Lake County Grant Deed Form (California)

All Lake County specific forms and documents listed below are included in your immediate download package:

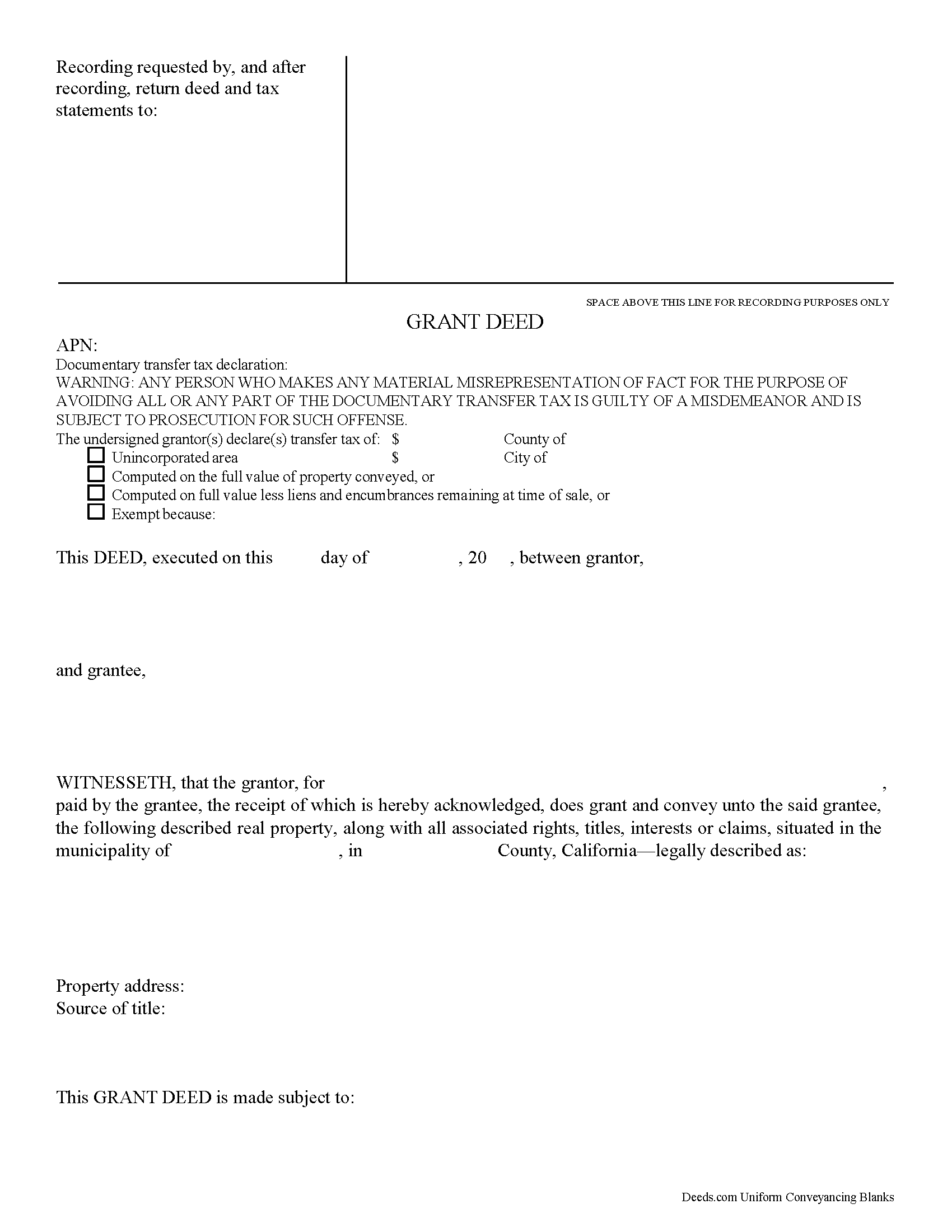

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lake County compliant document last validated/updated 10/1/2024

