Cochise County Quitclaim Deed Condominium Form (Arizona)

All Cochise County specific forms and documents listed below are included in your immediate download package:

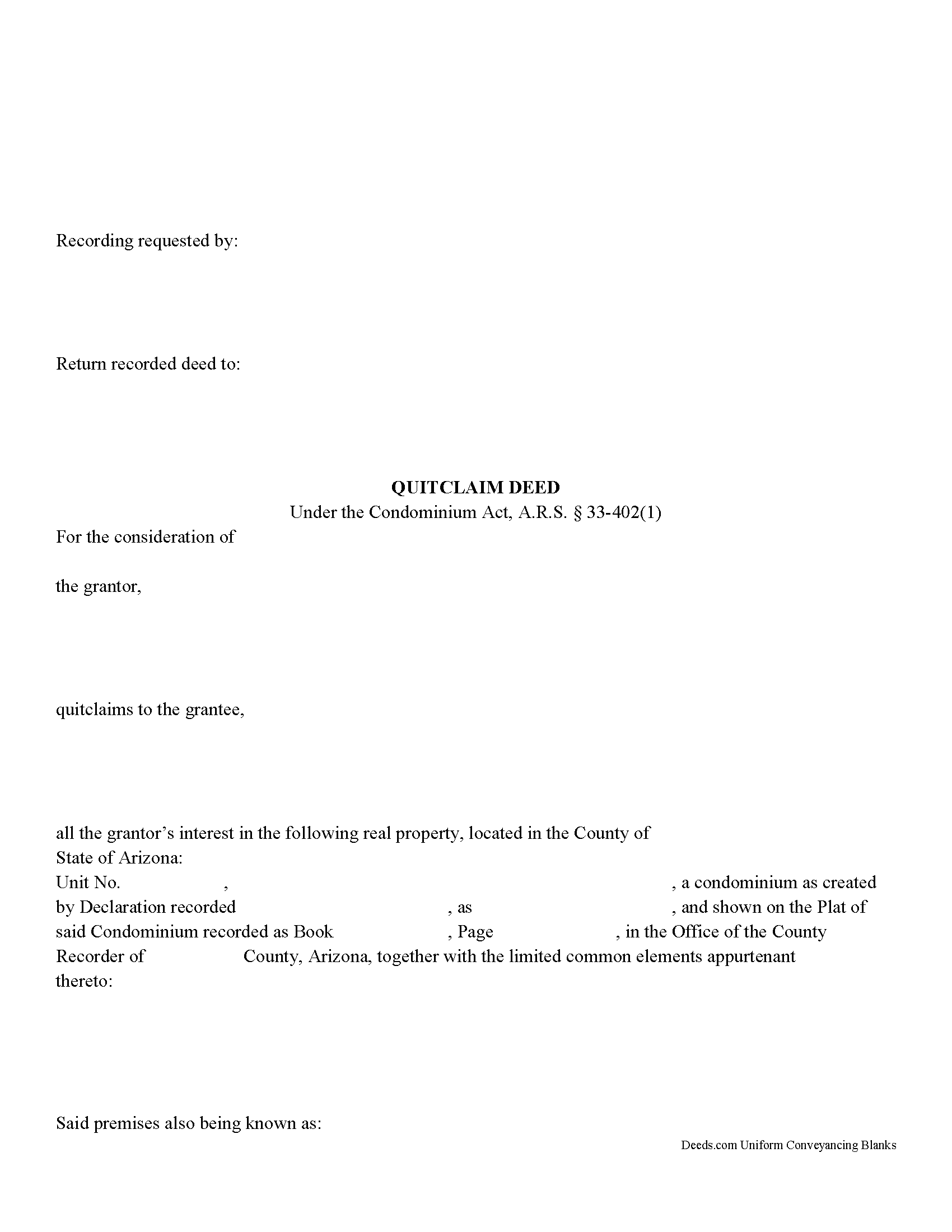

Quitclaim Deed Condominium Form

Fill in the blank Quitclaim Deed Condominium form formatted to comply with all Arizona recording and content requirements.

