San Bernardino County Transfer on Death Deed Form (California)

All San Bernardino County specific forms and documents listed below are included in your immediate download package:

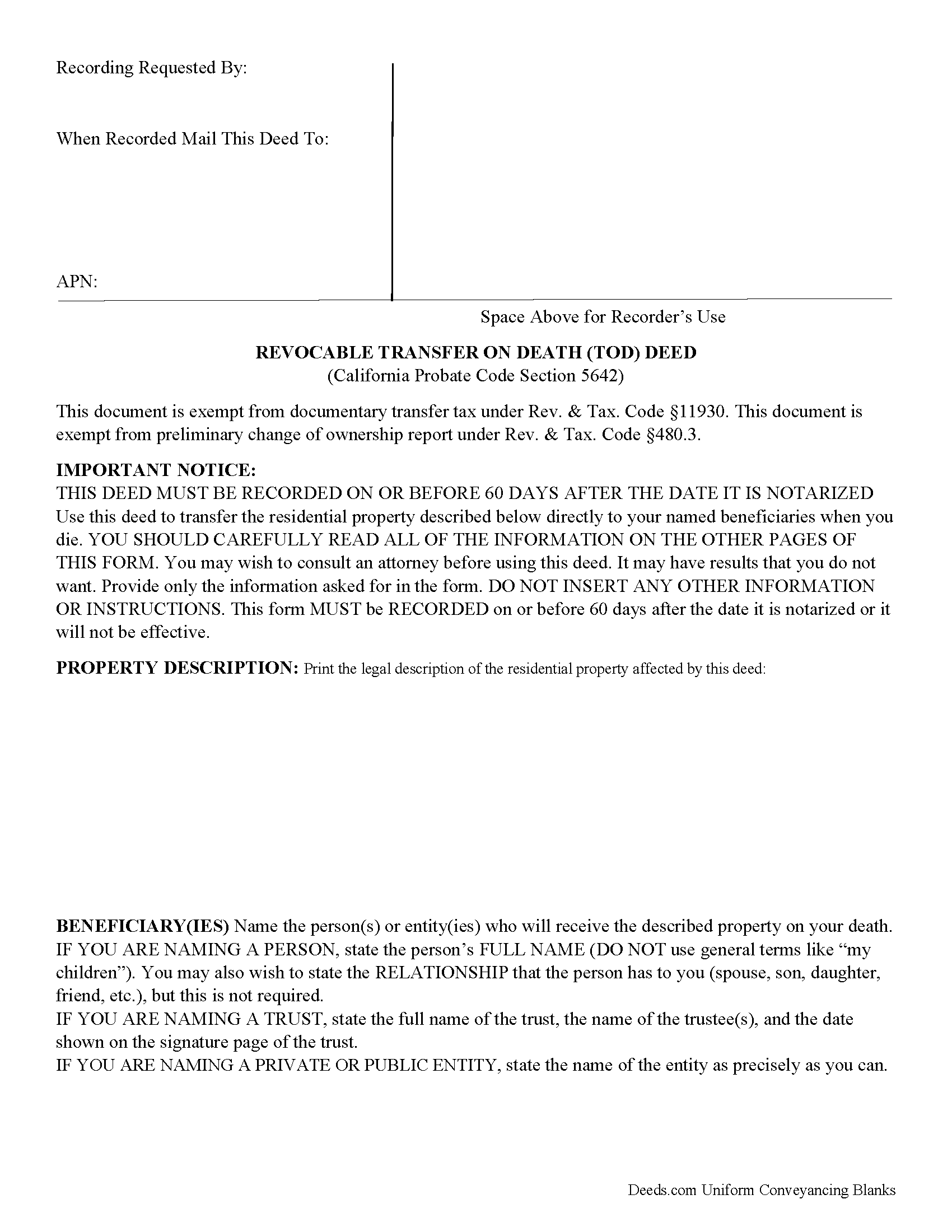

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included San Bernardino County compliant document last validated/updated 11/22/2024

