Nevada County Transfer on Death Deed Form (California)

All Nevada County specific forms and documents listed below are included in your immediate download package:

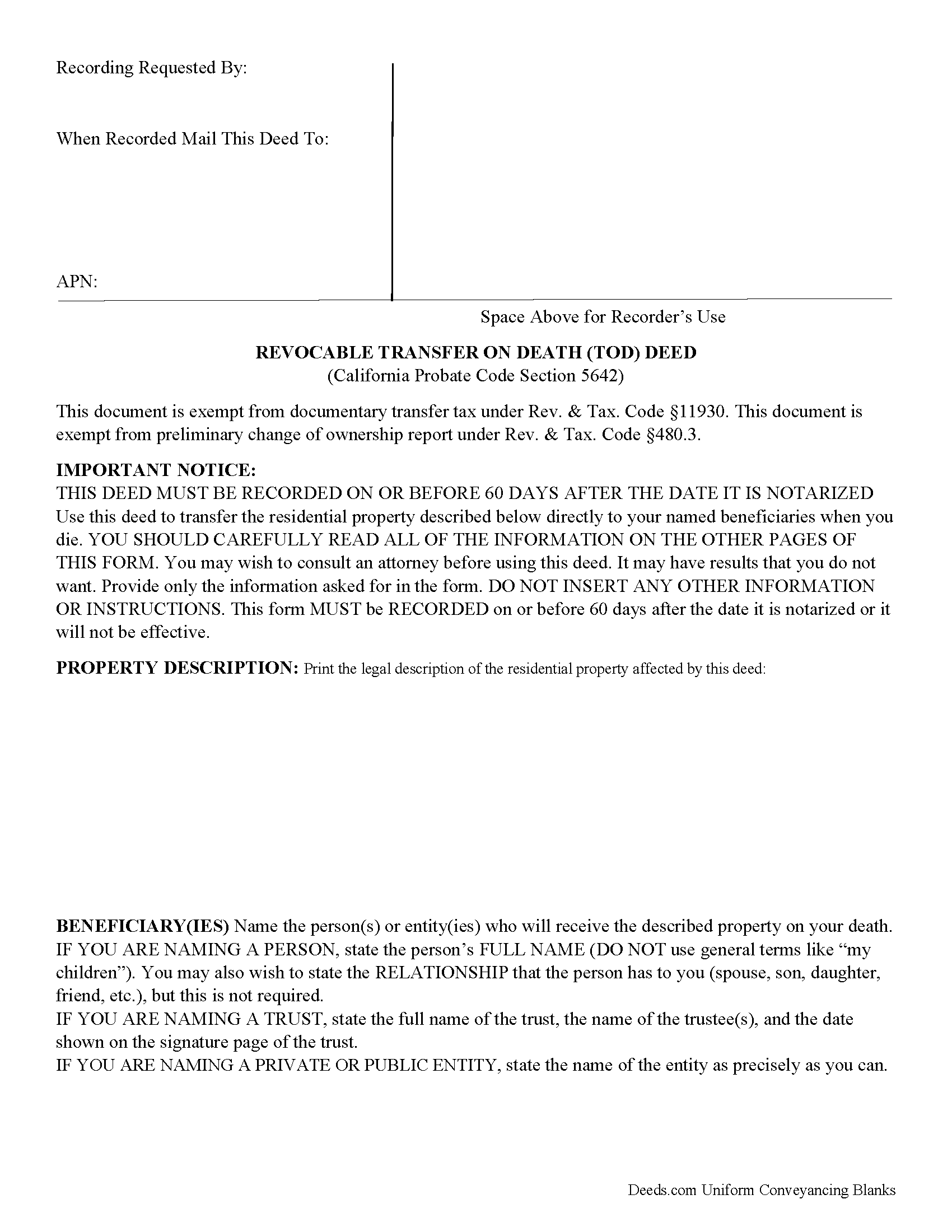

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Nevada County compliant document last validated/updated 11/22/2024

