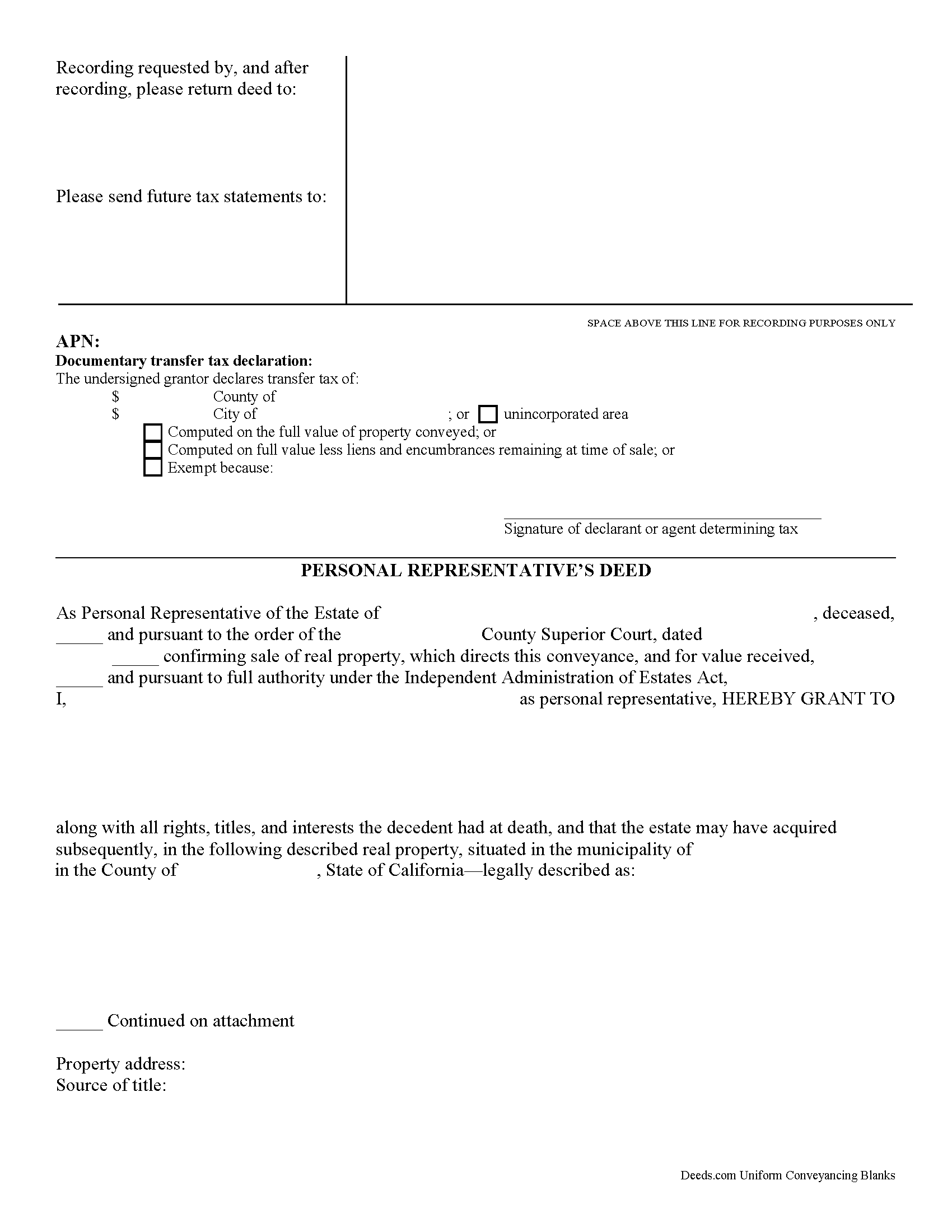

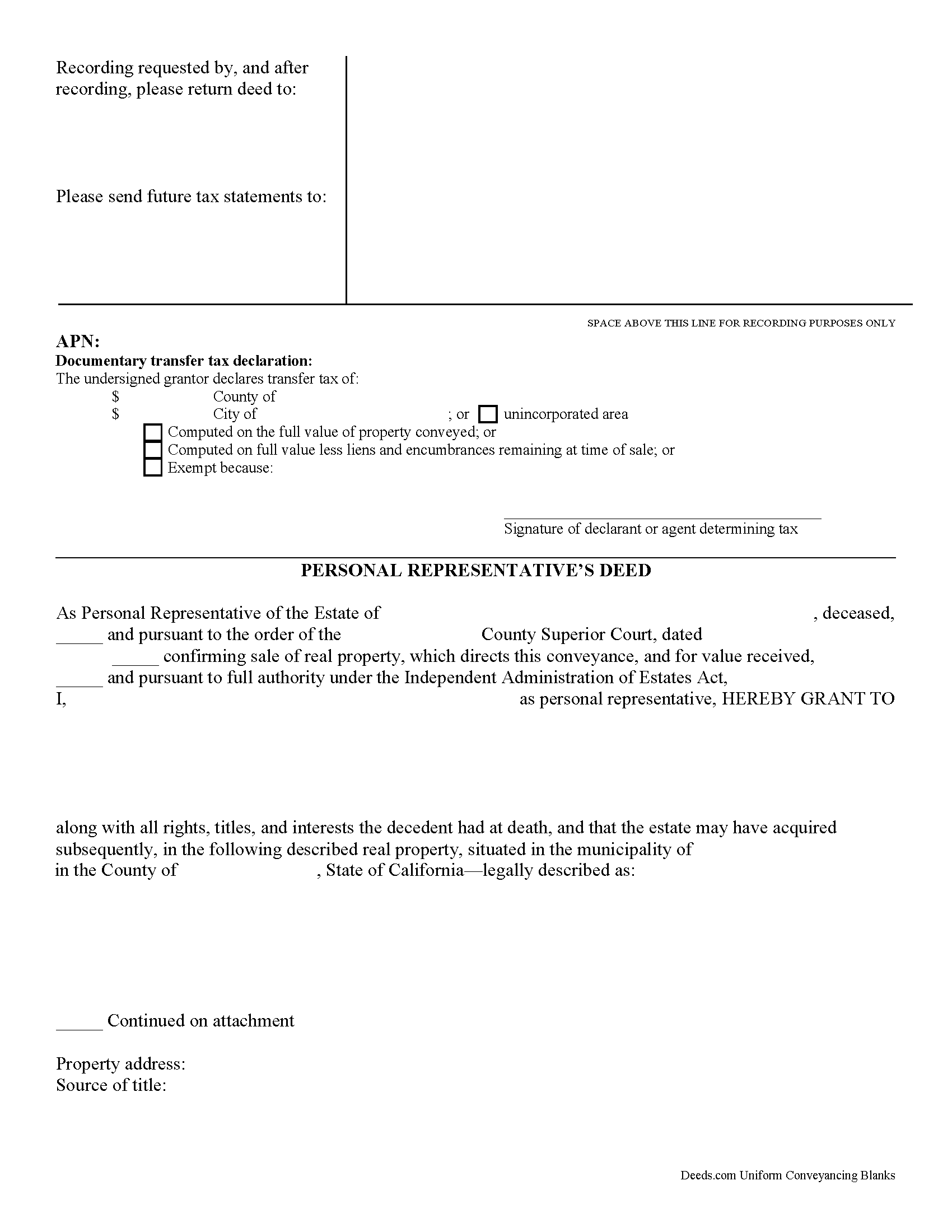

Download California Personal Representative Deed Legal Forms

California Personal Representative Deed Overview

Personal representative's deeds are used to transfer real property from both testate (with a will) and intestate (without a will) estates. These documents provide essential information about the specific probate estate and related property transfer in one document.

When a person dies, the probate court authorizes someone to take responsibility for distributing the remaining assets according to the instructions set out in the decedent's will (if one exists), while also following state and local laws. This person is often known as an executor or an administrator of the estate. California, however, identifies the individual who accepts that fiduciary duty as a personal representative (PR).

One common task involves transferring title on the decedent's real estate. Deeds used for this purpose must meet the same state and local requirements as warranty or quitclaim deeds. They also include other details, such as facts about the deceased property owner, the probate case, and anything else deemed necessary by the situation. In addition, the PR must file a PCOR with the county assessor's office when recording the completed deed.

Note that these deeds may need to be recorded with the probate court as well as the county recording office. Consult with the legal professional involved in managing the specific probate case to ensure that all recording and notice requirements are met.

See California Probate Code, Division 7. Administration of Estates of Decedents for more information. Remember that each case is unique, so contact an attorney with specific questions or for complex circumstances.

(California Personal Representative Deed Package includes form, guidelines, and completed example)