Saline County Notice of Intent to File Form (Arkansas)

All Saline County specific forms and documents listed below are included in your immediate download package:

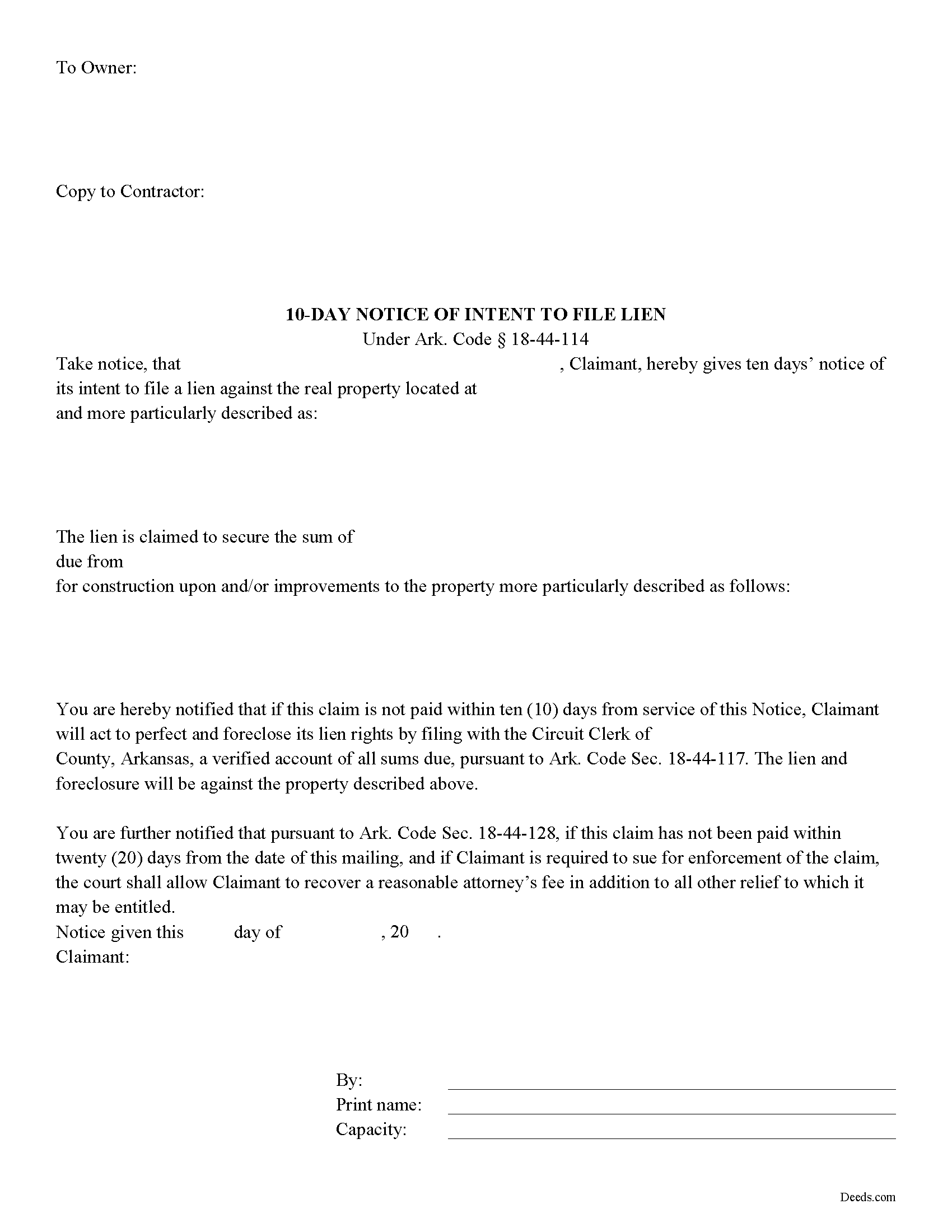

Notice of Intent to File Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Saline County compliant document last validated/updated 11/22/2024