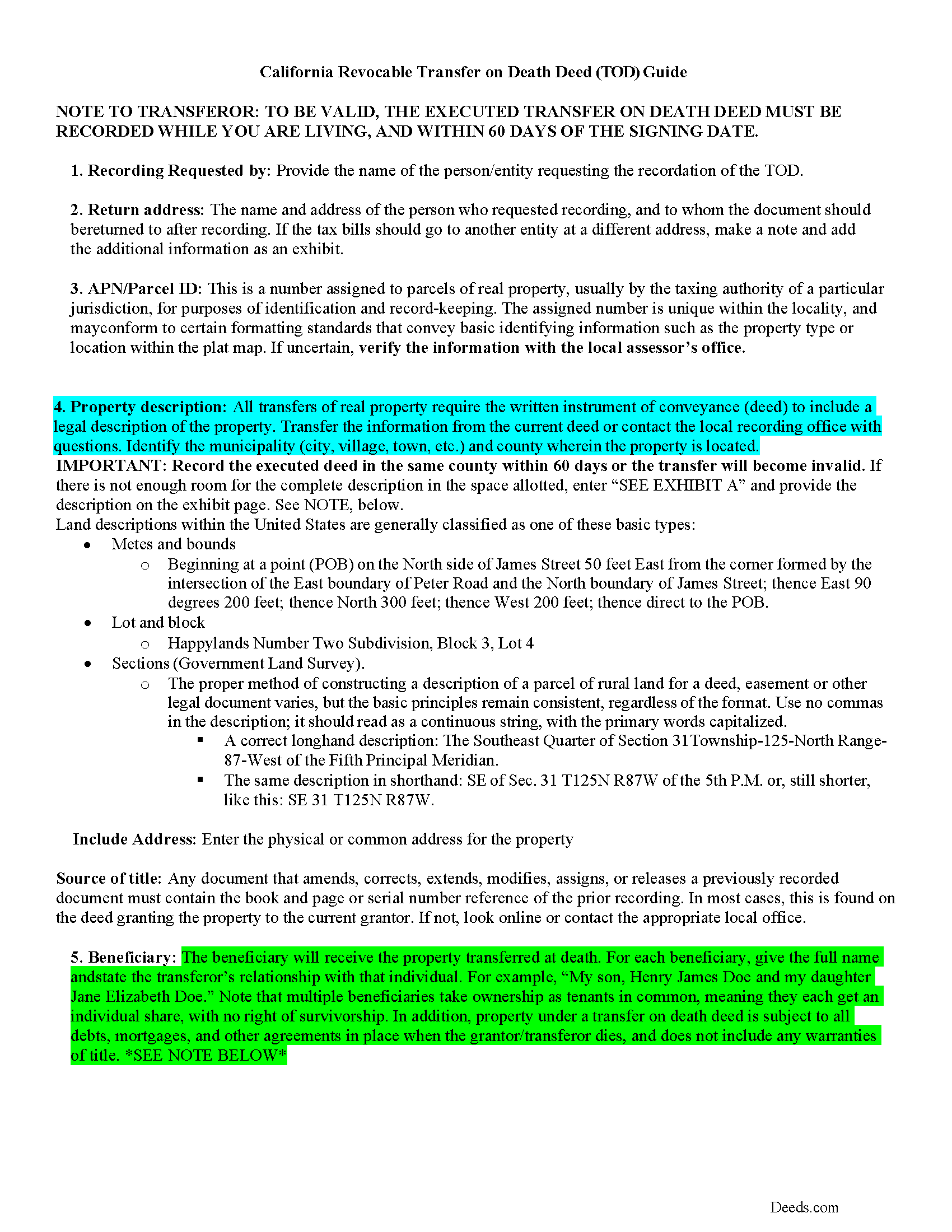

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included San Bernardino County compliant document last validated/updated 9/10/2024

