Independence County Purchaser's Agreement (with installment payments) Form (Arkansas)

All Independence County specific forms and documents listed below are included in your immediate download package:

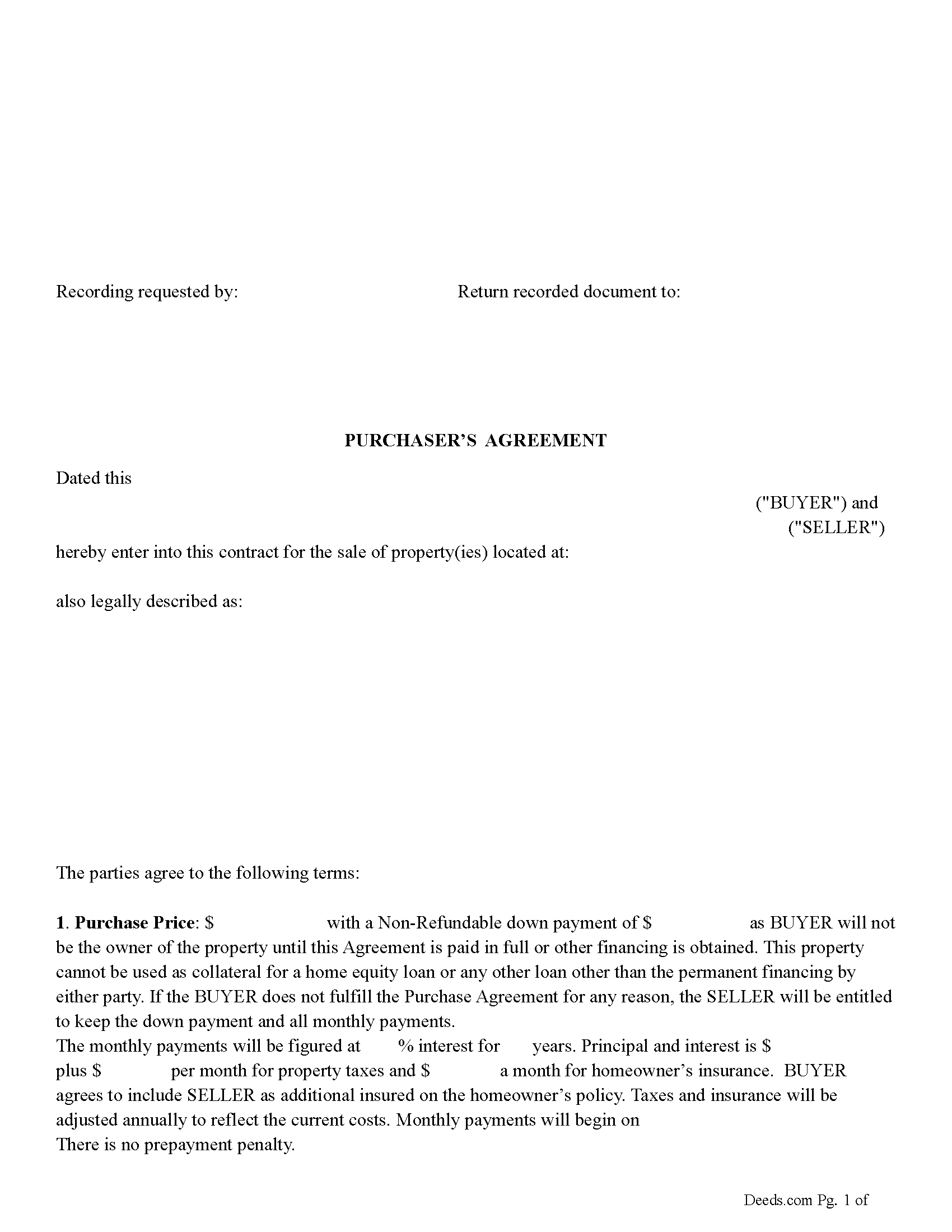

Purchaser's Agreement (with installment payments) Form

Fill in the blank Purchaser's Agreement (with installment payments) form formatted to comply with all Arkansas recording and content requirements.