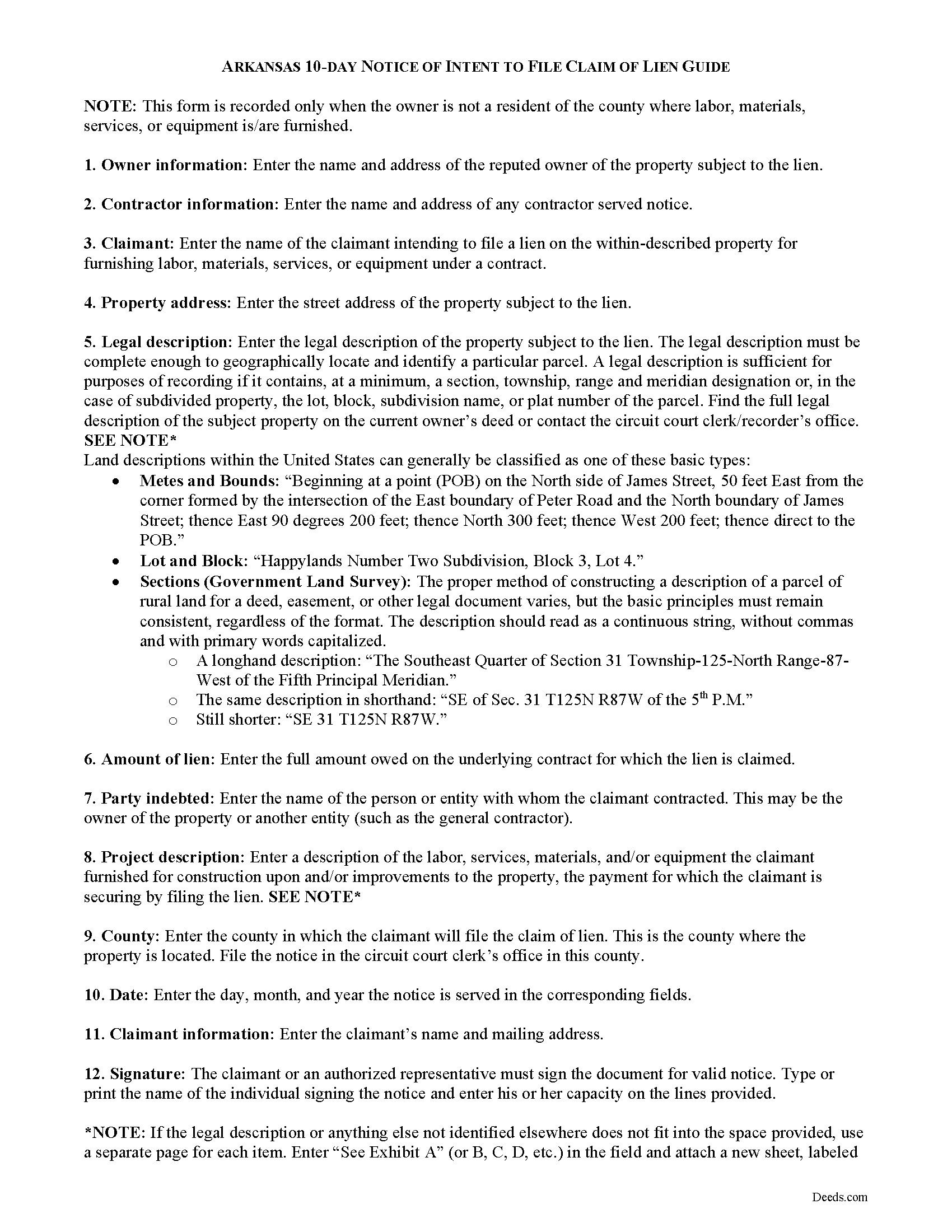

Notice of Intent to File Guide

Line by line guide explaining every blank on the form.