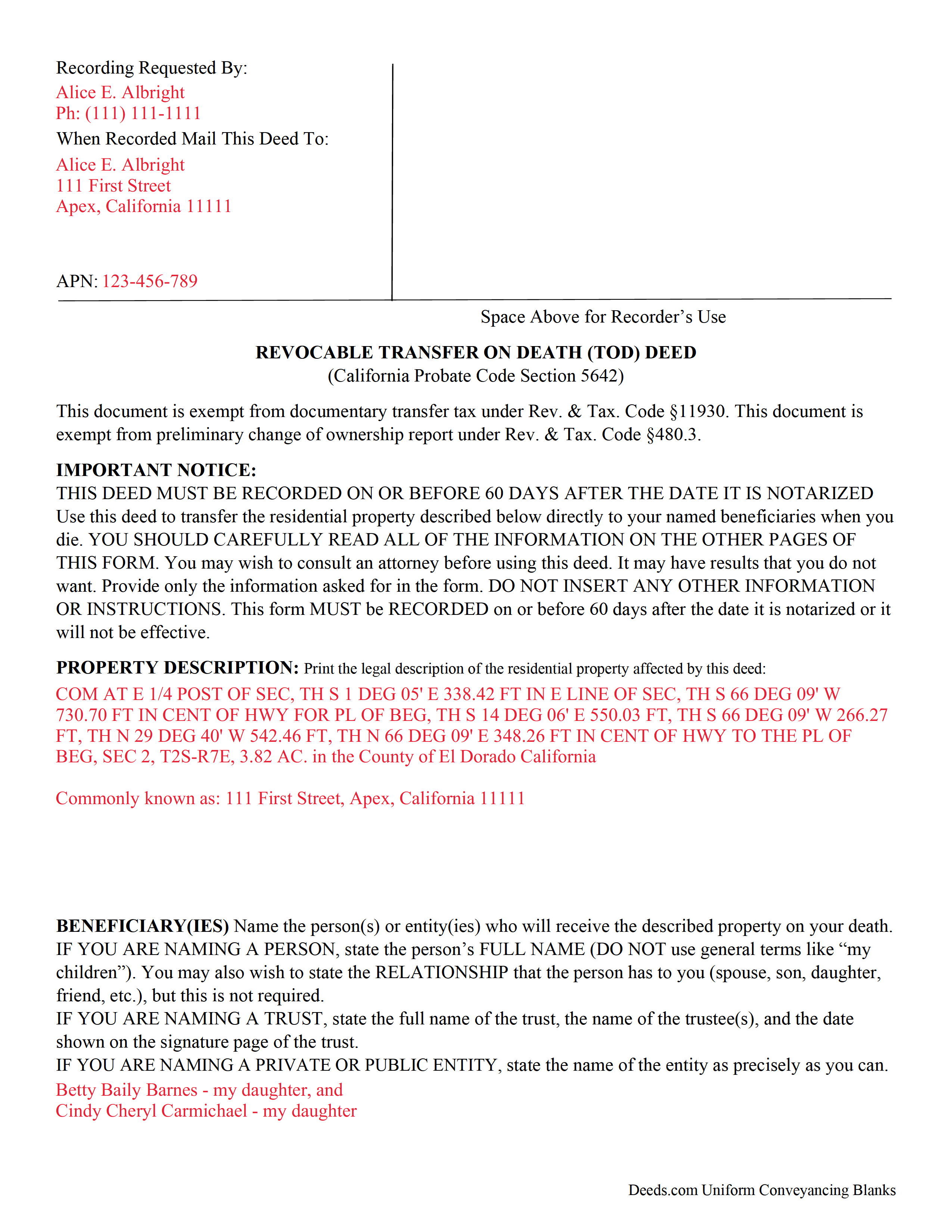

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included San Bernardino County compliant document last validated/updated 8/23/2024