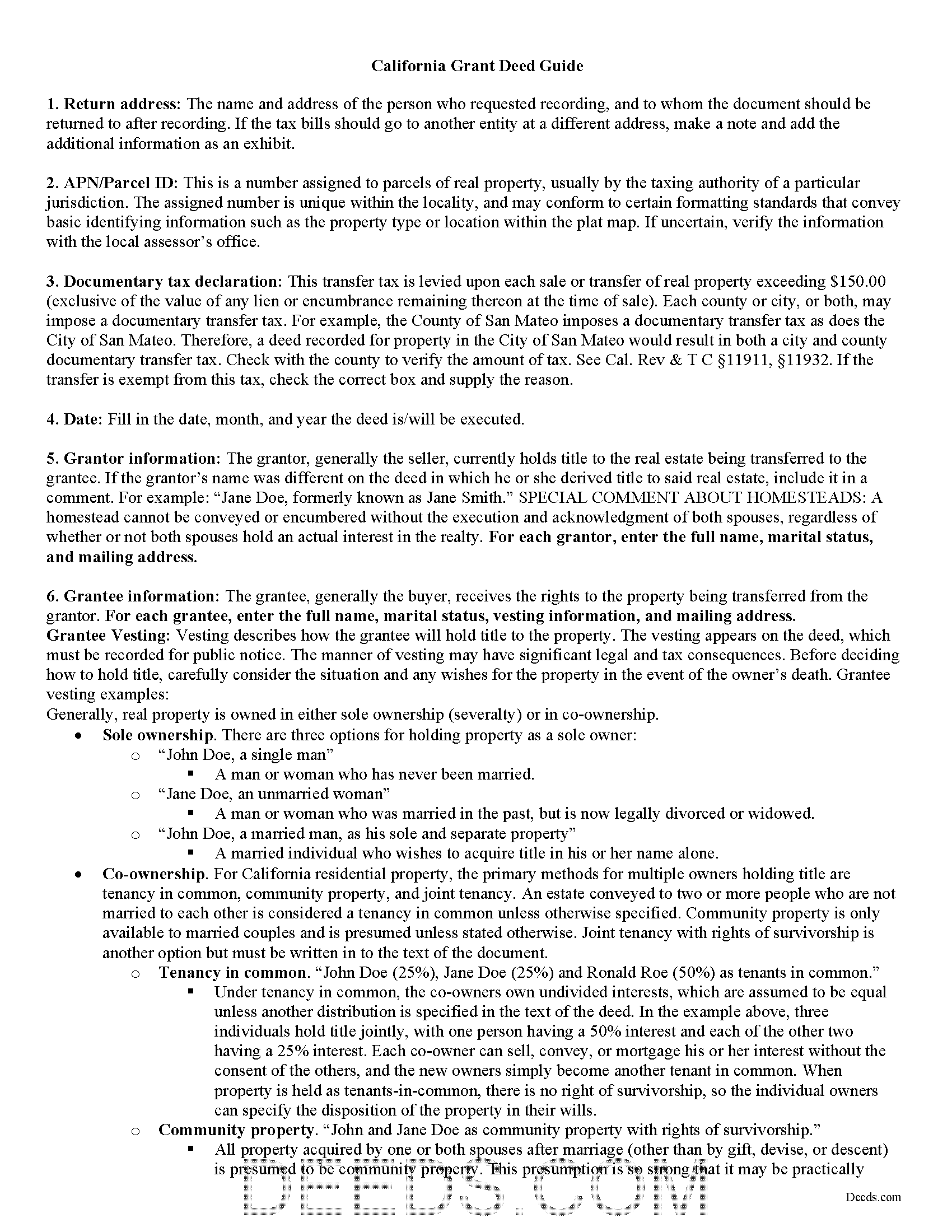

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Lake County compliant document last validated/updated 9/23/2024