Included Independence County compliant document last validated/updated 10/17/2024

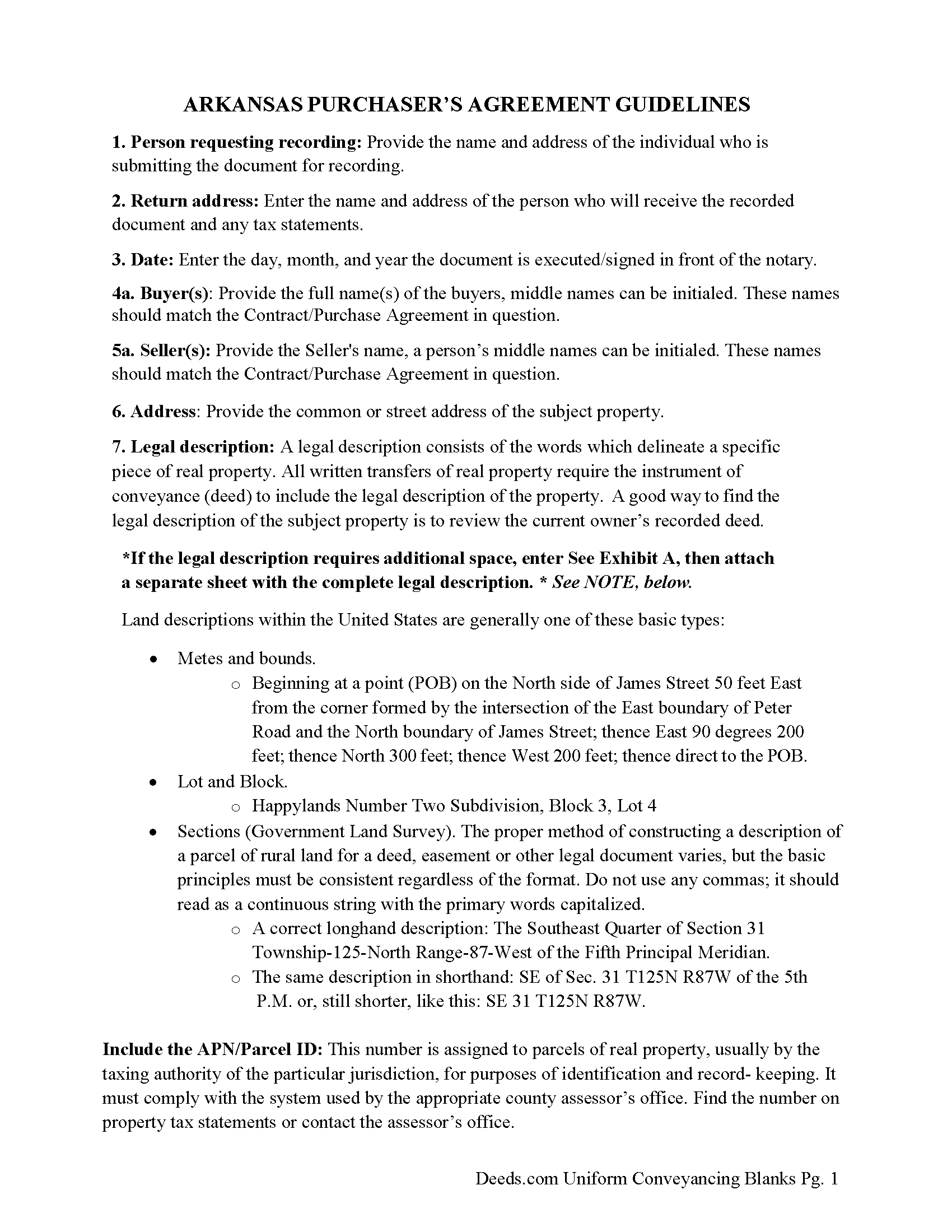

Purchaser's Agreement (with installment payments) Guide

Line by line guide explaining every blank on the Purchaser's Agreement (with installment payments) form.

