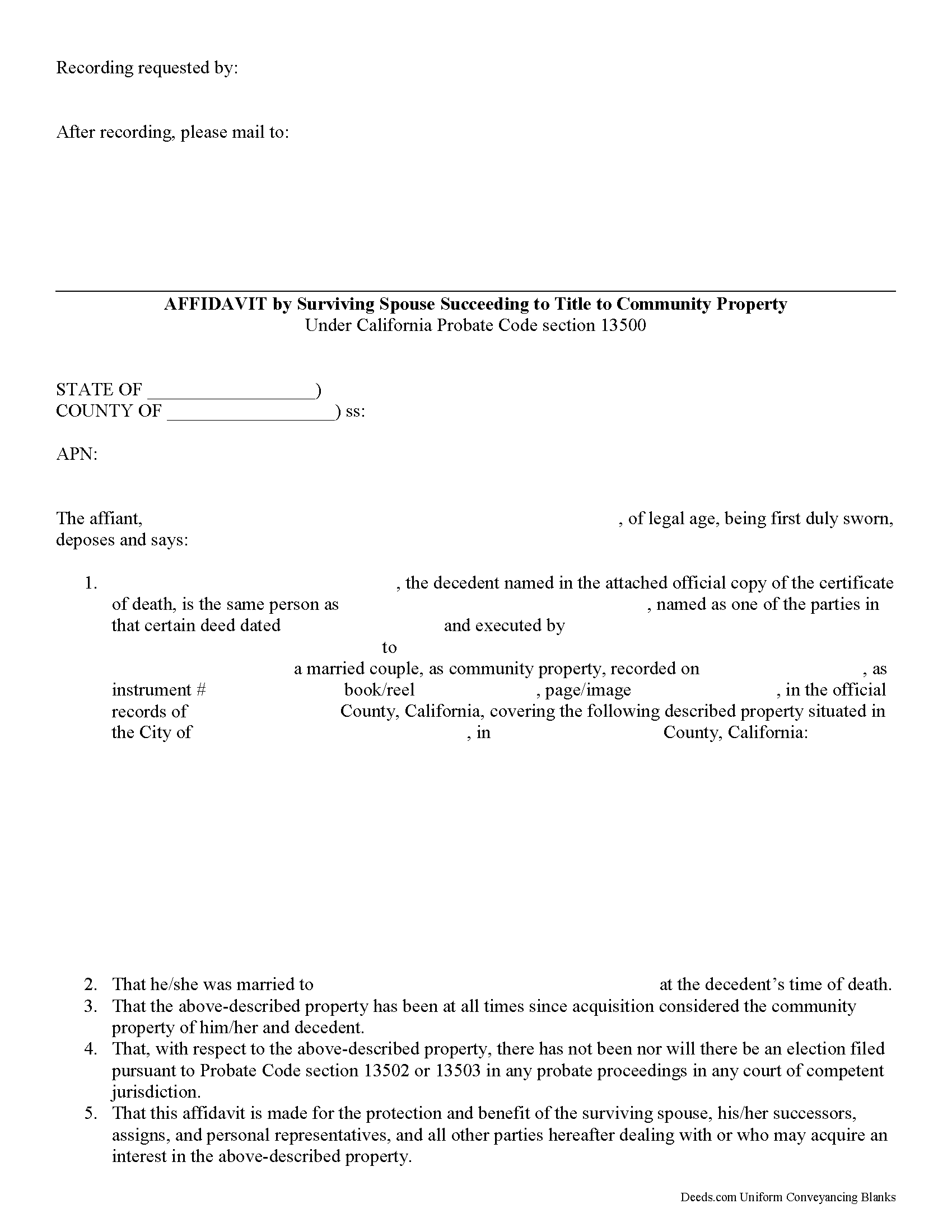

San Diego County Affidavit of Surviving Spouse Form

San Diego County Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

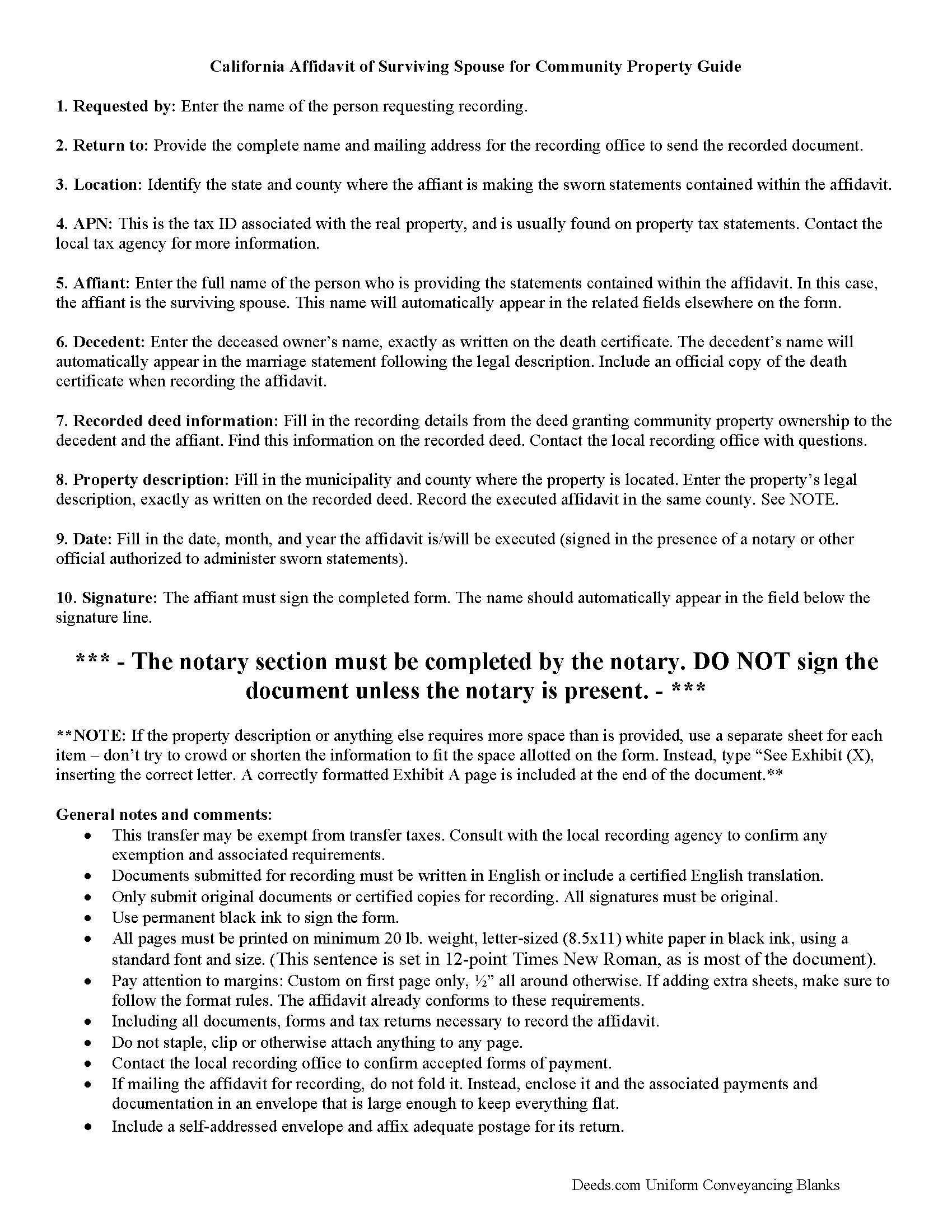

San Diego County Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

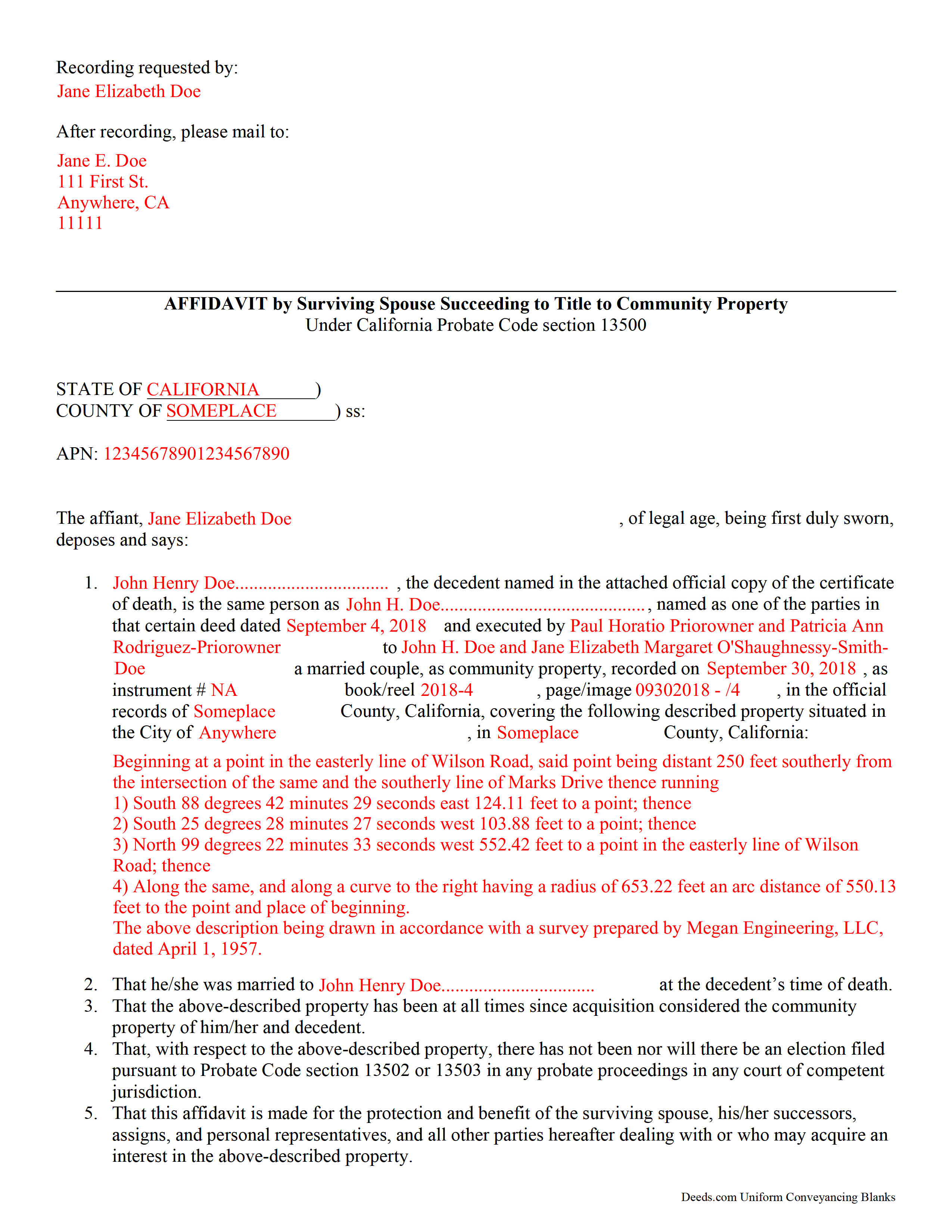

San Diego County Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and San Diego County documents included at no extra charge:

Where to Record Your Documents

San Diego Clerk/Recorder Main Office

San Diego, California 92101

Hours: Monday to Friday 8:00am - 5:00pm

Phone: (619) 236-3771, 238-8158; (760) 630-1219 North County

Mail to: San Diego Assessor/Recorder/Clerk

San Diego, California 92112-1750