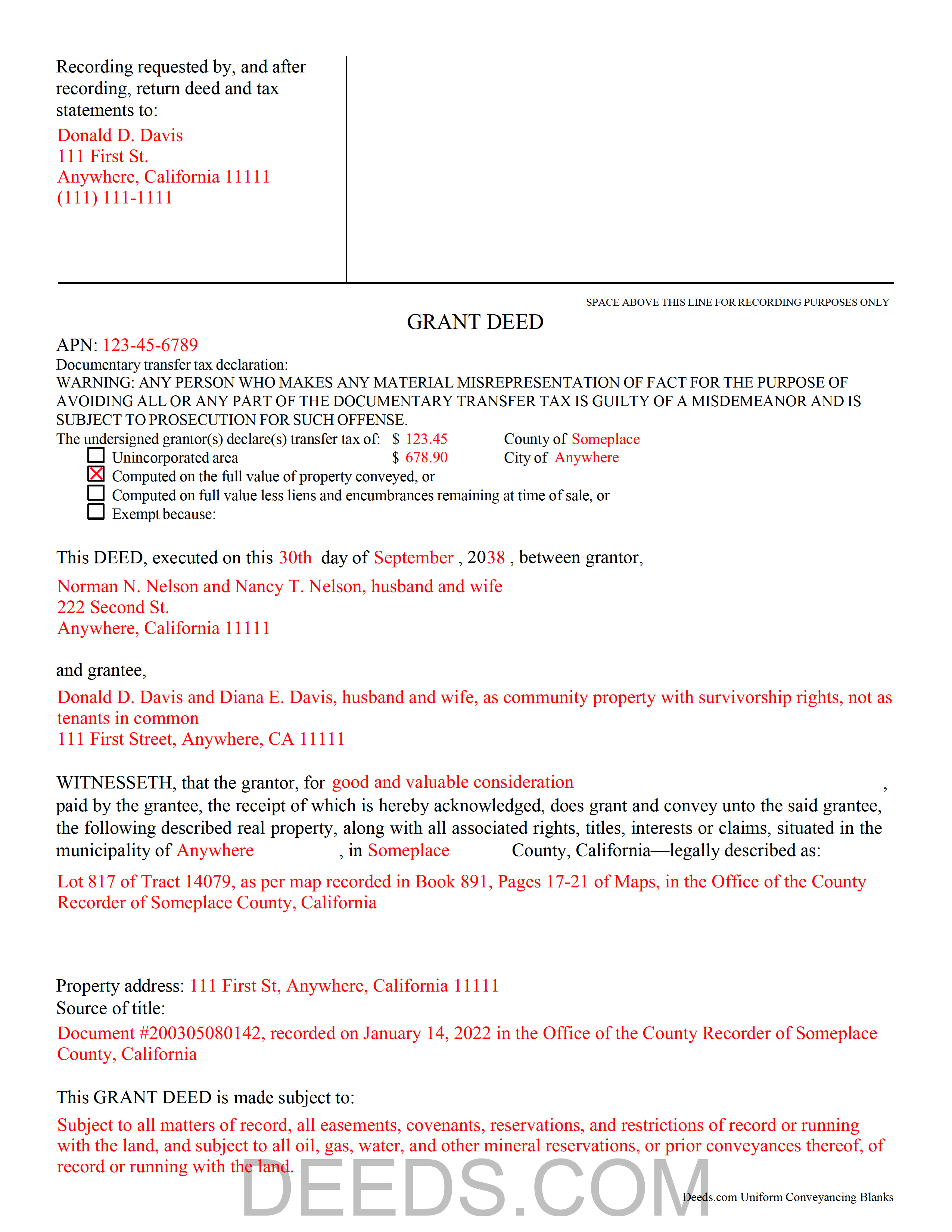

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Lake County compliant document last validated/updated 12/6/2024

The following California and Lake County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Lake County. The executed documents should then be recorded in the following office:

