Garland County Beneficiary Deed Form (Arkansas)

All Garland County specific forms and documents listed below are included in your immediate download package:

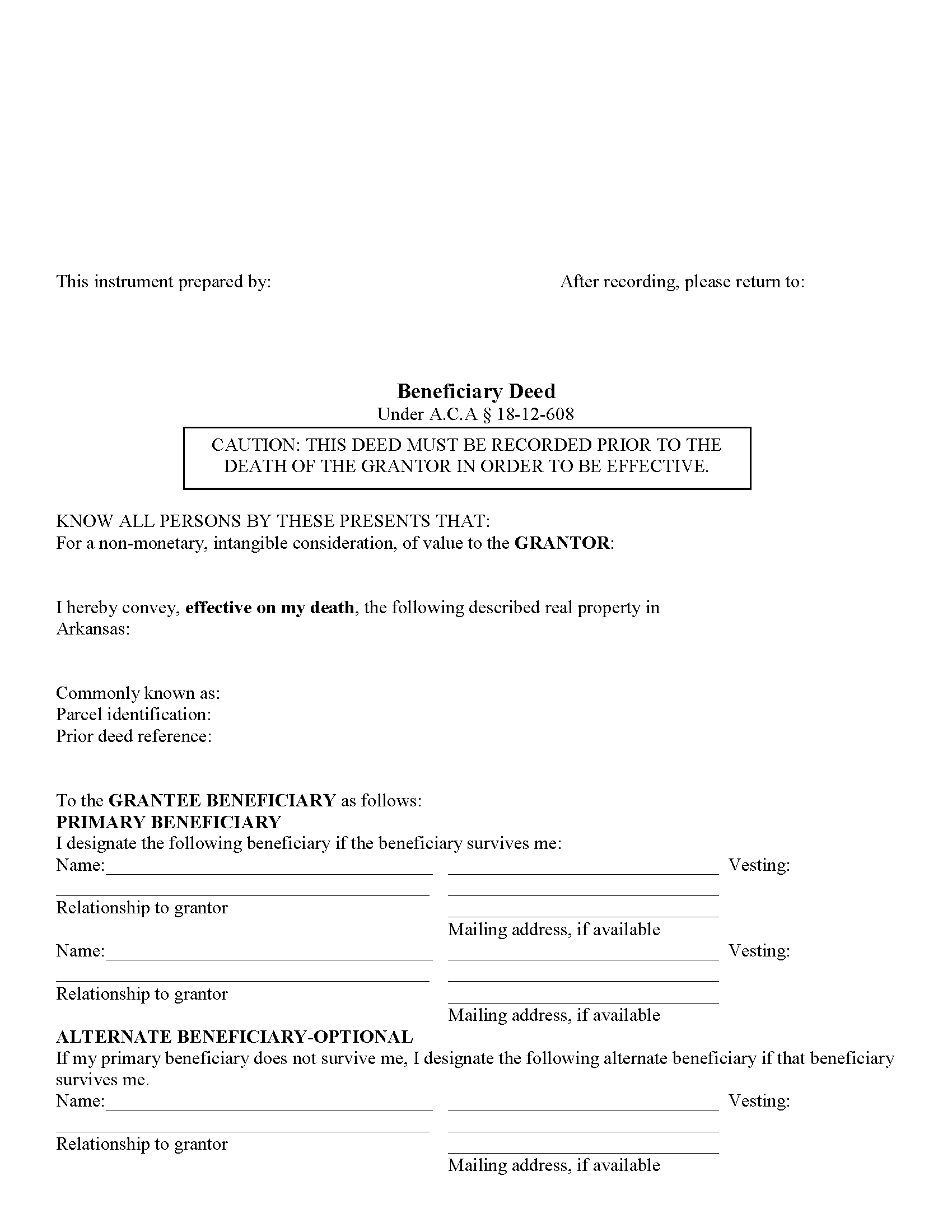

Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Garland County compliant document last validated/updated 10/30/2024