Included Saline County compliant document last validated/updated 10/28/2024

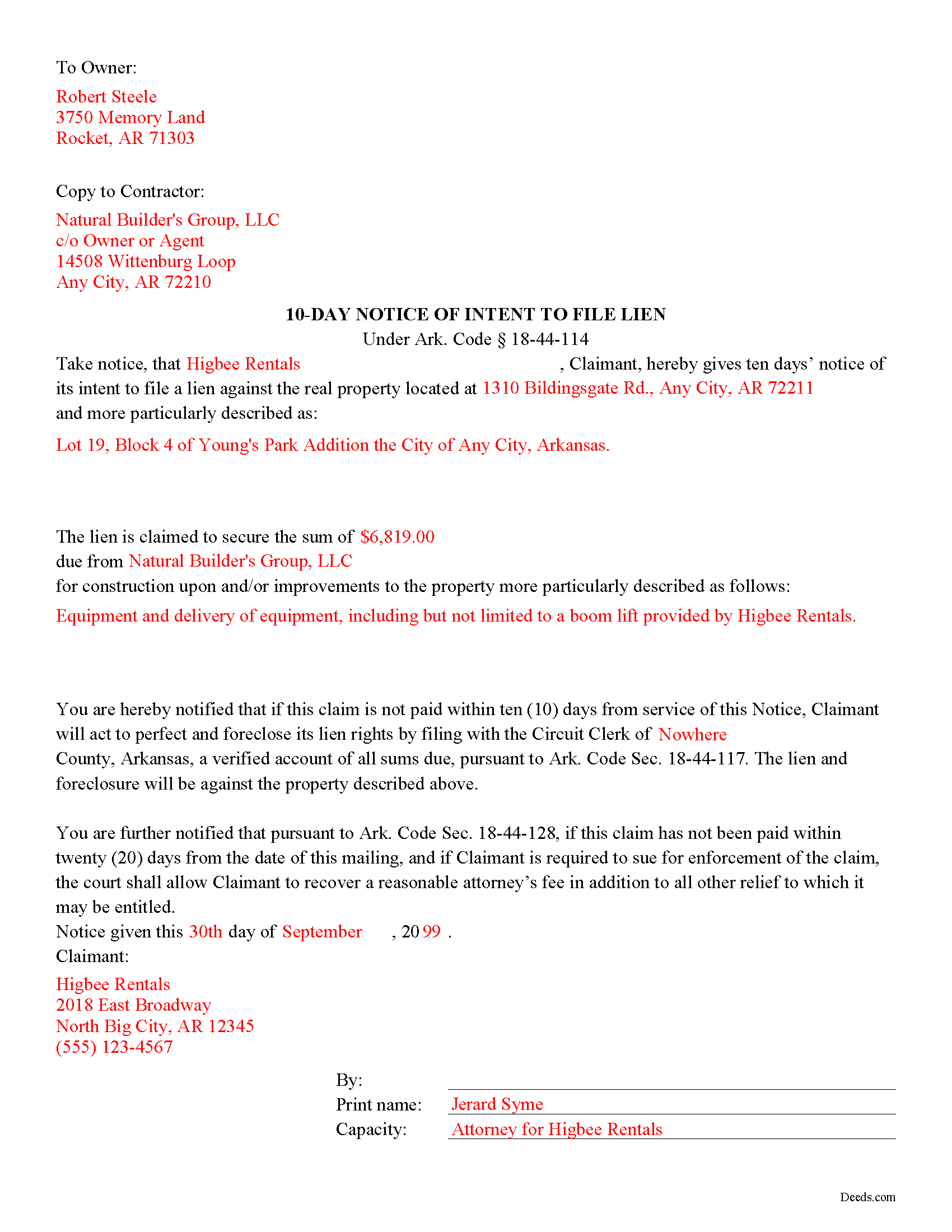

Completed Example of the Notice of Intent to File Document

Example of a properly completed form for reference.

Included Saline County compliant document last validated/updated 11/6/2024

The following Arkansas and Saline County supplemental forms are included as a courtesy with your order:

When using these Notice of Intent to File forms, the subject real estate must be physically located in Saline County. The executed documents should then be recorded in the following office:

Circuit Clerk & Recorder's Office

Courthouse - 200 N Main, Rm 113, Benton, Arkansas 72015

Hours: 8:00am to 4:30pm M-F

Phone: (501) 303-5615

Local jurisdictions located in Saline County include:

- Alexander

- Bauxite

- Benton

- Bryant

- Hensley

- Mabelvale

- Paron

- Traskwood

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Saline County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Saline County using our eRecording service.