Lake County Assessor-Recorder

Courthouse - 255 N Forbes St, Lakeport, California 95453-4757

Hours: Monday - Friday 8:00 a.m.- 5:00 p.m

Phone: (707) 263-2293 Recorder; (707) 263-2302 Assessor

Local jurisdictions located in Lake County include:

- Clearlake

- Clearlake Oaks

- Clearlake Park

- Cobb

- Finley

- Glenhaven

- Hidden Valley Lake

- Kelseyville

- Lakeport

- Lower Lake

- Lucerne

- Middletown

- Nice

- Upper Lake

- Witter Springs

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lake County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lake County using our eRecording service.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lake County that you need to transfer you would only need to order our forms once for all of your properties in Lake County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or Lake County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lake County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A grant deed is the most commonly used form for a conveyance of real property in California. This type of deed offers more protection to a buyer than a quitclaim deed, but less protection than a warranty deed.

The implied warranties in a grant deed are designed to protect the grantee (purchaser). The grant deed includes the implied warranty that the grantor has not conveyed the title or interest in the property to anyone else and that the property is free from any encumbrances done, made, or suffered by the grantor or any person claiming under him, except for any that may be specifically disclosed in the deed (CIV 1113). The main difference between a warranty deed and a grant deed is that in a warranty deed, the grantor will warrant and defend the title against the claims of all persons.

A grant deed in California requires the grantor's signature, which must also be acknowledged with a California all-purpose acknowledgement. The officer taking acknowledgements must have a certificate of acknowledgement endorsed on the deed (CIV 1188). Grant deeds submitted for recording must be accompanied by a completed Preliminary Change of Ownership Report.

All instruments that are entitled to be entered into the public record may be recorded at the office of the county clerk in the county where the property is located. Recording a grant deed allows it to serve as constructive notice of the contents to subsequent purchasers and mortgagees (CIV 1213). A grant deed in California is void as against any subsequent purchaser or mortgagee of the same real property, or part thereof, in good faith and for a valuable consideration, whose conveyance is first duly recorded, and as against any judgment affecting the title, unless the conveyance has been duly recorded prior to the record of notice of action (CIV 1214). An unrecorded grant deed is valid as between the parties to it and those who have notice of it (CIV 1217).

(California Grant Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4443 Reviews )

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Beatrica G.

November 5th, 2019

Thanks for your service. I recieved my documents on time and package information as promise.

Thank you for your feedback. We really appreciate it. Have a great day!

David M.

April 24th, 2019

Why is Dade County not listed for the Lady Bird Deed?

Because on November 13, 1997, voters changed the name of the county from Dade to Miami-Dade.

kathy d.

March 20th, 2019

very easy make sense instructions. Thank you.

Thank you for your feedback Kathy. Have an amazing day!

Daniel D.

February 9th, 2020

Well done. A little pricy.

Thank you!

Charles G.

June 22nd, 2022

I downloaded your Transfer on Death Deed Forms on Monday and registered the deed on Wednesday. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James J.

December 27th, 2019

Downloaded and used the Ladybird Warranty Deed for a county in Florida with no issues. Cost for the download and subsequent recording fee of the deed totaled less than $40. No reason to pay hundreds. I assume the subsequent transfer upon death will go smoothly, but I of course, will never know. The "example" of a completed form was very beneficial. Also, get a copy of the current deed and make sure legal description of real estate is exactly the same on the new deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Desiree R.

August 19th, 2024

very easy to use

We are delighted to have been of service. Thank you for the positive review!

Gary G.

June 26th, 2019

Ordered the forms I needed for my state and county and everything worked out perfectly. All the forms came with examples (filled in) and very detailed instructions for each block that required an entry. I was able to fill everything out on my computer and save the files for future use, if required. Deeds provides an excellent product. I highly recommend their products and will use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert V.

March 20th, 2019

Website seems to work great and documents are very clear and easy to review and download, thank you.

Regards,

Bob

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Yvonne A.

April 25th, 2021

love your Deeds.com website...

Thank you!