Hours: N/A

Phone: mailing address

El Cajon Branch Office

El Cajon, California 92020

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (619) 236-3771 Assessor

San Marcos Branch Office

San Marcos, California 92078

Hours: Monday through Friday 8:00am - 5:00pm

Phone: (619) 238-8158 or (760) 630-1219 North County

Chula Vista Branch Office

Chula Vista, California 91910

Hours: 8:00 a.m. to 5:00 p.m., Monday through Friday, except holidays.

Phone: (619) 238-8158

Recording Tips for San Diego County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in San Diego County

Properties in any of these areas use San Diego County forms:

- Alpine

- Bonita

- Bonsall

- Borrego Springs

- Boulevard

- Camp Pendleton

- Campo

- Cardiff By The Sea

- Carlsbad

- Chula Vista

- Coronado

- Del Mar

- Descanso

- Dulzura

- El Cajon

- Encinitas

- Escondido

- Fallbrook

- Guatay

- Imperial Beach

- Jacumba

- Jamul

- Julian

- La Jolla

- La Mesa

- Lakeside

- Lemon Grove

- Lincoln Acres

- Mount Laguna

- National City

- Oceanside

- Pala

- Palomar Mountain

- Pauma Valley

- Pine Valley

- Potrero

- Poway

- Ramona

- Ranchita

- Rancho Santa Fe

- San Diego

- San Luis Rey

- San Marcos

- San Ysidro

- Santa Ysabel

- Santee

- Solana Beach

- Spring Valley

- Tecate

- Valley Center

- Vista

- Warner Springs

Hours, fees, requirements, and more for San Diego County

How do I get my forms?