Included Cochise County compliant document last validated/updated 11/13/2024

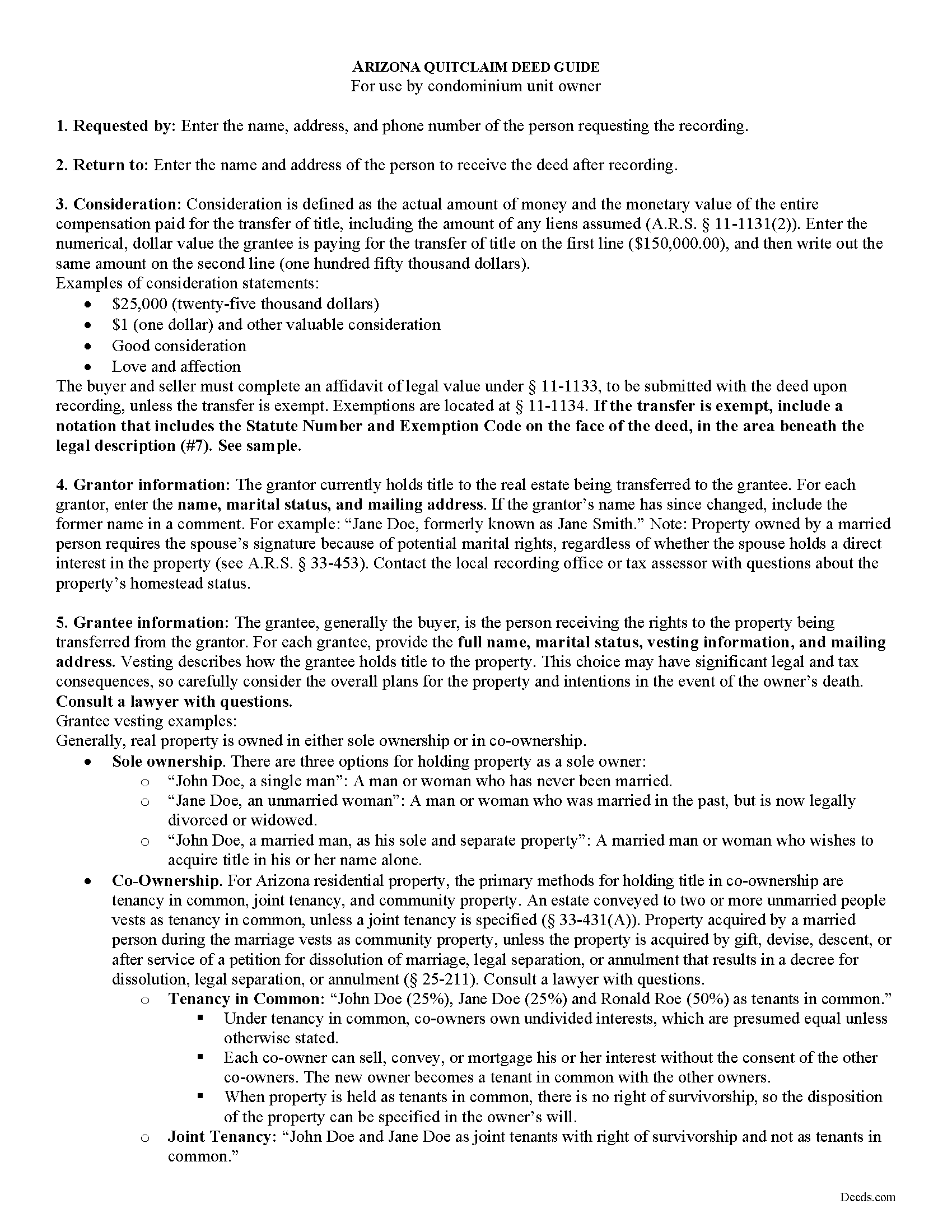

Quitclaim Deed Condominium Guide

Line by line guide explaining every blank on the Quitclaim Deed Condominium form.