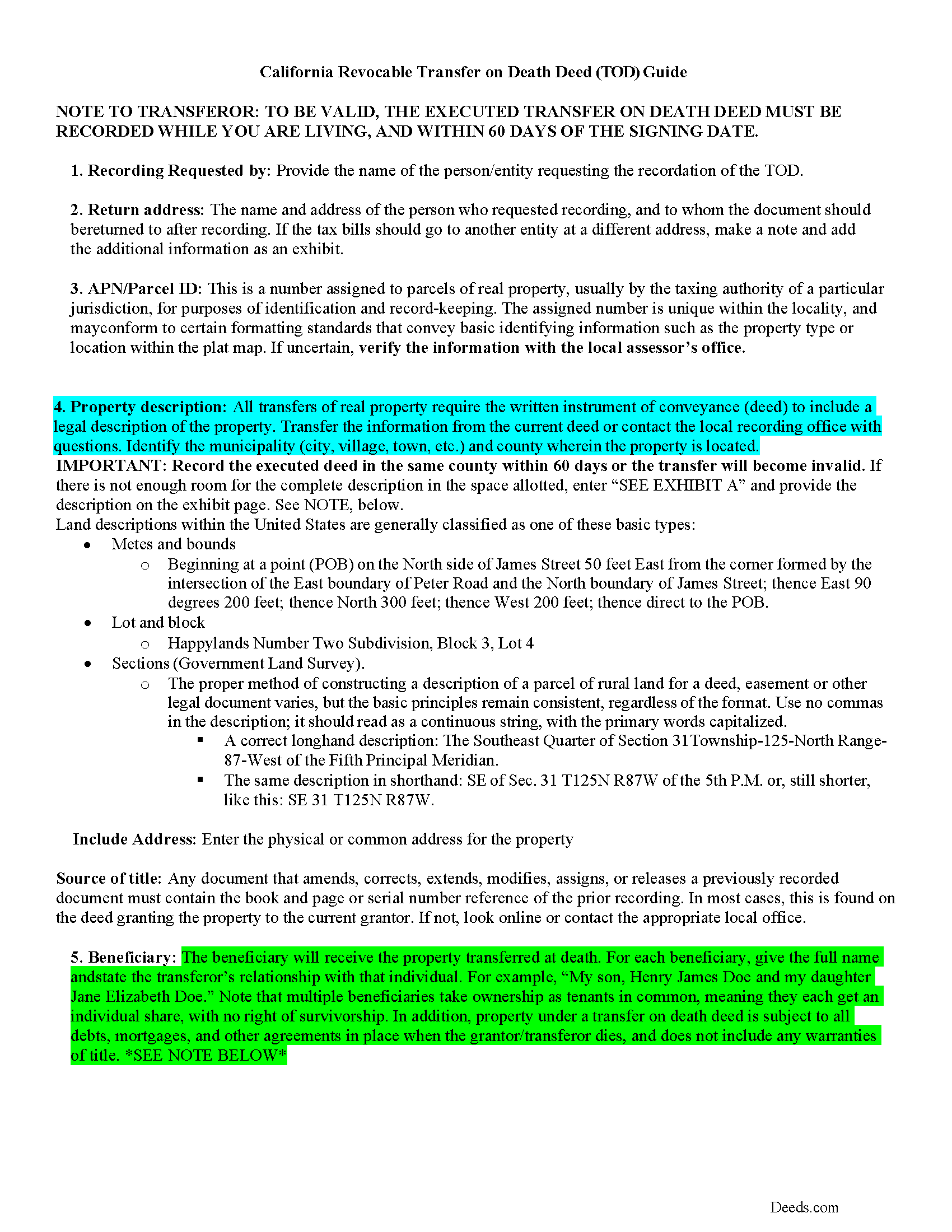

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Nevada County compliant document last validated/updated 9/10/2024