Included Independence County compliant document last validated/updated 5/29/2024

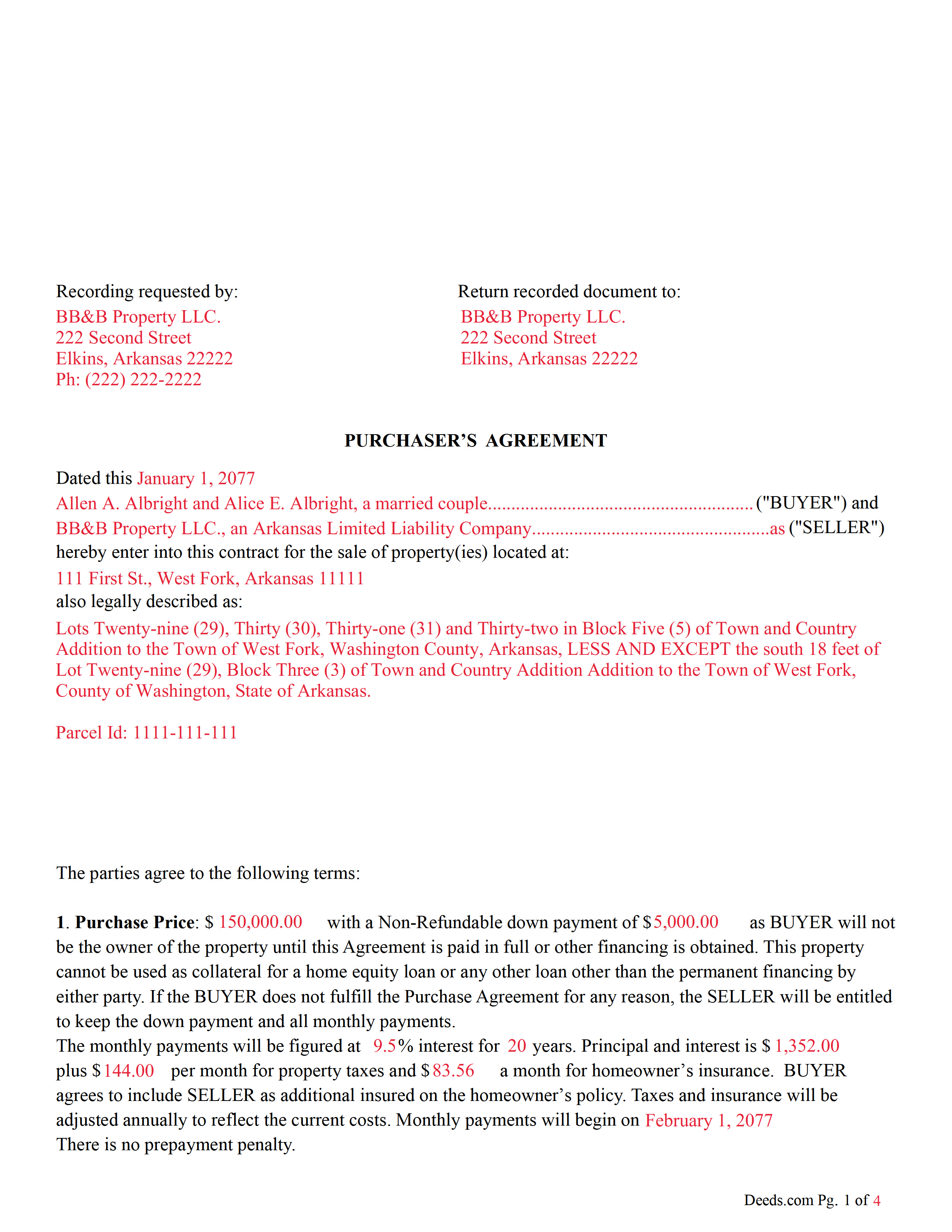

Completed Example of the Purchaser's Agreement (with installment payments) Document

Example of a properly completed Arkansas Purchaser's Agreement (with installment payments) document for reference.

Included Independence County compliant document last validated/updated 8/15/2024

The following Arkansas and Independence County supplemental forms are included as a courtesy with your order:

When using these Purchaser's Agreement (with installment payments) forms, the subject real estate must be physically located in Independence County. The executed documents should then be recorded in the following office:

Independence County Circuit Clerk

Courthouse - 192 E Main St, Batesville, Arkansas 72501

Hours: 8:00am to 4:30pm M-F

Phone: (870) 793-8833

Local jurisdictions located in Independence County include:

- Batesville

- Charlotte

- Cord

- Cushman

- Desha

- Floral

- Locust Grove

- Magness

- Newark

- Oil Trough

- Pleasant Plains

- Rosie

- Salado

- Sulphur Rock

- Thida

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Independence County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Independence County using our eRecording service.

Are these forms guaranteed to be recordable in Independence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Independence County including margin requirements, content requirements, font and font size requirements.

Can the Purchaser's Agreement (with installment payments) forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Independence County that you need to transfer you would only need to order our forms once for all of your properties in Independence County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Independence County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Independence County Purchaser's Agreement (with installment payments) forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

PURCHASER’S AGREEMENT (with installment payments)

In Arkansas, a purchaser’s agreement with payments, often referred to an installment sale agreement, is a common way to structure the sale of real property when the buyer is unable to pay the full purchase price upfront and does not qualify for or seek traditional mortgage financing. Here’s how such agreements typically work and key elements they include:

Overview of a Purchase Agreement with Payments:

1. A purchase agreement with payments in Arkansas allows a buyer to pay for the property in installments directly to the seller over a specified period. This method bypasses the need for immediate traditional financing.