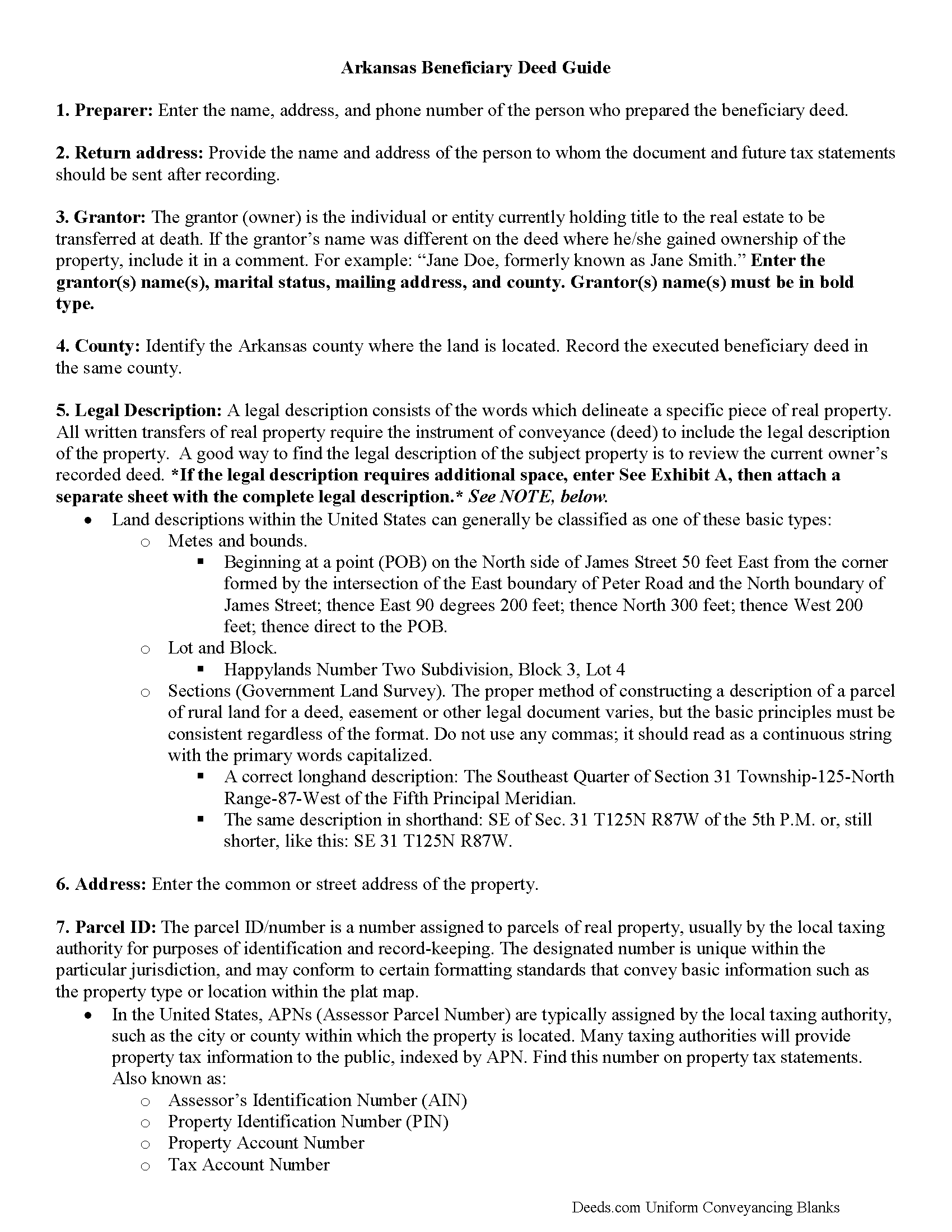

Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

Included Garland County compliant document last validated/updated 6/28/2024

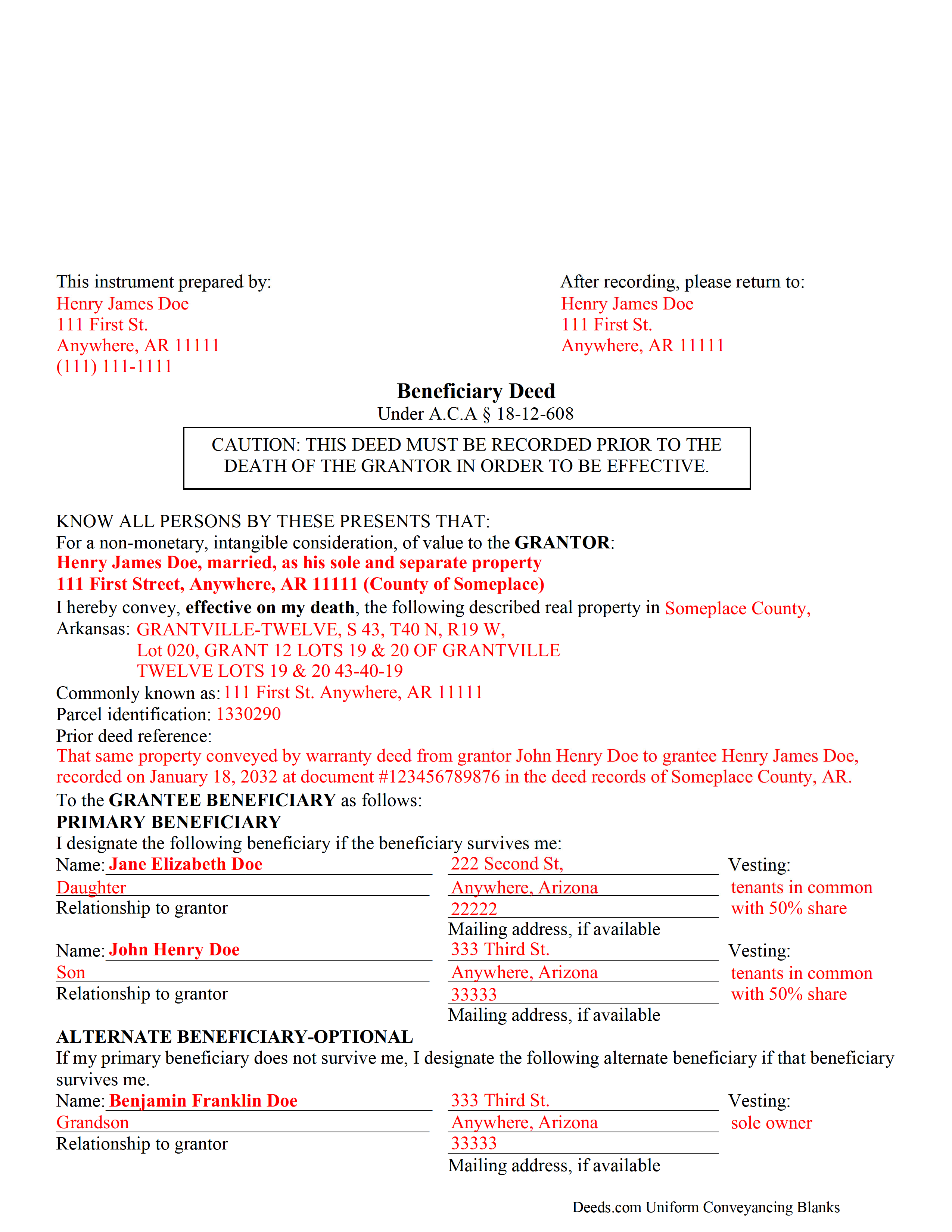

Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

Included Garland County compliant document last validated/updated 9/2/2024

The following Arkansas and Garland County supplemental forms are included as a courtesy with your order:

When using these Beneficiary Deed forms, the subject real estate must be physically located in Garland County. The executed documents should then be recorded in the following office:

Garland County Circuit Clerk

Courthouse - 501 Ouachita Ave, Hot Springs, Arkansas 71901

Hours: 8:00am-5:00pm M-F

Phone: (501) 622-3630

Local jurisdictions located in Garland County include:

- Hot Springs National Park

- Hot Springs Village

- Jessieville

- Lonsdale

- Mountain Pine

- Pearcy

- Royal

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Garland County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Garland County using our eRecording service.