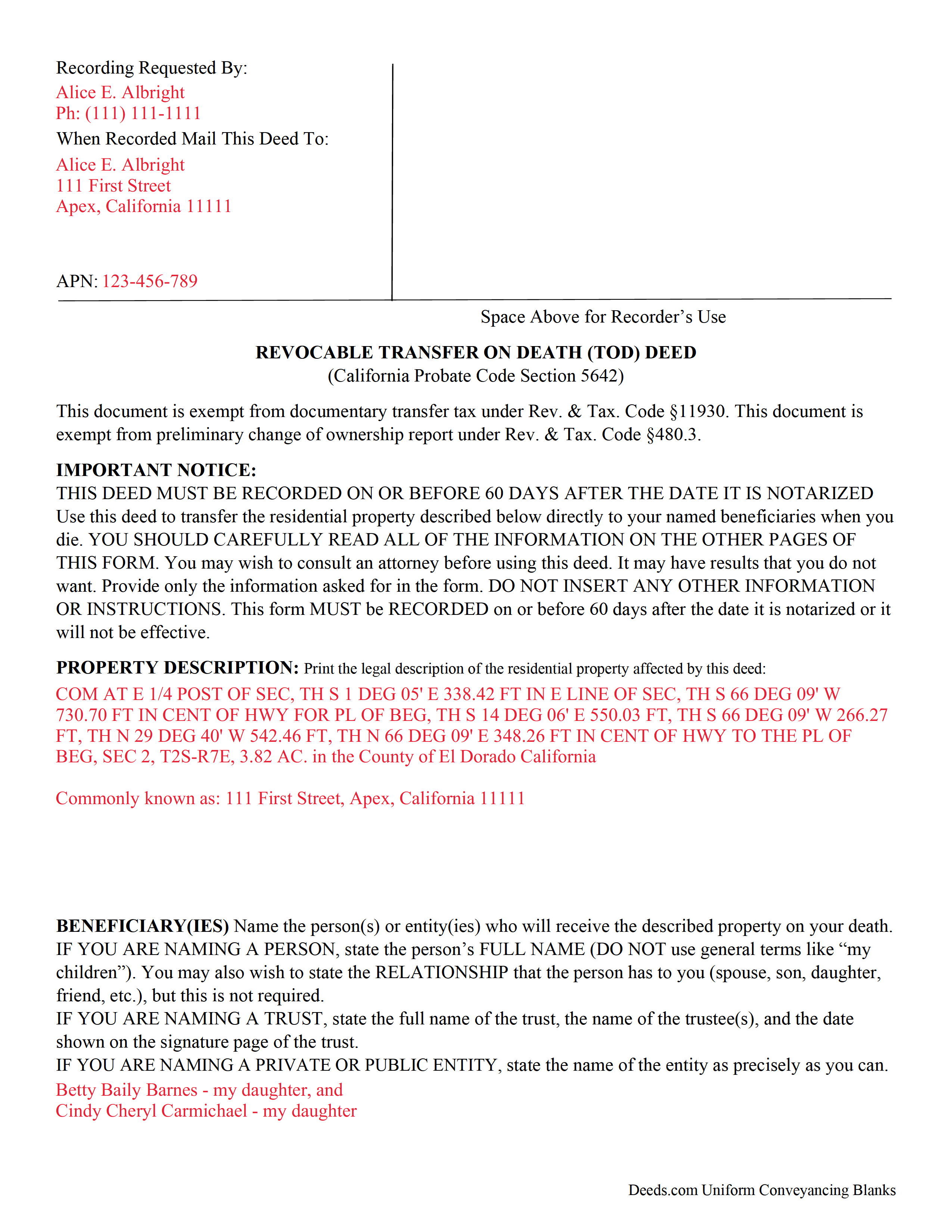

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included Nevada County compliant document last validated/updated 8/23/2024