Are these forms guaranteed to be recordable in Saline County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saline County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Intent to File forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Saline County that you need to transfer you would only need to order our forms once for all of your properties in Saline County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Saline County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Saline County Notice of Intent to File forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Arkansas 10 days' notice of intent to file lien under Ark Code Sec. 18-44-114 is a preliminary notice required from a potential claimant before filing a claim of lien against a property. A claim of lien is unenforceable if the claimant fails to abide notice requirements as directed by law.

The notice, delivered to the owner, states the balance owed on an underlying contract. If the balance is not paid within ten days' receipt of the notice, the claimant has a claim on the property and may proceed to file a claim of lien against the title.

Arkansas law stipulates what constitutes "delivery." Notice may be served by an officer authorized to serve process in a civil action; a person who would be a competent witness; by mail addressed to the person to be served, with restricted delivery and return receipt requested; or by any means that provides written, third-party verification of delivery to anywhere the owner maintains residence or an office or conducts business (18-44-114). When served by persons other than an officer, an affidavit of service of notice is also required. When served by mail, the verification of service is a return receipt signed by the addressee or a returned piece of mail or affidavit by postal worker showing refusal of notice by the addressee or that the notice was unclaimed.

In cases where the owner resides in a county other than the one in which the property under contract is located, the notice gets recorded in the circuit clerk's office. Otherwise, the notice is a standalone document, and is not required to be notarized or recorded. Proof of service of notice, along with a copy of the notice, however, is required when filing a claim of lien, so the document is attached as an exhibit to a claim of lien filing.

An effective notice should also contain a description of the property that will become subject to the lien, a description of the labor, services, materials, or equipment furnished by the claimant, and identify the claimant by name, along with any individual acting on behalf of the claimant signing the notice.

Consult an attorney questions about notice requirements, or for any other issues related to the lien law process in Arkansas.

Our Promise

The documents you receive here will meet, or exceed, the Saline County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saline County Notice of Intent to File form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

David J.

November 12th, 2019

Excellent documents, downloaded quick, completed and printed with no problems. Thank you

Thank you!

D. Jeffrey C.

June 10th, 2024

Generally I find the process works well, and the support personnel on the other end are usually fairly helpful.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Shabaz W.

June 5th, 2020

Very convenient

Thank you!

Sherry F.

January 5th, 2019

Good product and service.

Thank you!

Leslie C.

September 13th, 2023

I recently purchased online DIY legal forms, and I must say I was thoroughly impressed. The documents provided were accurate, comprehensive, and precisely what I needed. The accompanying guide was clear, instructive, and really bridged the gap for someone like me who isn't well-versed in legal jargon. What stood out the most, however, was the inclusion of the example. It served as a practical reference and made the entire process so much more approachable. Being able to see a filled-out sample made all the difference. Overall, this product has been invaluable in helping me navigate legal processes on my own.

Thank you for your feedback. We really appreciate it. Have a great day!

Javoura G.

January 31st, 2021

Great was not hard at all to do and process only wished it told how much it cost to actually submit the forms

Thank you for your feedback. We really appreciate it. Have a great day!

Irwin C.

August 25th, 2023

For starters, enrolling was as easy as could be. Then, it only took minutes before my entry was formatted and filed. Finally, when I asked a question, I got an answer within a few minutes. Couldn't be happier with service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erika M.

November 13th, 2020

Received the forms I ordered, found them to be easy to complete with the guide and example that was included. Had no issues recording them, smooth as silk from start to finish.

Thank you for your feedback. We really appreciate it. Have a great day!

Remon W.

January 26th, 2021

Excellent and fast service. I will be using this site as needed in the future.

Thank you Remon, we appreciate you.

Beverly D.

April 15th, 2021

Very User friendly site

Thank you for your feedback. We really appreciate it. Have a great day!

Michael K.

April 21st, 2020

Service seems smooth. I just wonder what the turn around time on recording is (I need proof of recordation).

Thank you!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!