2. Clearly identifies the buyer and the seller.

3. Legal Description of Property.

4. Purchase Price: States the total agreed-upon price for the property.

5. Down Payment: Specifies any down payment required by the buyer at the outset of the agreement.

6. Payment Schedule: Details the amount of each installment, when payments are due (e.g., monthly), and the duration over which payments will be made. It also specifies the form of payment.

7. Interest Rate: If applicable, the interest rate on the unpaid balance is stated.

8. Late Fees and Penalties: Any above noted payment past due shall be subject to a late charge of $ ----- And an additional $ ----per day until the payment is received.

9. Default Provisions: BUYER further agrees that they understand none of the down payment or the monthly payments will be refunded in the event of an eviction.

10. Transfer of Title: Specifies that the legal title to the property will remain with the seller until the buyer completes all payments under the contract. Once all payments are made, the seller is obligated to convey the title to the buyer by Warranty Deed.

11. Warranties or Disclosures: Sold in (As is Condition), exceptions can be made for a specific situation.

12. Insurance and Taxes: Outlines who is responsible for property taxes, insurance, and maintenance until the title is transferred.

Legal Considerations

Equitable Title: The buyer holds equitable title during the term of the agreement, meaning they have a right to obtain full legal title upon full payment.

Recording the Agreement: It's generally advisable to record the Purchasers Agreement with the county recorder’s office to protect both parties’ interests and provide public notice of the buyer’s interest in the property. (For use in Arkansas only.)

For privacy or Buyers protection, see (Memorandum and Notice of Agreement) form.

Our Promise

The documents you receive here will meet, or exceed, the Independence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Independence County Purchaser's Agreement (with installment payments) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Audrey A.

August 19th, 2019

Great!

Thank you!

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Jonathon K.

September 1st, 2023

Recording deeds from the comfort of my office has never been simpler thanks to Deeds.com. The service is affordable, fast, and extremely user friendly. I highly recommend anyone who needs a deed recorded in the state of Florida to look into this website, it has made my job much easier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gloria H.

December 17th, 2020

Very content with the service received. The document was recorded in the city in no time. Will definitely use Deeds.com again in the near future.

Thank you!

John B.

August 11th, 2022

Simply amazing. I had absolutely no idea how to properly file a deed, until someone told me about deeds.com. It's just such a well designed service, with fantastic customer support, and speed. Bravo to everyone at deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LAWRENCE S.

January 9th, 2022

I am mostly satisfied with my Deeds.Com experience. Not sure if you can do anything about this, but since it is fairly common, I thought the Quit Claim Form would have a section specifically for adding spouse to a deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Lavonia L.

October 7th, 2024

Found exactly what I was looking for and it helped tremendously.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason B.

July 19th, 2022

KVH provided excellent customer service (great communication was provided). I would differently use this service if needed in the further.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurie B.

June 23rd, 2021

You have made this process so simple - I can see it would have been complicated and frustrating without Deeds.com. Thank you!

Thank you!

Matthew L.

September 15th, 2022

I would make just two suggestions.

(1) Create and example showing multiple grantor(s) and

(2) In the same example, show where and estate is conveyed to two or more people.

It would help in knowing the correct format.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana H.

February 10th, 2019

little expensive same document in other county is free. however quite fast in responding. and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey T.

January 20th, 2022

I downloaded the Lady Bird deed. The process was quick and easy to download. Just select your county, fill out the form. You will need the property description from your original deed. In my case I had to go downtown Wayne County (Detroit). (Make an appt online). 1st you will have to get the property tax certified to ensure all taxes are paid to date (5th floor at the Wayne County Treasurer office). Give them the form you just filled out and they will stamp certified $5. After that take the form to the Register of Deeds (7th floor) appt needed. $18. Make sure it is properly notarized and all signatures completed. Once approved, they will scan it, stamp it, give it back with a receipt and mail a copy also. All Done. Worked beautifully. My co worker go a lawyer and paid over $250. I just used deeds.com and total for forms and going downtown with notarizing was less than $40 Yea!

Thank you for your feedback. We really appreciate it. Have a great day!