Included Cochise County compliant document last validated/updated 12/5/2024

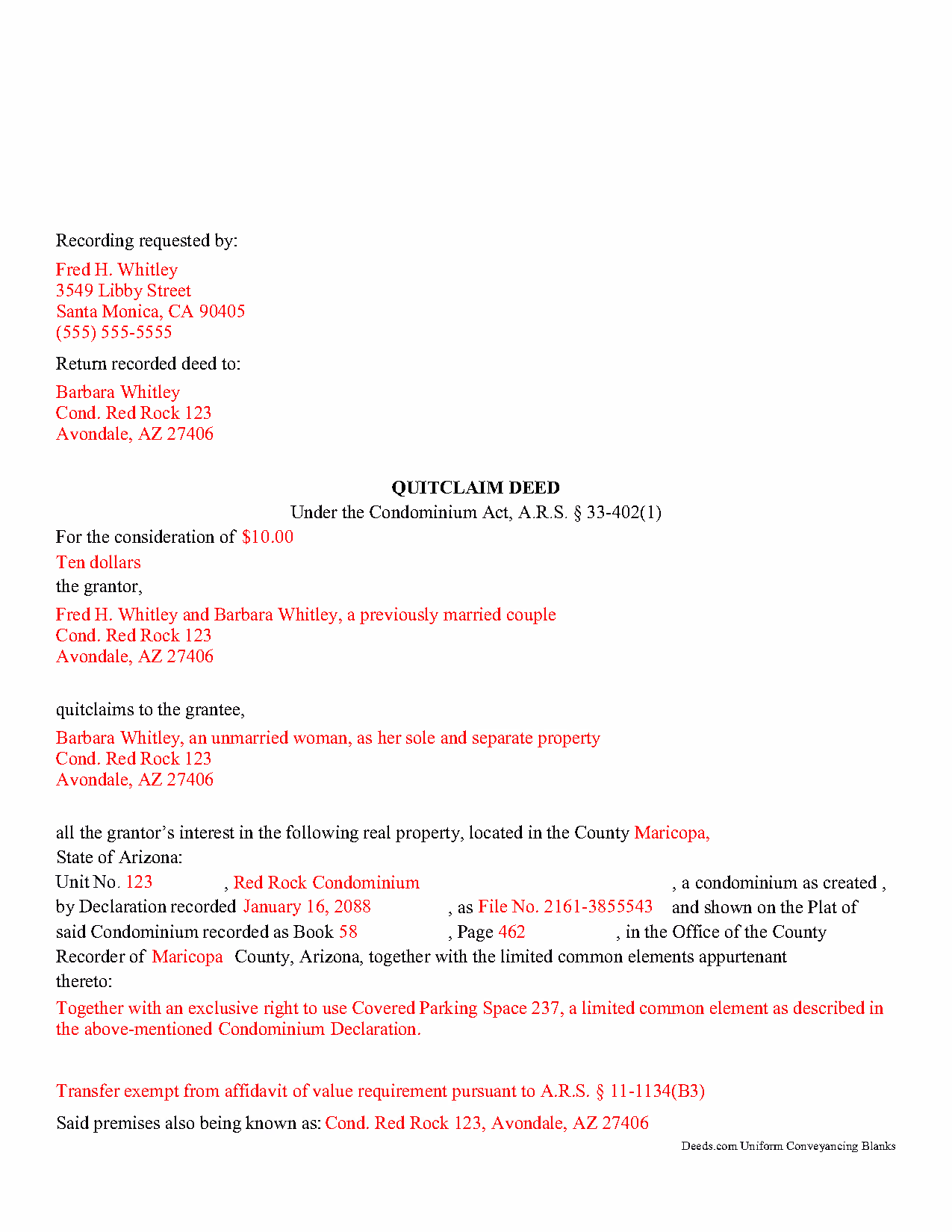

Completed Example of the Quitclaim Deed Condominium Document

Example of a properly completed Arizona Quitclaim Deed Condominium document for reference.

Included Cochise County compliant document last validated/updated 8/23/2024

The following Arizona and Cochise County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed Condominium forms, the subject real estate must be physically located in Cochise County. The executed documents should then be recorded in the following office:

Recorder's Office

1415 Melody Lane, Bldg. B, Bisbee, Arizona 85603

Hours: 8:00am - 5:00pm Monday - Friday

Phone: 520-432-8350

Local jurisdictions located in Cochise County include:

- Benson

- Bisbee

- Bowie

- Cochise

- Douglas

- Dragoon

- Elfrida

- Fort Huachuca

- Hereford

- Huachuca City

- Mc Neal

- Naco

- Pearce

- Pirtleville

- Pomerene

- Saint David

- San Simon

- Sierra Vista

- Tombstone

- Willcox

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Cochise County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Cochise County using our eRecording service.