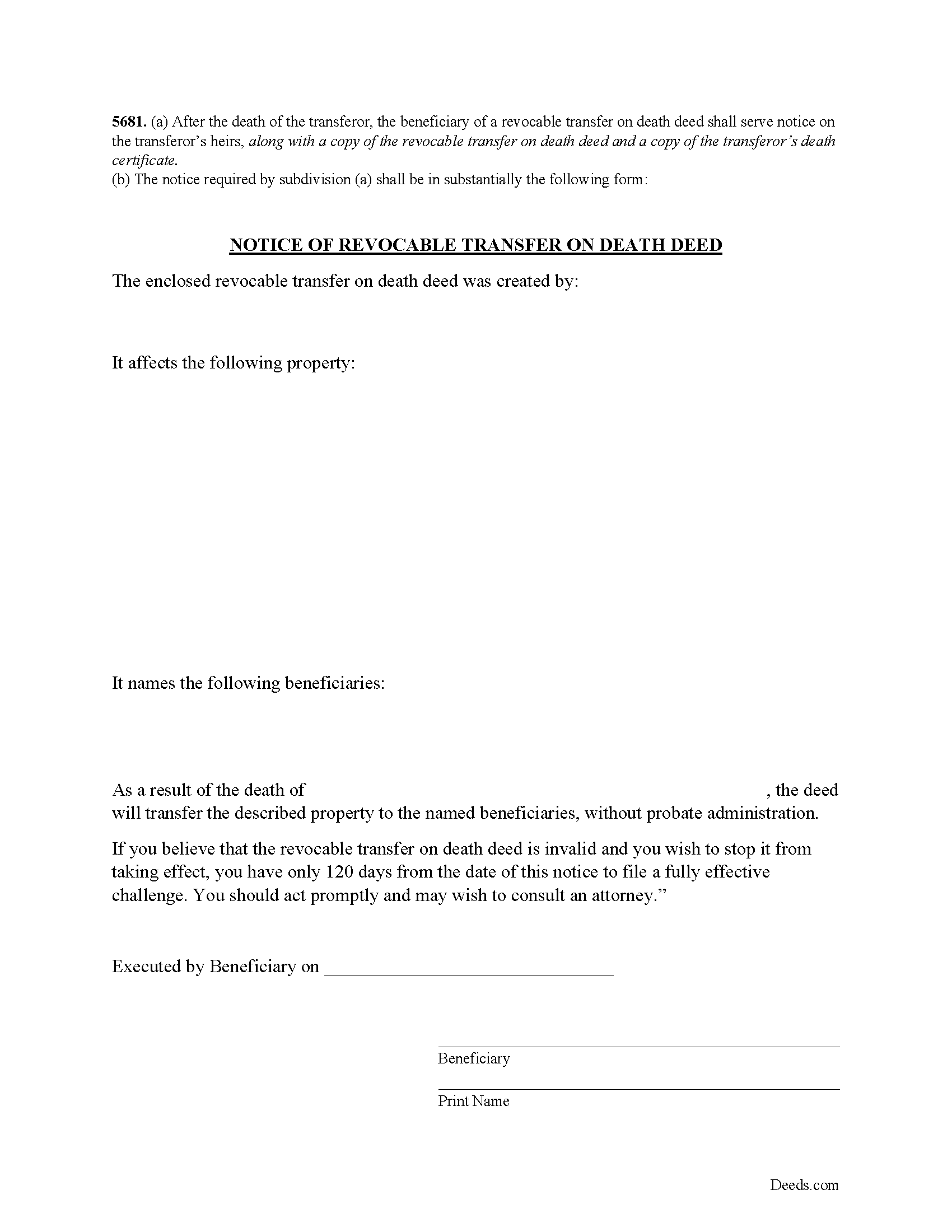

Notice of Revocable Transfer on Death Deed

Provide this form to your beneficiary(s).

Included San Bernardino County compliant document last validated/updated 11/27/2024

The following California and San Bernardino County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in San Bernardino County. The executed documents should then be recorded in one of the following offices:

San Bernardino County Recorder

Hall of Records - 222 West Hospitality Ln, 1st floor, San Bernardino, California 92415-0022

Hours: Monday to Friday 8:00am - 4:30pm

Phone: (909) 387-8306 and (855) 732-2575

High Desert Office

Government Center - 15900 Smoke Tree St, Hesperia, California 92345

Hours: Monday to Friday 8:00am - 4:30pm

Phone: (909) 387-8306

Local jurisdictions located in San Bernardino County include:

- Adelanto

- Amboy

- Angelus Oaks

- Apple Valley

- Baker

- Barstow

- Big Bear City

- Big Bear Lake

- Bloomington

- Blue Jay

- Bryn Mawr

- Cedar Glen

- Cedarpines Park

- Chino

- Chino Hills

- Cima

- Colton

- Crest Park

- Crestline

- Daggett

- Earp

- Essex

- Fawnskin

- Fontana

- Forest Falls

- Fort Irwin

- Grand Terrace

- Green Valley Lake

- Guasti

- Helendale

- Hesperia

- Highland

- Hinkley

- Joshua Tree

- Lake Arrowhead

- Landers

- Loma Linda

- Lucerne Valley

- Ludlow

- Lytle Creek

- Mentone

- Montclair

- Morongo Valley

- Mountain Pass

- Needles

- Newberry Springs

- Nipton

- Ontario

- Oro Grande

- Parker Dam

- Patton

- Phelan

- Pinon Hills

- Pioneertown

- Rancho Cucamonga

- Red Mountain

- Redlands

- Rialto

- Rimforest

- Running Springs

- San Bernardino

- Skyforest

- Sugarloaf

- Trona

- Twentynine Palms

- Twin Peaks

- Upland

- Victorville

- Vidal

- Wrightwood

- Yermo

- Yucaipa

- Yucca Valley

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the San Bernardino County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in San Bernardino County using our eRecording service.

