficiary deed by an applicant for or recipient of medical assistance as described in this section shall cause the property to be considered a countable resource in accordance with section 25.5-4-302 (6), C.R.S., and applicable rules."

- If the property identified on the beneficiary deed is held in joint ownership, 15-15-408 states that "title to the interest shall vest in the designated grantee-beneficiary only if the joint tenant-grantor is the last to die of all of the joint tenants of such interest. If a joint tenant-grantor is not the last joint tenant to die, the beneficiary deed shall not be effective, and the beneficiary deed shall not make the grantee-beneficiary an owner in joint tenancy with the surviving joint tenant or tenants. A beneficiary deed shall not sever a joint tenancy."

A word about grantee beneficiaries:

In most cases, the owner leaves the property to a family member. The statute does not, however, limit the conveyance to relatives. It defines grantee beneficiaries as "one or more persons or entities capable of holding title to real property designated in a beneficiary deed to receive an interest in real property upon the death of the owner. "Grantee-beneficiary" includes, but is not limited to, a successor grantee-beneficiary" (15-15-401(3)). If one or more named grantee beneficiaries are part of the owner's family, they are frequently identified as such for additional clarity.

Many owners wish to designate one or more successor grantee beneficiaries, in case the original one(s) are unable or unwilling to accept the real estate. If no successor is named and "one of multiple grantee-beneficiaries fails to survive the owner, and no provision for such contingency is made in the beneficiary deed, the share of the deceased grantee-beneficiary shall be proportionately added to, and pass as a part of, the shares of the surviving grantee-beneficiaries" (15-15-407(5)). Further, if no successor is named and there are no previously identified grantee beneficiaries in whom to vest title, the property typically reverts back to the deceased owner's estate for probate distribution.

As defined in 15-15-414, a "grantee-beneficiary may refuse to accept all or any part of the real property interest described in a beneficiary deed. A grantee-beneficiary may disclaim all or any part of the real property interest described in a beneficiary deed by any method provided by law. If a grantee-beneficiary refuses to accept or disclaims any real property interest, the grantee-beneficiary shall have no liability by reason of being designated as a grantee-beneficiary under this part 4."

Overall, Colorado beneficiary deeds are useful estate planning tools that can streamline the process of conveying ownership of real property to one or more designated grantee beneficiaries, free from the cost and complication of probate. They may, however, have an impact on taxes as well as eligibility for asset-based local, state, or federal programs. To ensure the most favorable outcome, carefully consider the associated risks and advantages before finalizing this or any other estate planning decision.

(Colorado Beneficiary Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Eagle County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Eagle County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Kathryn S.

September 16th, 2024

So quick. So easy. Worth every penny!

Thank you for your feedback. We really appreciate it. Have a great day!

FREDERICK T C.

November 8th, 2021

simple to follow and easy to use. Thanks

Thank you!

Susan B.

July 23rd, 2021

This package of documents from Deeds.com has been extremely helpful, particularly for one who has never needed this kind of service before and is unfamiliar with legal documents in general. It is well worth the price; I would recommend this company to anyone needing help with legal documents and information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jon G.

June 26th, 2021

Excellent service and professionalism

Thank you!

Michael L.

September 5th, 2020

Pretty good stuff, not exactly clear on the deed transfer costs and all

Thank you for your feedback. We really appreciate it. Have a great day!

lindsey r.

October 18th, 2021

easy to use

Thank you!

D F.

March 3rd, 2020

Find what i was looking for, and got the answers to my questions!!

Thank you

Thank you!

David C.

July 21st, 2021

I was very impressed. Your program makes it very user friendly which is a must for most of the public . I have recommended this site to various clients for estate planning documents with simple estates.

Thank you!

Eric F.

January 21st, 2022

Thank You deeds.com, your site helped me accomplish a difficult mission.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lee C.

February 10th, 2021

Quick, easy and reasonably priced.

Thank you!

Thomas G.

December 16th, 2019

fast and easy

Thank you!

edward d.

March 19th, 2023

used before awesome forms

Thank you!