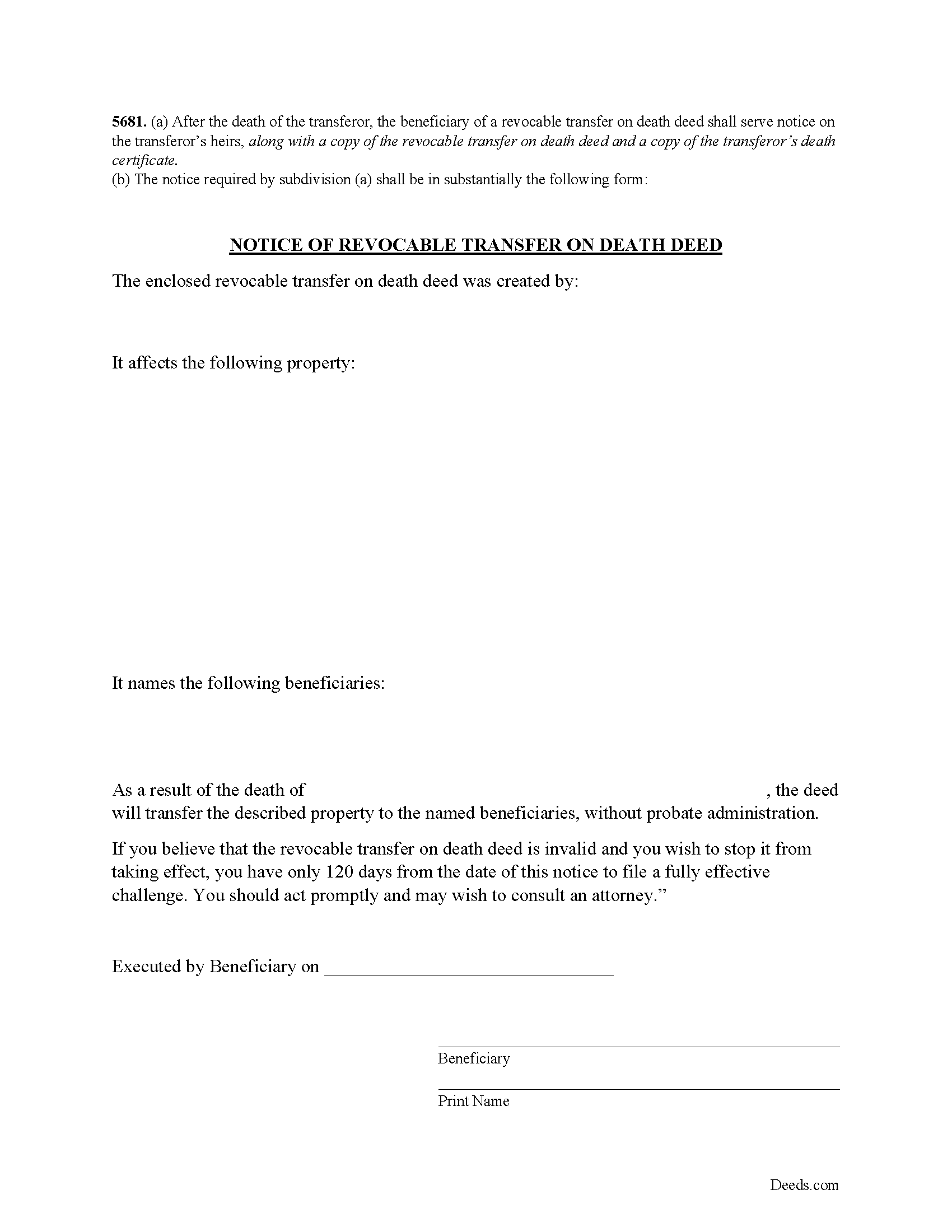

Notice of Revocable Transfer on Death Deed

Provide this form to your beneficiary(s).

Included Nevada County compliant document last validated/updated 11/27/2024

The following California and Nevada County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Nevada County. The executed documents should then be recorded in the following office:

Nevada County Clerk-Recorder

950 Maidu Ave, Suite 210, Nevada City , California 95959

Hours: 8:00 AM to 5:00 PM / Recording until 4:00 PM

Phone: 530-265-1221

Local jurisdictions located in Nevada County include:

- Cedar Ridge

- Chicago Park

- Floriston

- Grass Valley

- Nevada City

- Norden

- North San Juan

- Penn Valley

- Rough And Ready

- Smartsville

- Soda Springs

- Truckee

- Washington

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Nevada County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Nevada County using our eRecording service.

Are these forms guaranteed to be recordable in Nevada County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Nevada County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Nevada County that you need to transfer you would only need to order our forms once for all of your properties in Nevada County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or Nevada County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Nevada County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use this form to transfer real estate at death, but outside of a will and without the need for probate distribution. Execute the TODD form, then record it during the course of your life, and within 60 days of the signing date (5626(a)). Note that unlike grant deeds or quitclaim deeds, there is no change in ownership when transfer on death deeds are recorded (5650), so they are exempt from transfer taxes and the Preliminary Change of Ownership Report (PCOR).