Are these forms guaranteed to be recordable in San Bernardino County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Bernardino County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in San Bernardino County that you need to transfer you would only need to order our forms once for all of your properties in San Bernardino County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or San Bernardino County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our San Bernardino County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use this form to transfer real estate at death, but outside of a will and without the need for probate distribution. Execute the TODD form, then record it during the course of your life, and within 60 days of the signing date (5626(a)). Note that unlike grant deeds or quitclaim deeds, there is no change in ownership when transfer on death deeds are recorded (5650), so they are exempt from transfer taxes and the Preliminary Change of Ownership Report (PCOR).

Section 5650 explains that while you are alive, you retain absolute ownership of and control over your property. You may sell, mortgage, rent, or otherwise use the real estate in any lawful manner, without input from or notice to the beneficiaries, or even modify or revoke the future transfer.

Be aware, too, that the TODD is NOT affected by provisions in your will (5642(b)). Best practices dictate that any change to an estate plan initiates a review of the whole thing, so to reduce the chance for conflict, ensure that the transfer on death deed reinforces the will and other related documents.

Beneficiaries take title to the property under the rules set out at section 5652. Any associated debts, obligations, or agreements in place when you die follow the real estate to the beneficiaries. In addition, the title transfers without warranty, so the beneficiaries might find themselves liable for future claims against the property. For these reasons, among others, some beneficiaries might wish to disclaim the gift (5652(a)(1)).

As it stands, California's transfer on death deed is not valid for real estate held in joint tenancy or as community property with right of survivorship (5664).

5624. A revocable transfer on death deed is not effective unless all of the following conditions are satisfied:

(a) The deed is signed by the transferor and dated.

(b) The deed is signed by two witnesses who were present at the same time and who witnessed either the signing of the deed or the transferor's acknowledgment that the transferor had signed the deed.

(c) The deed is acknowledged before a notary public.

SEC. 10. Section 5625 is added to the Probate Code, to read:

5625. (a) Any person generally competent to be a witness may act as a witness to a revocable transfer on death deed.

(b) A revocable transfer on death deed is not invalid because it is signed by an interested witness.

(c) If a beneficiary of a revocable transfer on death deed is also a subscribing witness, there is a presumption that the witness procured the revocable transfer on death deed by duress, menace, fraud, or undue influence. This presumption is a presumption affecting the burden of proof. This presumption does not apply where the witness is named as beneficiary solely in a fiduciary capacity.

Overall, the Simple Revocable Transfer on Death Deed offers a convenient, flexible option to consider as part of an overall estate plan. Even so, they may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

Included NOTICE OF REVOCABLE TRANSFER ON DEATH DEED Form

5681. (a) After the death of the transferor, the beneficiary of a revocable transfer on death deed shall serve notice on the transferor's heirs, along with a copy of the revocable transfer on death deed and a copy of the transferor's death certificate. (b) The notice required by subdivision (a) shall be in substantially the following form:

(California Transfer on Death Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the San Bernardino County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Bernardino County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

AMY J.

February 16th, 2022

Very easy user friendly thank you for that

Thank you!

A R M.

May 1st, 2021

Great so far. Just downloaded all the documents, and they seem to be easy to save and are fillable.

A R M

Thank you for your feedback. We really appreciate it. Have a great day!

Charles H.

December 8th, 2020

Website is user-friendly and very helpful, butI will have to wait until I submit my documents to the Clerk of Court to see if they are acceptable.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine H.

March 30th, 2023

extremely thorough by covering all bases, easy to understand, direct access, fair price with no strings attached. I recommend the service to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly J. A.

April 24th, 2022

Thank you for the paperwork. It was so much easier to do at home than go out and have to have people miss work.

Thank you!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

Maricarol F.

March 6th, 2019

Found the site very easy to use. My fault I did not answer back right away. What was found is almost what I needed... Thanks.

Thank you for the feedback Maricarol, we really appreciate it.

Vanessa G.

January 9th, 2024

Quick, painless, and they communicated with me during the entire process. I will certainly be suing them again.

We are delighted to have been of service. Thank you for the positive review!

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

Rechantell A.

August 1st, 2020

It was quick and easy. Trust worthy. Very satisfied and would recommend. Thank you for your services.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!