Are these forms guaranteed to be recordable in Cochise County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cochise County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed Condominium forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Cochise County that you need to transfer you would only need to order our forms once for all of your properties in Cochise County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arizona or Cochise County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Cochise County Quitclaim Deed Condominium forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Condominium Act is codified in Arizona at ARS 33-1201, et seq. A condominium is a piece of real estate, portions (units) of which are reserved for separate ownership, with the remainder designated for common ownership solely by owners of the separate units (33-1202(10)).

A conveyance of a condominium unit typically includes the unit and common elements appurtenant to the unit. "Common elements" are the portions of a condominium other than the units, such as entryways, hallways, walls, and gardens (33-1212(7)). The declaration establishing the condominium, recorded in the real property records, designates the allocated interest of each unit, meaning the undivided interest in the common elements, the common expense liability, and votes in the association allocated to each unit (33-1202(2)).

Conveyances of condominium units follow the same guidelines for conveyances of real property under Title 33 of the Arizona Revised Statutes. As with any other transfer of real property, conveyance of a unit requires the execution of a deed.

A quitclaim deed is a statutory form under ARS 33-402(1) that transfers the grantor's interest, if any, in the described property, with no warranties of title. Quitclaim deeds are often reserved for clearing title defects or for familial transfers (to sever an heir's interest in a property, a transfer pursuant to divorce) because they do not guarantee the grantor has a valid interest in the property, and therefore carry the highest level of risk.

To transfer a unit, the instrument of conveyance requires a sufficient legal description that designates the unit by number and includes the name of the condominium, the recording information for the declaration (recording date and location), the county or counties in which the condominium is located, and a description of the common elements, rights, obligations, and interests appurtenant to the unit (33-1214).

Either the unit owner or the association, depending on the whether the size of the condominium is below or above fifty (50) units, respectively, is required to furnish information, including the bylaws of the association, a copy of the declaration, and other various statements, to the purchaser within ten days of a receipt of pending sale (33-1260).

In addition to the unit-specific legal description, the unit deed requires the name, marital status, and address of each grantor and grantee, as well as the grantee's vesting information, in the conveyancing clause. A statement of consideration reflects the amount of money and the monetary value of the entire compensation paid for the transfer of title, including the amount of any liens assumed (11-1131(2)).

Arizona requires an affidavit of real value, alternately referred to as an affidavit of property value, completed by both parties to the instrument, to accompany all instruments transferring an interest in real property pursuant to 11-1133. When documents are exempt, a statement that the transfer is exempt and a citation of the relevant exemption should appear below the legal description on the face of the deed.

All conveyances are subscribed and delivered by the grantor and acknowledged in the presence of an authorized officer (33-401). Instruments must comply with the formatting requirements set forth at 11-480, and any other county-specific requirements for form and content.

Submit the deed and any supplemental materials for recording to the county clerk's office of the county where the subject property is situated. Contact the office to verify recording fees and accepted forms of payment.

Consult a lawyer with questions about transferring condominium units and quitclaim deeds in Arizona, as each situation is unique.

(Arizona Quitclaim Deed Condominium Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Cochise County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cochise County Quitclaim Deed Condominium form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

November 16th, 2021

So far the web site and the tools are a pleasure to use. The price is reasonable. If only getting rid of this timeshare in Mashpee Massachusetts (that I have owned for over thirty years) was this easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janice b.

April 29th, 2021

This is a very helpful site when you don't know exactly what to do. Very clear in explaining the wording on deeds. Thank you it made a big difference knowing the right way to do things.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT K.

April 12th, 2021

It was so easy to obtain the necessary documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Jane D.

February 5th, 2021

Very easy to navigate and we get exactly what we need, when we need it! Also, they keep Tra k of previous purchases, so you don't have to repurchase! It's great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John M.

May 14th, 2022

I found just what I needed at a very good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melvin F.

March 5th, 2021

Was a little frustrated first using your site, but due to my mental state, I expected that! Got what I needed, thank you very much.

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

rosie s.

March 24th, 2019

Very please with the service

Thank you!

Sandra K.

April 29th, 2019

Seems fairly simple with forms and instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

BARBARA T.

July 16th, 2019

Love this site! So easy to use and very economical

Thank you!