Lawrence County Beneficiary Deed Revocation Form (Arkansas)

All Lawrence County specific forms and documents listed below are included in your immediate download package:

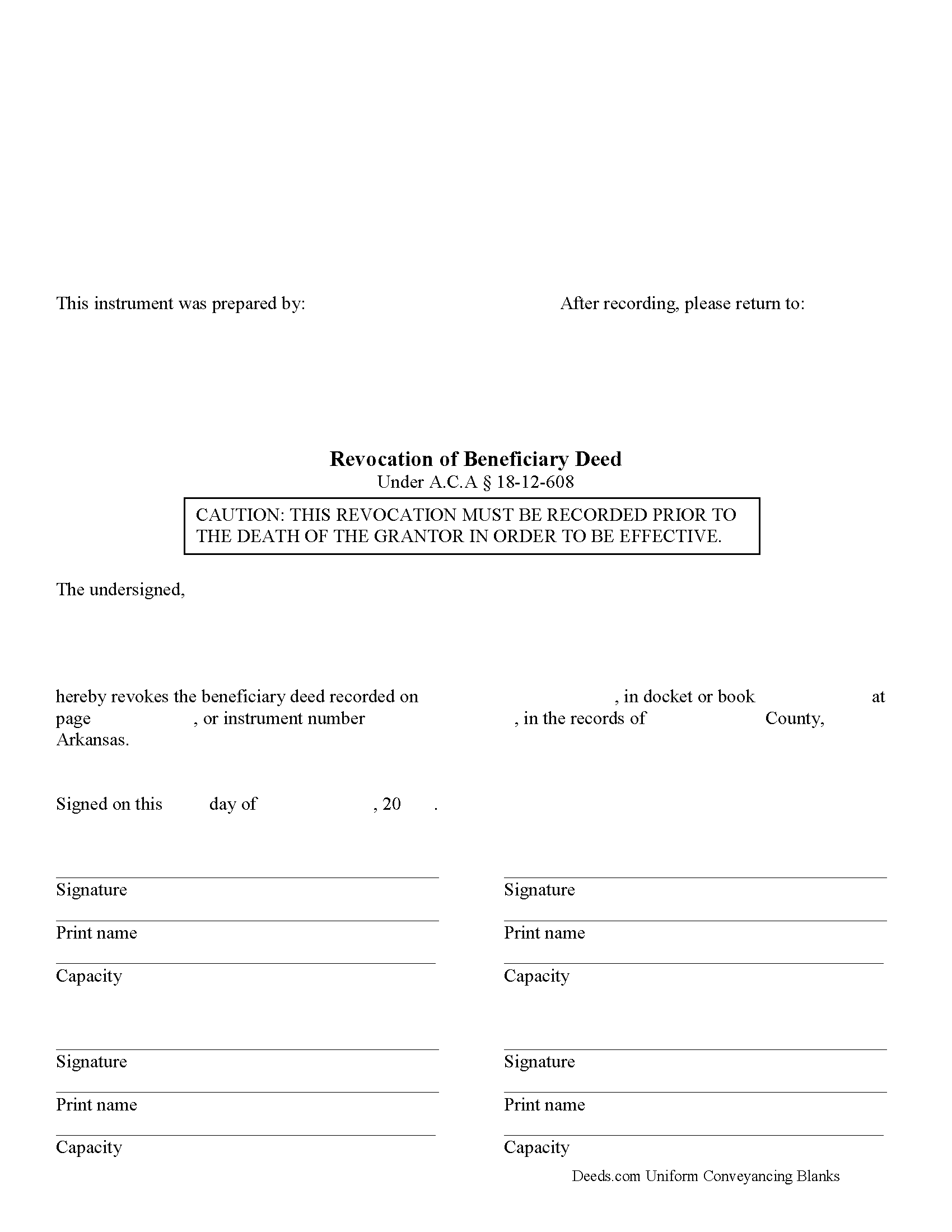

Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lawrence County compliant document last validated/updated 12/20/2024