Section 5650 explains that while you are alive, you retain absolute ownership of and control over your property. You may sell, mortgage, rent, or otherwise use the real estate in any lawful manner, without input from or notice to the beneficiaries, or even modify or revoke the future transfer.

Be aware, too, that the TODD is NOT affected by provisions in your will (5642(b)). Best practices dictate that any change to an estate plan initiates a review of the whole thing, so to reduce the chance for conflict, ensure that the transfer on death deed reinforces the will and other related documents.

Beneficiaries take title to the property under the rules set out at section 5652. Any associated debts, obligations, or agreements in place when you die follow the real estate to the beneficiaries. In addition, the title transfers without warranty, so the beneficiaries might find themselves liable for future claims against the property. For these reasons, among others, some beneficiaries might wish to disclaim the gift (5652(a)(1)).

As it stands, California's transfer on death deed is not valid for real estate held in joint tenancy or as community property with right of survivorship (5664).

5624. A revocable transfer on death deed is not effective unless all of the following conditions are satisfied:

(a) The deed is signed by the transferor and dated.

(b) The deed is signed by two witnesses who were present at the same time and who witnessed either the signing of the deed or the transferor's acknowledgment that the transferor had signed the deed.

(c) The deed is acknowledged before a notary public.

SEC. 10. Section 5625 is added to the Probate Code, to read:

5625. (a) Any person generally competent to be a witness may act as a witness to a revocable transfer on death deed.

(b) A revocable transfer on death deed is not invalid because it is signed by an interested witness.

(c) If a beneficiary of a revocable transfer on death deed is also a subscribing witness, there is a presumption that the witness procured the revocable transfer on death deed by duress, menace, fraud, or undue influence. This presumption is a presumption affecting the burden of proof. This presumption does not apply where the witness is named as beneficiary solely in a fiduciary capacity.

Overall, the Simple Revocable Transfer on Death Deed offers a convenient, flexible option to consider as part of an overall estate plan. Even so, they may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

Included NOTICE OF REVOCABLE TRANSFER ON DEATH DEED Form

5681. (a) After the death of the transferor, the beneficiary of a revocable transfer on death deed shall serve notice on the transferor's heirs, along with a copy of the revocable transfer on death deed and a copy of the transferor's death certificate. (b) The notice required by subdivision (a) shall be in substantially the following form:

(California Transfer on Death Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Nevada County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Nevada County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norman K.

August 13th, 2021

Easy to use, would like to convert to a Word doc though

Thank you!

Matthew T.

September 9th, 2020

I am a litigator based in Lee County that rarely needs to record deeds or mortgages. However, at times, the settlement or resolution of a dispute results in the conveyance of real property. I ended up in a situation where a deed to real property in Bradford County needed to be recorded on behalf of a client. My usual e-recording vendor does not include that County. Registering with Bradford County's regular e-recording vendor would have required an expensive and unnecessary annual fee.

Deeds.com was easy to use, inexpensive and fast. I highly encourage its use, especially for lawyers that occasionally need to record instruments but do not do so regularly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!

ROSALYN L.

May 31st, 2021

I just now downloaded the forms. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie R.

August 31st, 2022

FIVE STARS !!!

Clear instructions

Easy to navigate

Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JoAnn L.

September 10th, 2020

The process was easy, and efficient. There was a person available to help if needed. Very pleased, would use this again.

Thank you!

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately.

However I asked a question via the "Contact Us" link and days later I get a survey but no reply.

I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer.

What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

Tammy C.

September 24th, 2020

Was very easy to use and i would recommend it

Thank you!

David G.

September 2nd, 2020

Fill in the blanks portions are so limited, it makes it almost impossible to use.

Sorry to hear that David. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere.

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. rnThank you.

We are delighted to have been of service. Thank you for the positive review!

JAY W.

June 17th, 2021

ok

Thank you!

Grace G.

January 21st, 2019

The Forms I received were perfect for me. I also double ordered one of the forms and you corrected it on the spot. Thanks. (I am a Real Estate Broker)

Thank you!