Forms are available for immediate download after payment. The San Diego County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Diego County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Diego County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Diego County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Diego County?

Recording fees in San Diego County vary. Contact the recorder's office at (619) 236-3771, 238-8158; (760) 630-1219 North County for current fees.

Questions answered? Let's get started!

Transferring California Community Property to the Surviving Spouse

Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution. For transfers occurring after July 1, 2001, California property owners gained the option to hold title as community property with the right of survivorship. By vesting this way, the remaining spouse acquires the deceased spouse's portion of the shared property without the need for probate (Cal Civ Code 682.1(a)).

The surviving spouse files an affidavit (a statement of facts, made under oath), along with an official copy of the death certificate, at the recording office for the county where the property is located. The content may vary depending on the circumstances, but it generally contains the names of both spouses, a formal legal description of the shared real estate, and the recording information for the deed transferring ownership to the couple, confirming their intention to hold title as community property. Note that the right of survivorship is not automatic with community property -- it must be written on the face of the deed. To alleviate any questions about the survivorship status, consider including an official copy of the recorded deed.

The affidavit should also confirm, among other things, that the co-owners were married when the decedent died, that there are no probate actions related to the property, and that the surviving spouse is submitting the affidavit to ensure clear title. A clear title is important because it makes future transactions involving the real estate less complicated.

Each case is unique, so contact an attorney with specific questions or for complex situations.

(California Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Important: Your property must be located in San Diego County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Spouse meets all recording requirements specific to San Diego County.

Our Promise

The documents you receive here will meet, or exceed, the San Diego County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Diego County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4612 Reviews )

Deborah C.

February 1st, 2019

I would recommend these forms to others.

Thank you!

Lahoma G.

February 3rd, 2021

Got it very fast !! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Carol H.

October 8th, 2022

Easy to understand, quick access, inexpensive, and I took it to my registrar's office and he said the warranty deed was good to go. Thanks for saving me a bundle in lawyer's fees.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eric G.

October 22nd, 2021

Need to offer option to download ALL forms as a single (bookmarked) PDF, rather than as separates... Quite inefficient as is.

Thank you for your feedback. We really appreciate it. Have a great day!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank G B.

December 21st, 2019

site is very helpful and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beaugwynn Wigley S.

October 26th, 2021

Thanks so much for all your help! That was painless.

Thank you!

Dorothy S.

November 11th, 2020

Great service and documents that solved my legal issues I was frustrated with my inability to safe my information on the template and add an extra field box. Please make those instructions more clear for future customers.

Thank you for your feedback. We really appreciate it. Have a great day!

Maureen F.

January 27th, 2021

Forms were delivered quickly and were easily filled out. State specific!

Thank you!

Sylvia H.

December 22nd, 2023

Deeds.com really made the process of completing and submitting the Lien application easy. Thank you, and I will be using you whenever I need a real estate document that you carry.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert R.

September 7th, 2025

I found the form I needed. I ordered the wrong ones the first time. I didn't know if I could get refund or not. The information with the forms is very helpful Thank you

Thank you for your feedback. We’re pleased to hear you found the forms and supporting information helpful. Your initial order has been canceled and refunded, and we’re glad you now have the correct forms in hand. We appreciate your business and are here if you need further assistance.

Alex J.

August 6th, 2020

Very simple to use. I am a private homeowner with no experience in such things and it was very easy to do which was quite a relief. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George S.

October 29th, 2025

Deeds.com made the recording of my timeshare Quit Claim Deed painless and extremely fast. I'm talking hours, not days. Thank You!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Ajinder M.

June 18th, 2020

wonderful. saved my time and energy. Absolutely love this service. All the best AJ

Thank you!

Randi J.

September 8th, 2020

Everything was so easy and self explanatory and very inexpensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!