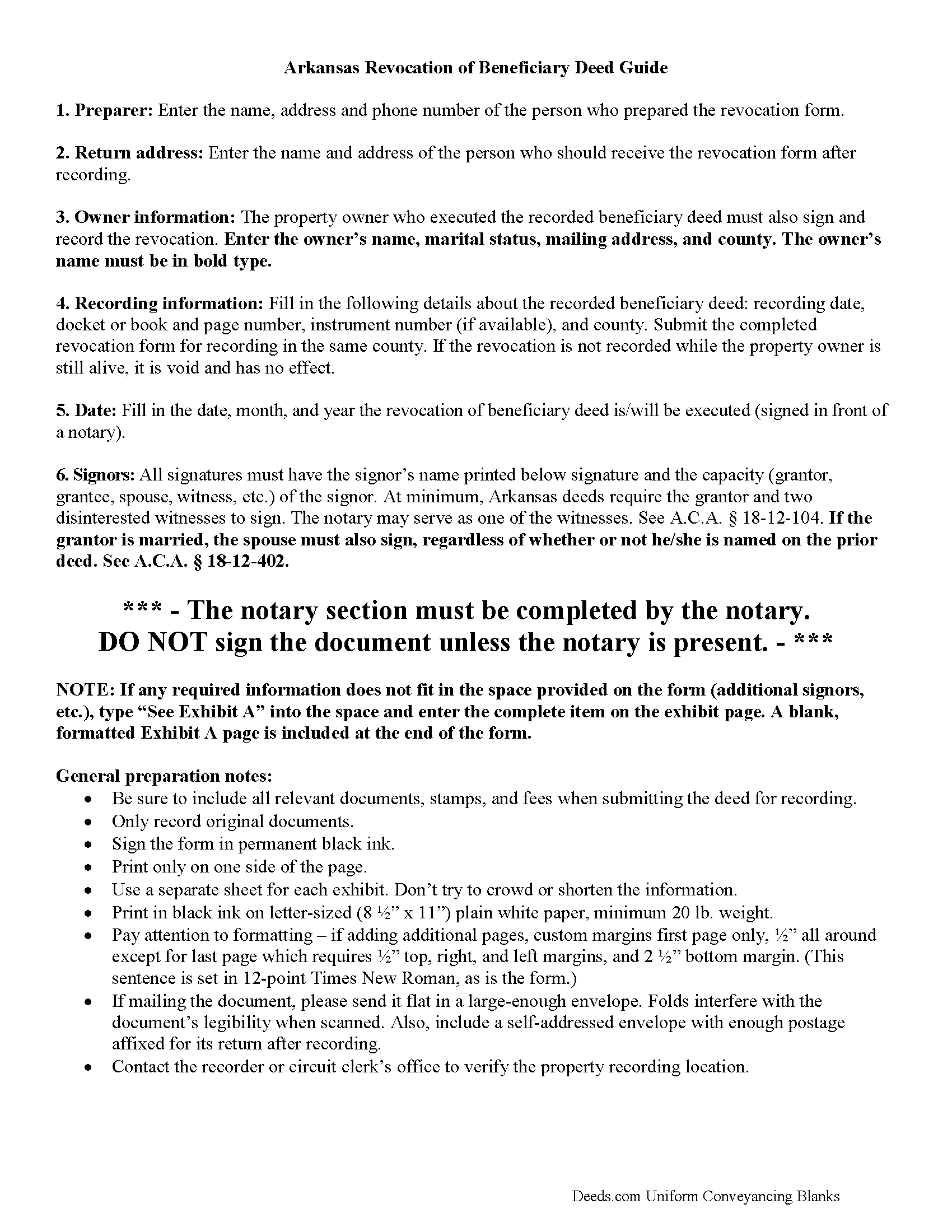

Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

Included Lawrence County compliant document last validated/updated 10/3/2024

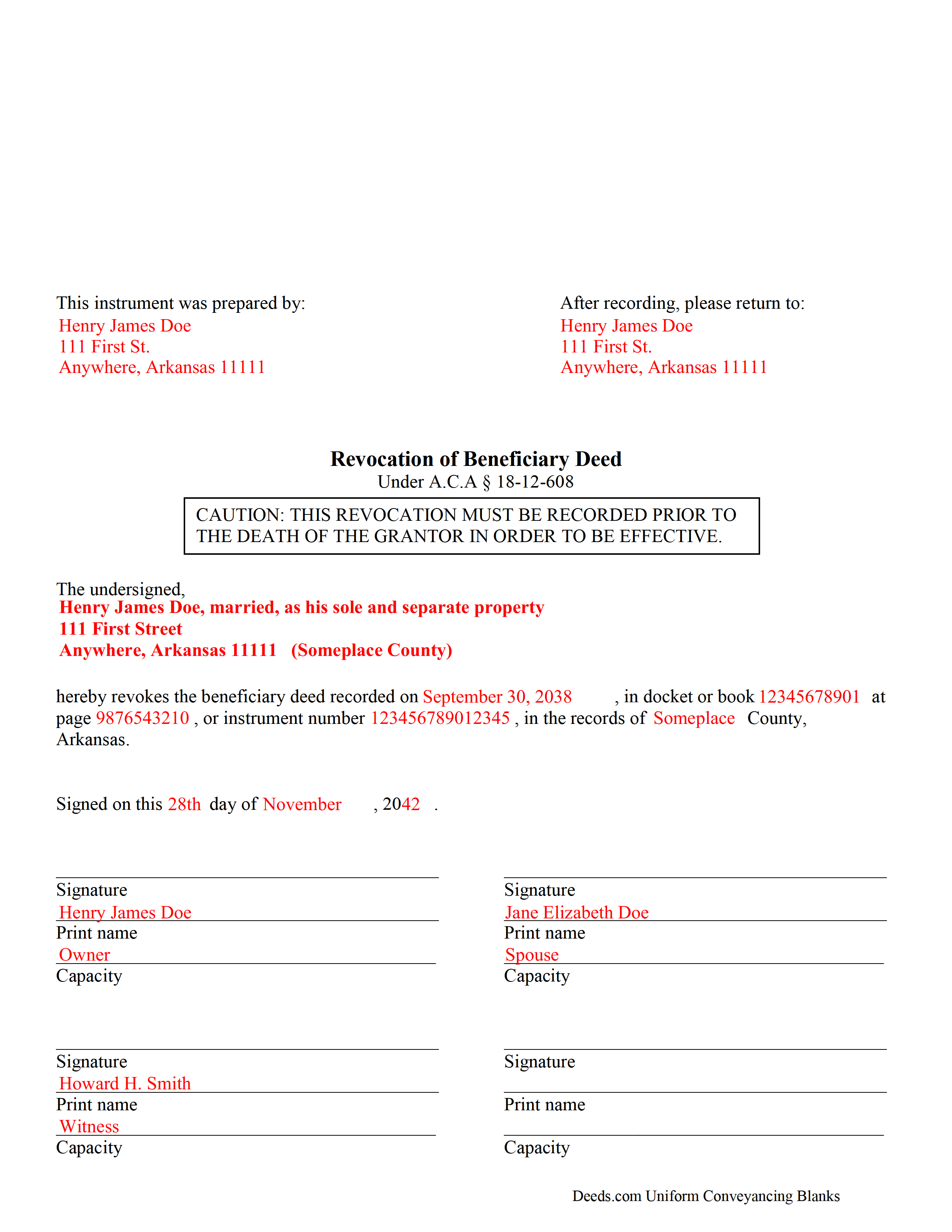

Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

Included Lawrence County compliant document last validated/updated 11/19/2024

The following Arkansas and Lawrence County supplemental forms are included as a courtesy with your order:

When using these Beneficiary Deed Revocation forms, the subject real estate must be physically located in Lawrence County. The executed documents should then be recorded in the following office:

Lawrence County Circuit Clerk

315 West Main, Rm 7 / PO Box 581, Walnut Ridge, Arkansas 72476

Hours: 8:30 to 4:30 M-F

Phone: (870) 886-1112

Local jurisdictions located in Lawrence County include:

- Alicia

- Black Rock

- Hoxie

- Imboden

- Lynn

- Minturn

- Portia

- Powhatan

- Ravenden

- Saffell

- Sedgwick

- Smithville

- Strawberry

- Walnut Ridge

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lawrence County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lawrence County using our eRecording service.