Are these forms guaranteed to be recordable in Garland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garland County including margin requirements, content requirements, font and font size requirements.

Can the Beneficiary Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Garland County that you need to transfer you would only need to order our forms once for all of your properties in Garland County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Garland County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Garland County Beneficiary Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute offers owners of Arkansas real property to designate one or more beneficiaries who may gain the interest that remains in the owner's name at the time of his/her death.

Even though beneficiary deeds, just like other deeds of conveyance, must be lawfully recorded after they are completed and executed (signed in front of a notary), they differ from standard deeds in some important ways. If they are not recorded during the owner's life, they have no effect. Beneficiary deeds do not transfer any present interest in the real estate, so there is no requirement for consideration.

Perhaps one of their most unique features is the fact that the owner may execute and record new beneficiary deeds that change the beneficiary, the terms of the transfer, or even revoke the whole thing. The owner may even sell the property to someone else, leaving no interest to convey at death. Again, like the beneficiary deeds, to be effective, any changes must be recorded while the owner is alive. This flexibility allows land owners to retain absolute control over and use of the property.

When the owner dies, the beneficiary gains the title to the real estate described in the beneficiary deed. Any mortgages, liens, or obligations attached to the land at the time of the owner's death become the beneficiary's responsibility. In addition, if the owner received benefits from state or federal agencies, they might file reimbursement claims against the estate or the beneficiary.

Ultimately, beneficiary deeds can be a useful part of an overall estate plan. Still, executing one may impact the owner's eligibility for asset-based programs. Carefully consider the benefits and drawbacks to this type of conveyance to ensure that it supports the owner's overall intentions. Because each situation is unique, consult an attorney with specific questions.

(Arkansas Beneficiary Deed Package includes form, guidelines, and completed example) For use in Arkansas only.

Our Promise

The documents you receive here will meet, or exceed, the Garland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garland County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rose C.

September 12th, 2020

easy breezy *****

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vertina B.

June 14th, 2022

The website is well established and easy to use. I got everything I was supposed to get. I had no problem downloading the forms. All of the forms printed well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim K.

December 16th, 2021

Looks like it will be helpful in preparing deeds for distant counties

Thank you!

April L.

November 13th, 2019

The warranty deed forms I received worked fine.

Thank you!

RUSSELL E.

August 5th, 2020

The process sure was easy and fast. Not sure why a rep would question why I am requesting an exhibit page on the Deed when that's a common practice here in AZ. They recorded it the way I sent it so all good.

Thank you!

Clay H.

July 11th, 2022

The provided docs and guide were very helpful. Well worth the price in my opinion.

Thank you for your feedback. We really appreciate it. Have a great day!

Rachel E.

April 3rd, 2020

Our firm is working remotely and a lot of court services are limited with the corona-virus shutdowns, but we needed to record a Deed at the last minute. There was no other way we'd could get it done that quick without Deeds.com

(staff) helped us work out some kinks and we got it recorded in less than 1 business day!

Thank you!

Thank you for your feedback, we really appreciate it. Glad we could help.

Lisa B.

April 13th, 2019

Awesome service. User friendly, simple, easy and quick to fill out with instructions and sample copy and print.

Thank you Lisa, we appreciate your feedback.

Chris M.

April 19th, 2022

simple, Clean, and easy, to retrieve the forms i needed, while on this site.

and the Fee for the Fill-in forms is Remarkably inexpensive, to say the least!

Thank you!

Cessaly D H.

December 27th, 2022

Excellent service bc you create your own account and have immediate access to documents!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dwayne H.

November 3rd, 2020

The Oregon TODD transfer on death deed template worked great and was easy to use. They had instructions and a guide that had good pointers to filling everything out. It took about 2 weeks to mail in my filled TODD and receive it back from the county with their stamp. Would definitely use this service for other documents

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia S.

August 3rd, 2022

The forms was easy to use and the guides was helpful

We appreciate your business and value your feedback. Thank you. Have a wonderful day!