Are these forms guaranteed to be recordable in Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lawrence County including margin requirements, content requirements, font and font size requirements.

Can the Beneficiary Deed Revocation forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lawrence County that you need to transfer you would only need to order our forms once for all of your properties in Lawrence County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Lawrence County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lawrence County Beneficiary Deed Revocation forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Revoking a Beneficiary Deed in Arkansas

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute also includes information about revoking an executed and recorded beneficiary deed.

Section 18-12-608 (d)(1) states that a beneficiary deed "may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed." Why is this flexibility important? Well, life is uncertain and circumstances change. The original beneficiary may no longer be an appropriate recipient of the real property. Perhaps the beneficiary knows about the transfer, but is unable or unwilling to accept it. Instead of disclaiming the gift when the owner dies, thus forcing the property back into the estate for probate, the owner has the option to revoke the beneficiary deed and designate someone else to receive it.

Regardless of the reason, to revoke a beneficiary deed, the owner must execute a document setting forth the revocation and then record it, DURING HIS/HER LIFE, in the county where the property is situated. This should be the same county where the beneficiary deed was recorded earlier.

The owner may also simply sell the property outright, thereby extinguishing any remaining interest in it and leaving nothing to transfer at death. Or, he/she may execute and record another beneficiary deed, naming someone else to receive the real estate. This method is effective because "the recorded beneficiary deed that is last signed before the owner's death is the effective beneficiary deed, regardless of the sequence of recording." ( 18-12-608(e))

Even though there are several options available to revoke or change a recorded beneficiary deed, recording a revocation is the most efficient way to ensure the owner's wishes are carried out. A revocation discontinues the potential future interest described in the beneficiary deed, which then frees the real estate for whatever the owner wishes to do with it next. This is also important because it helps maintain a clear chain of title, which will make later sales or mortgages of the property less complicated.

Note: as with beneficiary deeds, any changes or revocations must be executed and recorded while the owner is alive.

(Arkansas Beneficiary Revocation Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lawrence County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline S.

May 4th, 2021

Outstanding service. The quit claim Deed form was great. Very easy to use and explained very clearly. Definitely recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Alfred J. H.

August 17th, 2019

Excellent resource for legal forms. Very satisfied.

Instructions and caveats explained clearly. Thank You!

Thank you!

Donald C.

February 22nd, 2019

No review provided.

Thank you!

Lara T.

December 1st, 2021

Made recording my document so much easier and faster. First attempt failed due to illegible blue ink, got that fixed and deeds.com resubmitted and doc was recorded within a couple of hours, all from the comfort of my home.

Thank you for your feedback. We really appreciate it. Have a great day!

Steve F.

July 9th, 2021

Fast Service, Easy to use. Highly Recommend!

Thank you!

Allison M.

February 28th, 2024

Completely painless process! Great customer service! Thank you for everything!

Your words of encouragement and feedback are greatly appreciated. They motivate us to maintain high standards in our service.

James S.

December 2nd, 2020

It worked great. But it turns out I didn't need it.

Thank you!

Marilyn J.

July 18th, 2020

Just what I needed!

Thank you!

Quinn R.

April 3rd, 2023

DEEDS.COM IS THE BEST WAY TO E-RECORD DEEDS. THEY ARE FAST, POLITE AND A FANTASTIC DEAL FOR THE SERVICE THAT THEY OFFER!!!

Thank you!

Francine B.

March 25th, 2020

Looks like all forms are available. Hope they are as easy to use as it was to obtain. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!